Answered step by step

Verified Expert Solution

Question

1 Approved Answer

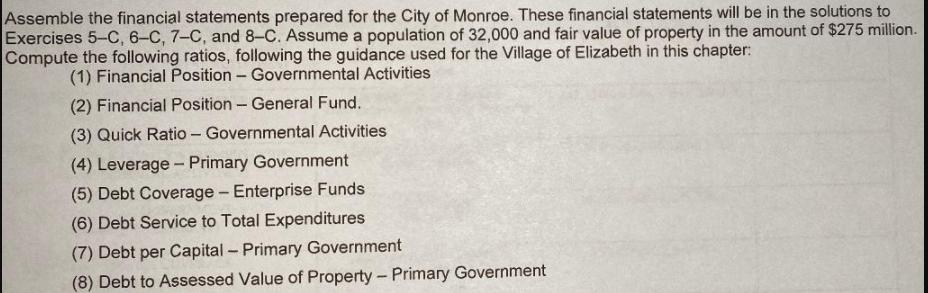

Assemble the financial statements prepared for the City of Monroe. These financial statements will be in the solutions to Exercises 5-C, 6-C, 7-C, and

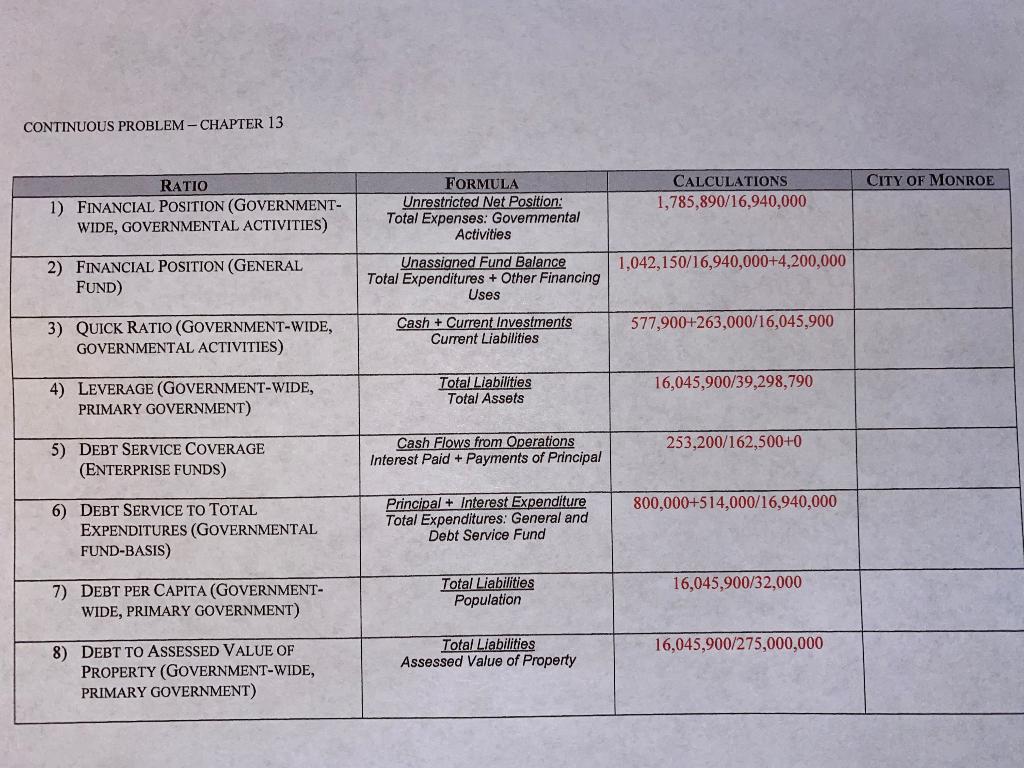

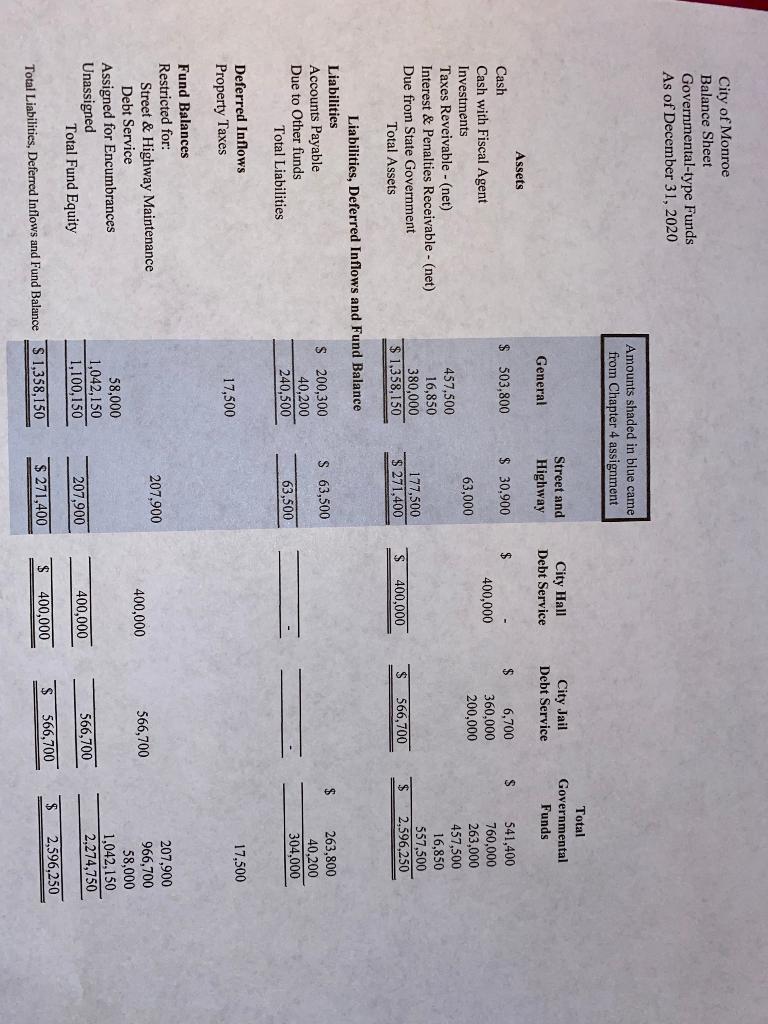

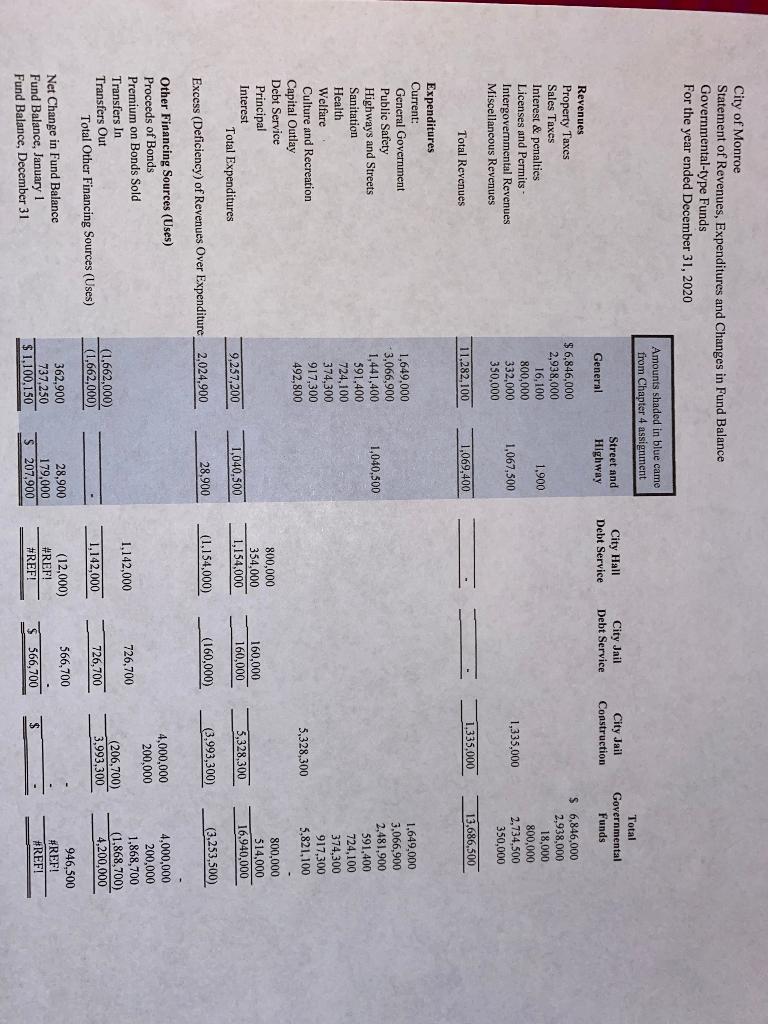

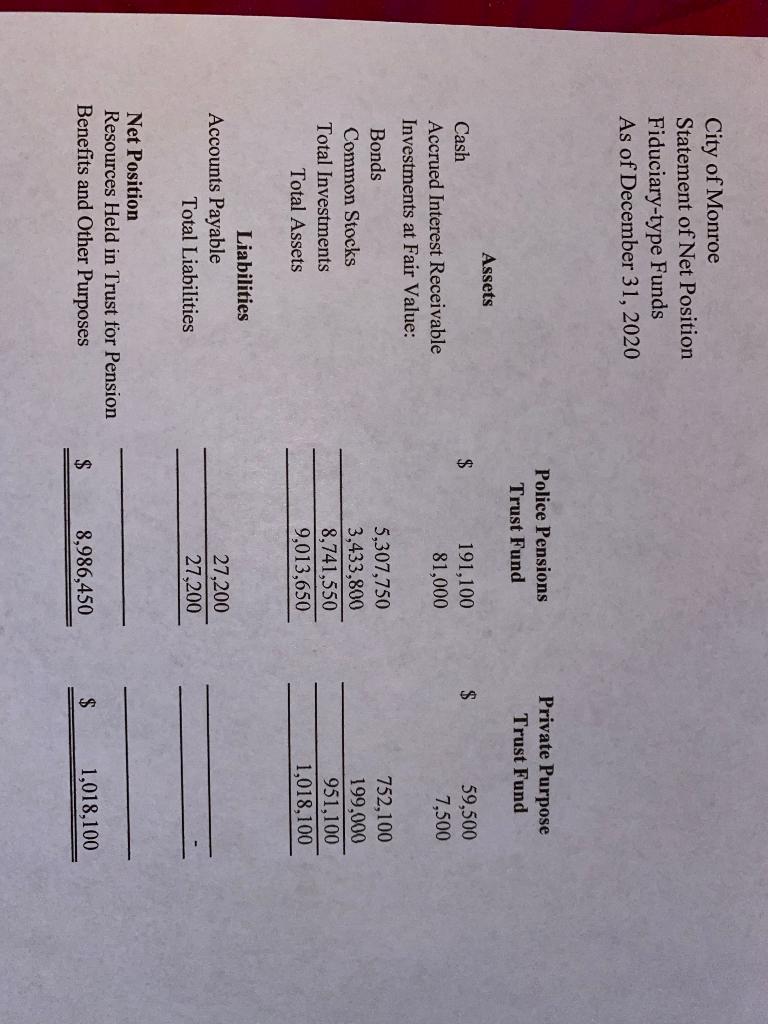

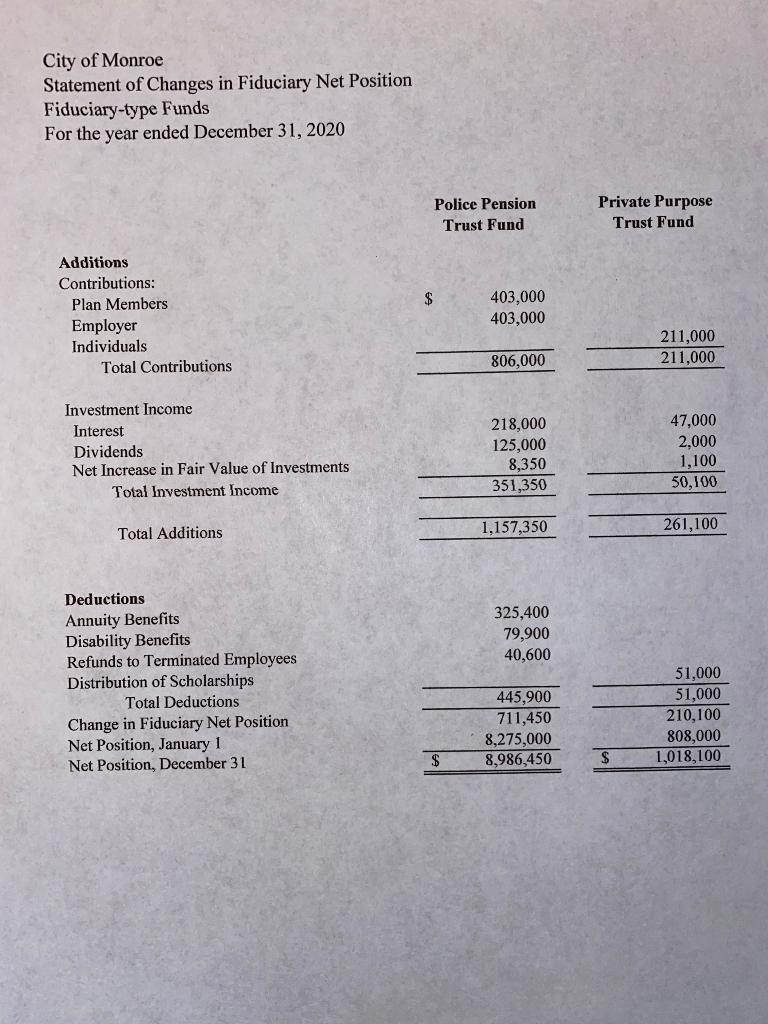

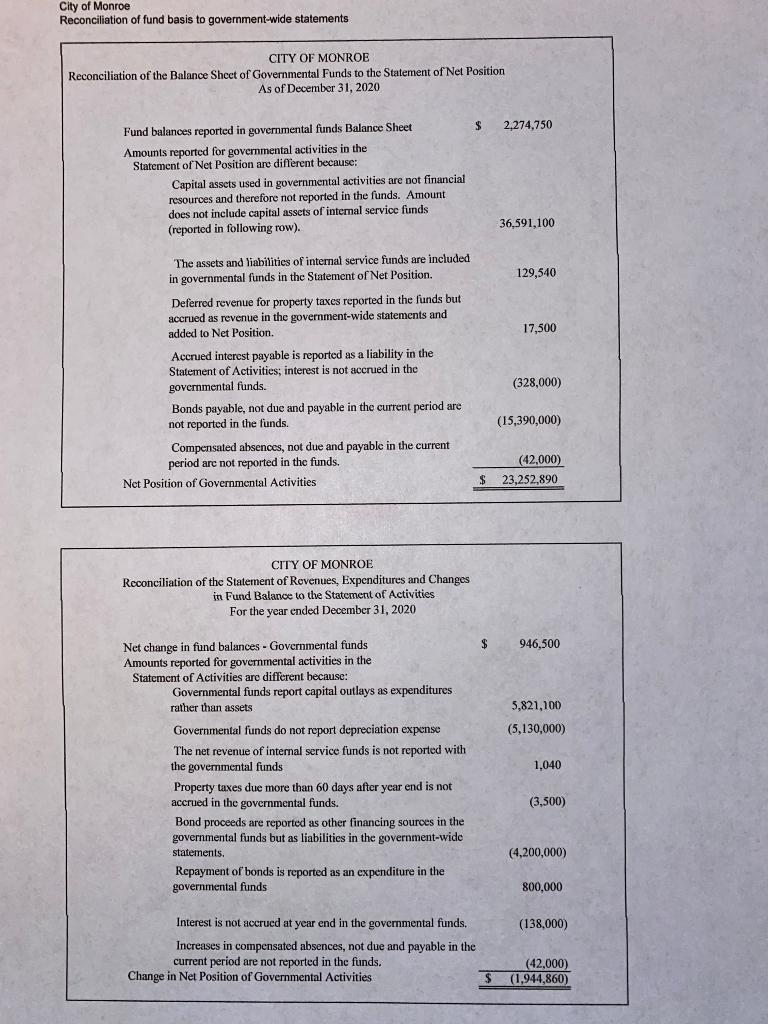

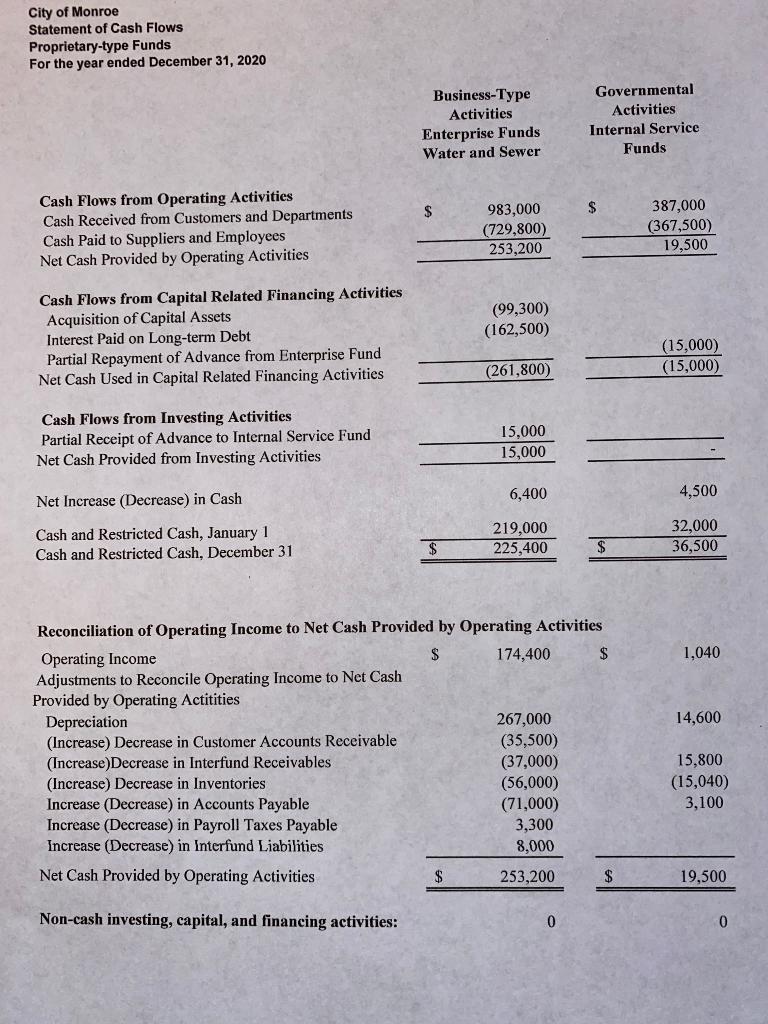

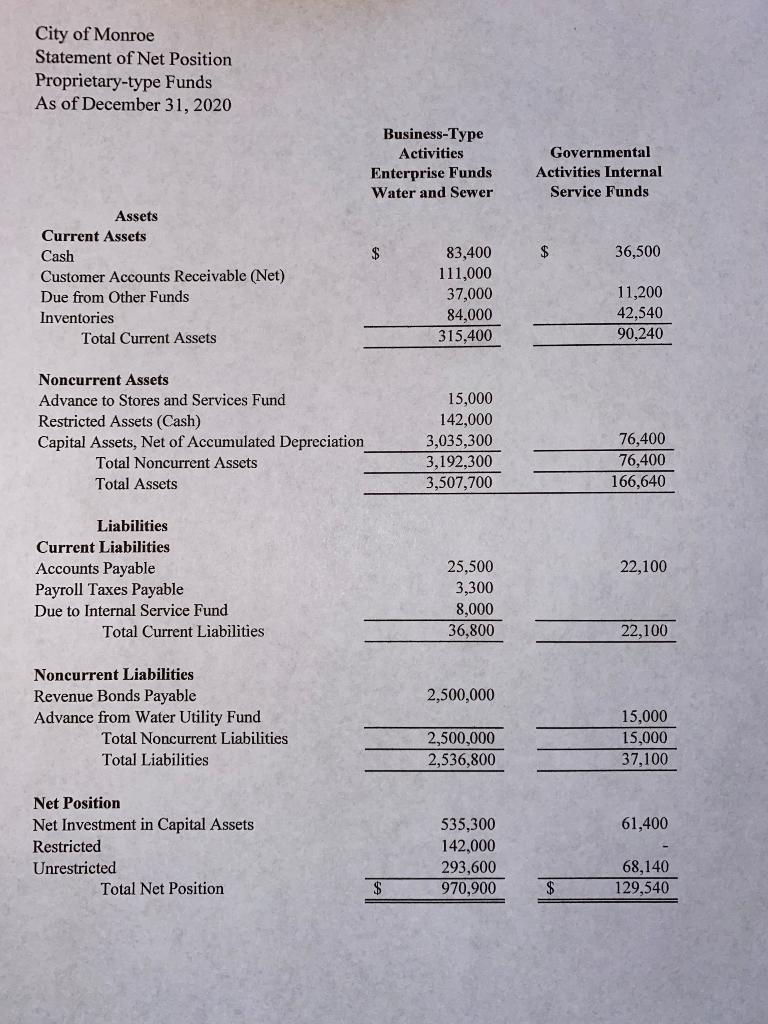

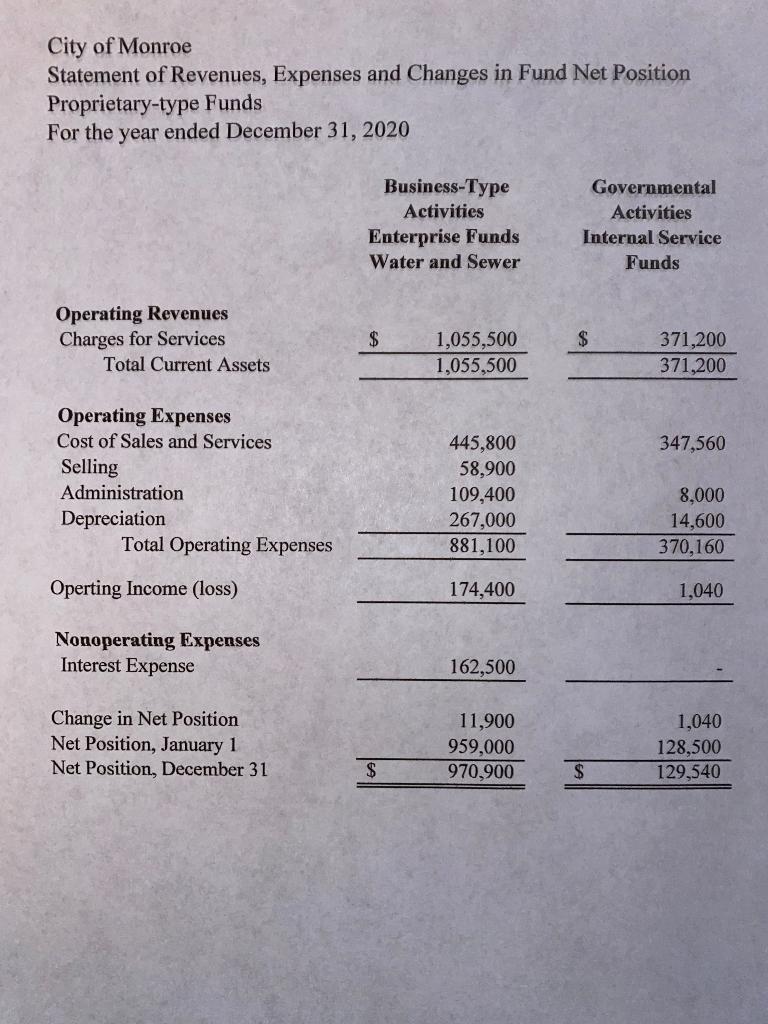

Assemble the financial statements prepared for the City of Monroe. These financial statements will be in the solutions to Exercises 5-C, 6-C, 7-C, and 8-C. Assume a population of 32,000 and fair value of property in the amount of $275 million. Compute the following ratios, following the guidance used for the Village of Elizabeth in this chapter: (1) Financial Position - Governmental Activities (2) Financial Position - General Fund. (3) Quick Ratio - Governmental Activities (4) Leverage - Primary Government (5) Debt Coverage - Enterprise Funds (6) Debt Service to Total Expenditures (7) Debt per Capital - Primary Government (8) Debt to Assessed Value of Property- Primary Government CONTINUOUS PROBLEM -- CHAPTER 13 RATIO FORMULA CALCULATIONS CITY OF MONROE Unrestricted Net Position: Total Expenses: Govemmental Activities 1,785,890/16,940,000 1) FINANCIAL POSITION (GOVERNMENT- WIDE, GOVERNMENTAL ACTIVITIES) Unassigned Fund Balance Total Expenditures + Other Financing Uses 1,042,150/16,940,000+4,200,000 2) FINANCIAL POSITION (GENERAL FUND) Cash + Current Investments Current Liabilities 577,900+263,000/16,045,900 3) QUICK RATIO (GOVERNMENT-WIDE, GOVERNMENTAL ACTIVITIES) 4) LEVERAGE (GOVERNMENT-WIDE, PRIMARY GOVERNMENT) Total Liabilities Total Assets 16,045,900/39,298,790 253,200/162,500+0 5) DEBT SERVICE COVERAGE (ENTERPRISE FUNDS) Cash Flows from Operations Interest Paid + Payments of Principal Principal+ Interest Expenditure Total Expenditures: General and Debt Service Fund 800,000+514,000/16,940,000 6) DEBT SERVICE TO TOTAL EXPENDITURES (GOVERNMENTAL FUND-BASIS) Total Liabilities Population 16,045,900/32,000 7) DEBT PER CAPITA (GOVERNMENT- WIDE, PRIMARY GOVERNMENT) Total Liabilities Assessed Value of Property 16,045,900/275,000,000 8) DEBT TO ASSESSED VALUE OF PROPERTY (GOVERNMENT-WIDE, PRIMARY GOVERNMENT) City of Monroe Balance Sheet Governmental-type Funds As of December 31, 2020 Amounts shaded in blue came from Chapter 4 assignment Total Street and City Jail Debt Service City Hall Governmental General Highway Debt Service Funds Assets Cash $ 503,800 $ 30,900 6,700 541,400 760,000 263,000 457,500 $ Cash with Fiscal Agent 360,000 200,000 400,000 Investments 63,000 457,500 16,850 380,000 $1,358,150 Taxes Reveivable - (net) Interest & Penalties Receivable - (net) 16,850 Due from State Government 557,500 177,500 $ 271,400 Total Assets 400,000 566,700 2,596.250 Liabilities, Deferred Inflows and Fund Balance Liabilities Accounts Payable $ 200,300 40,200 240,500 S 63,500 263,800 40,200 $ Due to Other funds Total Liabilities 63,500 304,000 Deferred Inflows Property Taxes 17,500 17,500 Fund Balances Restricted for: 207,900 966,700 58,000 1,042,150 2,274,750 Street & Highway Maintenance Debt Service 207,900 400,000 566,700 Assigned for Encumbrances Unassigned 58,000 1,042,150 1,100,150 Total Fund Equity 207,900 400,000 566,700 S 1,358,150 $ 271,400 400,000 566,700 2,596,250 Total Liabilities, Deferred Inflows and Fund Balance City of Monroe Statement of Revenues, Expenditures and Changes in Fund Balance Governmental-type Funds For the year ended December 31, 2020 Amounts shaded in blue came from Chapter 4 assignment Total Governmental Street and Highway City Hall City Jail Debt Service City Jail General Debt Service Construction Funds Revenues Property Taxes Sales Taxes Interest & penalties Licenses and Permits Intergovernmental Revenues Miscellancous Revenues $ 6,846,000 2,938,000 16,100 800,000 332,000 350,000 $ 6,846,000 2,938,000 1,900 18,000 800,000 2,734,500 350,000 1,067,500 1,335,000 Total Revenues 11,282,100 1,069,400 1,335,000 13,686,500 Expenditures Current: General Government Public Safety Highways and Streets Sanitation 1.649.000 1.649,000 3,066,900 2,481,900 3,066,900 1,040,500 1,441,400 591,400 724,100 374,300 917,300 492,800 Health Welfare Culture and Recreation 591,400 724,100 374,300 917,300 5,821,100 5,328,300 Capital Outlay Debt Service Principal 800,000 800.000 354.000 514,000 160,000 160,000 Interest Total Expenditures 9.257,200 1,040,500 1,154,000 5.328.300 16,940,000 Excess (Deficiency) of Revenues Over Expenditure 2,024,900 28,900 (1,154,000) (160,000) (3,993,300) (3,253,500) Other Financing Sources (Uses) Proceeds of Bonds 4,000,000 4,000,000 200,000 200,000 Premium on Bonds Sold 1,868,700 (1,868,700) 4,200,000 Transfers In 1,142,000 726,700 (206,700) 3,993,300 Transfers Out (1,662,000) Total Other Financing Sources (Uses) (1,662,000) 1,142,000 726,700 566,700 946,500 28,900 179,000 S 207,900 (12,000) #REF! 362,900 Net Change in Fund Balance Fund Balance, January 1 Fund Balance, December 31 #REF! #REF! 737,250 $ 1,100,150 #REF! 3 566,700 City of Monroe Statement of Net Position Fiduciary-type Funds As of December 31, 2020 Police Pensions Private Purpose Trust Fund Trust Fund Assets 59,500 7,500 Cash 2$ 2$ 191,100 81,000 Accrued Interest Receivable Investments at Fair Value: 5,307,750 3,433,800 8,741,550 9,013,650 Bonds 752,100 199,000 951,100 1,018,100 Common Stocks Total Investments Total Assets Liabilities Accounts Payable 27,200 Total Liabilities 27,200 Net Position Resources Held in Trust for Pension Benefits and Other Purposes 24 8,986,450 2$ 1,018,100 City of Monroe Statement of Changes in Fiduciary Net Position Fiduciary-type Funds For the year ended December 31, 2020 Police Pension Private Purpose Trust Fund Trust Fund Additions Contributions: Plan Members 403,000 403,000 $ Employer Individuals Total Contributions 211,000 211,000 806,000 Investment Income Interest 47,000 2,000 1,100 50,100 218,000 Dividends Net Increase in Fair Value of Investments 125,000 8,350 351,350 Total Investment Income 1,157,350 261,100 Total Additions Deductions Annuity Benefits Disability Benefits Refunds to Terminated Employees Distribution of Scholarships Total Deductions 325,400 79,900 40,600 51,000 51,000 Change in Fiduciary Net Position Net Position, January 1 Net Position, December 31 445,900 711,450 8,275,000 8,986,450 210,100 808,000 1,018,100 $4 City of Monroe Reconciliation of fund basis to government-wide statements CITY OF MONROE Reconciliation of the Balance Sheet of Governmental Funds to the Statement of Net Position As of December 31, 2020 2,274,750 Fund balances reported in governmental funds Balance Sheet Amounts reported for governmental activities in the Statement of Net Position are different because: Capital assets used in governmental activities are not financial resources and therefore not reported in the funds. Amount does not include capital assets of internal service funds (reported in following row). 36,591,100 The assets and liabilities of internal service funds are included 129,540 in governmental funds in the Statement of Net Position. Deferred revenue for property taxes reported in the funds but accrued as revenue in the government-wide statements and 17,500 added to Net Position. Accrued interest payable is reported as a liability in the Statement of Activities; interest is not accrued in the governmental funds. (328,000) Bonds payable, not due and payable in the current period are not reported in the funds. (15,390,000) Compensated absences, not due and payable in the current period are not reported in the funds. (42,000) $ 23,252,890 Net Position of Governmental Activities CITY OF MONROE Reconciliation of the Statement of Rovenues, Expenditures and Changes in Fund Balance to the Statement of Activities For the year ended December 31, 2020 Net change in fund balances - Governmental funds. Amounts reported for governmental activities in the Statement of Activities are different because: $ 946,500 Governmental funds report capital outlays as expenditures rather than assets 5,821,100 Governmental funds do not report depreciation expense (5,130,000) The net revenue of internal service funds is not reported with the governmental funds 1,040 Property taxes due more than 60 days after year end is not accrued in the governmental funds. (3,500) Bond proceeds are reported as other financing sources in the governmental funds but as liabilities in the government-wide statements. (4,200,000) Repayment of bonds is reported as an expenditure in the governmental funds 800,000 Interest is not accrued at year end in the governmental funds. (138,000) Increases in compensated absences, not due and payable in the current period are not reported in the funds. Change in Net Position of Governmental Activities (42,000) (1,944,860) City of Monroe Statement of Cash Flows Proprietary-type Funds For the year ended December 31, 2020 Business-Type Governmental Activities Activities Internal Service Enterprise Funds Water and Sewer Funds Cash Flows from Operating Activities Cash Received from Customers and Departments Cash Paid to Suppliers and Employees Net Cash Provided by Operating Activities 387,000 (367,500) 19,500 2$ 983,000 (729,800) 253,200 $ Cash Flows from Capital Related Financing Activities Acquisition of Capital Assets Interest Paid on Long-term Debt Partial Repayment of Advance from Enterprise Fund Net Cash Used in Capital Related Financing Activities (99,300) (162,500) (15,000) (15,000) (261,800) Cash Flows from Investing Activities Partial Receipt of Advance to Internal Service Fund Net Cash Provided from Investing Activities 15,000 15,000 6,400 4,500 Net Increase (Decrease) in Cash Cash and Restricted Cash, January 1 Cash and Restricted Cash, December 31 219,000 225,400 32,000 36,500 24 Reconciliation of Operating Income to Net Cash Provided by Operating Activities $ 174,400 2$ 1,040 Operating Income Adjustments to Reconcile Operating Income to Net Cash Provided by Operating Actitities Depreciation (Increase) Decrease in Customer Accounts Receivable (Increase)Decrease in Interfund Receivables (Increase) Decrease in Inventories Increase (Decrease) in Accounts Payable Increase (Decrease) in Payroll Taxes Payable Increase (Decrease) in Interfund Liabilities 267,000 (35,500) (37,000) (56,000) (71,000) 14,600 15,800 (15,040) 3,100 3,300 8,000 Net Cash Provided by Operating Activities $4 253,200 2$ 19,500 Non-cash investing, capital, and financing activities: 0. City of Monroe Statement of Net Position Proprietary-type Funds As of December 31, 2020 Business-Type Activities Governmental Enterprise Funds Activities Internal Water and Sewer Service Funds Assets Current Assets $ 36,500 83,400 111,000 37,000 84,000 315,400 2$ Cash Customer Accounts Receivable (Net) Due from Other Funds 11,200 42,540 Inventories Total Current Assets 90,240 Noncurrent Assets Advance to Stores and Services Fund 15,000 142,000 3,035,300 3,192,300 3,507,700 Restricted Assets (Cash) Capital Assets, Net of Accumulated Depreciation 76,400 76,400 166,640 Total Noncurrent Assets Total Assets Liabilities Current Liabilities 25,500 3,300 8,000 36,800 Accounts Payable 22,100 Payroll Taxes Payable Due to Internal Service Fund Total Current Liabilities 22,100 Noncurrent Liabilities Revenue Bonds Payable Advance from Water Utility Fund 2,500,000 15,000 Total Noncurrent Liabilities 2,500,000 2,536,800 15,000 Total Liabilities 37,100 Net Position Net Investment in Capital Assets Restricted Unrestricted 61,400 535,300 142,000 293,600 970,900 68,140 129,540 Total Net Position $4 City of Monroe Statement of Revenues, Expenses and Changes in Fund Net Position Proprietary-type Funds For the year ended December 31, 2020 Business-Type Governmental Activities Activities Enterprise Funds Internal Service Water and Sewer Funds Operating Revenues Charges for Services Total Current Assets 1,055,500 1,055,500 2$ 2$ 371,200 371,200 Operating Expenses Cost of Sales and Services 445,800 58,900 347,560 Selling Administration 109,400 267,000 881,100 8,000 Depreciation 14,600 Total Operating Expenses 370,160 Operting Income (loss) 174,400 1,040 Nonoperating Expenses Interest Expense 162,500 Change in Net Position Net Position, January 1 Net Position, December 31 1,040 128,500 129,540 11,900 959,000 970,900 2$ $4

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started