Question

Asphalt Inc. lays asphalt in parking lots and roadways. This year they were awarded the state roadway contract and decided to purchase new equipment. Asphalt

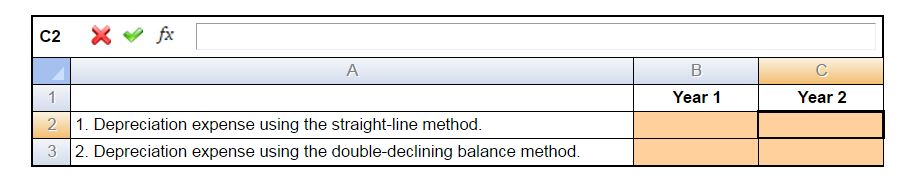

Asphalt Inc. lays asphalt in parking lots and roadways. This year they were awarded the state roadway contract and decided to purchase new equipment. Asphalt purchased a new piece of equipment with a cost of $43,600 and a $6,000 salvage value, and placed it into service on April 1, Year 1. The equipment was installed at an additional cost of $3,400. The estimated life of the equipment is 8 years. Use the spreadsheet below to calculate the depreciation expense for this asset for Years 1 and 2. Enter your answers in the appropriate shaded cell. Note: To use a formula in the spreadsheet, it must be preceded by an equal sign (e.g., =A1+B1).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started