Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aspis Securities, Inc. provides financial analysis and information about publicly traded securities. You work as an analyst for Aspis. The firm's owner, George Stein,

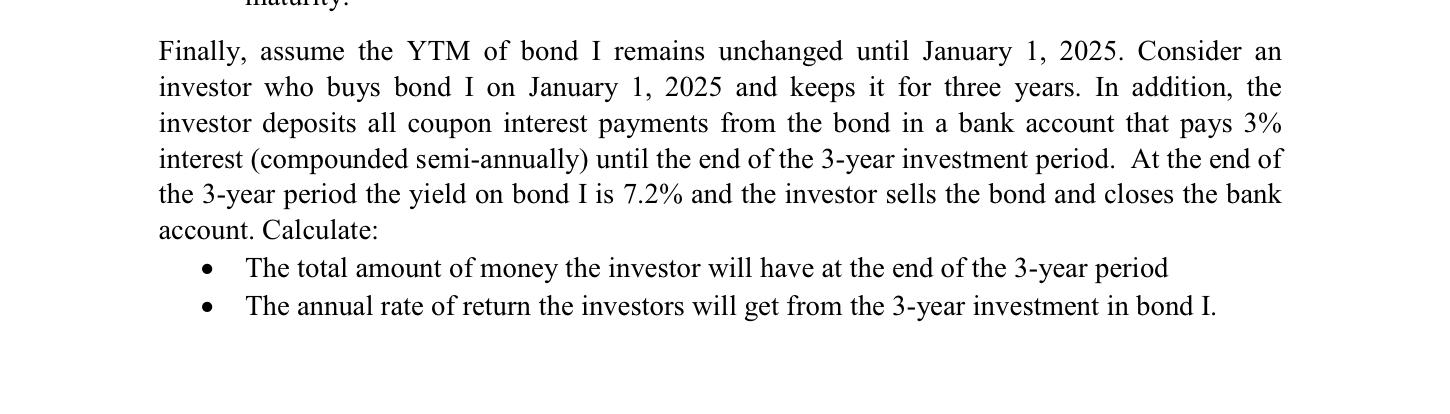

Aspis Securities, Inc. provides financial analysis and information about publicly traded securities. You work as an analyst for Aspis. The firm's owner, George Stein, is preparing to make a presentation to the firm's clients and has asked you to provide some input regarding the bonds of KLX, a publically traded company. To simplify calculations, assume that it currently is January 1, 2023. Regarding KLX's existing bonds, George wants you to concentrate on the mortgage bonds in the Table below. These bonds were issued at different times but each one of them had 20 years to maturity when first issued. KLX's bonds pay interest semiannually, and each bond has a par value of $1000. Bond Price per bond I II III * As of January 1, 2023. $ 825.00 930.52 1108.08 Table Coupon Rate 3.75% 6.50 9.25 Maturity Year 2028 2033 2038 Years to Maturity* 5 10 15 Finally, assume the YTM of bond I remains unchanged until January 1, 2025. Consider an investor who buys bond I on January 1, 2025 and keeps it for three years. In addition, the investor deposits all coupon interest payments from the bond in a bank account that pays 3% interest (compounded semi-annually) until the end of the 3-year investment period. At the end of the 3-year period the yield on bond I is 7.2% and the investor sells the bond and closes the bank account. Calculate: The total amount of money the investor will have at the end of the 3-year period The annual rate of return the investors will get from the 3-year investment in bond I.

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To provide input on KLXs existing mortgage bonds lets analyze the information provided in the table ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started