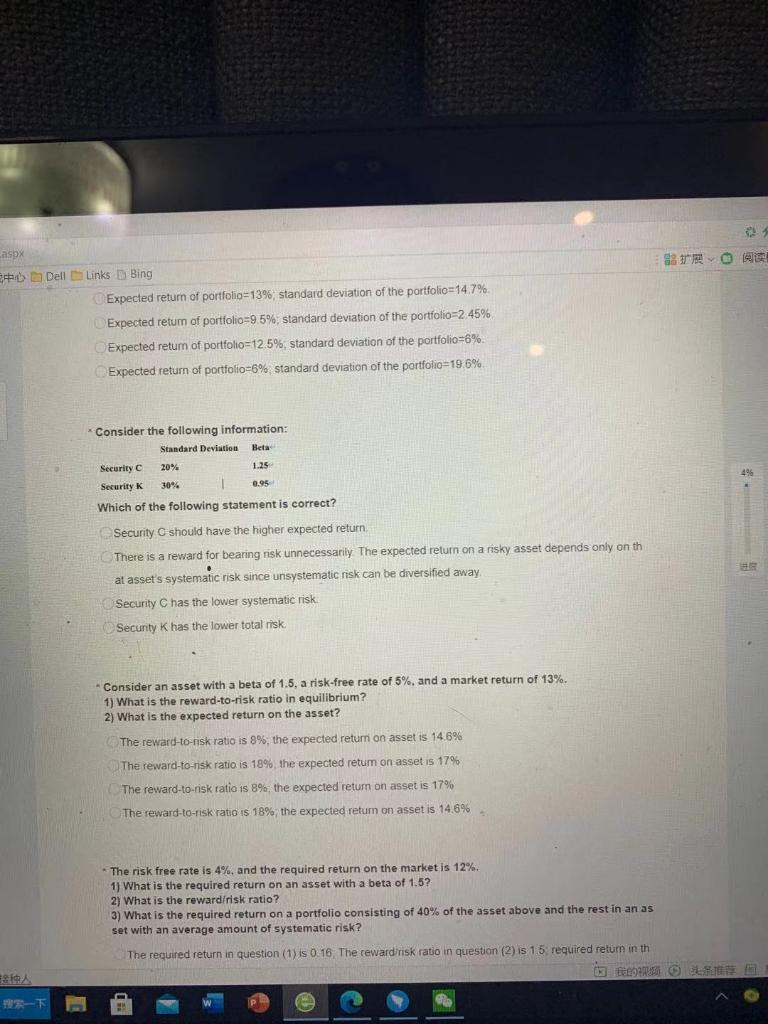

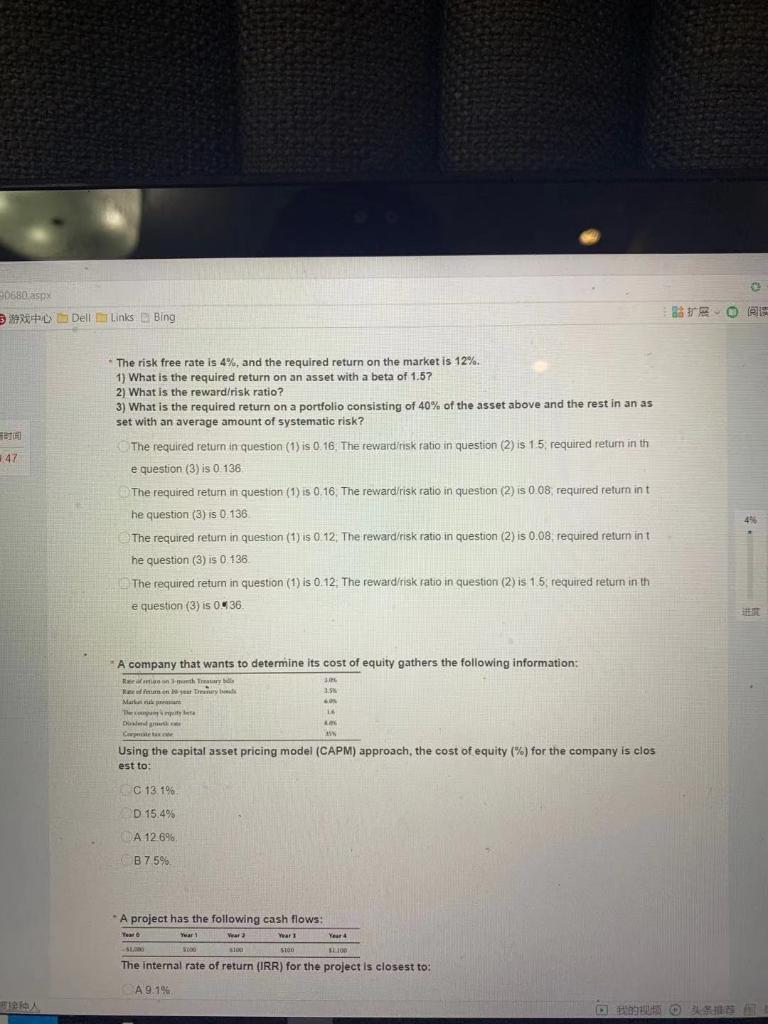

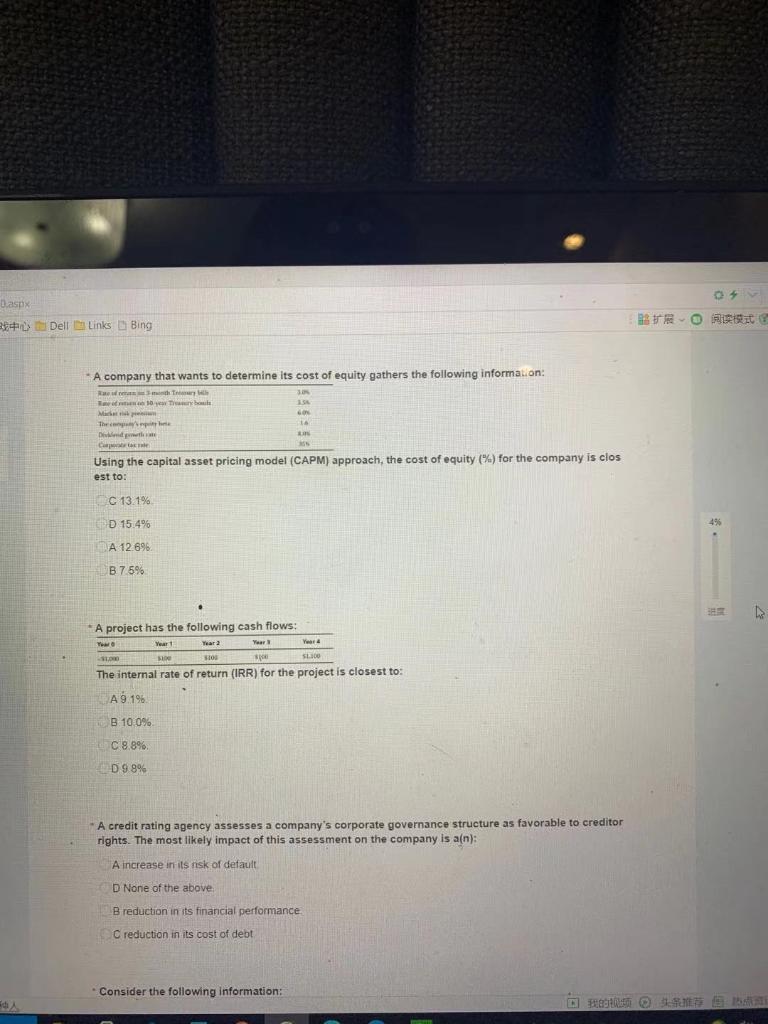

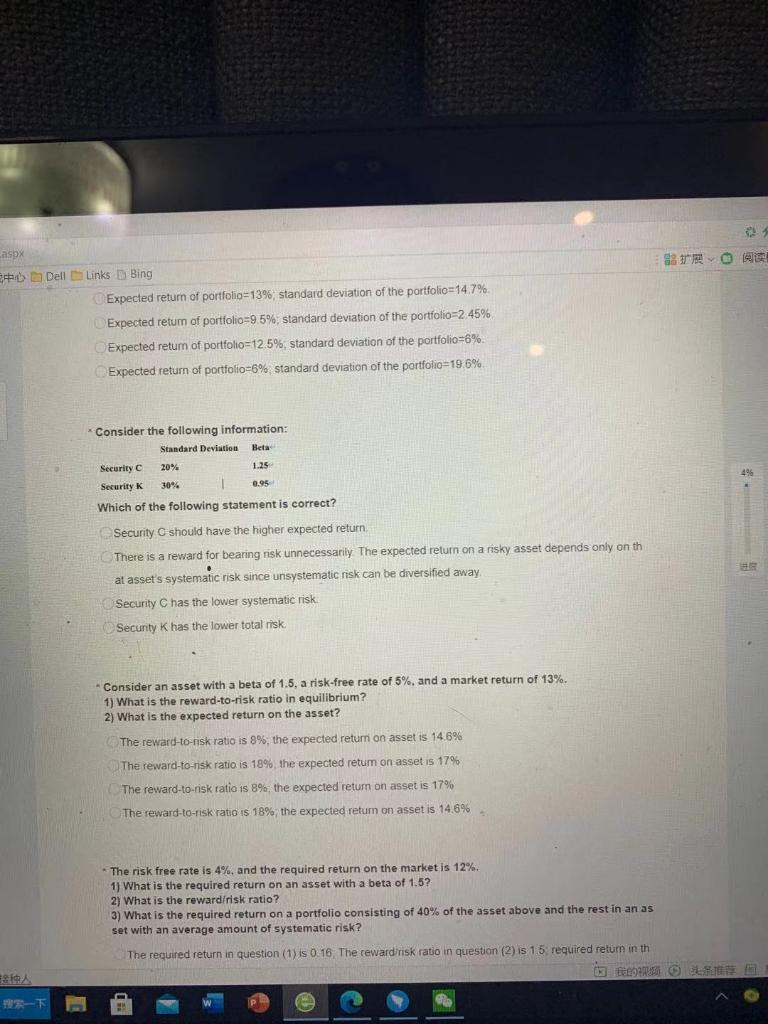

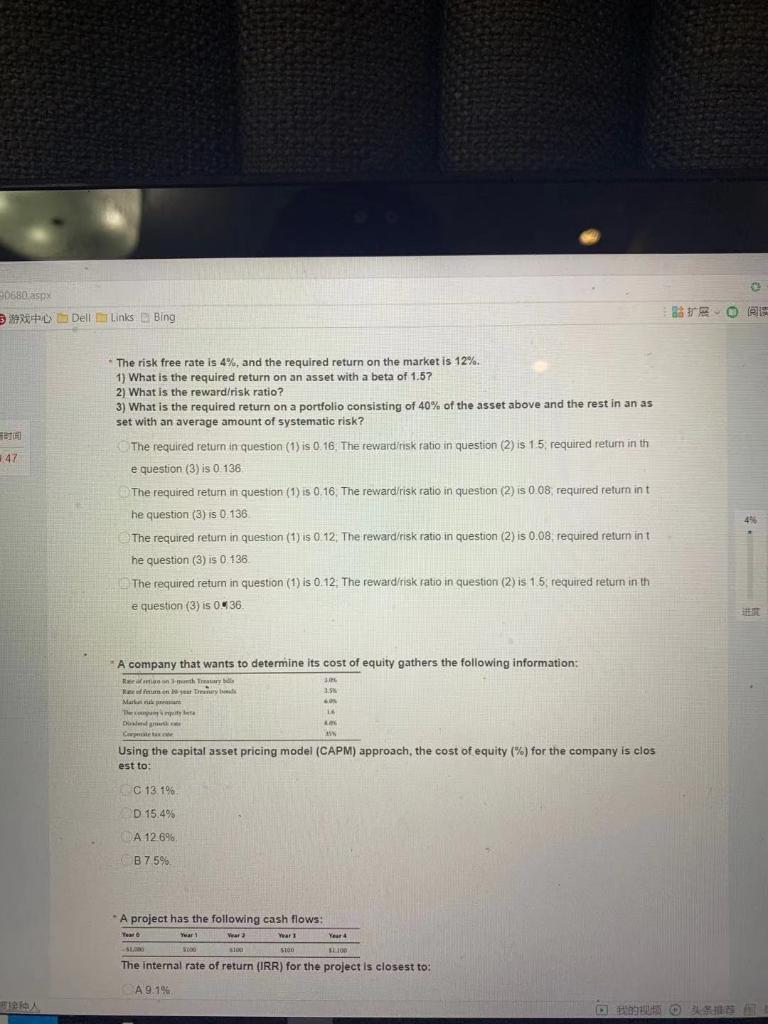

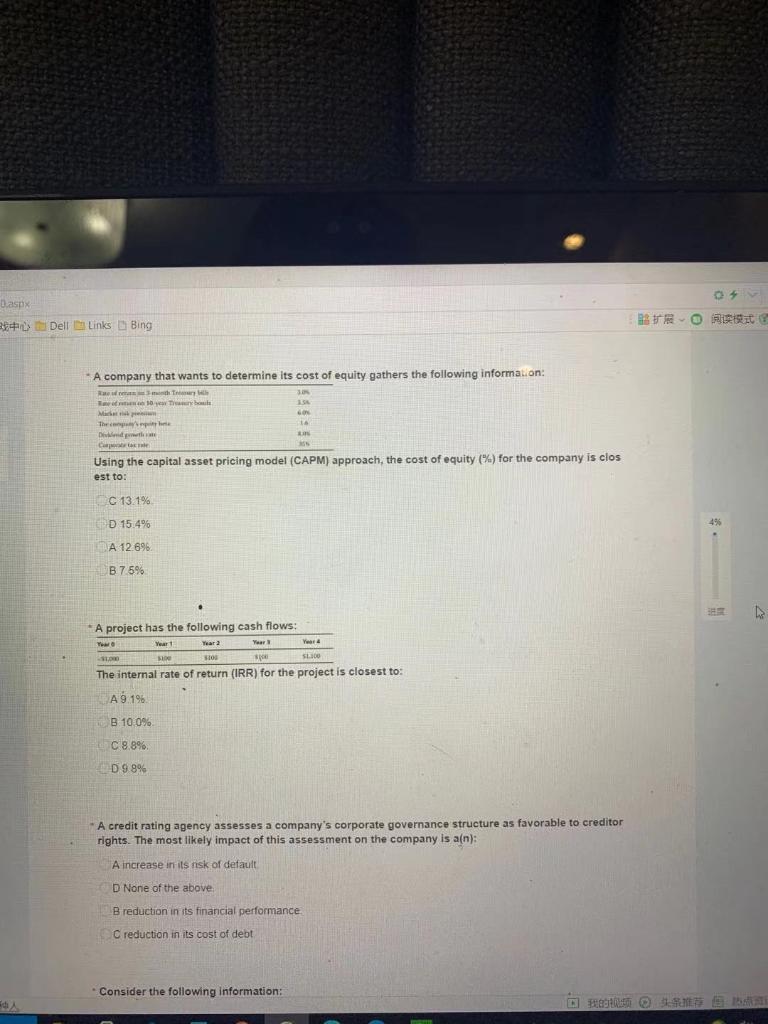

aspx 88 E Dell Links Bing Expected return of portfolio=13%, standard deviation of the portfolio=14.7%. Expected retum of portfolio=9.5%, standard deviation of the portfolio 2 45% Expected return of portfolio=12.5%, standard deviation of the portfolio=6% Expected return of portfolio=6% standard deviation of the portfolio=19.6% Consider the following information: Standard Deviation Beta Security 20% 1.25 Security K 30% 0.95 Which of the following statement is correct? 496 Security C should have the higher expected return There is a reward for bearing risk unnecessarily The expected return on a risky asset depends only on th at asset's systematic risk since unsystematic risk can be diversified away Security C has the lower systematic risk Security K has the lower total risk - Consider an asset with a beta of 1.5, a risk-free rate of 5%, and a market return of 13%. 1) What is the reward-to-risk ratio in equilibrium? 2) What is the expected return on the asset? The reward-to-risk ratio is 8%, the expected return on asset is 14.6% The reward-to-nsk ratio is 18% the expected retum on asset is 17% The reward-to-risk ratio is 89, the expected return on asset is 17% The reward-to-risk ratio is 18%, the expected return on asset is 14.6% The risk free rate is 4%, and the required return on the market is 12% 1) What is the required return on an asset with a beta of 1.5? 2) What is the reward/risk ratio? 3) What is the required return on a portfolio consisting of 40% of the asset above and the rest in an as set with an average amount of systematic risk? The required return in question (1) is 0 16 The reward risk ratio in question (2) is 1.5 required return in th & 50680-as Dell Links Bing ( AS 247 The risk free rate is 4%, and the required return on the market is 12%. 1) What is the required return on an asset with a beta of 1.5? What is the reward/risk ratio? 3) What is the required return on a portfolio consisting of 40% of the asset above and the rest in an as set with an average amount of systematic risk? The required return in question (1) is 0.16 The reward risk ratio in question (2) is 1.5, required return in th e question (3) is 0.136 The required return in question (1) is 0.16. The reward risk ratio in question (2) is 0.08 required return int he question (3) is 0.136 The required retum in question (1) is 0 12. The reward/risk ratio in question (2) is 0.08. required return int he question (3) is 0.136 The required return in question (1) is 0.12. The reward/risk ratio in question (2) is 1.5, required return in th e question (3) is 0.36. ES A company that wants to determine its cost of equity gathers the following information: Remonty Roman. Try Maria Thereta Das Le Using the capital asset pricing model (CAPM) approach, the cost of equity (%) for the company is clos est to C 13.1% D 15.4% A 12.6% B 7.5% A project has the following cash flows: Yeart Year Years Year 4 100 SOD The internal rate of return (IRR) for the project is closest to: A 9.1% D.aspx A Della Links Bing : A company that wants to determine its cost of equity gathers the following information: who This M The cop G CH Using the capital asset pricing model (CAPM) approach, the cost of equity (%) for the company is clos est to: C 13.1% D 15.4% 49 FA 12.696 B 75% A project has the following cash flows: Yeart Year 2 | Year Ver so SLO The internal rate of return (IRR) for the project is closest to: A 9.1% B. 100% C 8.8% D 98% * A credit rating agency assesses a company's corporate governance structure as favorable to creditor rights. The most likely impact of this assessment on the company is a(n): A increase in its risk of default D None of the above B reduction in its financial performance C reduction in its cost of debt Consider the following information: a mais aspx 88 E Dell Links Bing Expected return of portfolio=13%, standard deviation of the portfolio=14.7%. Expected retum of portfolio=9.5%, standard deviation of the portfolio 2 45% Expected return of portfolio=12.5%, standard deviation of the portfolio=6% Expected return of portfolio=6% standard deviation of the portfolio=19.6% Consider the following information: Standard Deviation Beta Security 20% 1.25 Security K 30% 0.95 Which of the following statement is correct? 496 Security C should have the higher expected return There is a reward for bearing risk unnecessarily The expected return on a risky asset depends only on th at asset's systematic risk since unsystematic risk can be diversified away Security C has the lower systematic risk Security K has the lower total risk - Consider an asset with a beta of 1.5, a risk-free rate of 5%, and a market return of 13%. 1) What is the reward-to-risk ratio in equilibrium? 2) What is the expected return on the asset? The reward-to-risk ratio is 8%, the expected return on asset is 14.6% The reward-to-nsk ratio is 18% the expected retum on asset is 17% The reward-to-risk ratio is 89, the expected return on asset is 17% The reward-to-risk ratio is 18%, the expected return on asset is 14.6% The risk free rate is 4%, and the required return on the market is 12% 1) What is the required return on an asset with a beta of 1.5? 2) What is the reward/risk ratio? 3) What is the required return on a portfolio consisting of 40% of the asset above and the rest in an as set with an average amount of systematic risk? The required return in question (1) is 0 16 The reward risk ratio in question (2) is 1.5 required return in th & 50680-as Dell Links Bing ( AS 247 The risk free rate is 4%, and the required return on the market is 12%. 1) What is the required return on an asset with a beta of 1.5? What is the reward/risk ratio? 3) What is the required return on a portfolio consisting of 40% of the asset above and the rest in an as set with an average amount of systematic risk? The required return in question (1) is 0.16 The reward risk ratio in question (2) is 1.5, required return in th e question (3) is 0.136 The required return in question (1) is 0.16. The reward risk ratio in question (2) is 0.08 required return int he question (3) is 0.136 The required retum in question (1) is 0 12. The reward/risk ratio in question (2) is 0.08. required return int he question (3) is 0.136 The required return in question (1) is 0.12. The reward/risk ratio in question (2) is 1.5, required return in th e question (3) is 0.36. ES A company that wants to determine its cost of equity gathers the following information: Remonty Roman. Try Maria Thereta Das Le Using the capital asset pricing model (CAPM) approach, the cost of equity (%) for the company is clos est to C 13.1% D 15.4% A 12.6% B 7.5% A project has the following cash flows: Yeart Year Years Year 4 100 SOD The internal rate of return (IRR) for the project is closest to: A 9.1% D.aspx A Della Links Bing : A company that wants to determine its cost of equity gathers the following information: who This M The cop G CH Using the capital asset pricing model (CAPM) approach, the cost of equity (%) for the company is clos est to: C 13.1% D 15.4% 49 FA 12.696 B 75% A project has the following cash flows: Yeart Year 2 | Year Ver so SLO The internal rate of return (IRR) for the project is closest to: A 9.1% B. 100% C 8.8% D 98% * A credit rating agency assesses a company's corporate governance structure as favorable to creditor rights. The most likely impact of this assessment on the company is a(n): A increase in its risk of default D None of the above B reduction in its financial performance C reduction in its cost of debt Consider the following information: a mais