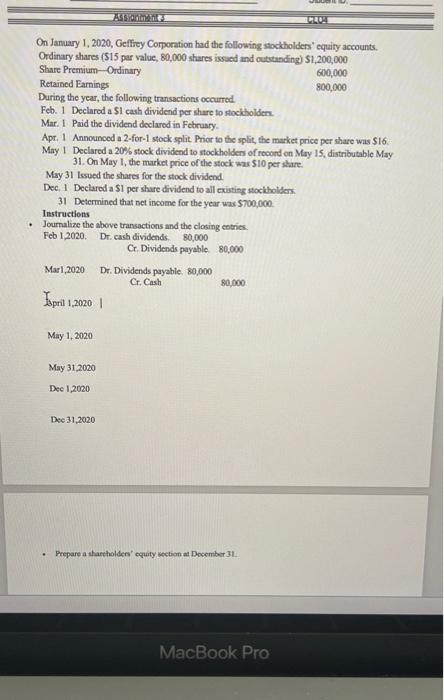

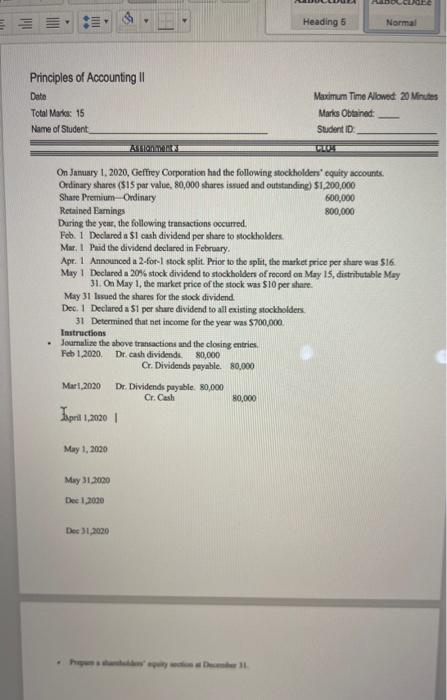

Assa On January 1, 2020, Geffrey Corporation had the following stockholders' equity accounts. Ordinary shares (515 par value, 80,000 shares issued and outstanding) $1,200,000 Share Premium-Ordinary 600,000 Retained Earnings 800,000 During the year, the following transactions occurred Feb. 1 Declared a $1 cash dividend per share to stockholder Mar. 1 Paid the dividend declared in February Apr. 1 Announced a 2-for-1 stock split. Prior to the split, the market price per share wus $16. May 1 Declared a 20% stock dividend to stockholders of record on May 15, distributable May 31. On May 1, the market price of the stock was $10 per share. May 31 lessed the shares for the stock dividend. Dec. 1 Declared a S1 per share dividend to all existing stockholders 31 Determined that net income for the year was $700,000 Instructions Journalize the above transactions and the closing entries. Feb 1,2020 Dr. cash dividends 80,000 Cr. Dividends payable 80,000 Mar 1,2020 Dr. Dividends payable. 80,000 Cr. Cash 80,000 . Iepril 1.2020 May 1, 2020 May 31,2020 Dec 1,2020 Dec 31,2020 Prepare a shareholders' equity section at December 3L MacBook Pro ilil Heading 5 Normal Principles of Accounting | Date Total Martos: 15 Name of Student Maximum Time Allowed 20 Minutes Maris Obtained Sudent ID On January 1, 2020, Geffrey Corporation had the following stockholders' equity accounts. Ordinary shares (515 par value, 80,000 shares issued and outstanding) $1,200,000 Share Premium Ordinary 600,000 Retained Eamings 800,000 During the year, the following transactions occurred. Feb. 1 Declared a $1 cash dividend per share to stockholders Mar. 1 Paid the dividend declared in February Apr. 1 Announced a 2-for-Istock split. Prior to the split, the market price per share was 516 May 1 Declared a 20% stock dividend to stockholders of record on May 15, distributable May 31. On May 1, the market price of the stock was $10 per share May 31 Issued the shares for the stock dividend. Deo. 1 Declared a S1 per shure dividend to all existing stockholders 31 Determined that net income for the year was $700,000 Instructions Jomalize the above transactions and the closing entries Feb 1.2020 Dr cash dividends. 80,000 Cr. Dividends payable. 80,000 Mar 1,2020 Dr. Dividends payable. 80,000 Cr. Cash 80,000 Iepril 19,2020 May 1, 2020 May 31,2020 Dec 1.2000 Dec 31, 2020