Answered step by step

Verified Expert Solution

Question

1 Approved Answer

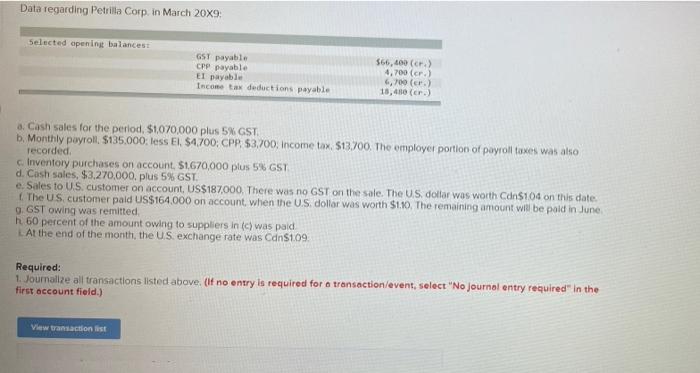

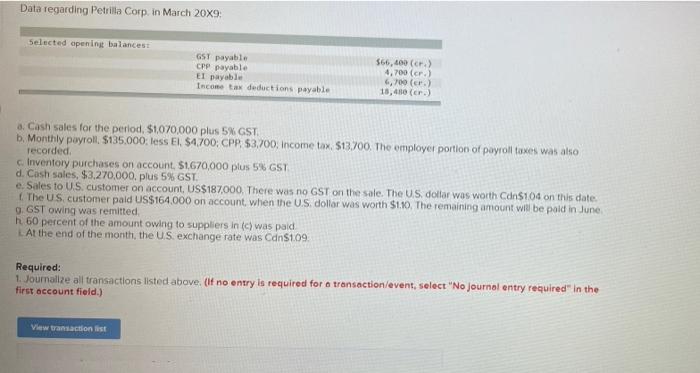

asps plz Data regarding Petrila Corp. in March 2009: Selected opening balances GST payable CPP payable El payable Income tax deductions payable $66,400 (c) 4.700

asps plz

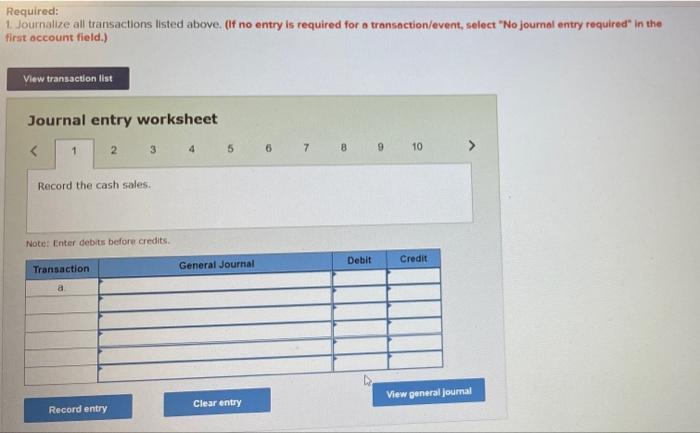

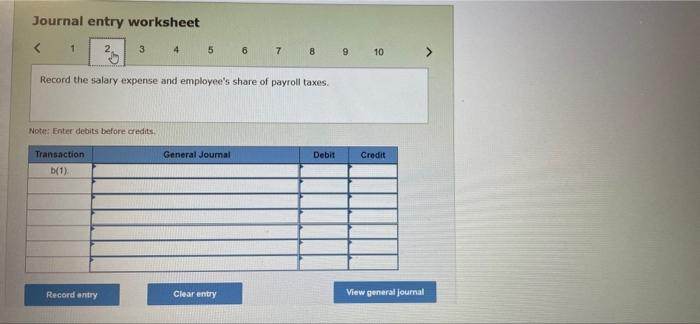

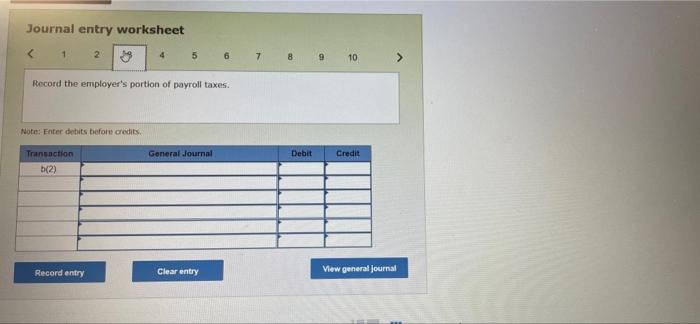

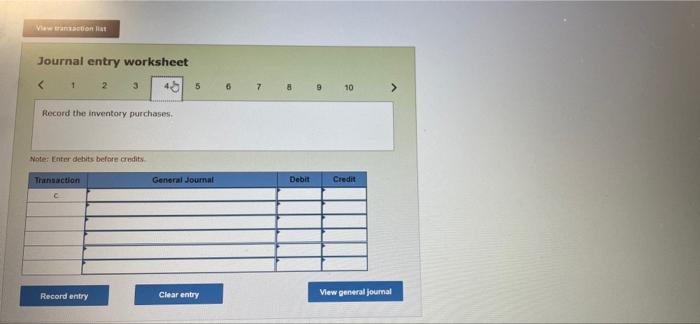

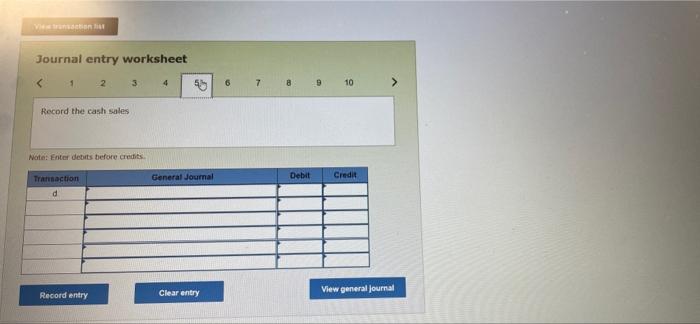

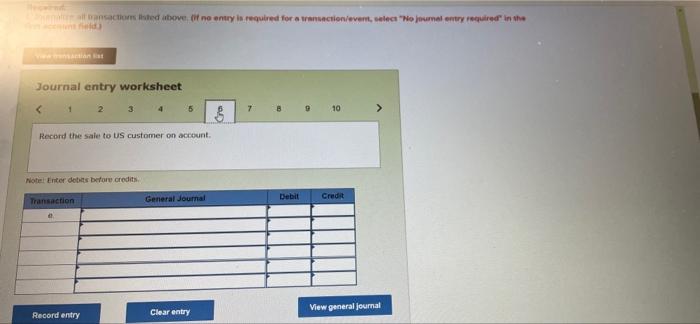

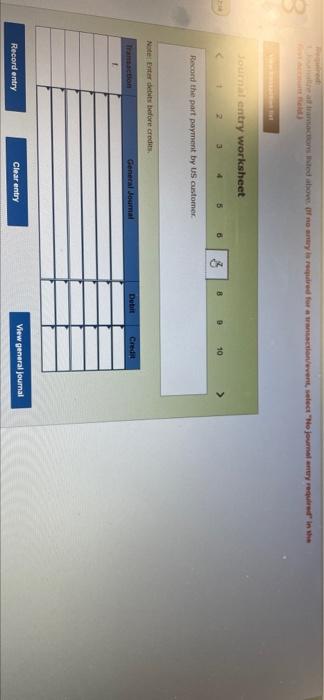

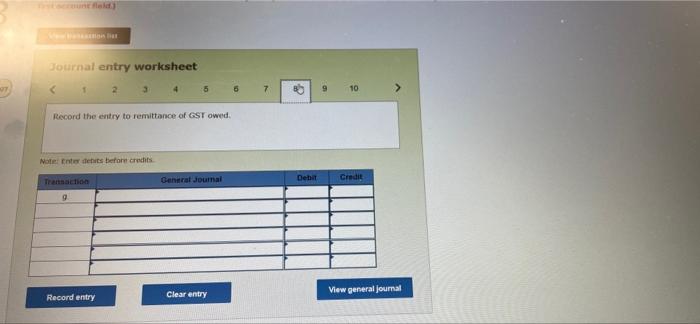

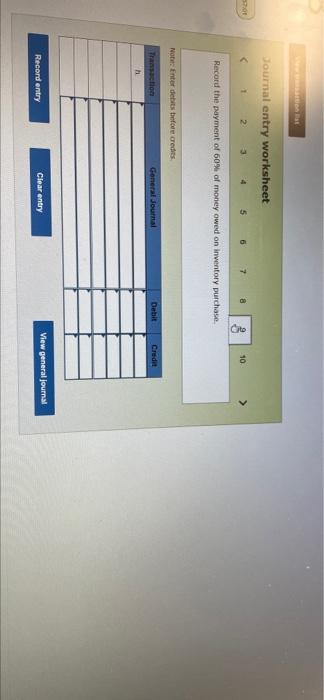

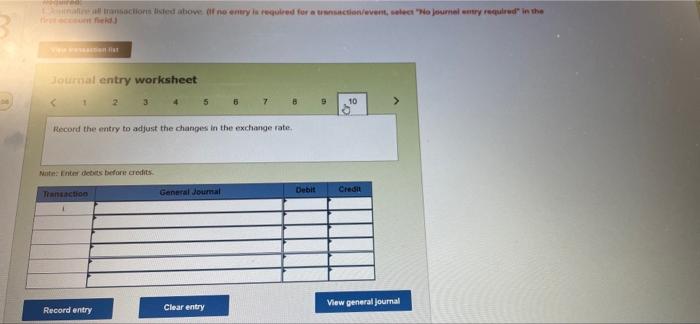

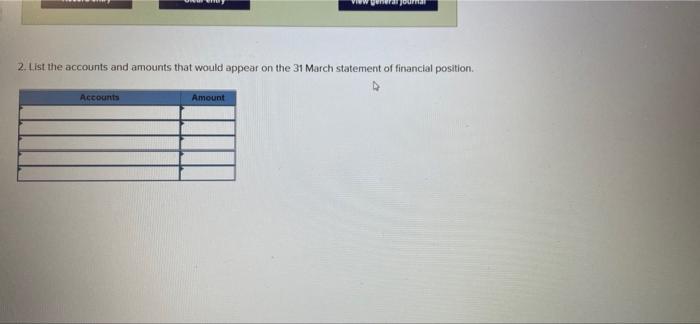

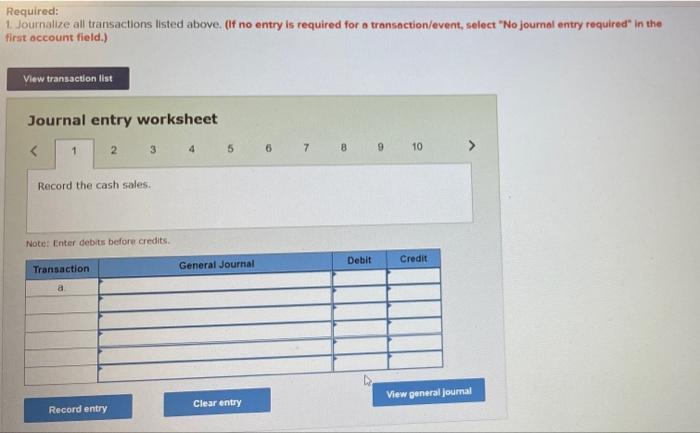

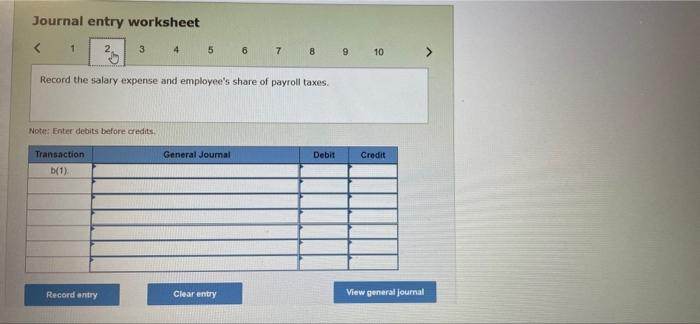

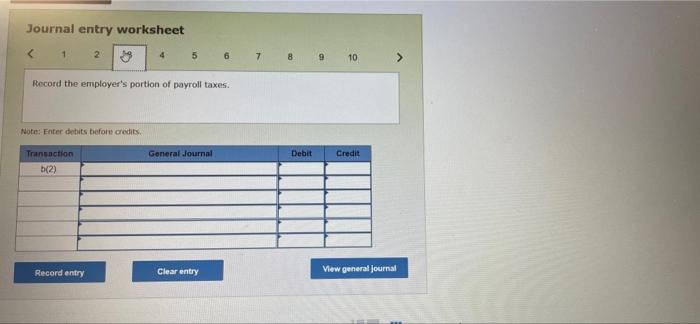

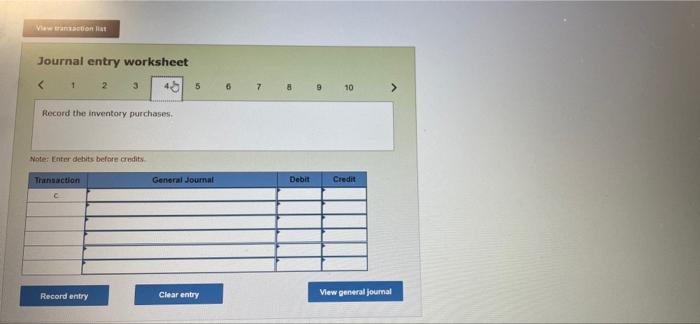

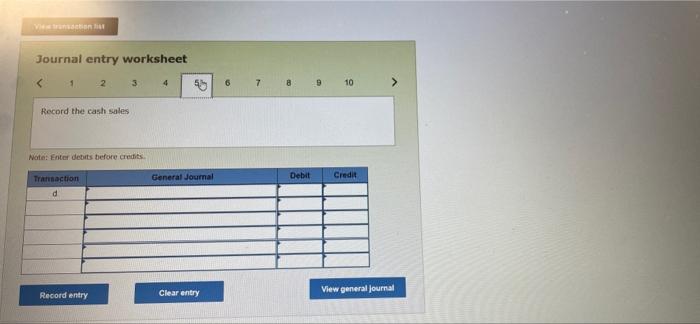

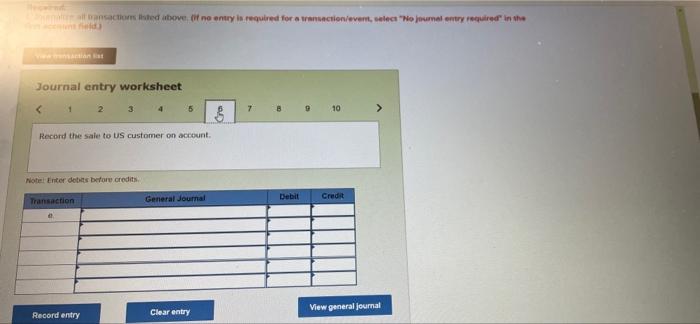

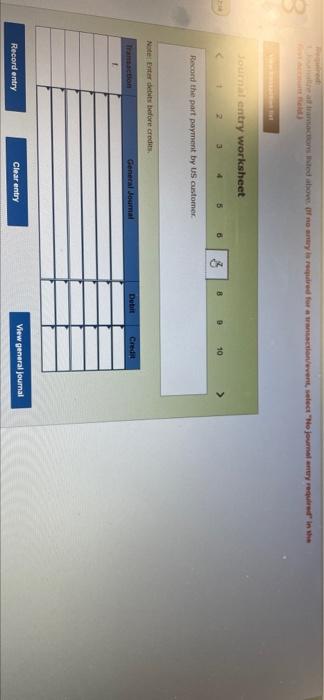

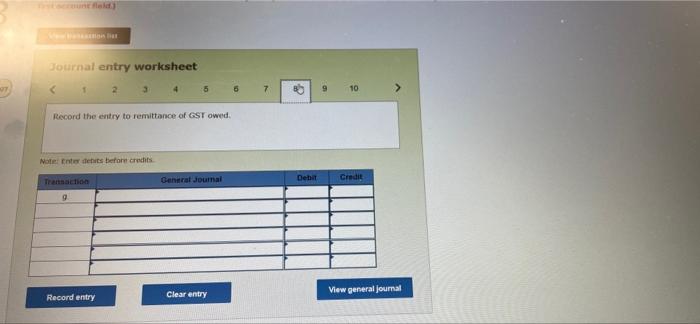

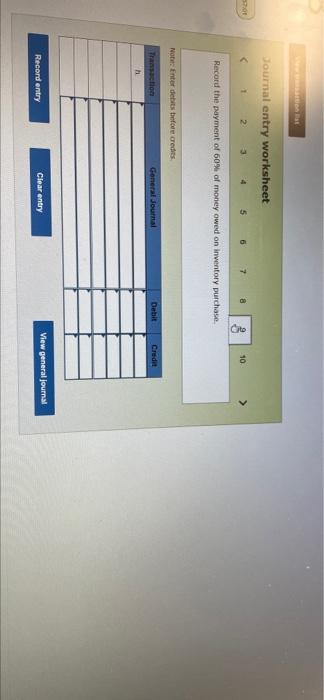

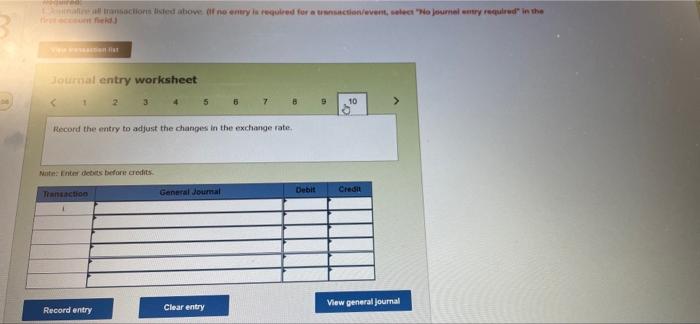

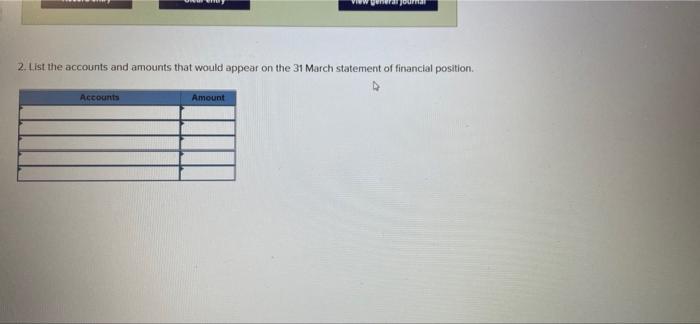

Data regarding Petrila Corp. in March 2009: Selected opening balances GST payable CPP payable El payable Income tax deductions payable $66,400 (c) 4.700 (r.) 6,700 (Cr.) 18,4110(er) a. Cash sales for the period, $1.070,000 plus 5% GST b. Monthly payroll. $135.000 less El $4.700: CPR 53,700 Income tax 513700 The employer portion of payroll taxes was also recorded c. Inventory purchases on account $1.670,000 plus 5% GST d. Cash sales, $3.270,000, plus 5% GST e. Sales to U.S. customer on account, US$187,000. There was no GST on the sale. The US dollar was worth Con$104 on this date. (The US customer paid US$164.000 on account when the US dollar was worth $110. The remaining amount will be paid in June 9. GST owing was remitted h 60 percent of the amount owing to suppliers in (c) was paid At the end of the month, the U.S. exchange rate was Con$109. Required: 1. Joumalize all transactions listed above. (If no enery is required for a transaction/event, select "No journal entry required" In the first account field.) View transaction fist Required: 1. Journalize all transactions listed above. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record the salary expense and employee's share of payroll taxes Note: Enter debits before credits General Journal Debit Credit Transaction (1) Record entry Clear entry View general Journal Journal entry worksheet Record the employer's portion of payroll taxes. Note: Enter debits before credits General Journal Debit Credit Transaction (2) Record entry Clear entry View general Journal View Journal entry worksheet 3 45 5 6 8 9 10 > Record the inventory purchases. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal ton Journal entry worksheet Record the cash sales Note: Enter debts before credits Transaction Debit General Journal Credit Clear entry Record entry View general Journal na wanachosted above, if no entry is required for a wenu Clonevent, select "No jumal entry required in the matan at Journal entry worksheet 5 7 8 9 10 8 Record the sale to US customer on account Notel Enter det before credits Debit General Journal Transaction Crede View general journal Record entry Clear entry the actioned above and for action select "Hojom regulerin the Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started