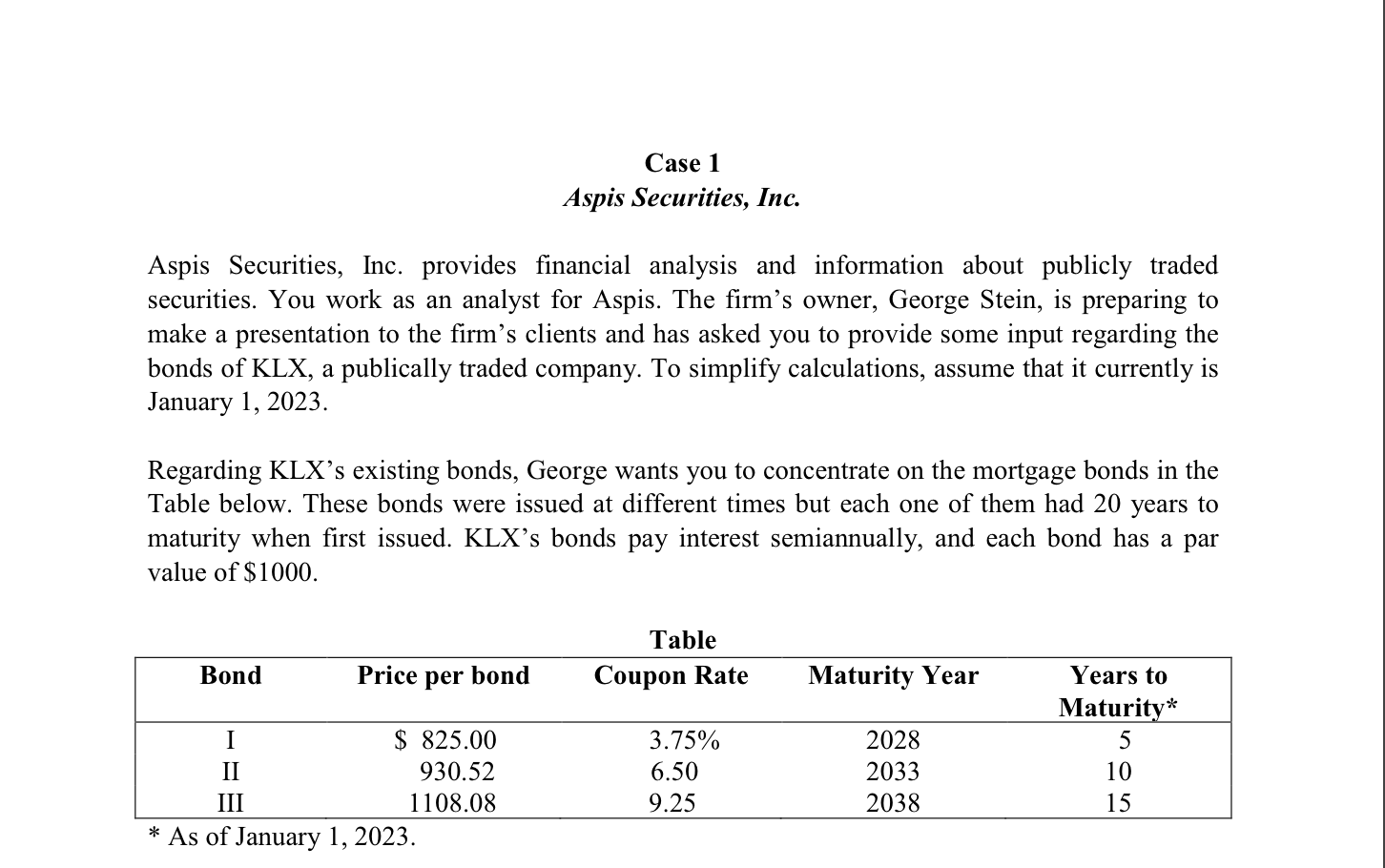

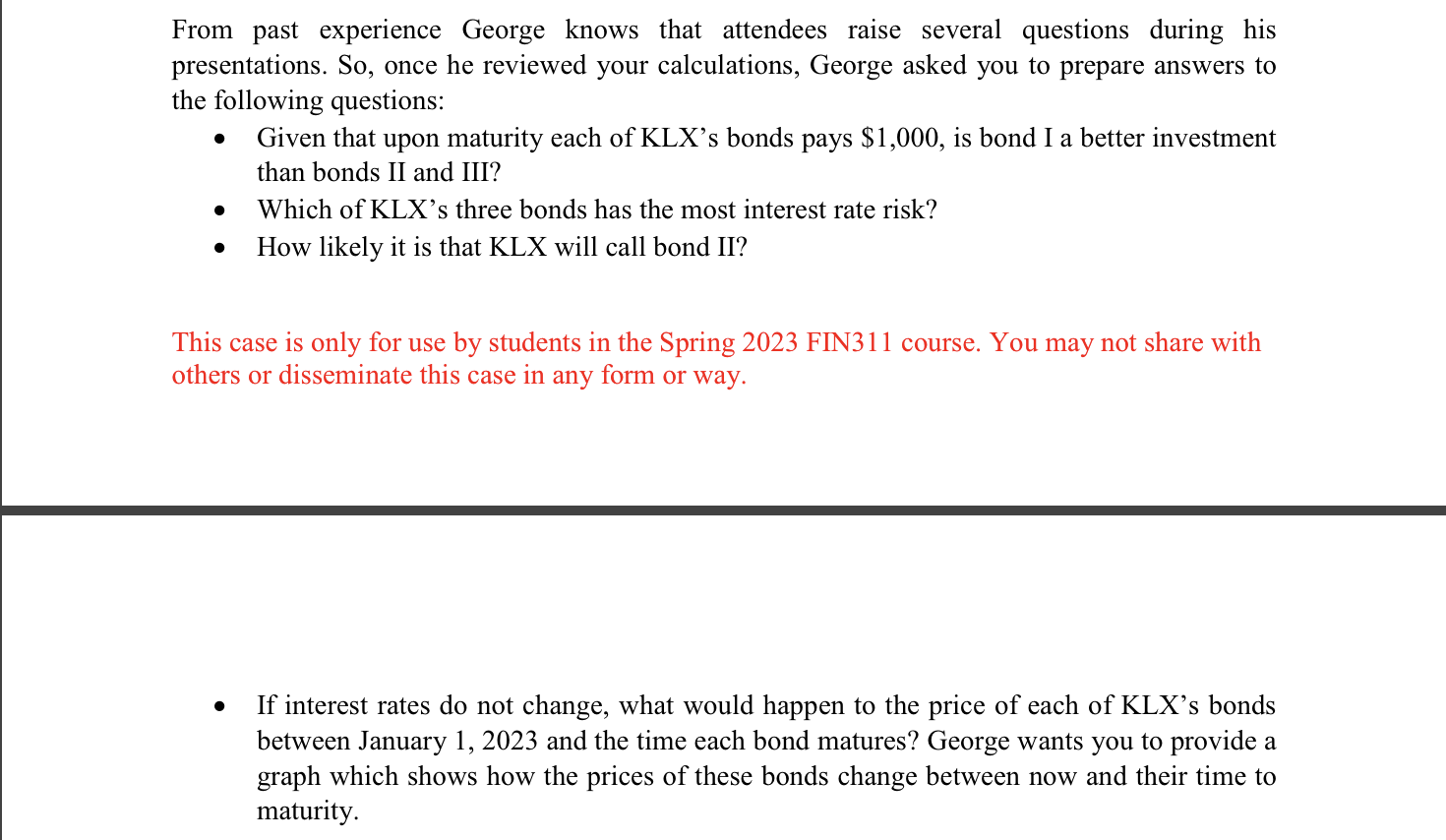

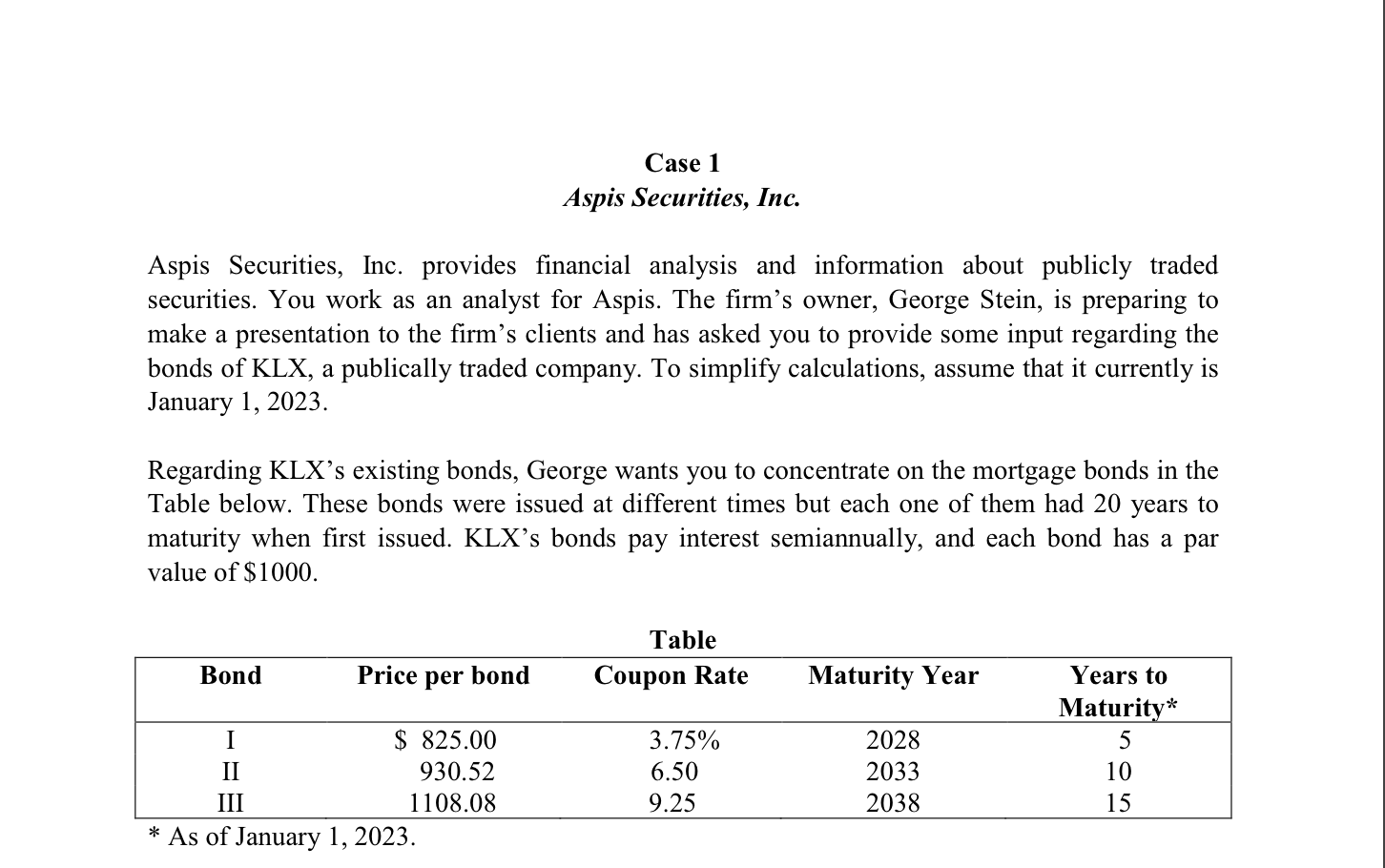

Aspis Securities, Inc. provides financial analysis and information about publicly traded securities. You work as an analyst for Aspis. The firm's owner, George Stein, is preparing to make a presentation to the firm's clients and has asked you to provide some input regarding the bonds of KLX, a publically traded company. To simplify calculations, assume that it currently is January 1, 2023. Regarding KLX's existing bonds, George wants you to concentrate on the mortgage bonds in the Table below. These bonds were issued at different times but each one of them had 20 years to maturity when first issued. KLX's bonds pay interest semiannually, and each bond has a par value of $1000. From past experience George knows that attendees raise several questions during his presentations. So, once he reviewed your calculations, George asked you to prepare answers to the following questions: - Given that upon maturity each of KLX's bonds pays $1,000, is bond I a better investment than bonds II and III? - Which of KLX's three bonds has the most interest rate risk? - How likely it is that KLX will call bond II? This case is only for use by students in the Spring 2023 FIN311 course. You may not share with others or disseminate this case in any form or way. - If interest rates do not change, what would happen to the price of each of KLX's bonds between January 1, 2023 and the time each bond matures? George wants you to provide a graph which shows how the prices of these bonds change between now and their time to maturity. Aspis Securities, Inc. provides financial analysis and information about publicly traded securities. You work as an analyst for Aspis. The firm's owner, George Stein, is preparing to make a presentation to the firm's clients and has asked you to provide some input regarding the bonds of KLX, a publically traded company. To simplify calculations, assume that it currently is January 1, 2023. Regarding KLX's existing bonds, George wants you to concentrate on the mortgage bonds in the Table below. These bonds were issued at different times but each one of them had 20 years to maturity when first issued. KLX's bonds pay interest semiannually, and each bond has a par value of $1000. From past experience George knows that attendees raise several questions during his presentations. So, once he reviewed your calculations, George asked you to prepare answers to the following questions: - Given that upon maturity each of KLX's bonds pays $1,000, is bond I a better investment than bonds II and III? - Which of KLX's three bonds has the most interest rate risk? - How likely it is that KLX will call bond II? This case is only for use by students in the Spring 2023 FIN311 course. You may not share with others or disseminate this case in any form or way. - If interest rates do not change, what would happen to the price of each of KLX's bonds between January 1, 2023 and the time each bond matures? George wants you to provide a graph which shows how the prices of these bonds change between now and their time to maturity