Answered step by step

Verified Expert Solution

Question

1 Approved Answer

asnwer needed asap ACCT443 FORM 1040 Question - Exercise 2 Maybelle and Mierelle Dennis are a married couple living in Richmond, Virginia. Maybelle is a

asnwer needed asap

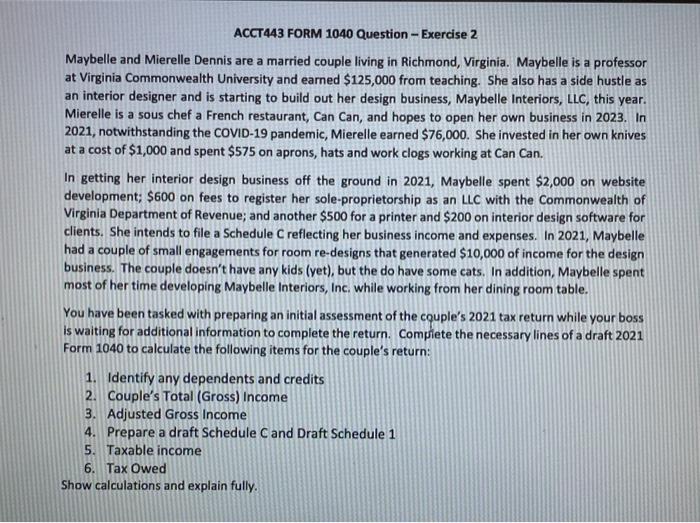

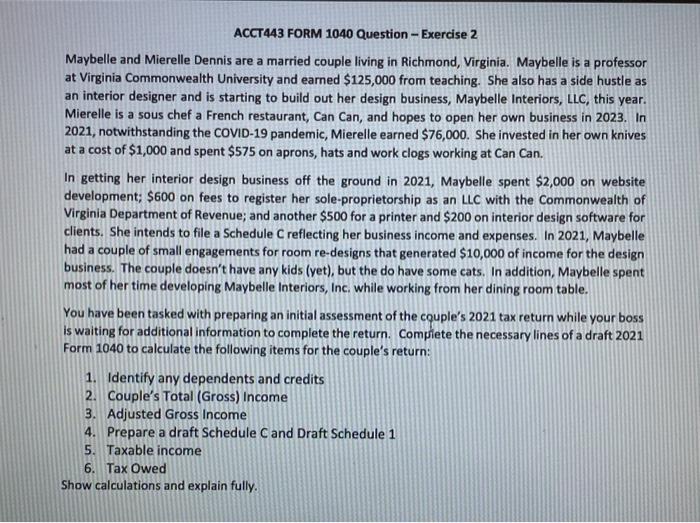

ACCT443 FORM 1040 Question - Exercise 2 Maybelle and Mierelle Dennis are a married couple living in Richmond, Virginia. Maybelle is a professor at Virginia Commonwealth University and earned $125,000 from teaching. She also has a side hustle as an interior designer and is starting to build out her design business, Maybelle Interiors, LLC, this year. Mierelle is a sous chef a French restaurant, Can Can, and hopes to open her own business in 2023. In 2021, notwithstanding the COVID-19 pandemic, Mierelle earned $76,000. She invested in her own knives at a cost of $1,000 and spent $575 on aprons, hats and work clogs working at Can Can. In getting her interior design business off the ground in 2021, Maybelle spent $2,000 on website development: $600 on fees to register her sole proprietorship as an LLC with the Commonwealth of Virginia Department of Revenue; and another $500 for a printer and $200 on interior design software for clients. She intends to file a Schedule C reflecting her business income and expenses. In 2021, Maybelle had a couple of small engagements for room re-designs that generated $10,000 of income for the design business. The couple doesn't have any kids (yet), but the do have some cats. In addition, Maybelle spent most of her time developing Maybelle Interiors, Inc. while working from her dining room table. You have been tasked with preparing an initial assessment of the couple's 2021 tax return while your boss is waiting for additional information to complete the return. Complete the necessary lines of a draft 2021 Form 1040 to calculate the following items for the couple's return: 1. Identify any dependents and credits 2. Couple's Total (Gross) Income 3. Adjusted Gross Income 4. Prepare a draft Schedule C and Draft Schedule 1 5. Taxable income 6. Tax Owed Show calculations and explain fully. ACCT443 FORM 1040 Question - Exercise 2 Maybelle and Mierelle Dennis are a married couple living in Richmond, Virginia. Maybelle is a professor at Virginia Commonwealth University and earned $125,000 from teaching. She also has a side hustle as an interior designer and is starting to build out her design business, Maybelle Interiors, LLC, this year. Mierelle is a sous chef a French restaurant, Can Can, and hopes to open her own business in 2023. In 2021, notwithstanding the COVID-19 pandemic, Mierelle earned $76,000. She invested in her own knives at a cost of $1,000 and spent $575 on aprons, hats and work clogs working at Can Can. In getting her interior design business off the ground in 2021, Maybelle spent $2,000 on website development: $600 on fees to register her sole proprietorship as an LLC with the Commonwealth of Virginia Department of Revenue; and another $500 for a printer and $200 on interior design software for clients. She intends to file a Schedule C reflecting her business income and expenses. In 2021, Maybelle had a couple of small engagements for room re-designs that generated $10,000 of income for the design business. The couple doesn't have any kids (yet), but the do have some cats. In addition, Maybelle spent most of her time developing Maybelle Interiors, Inc. while working from her dining room table. You have been tasked with preparing an initial assessment of the couple's 2021 tax return while your boss is waiting for additional information to complete the return. Complete the necessary lines of a draft 2021 Form 1040 to calculate the following items for the couple's return: 1. Identify any dependents and credits 2. Couple's Total (Gross) Income 3. Adjusted Gross Income 4. Prepare a draft Schedule C and Draft Schedule 1 5. Taxable income 6. Tax Owed Show calculations and explain fully

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started