Question

Aspect Corp. paid out a $3 dividend per share to their shareholders 'last year' and has just decided in the shareholders' meeting for increasing

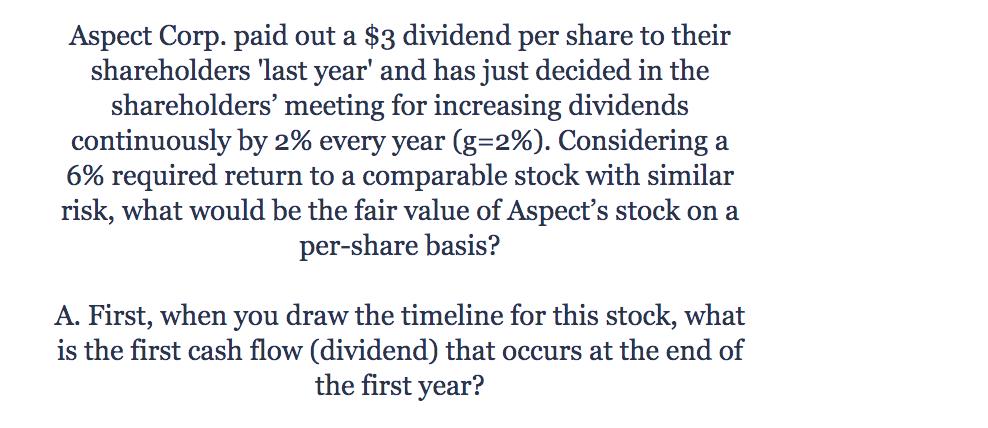

Aspect Corp. paid out a $3 dividend per share to their shareholders 'last year' and has just decided in the shareholders' meeting for increasing dividends continuously by 2% every year (g=2%). Considering a 6% required return to a comparable stock with similar risk, what would be the fair value of Aspect's stock on a per-share basis? A. First, when you draw the timeline for this stock, what is the first cash flow (dividend) that occurs at the end of the first year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The first cash flow dividend that occurs at the end of the first year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial accounting

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel

IFRS Edition

9781119153726, 978-1118285909

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App