Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assess the companys burn rate (cash expenditure without any notable cash inflow) and financial outlook. 448 PART 3 Entrepreneurial Case Analysis entrepreneurial CASE ANALYSIS Introduction

Assess the company’s burn rate (cash expenditure without any notable cash inflow) and financial outlook.

Assess the company’s burn rate (cash expenditure without any notable cash inflow) and financial outlook.

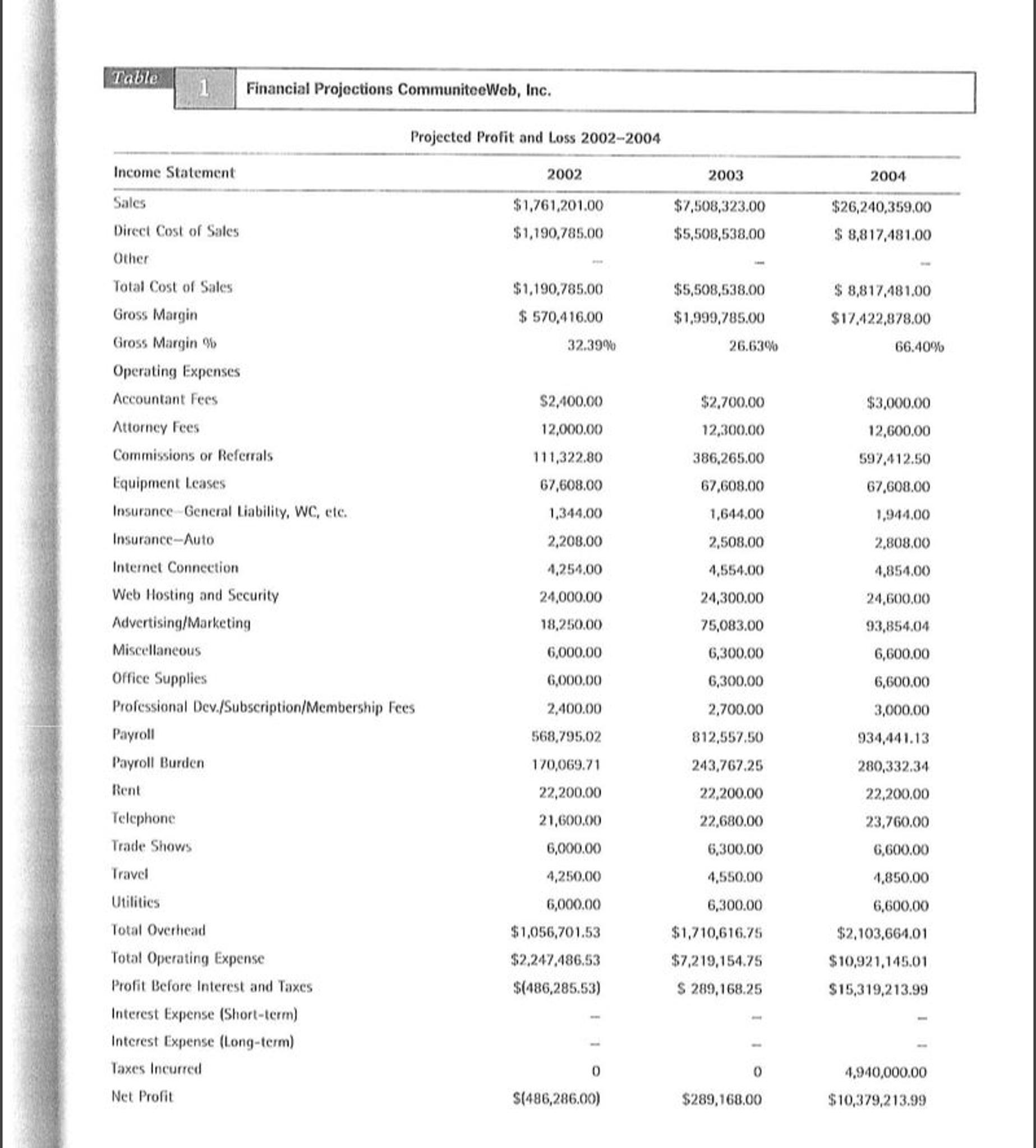

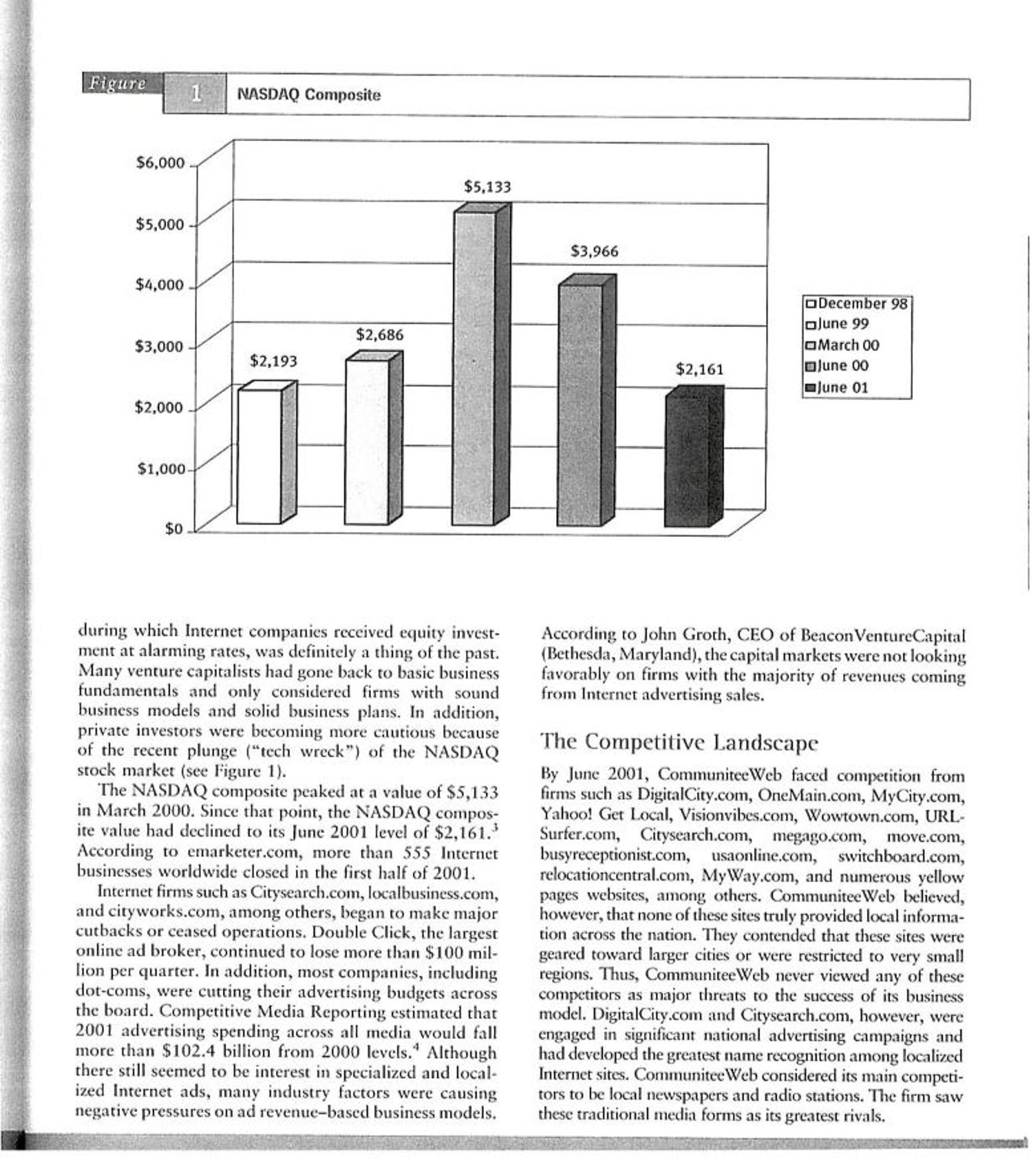

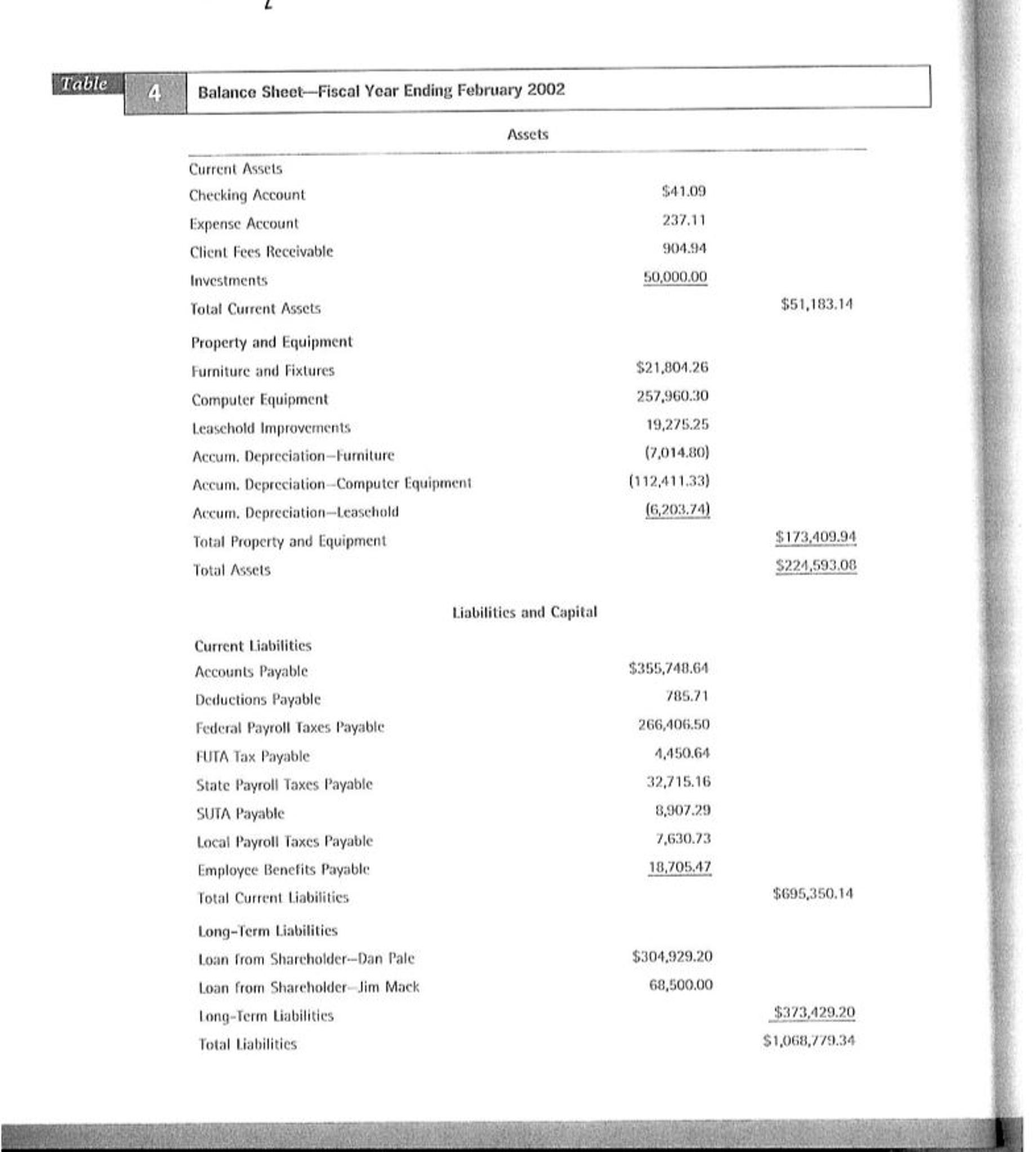

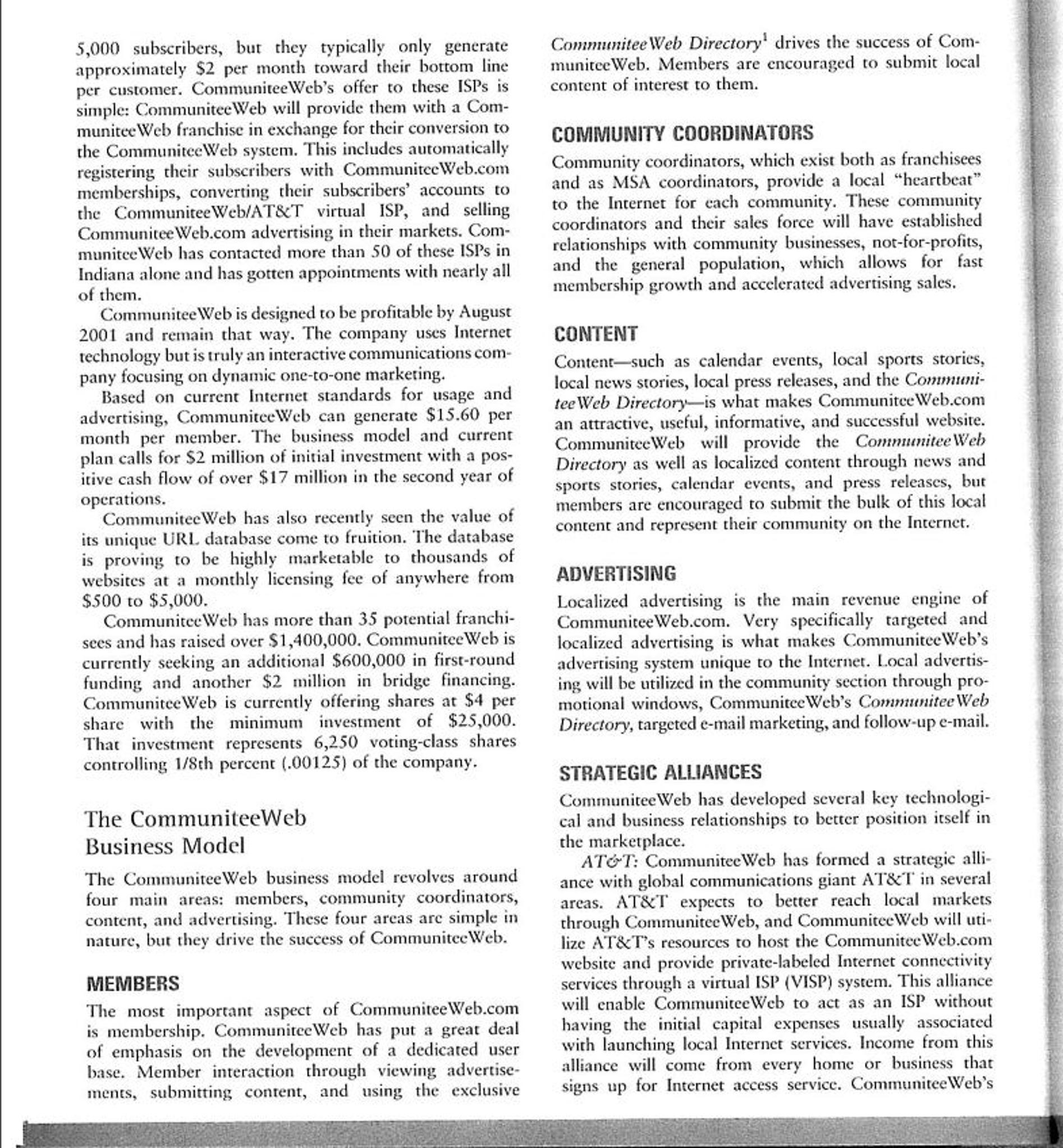

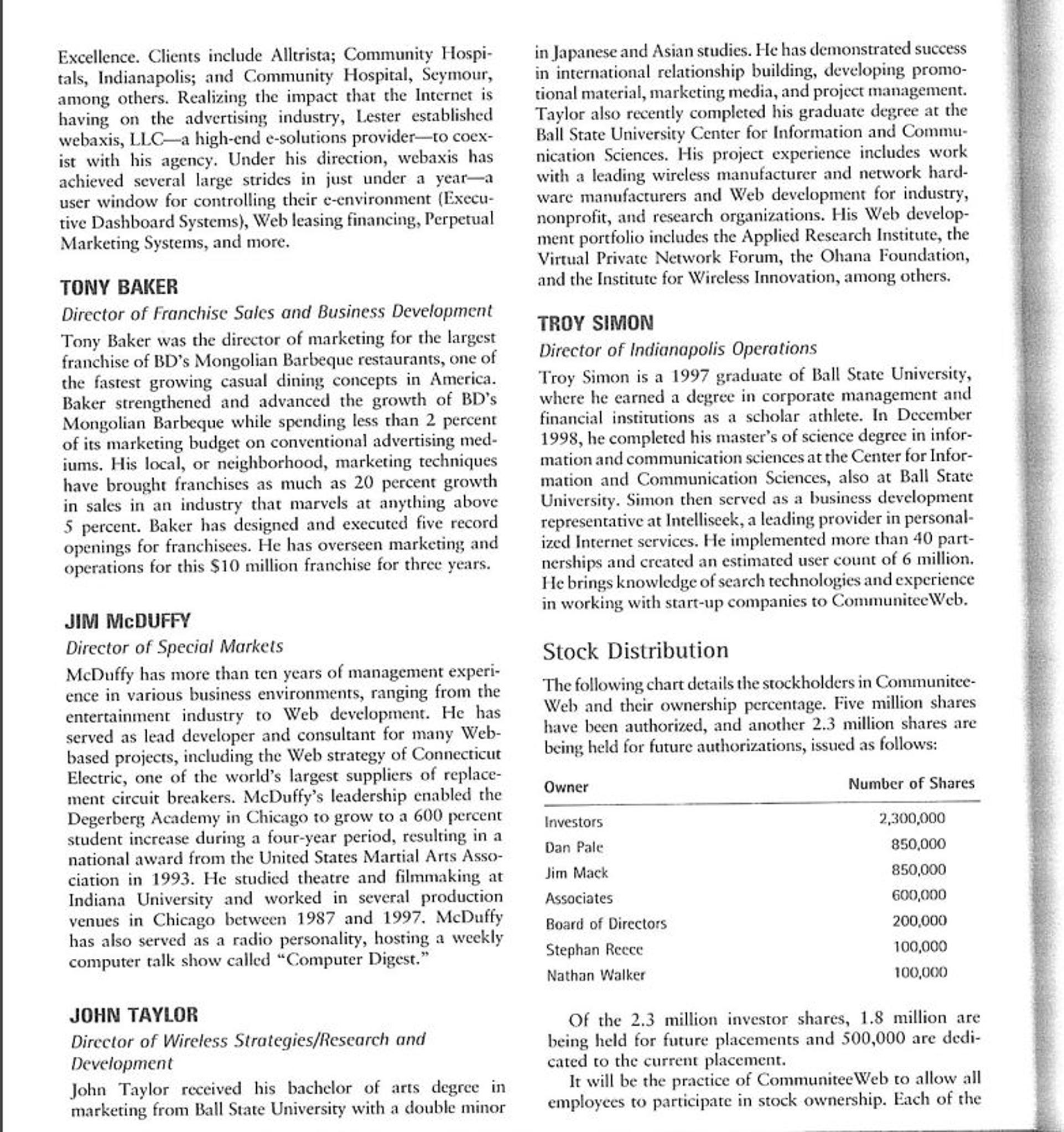

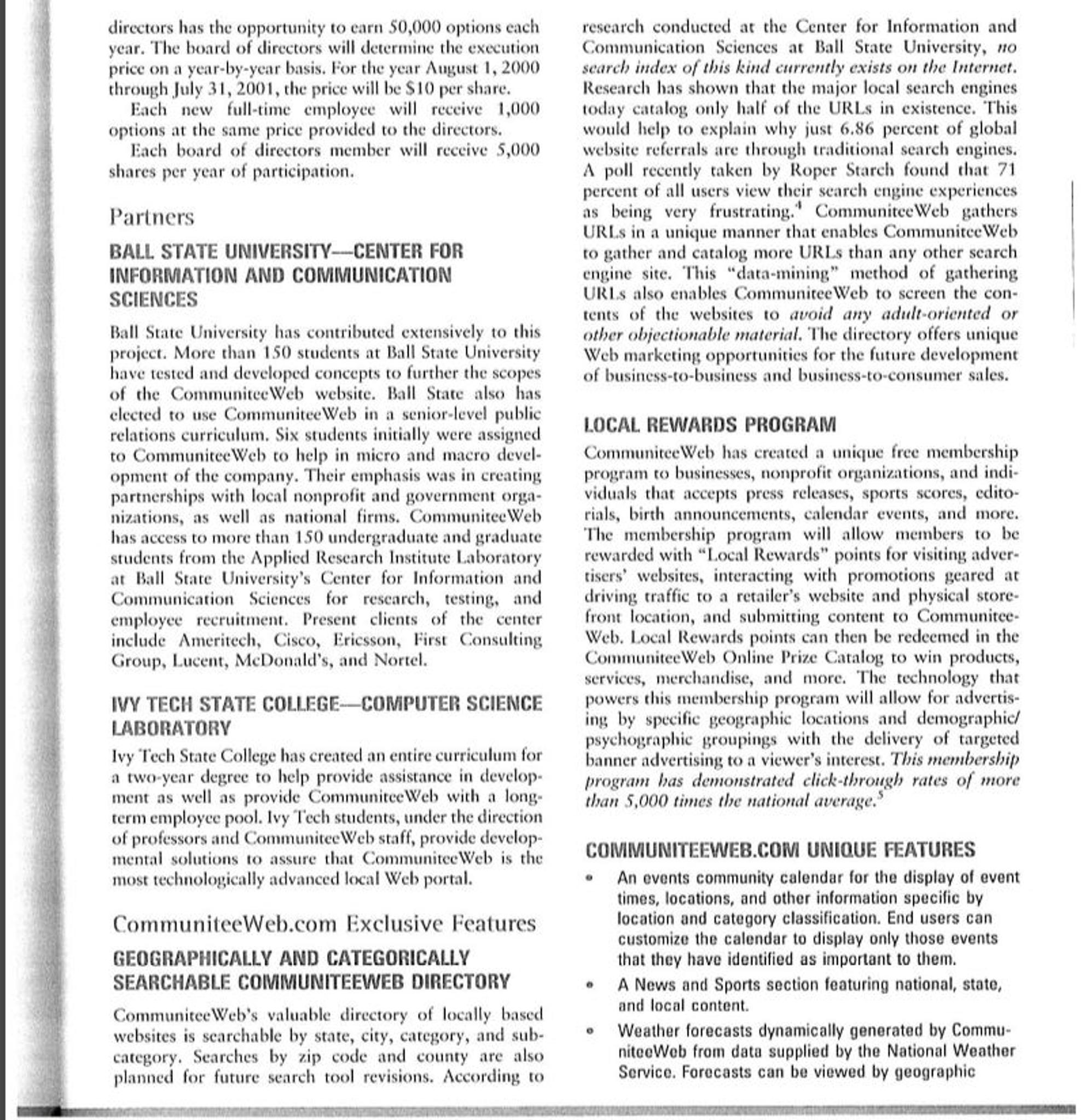

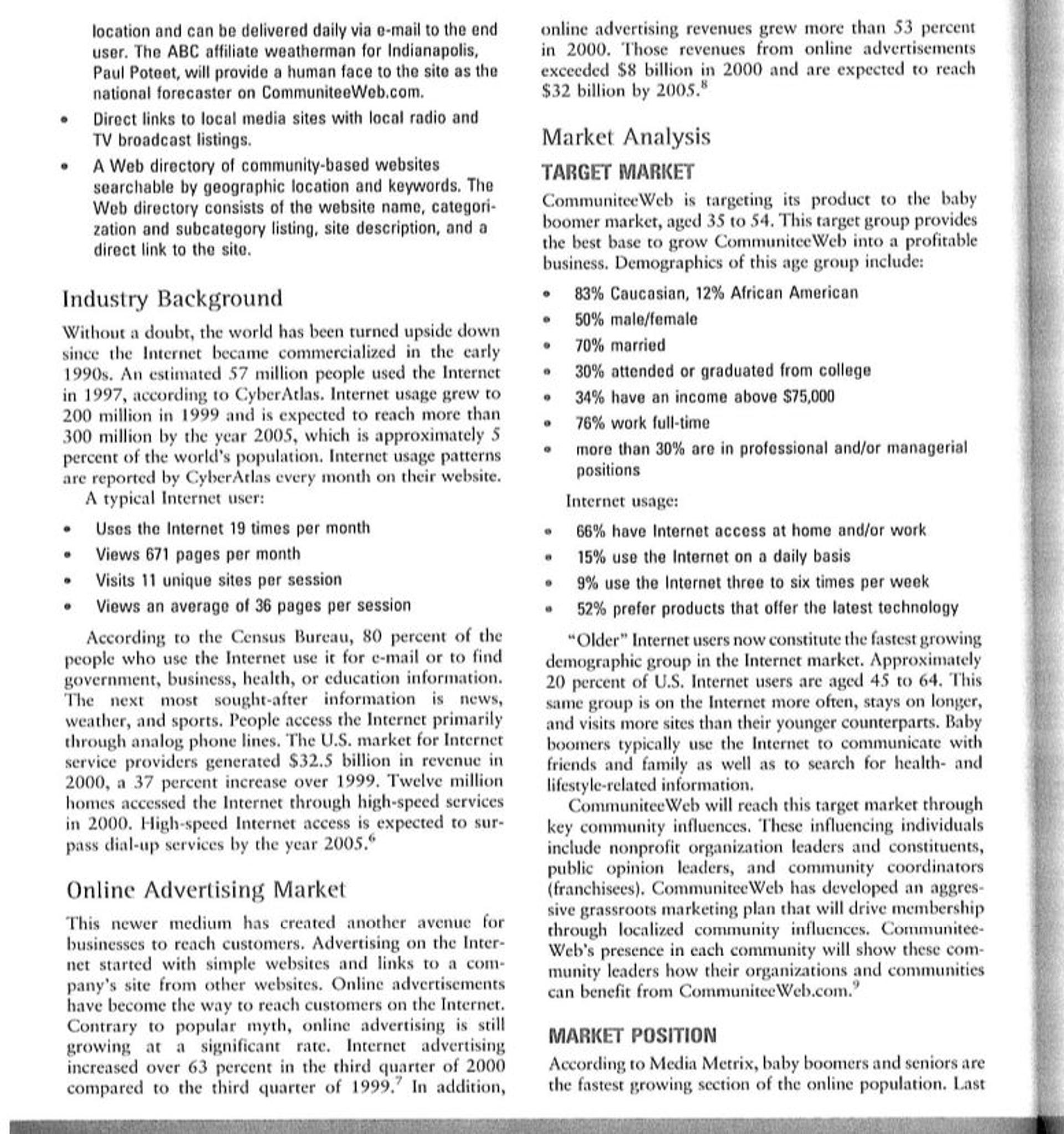

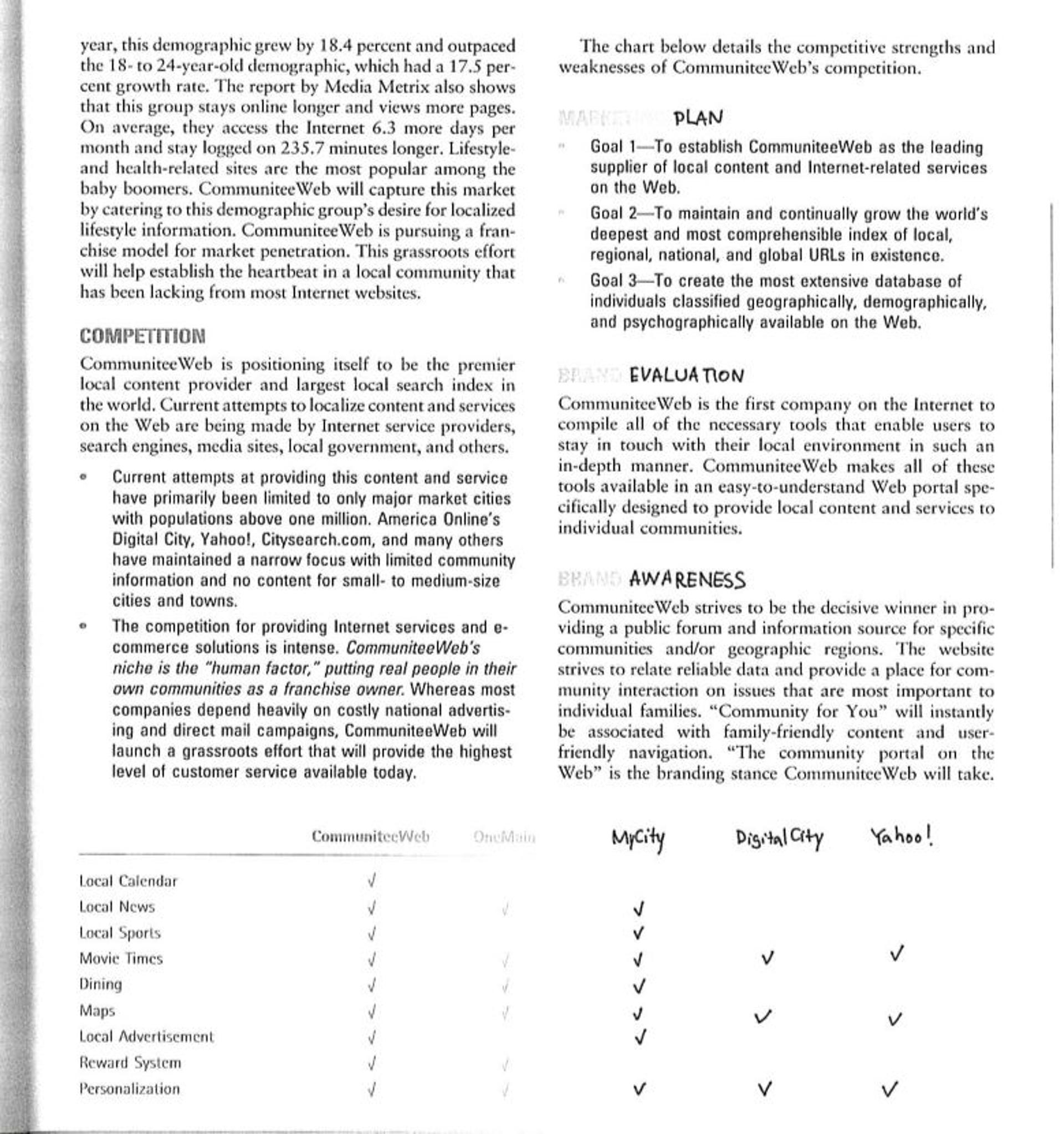

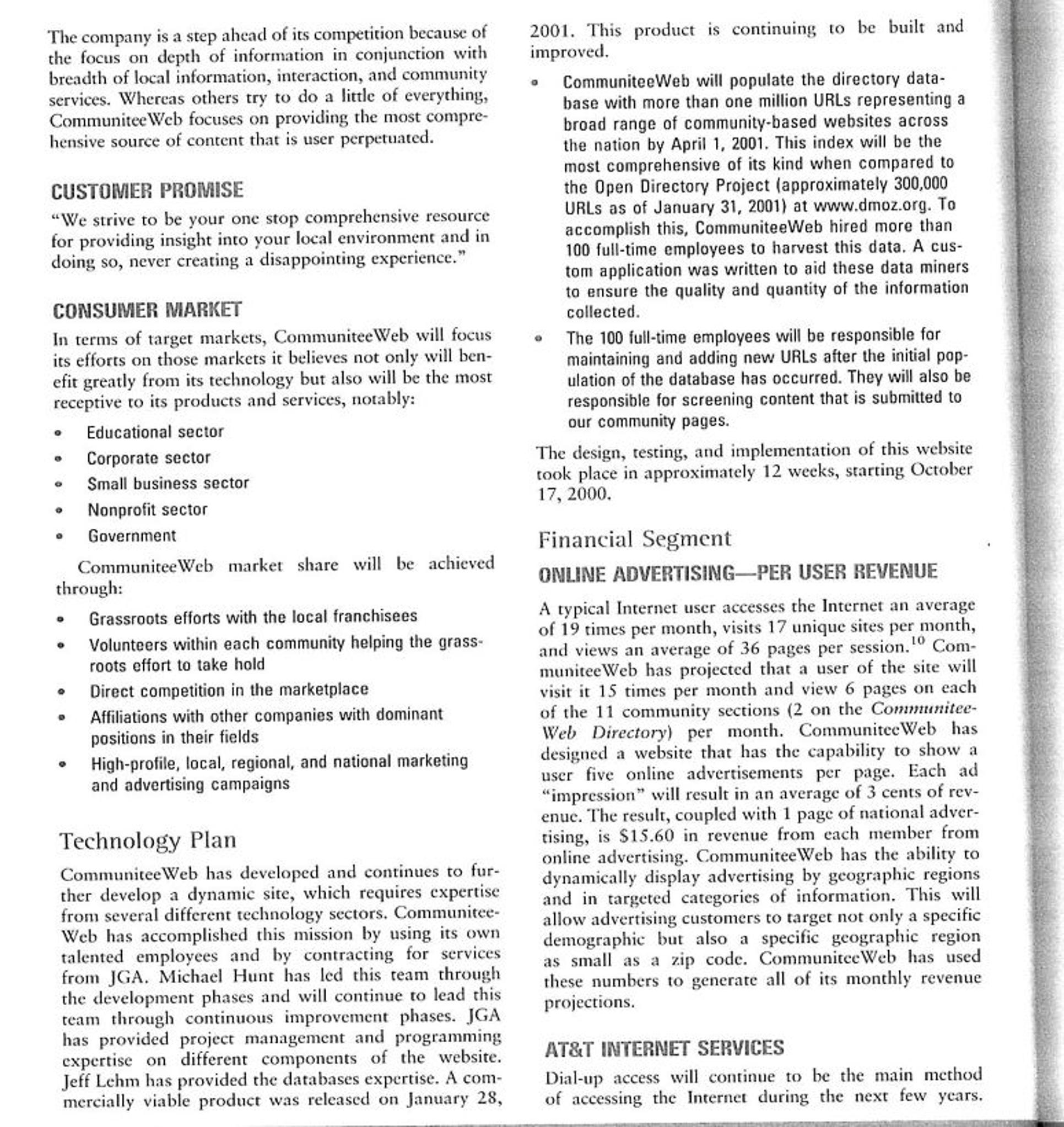

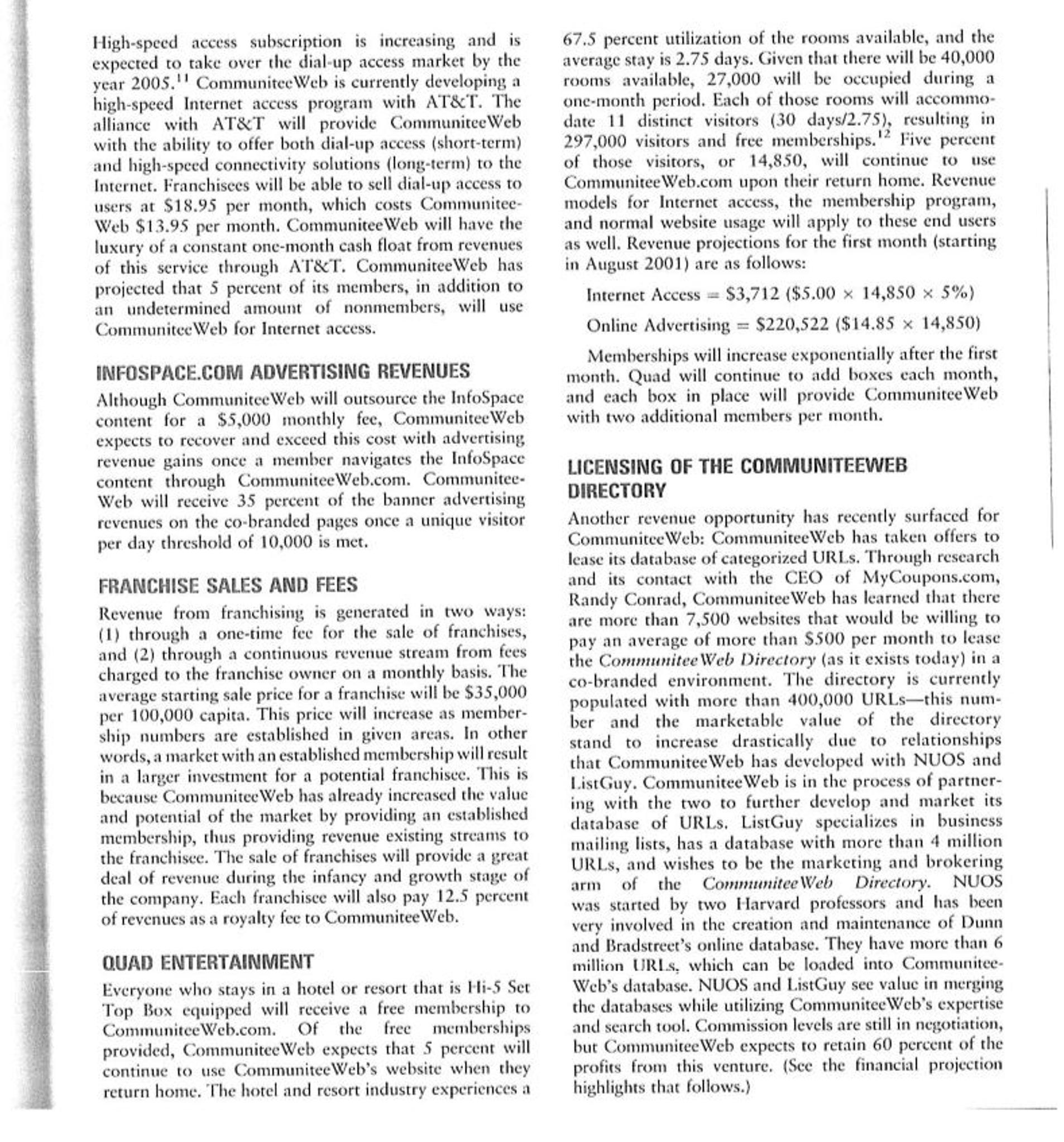

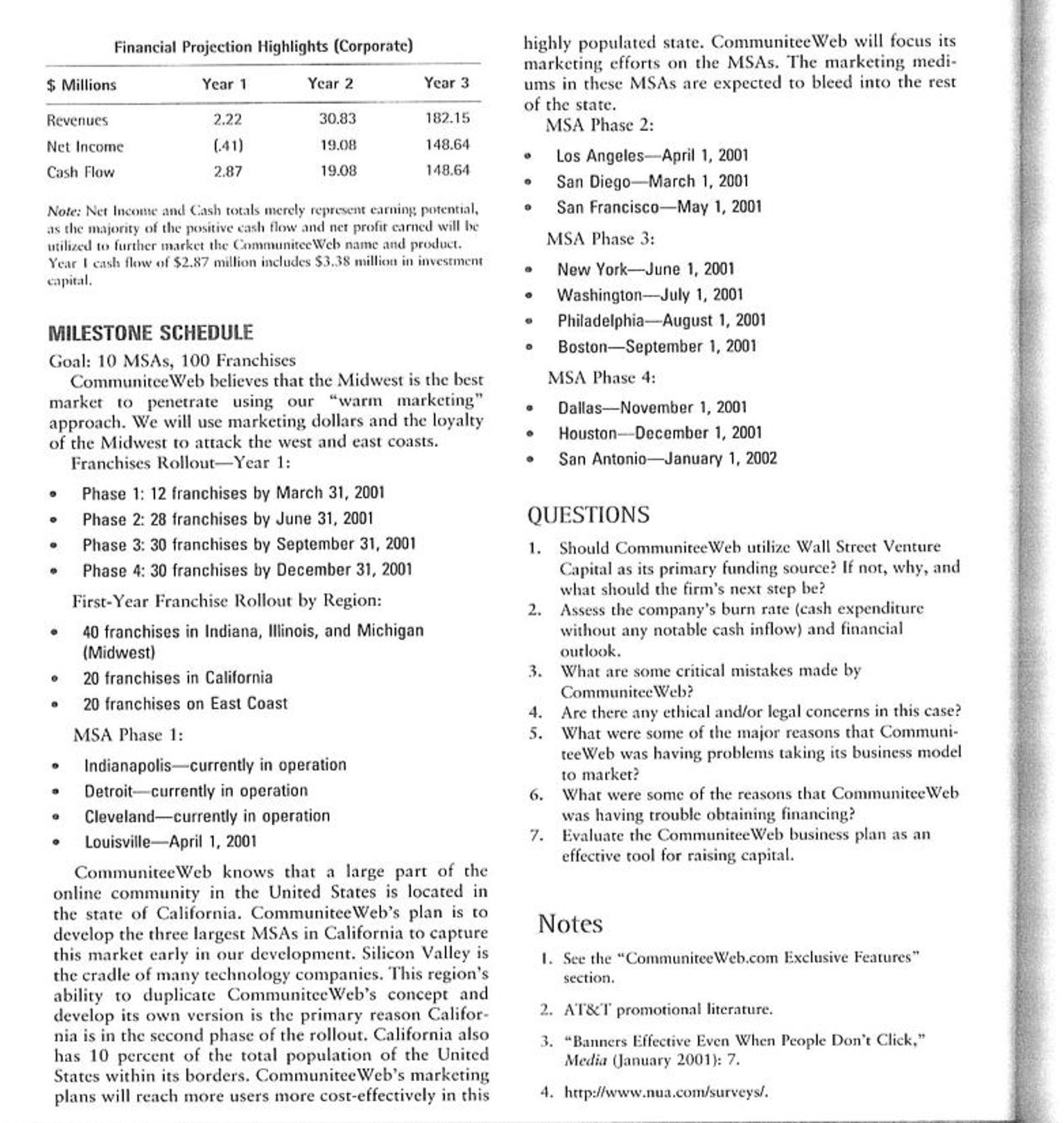

448 PART 3 Entrepreneurial Case Analysis entrepreneurial CASE ANALYSIS Introduction Dan Pale, a 30-year-old CEO of an Internet start-up company, CommuniteeWeb.com, was faced with the most important decision of his business career. After more than a year of operation that was funded with approxi- mately $1.6 million in start-up capital, his company was experiencing difficult times. Pale and cofounder, Jim Mack, were faced with some tough decisions. A lack of cash flow to the business coupled with rapidly increasing debt was causing mounting financial pressures. Potential legal problems were also on the horizon. Sitting at his desk on June 8, 2001, Pale now ponders a decision to sign a funding agreement with Wall Street Venture Capital. Formation of the Initial Business Concept: CommuniteeWeb.com Dan Pale had talked about and researched the idea of a localized Internet portal for many months. In the fall of 1999, Pale-determined that the idea seemed technolog- ically feasible-visited Jim Mack, owner of a financial planning firm in Seymour, Indiana. After three meetings, Mack agreed to join the venture. They contacted the Information and Communication Sciences Applied Research Institute at Ball State University to conduct further research on the concept. In March 2000, CommuniteeWeb, Inc. was officially established. Jim Mack served as the CEO and chairman of the board of directors, while Dan Pale served as the president/COO. The basic idea behind the business concept was to localize the Internet. This would be done through a website that would allow users to narrow information found on the Web to a localized and specific geographic area. In turn, the website would then generate advertise- ments specific to the geographic area from which the user had originated his or her visit. The idea was to contain these capabilities within one national website. This site would also give users the ability to interact by posting stories about local sporting and news events. Building the Organization and Its Product Dan Pale recruited and hired a talented, young team at Communitee Web. For several months, employees mined and categorized an extensive database of URLs and built a model for taking Communitee Web.com to market. The firm used in-house software to locate, capture, and cate- gorize these website addresses. Pale and Mack planned to take their concept of localized Internet utilization to market via franchising. Franchisees would buy the rights to sell CommuniteeWeb.com advertising (banner ads, e-mail marketing, pop-up ads) to specific territories. Each franchise would sell for $35,000 and would cover a geographic region populated by approximately 100,000 people. Pale and Mack expected to use the fran- chise fees to fund Communitee Web s further growth. The company planned on retaining ownership of the 50 largest metropolitan markets in the United States. Jim Mack and Dan Pale initially estimated that the company would need $2 million in start-up equity. Raising this amount of money as an Internet start-up, especially in a small, Midwestern city, was not an easy task. Jim Mack tapped his extensive base of financial planning clients and raised nearly all of the company s angel capital. However, the fund-raising efforts proved to be quite costly. A great deal of money was spent pro- moting Communitee Web to potential investors. The amount contributed by each investor averaged between $25,000 and $50,000. By mid-January 2001, the com- pany had raised $1.6 million of its original $2 million target but had sold only two franchises. Pale and Mack developed the company s business plan for the sole purpose of attracting investors (see Appendix). Communitee Web s business model and the projected financial forecasts seemed to change on a near-weekly basis, making it difficult to constantly update the busi- ness plan. Very few changes were ever made to the firm s original business plan. As the business model began to change, financial projections were hastily adapted, and the business plan was never adjusted accordingly. The firm s first set of pro forma financial statements esti- mated that revenues would exceed $1 billion within two years. After consulting venture capital firms and other dot-com businesses that had already been in oper- ation, CommuniteeWeb reduced its estimations to a more conservative figure. The projected third-year reven- ues would be just over $160 million. The company s June 2001 projected financial statements business plan addendum shows the earnings estimates also had been scaled back even further (see Table 1). Table 1 Financial Projections CommuniteeWeb, Inc. Income Statement Sales Direct Cost of Sales Other Total Cost of Sales Gross Margin Gross Margin Operating Expenses Accountant Fees Attorney Fees Commissions or Referrals Equipment Leases Insurance General Liability, WC, etc. Insurance-Auto Internet Connection Web Hosting and Security Advertising/Marketing Miscellaneous Office Supplies Professional Dev./Subscription/Membership Fees Payroll Payroll Burden Rent Telephone Trade Shows Travel Utilities Total Overhead Total Operating Expense Profit Before Interest and Taxes Projected Profit and Loss 2002-2004 Interest Expense (Short-term) Interest Expense (Long-term) Taxes Incurred Net Profit 2002 $1,761,201.00 $1,190,785.00 $1,190,785.00 $570,416.00 32.39% $2,400.00 12,000.00 111,322.80 67,608.00 1,344.00 2,208.00 4,254.00 24,000.00 18,250.00 6,000.00 6,000.00 2,400.00 568,795.02 170,069.71 22,200.00 21,600.00 6,000.00 4,250.00 6,000.00 $1,056,701.53 $2,247,486.53 $(486,285.53) 0 $(486,286.00) 2003 $7,508,323.00 $5,508,538.00 $5,508,538.00 $1,999,785.00 26.63% $2,700.00 12,300.00 386,265.00 67,608.00 1,644.00 2,508.00 4,554.00 24,300.00 75,083.00 6,300.00 6,300.00 2,700.00 812,557.50 243,767.25 22,200.00 22,680.00 6,300.00 4,550.00 6,300.00 $1,710,616.75 $7,219,154.75 $ 289,168.25 0 $289,168.00 2004 $26,240,359.00 $8,817,481.00 $8,817,481.00 $17,422,878.00 66.40% $3,000.00 12,600.00 597,412.50 67,608.00 1,944.00 2,808.00 4,854.00 24,600.00 93,854.04 6,600.00 6,600.00 3,000.00 934,441.13 280,332.34 22,200.00 23,760.00 6,600.00 4,850.00 6,600.00 $2,103,664.01 $10,921,145.01 $15,319,213.99 4,940,000.00 $10,379,213.99 BREAT 450 PART 3 Entrepreneurial Case Analysis entrepreneurial CASE ANALYSIS Because the firm s historical financial statements had not been audited, communication with potential institu- tional investors and venture capitalists was difficult. There was also the issue that Jim Mack never registered the distribution of equities for private placement with the Securities and Exchange Commission (SEC). Therefore, the legality of these securities could be in question. (The SEC provides Regulation D for selling stock to private parties. Rules 504a, 504, 505, and 506 cover the specific requirements.) The Founders and the Management Team Dan Pale s business career began at age 23 when he founded a clothing store that quickly grew to more than $1.2 million in annual sales. Pale was also co-owner of his family s business, a True Value hardware store and Just Ask Rental Center. In 1998, he repositioned himself in telecommunica- tions and took over management of WKBY-AM talk radio in Seymour, Indiana. In less than two years, he increased the station s revenue by 600 percent. He also helped position WKBY as the largest talk-format station in southern Indi- ana. He served in a management role in Indiana Regional Radio Partners, Inc., through April 2000. Jim Mack was a certified financial planner and registered financial consultant. He had 13 years experience in the financial services industry. He was cofounder and president of the Financial Investors Group based in Seymour, Indiana, and had clients in 17 states. Mack hosted a weekly radio program at WKBY and was a contributor to The Roaring 2000 s Investor s Guide, one of the New York Times busi- ness best sellers. He also served on the advisory board of the H. S. Dent Foundation and was a noted speaker in areas of business development and fundamental economic trends. The rest of the management team was very young and energetic. Most of the team members were recent college graduates. The following were the original management team at Communitee Web and their credentials as of spring 2001: JEFFREY LEHM Director of Database Development and Technology Lehm left his position as computer information systems regional program chair for Ivy Tech State College in Seymour, Indiana, to join Communitee Web. MICHAEL HUNT Chief Information Officer Hunt completed his master s degree in information and communication sciences from Ball State University in December 2000. JONATHAN LESTER Director of Communications Lester earned degrees in both advertising and marketing from Ball State University and is currently completing a master s degree in public relations. TONY BAKER Director of Franchise Sales and Business Development Baker was the director of marketing for the largest fran- chise of BD s Mongolian Barbecue restaurants. JIM McDUFFY Director of Special Markets McDuffy had more than ten years of management expe- rience in various business environments, ranging from the entertainment industry to Web development. JOHN TAYLOR Director of Wireless Strategies/Research and Development Taylor received his bachelor of arts in marketing from Ball State University with a double minor in Japanese and Asian studies. He was also pursuing a master s degree in information and communication sciences. TROY SIMON Director of Indianapolis Operations Simon completed his master s degree in information and communication sciences from Ball State University in 1998. Simon then served as a business development rep- resentative at Intelliseek, a leading provider in personal- ized Internet services. Business, Industry, and Economic Conditions The Internet had a significant impact on the global busi- ness climate between 1999 and 2001. By 2001, there were more than 160 million Internet users worldwide, and they were beginning to spend a significant amount of time online-averaging more than 18 hours connected monthly. Internet retailing had also become a dominant business force in the American economy, as monthly Internet spending was approaching $4 billion, an aver- age of $270 per consumer. The economic conditions during 2001 made it diffi- cult for growing businesses, especially Internet-based, to obtain funding. The Internet boom of 1999 and 2000, Figure $6,000 $5,000 $4,000. $3,000 $2,000 $1,000- $0 NASDAQ Composite $2,193 $2,686 $5,133 during which Internet companies received equity invest- ment at alarming rates, was definitely a thing of the past. Many venture capitalists had gone back to basic business fundamentals and only considered firms with sound business models and solid business plans. In addition, private investors were becoming more cautious because of the recent plunge ( tech wreck ) of the NASDAQ stock market (see Figure 1). The NASDAQ composite peaked at a value of $5,133 in March 2000. Since that point, the NASDAQ compos- ite value had declined to its June 2001 level of $2,161. According to emarketer.com, more than 555 Internet businesses worldwide closed in the first half of 2001. Internet firms such as Citysearch.com, localbusiness.com, and cityworks.com, among others, began to make major cutbacks or ceased operations. Double Click, the largest online ad broker, continued to lose more than $100 mil- lion per quarter. In addition, most companies, including dot-coms, were cutting their advertising budgets across the board. Competitive Media Reporting estimated that 2001 advertising spending across all media would fall more than $102.4 billion from 2000 levels. Although there still seemed to be interest in specialized and local- ized Internet ads, many industry factors were causing negative pressures on ad revenue-based business models. $3,966 $2,161 December 98 June 99 March 00 June 00 June 01 According to John Groth, CEO of Beacon Venture Capital (Bethesda, Maryland), the capital markets were not looking favorably on firms with the majority of revenues coming from Internet advertising sales. The Competitive Landscape By June 2001, Communitee Web faced competition from firms such as DigitalCity.com, OneMain.com, MyCity.com, Yahoo! Get Local, Visionvibes.com, Wowtown.com, URL- Surfer.com, Citysearch.com, megago.com, move.com, busyreceptionist.com, usaonline.com, switchboard.com, relocationcentral.com, MyWay.com, and numerous yellow pages websites, among others. Communitee Web believed, however, that none of these sites truly provided local informa- tion across the nation. They contended that these sites were geared toward larger cities or were restricted to very small regions. Thus, CommuniteeWeb never viewed any of these competitors as major threats to the success of its business model. DigitalCity.com and Citysearch.com, however, were engaged in significant national advertising campaigns and had developed the greatest name recognition among localized Internet sites. Communitee Web considered its main competi- tors to be local newspapers and radio stations. The firm saw these traditional media forms as its greatest rivals. CommuniteeWeb.com in Operation The CommuniteeWeb.com website was officially launched on January 28, 2001. Visitors to the site could read and post local news and sports stories, check the local weather forecast, and search for Uniform Resource Locators (URLs, or website addresses) tailored to specific locales and business categories. The URL searches used Communitee Web s tool and its database, which by April 2001 included more than 200,000 URLs. During the first few months of 2001, Communitee Web was able to establish partnerships and alliances with sev- eral strong companies such as AT&T, Infospace.com, and Hargiss Communication. Communitee Web, however, soon realized that many of these partners did not fit into its vision and broke all ties with most of these partners to pursue other partnerships with companies like LocaLine and valupage.com. Table Professional and consulting fees Equipment lease and depreciation Software/Connectivity/Hosting 2 Summary Financial Information as Provided by Management Employee/Payroll expenses: CEO-Mack President-Pale Staff-Other Contract labor-Mining Taxes Training Other Employec/Payroll expenses-total Marketing expenses Rent/Utilities Communitee Web continued to struggle to get its busi- ness concept off the ground. Tony Baker, the person hired as director of franchise sales, had managed to sell just two franchises, leaving Dan Pale and Jim Mack to contemplate their next move. They were faced with the immediate need to generate positive cash flow within the next two to three months. Website maintenance/design Office supplies Interest/Other Total expenses Communitee Web s workforce had peaked to approx- imately 175 employees in March 2001, causing the com- pany to incur over $200,000 of payroll expenses. Pale and Mack had expected to sign more than 100 franchi- sees in the first year, but their efforts produced only failed prospects. Running short of funds in April 2001, they imposed major cutbacks, leaving only 15 key employees and a monthly expenditure of about $75,000 (Table 2). Pale and Mack saw these cuts as a necessary move to keep their firm alive. With no incom- ing revenue, mounting debt, and a failing business March 2001 $9,500 19,000 35,000 10,000 10,000 142,500 20,000 14,300 10,000 2,600 209,400 20,050 3,655 14,000 4,000 5,400 $320,005 April 2001 $2,000 3,000 6,250 5,000 25,850 3,265 - 2,500 42,865 5,000 2,100 13,000 3,100 4,400 $75,465 Table 3 . Timeline of Critical Events January February 2000-Dan Pale researches the possibility bealizing the Internet February 2000-Pale meets with Jim Mack of the Financial Investors Group to discuss the possibility of building a localized Internet portal. March 2000-Mack and Pale agree to start the business, which they name Communiteeweb. They incorporate as a C corporation and begin staffing the company. April 2000-January 2001-The large staff of miners collect and capture a comprehensive database. of URLs. January 28, 2001-The website, http://www.CommuniterWeb.com, is offically launched. February-May 2001-CommuniteeWeb management works on developing business relationships. that will strengthen its position in the marketplace. The firm also works on raising equity and selling franchises. April 2001-Due to mounting financial pressures, Mack is her to make major cuthacks in workforce and expenditures. May 2001-CommuniteeWeb changes its business model to sell its website tods to ISPs. The firm discontinues the use of its URL database. Mack steps down as CEO and chairman of the board, and Pale takes over as CEO. Mack remains on the board of directors June 2001-CommuniteeWeb considers entering a deal with Wall Street Venture Capital of New York. model, they began to panic and felt that cutbacks across the board were their only option. At this point, Communitee Web had abandoned its orig- inal business plan and now focused on selling its website tools to Internet service providers (ISPs). They believed that Communitee Web s tools could be used by the ISPs in their default browsers and portals (gateways). Commu- nitee Web would become their provider of local informa- tion and their face to users. However, the firm was forced to drop its URL database from its set of tools offered to ISPs, due to significant technical errors that reduced both the effectiveness and size (reduced to under 40,000 URLs) of the database. This was a major setback to CommuniteeWeb, but the company just did not have the financial resources needed to fix the database errors (see Table 3 for a timeline of critical events). To generate additional revenues, Communitee Web also introduced a Web development division to its business. In addition, the company attempted to market itself as an ISP. Mounting Financial Pressure and Internal Conflict Jim Mack and Dan Pale recognized their financial crisis. They believed that CommuniteeWeb had only a few months to establish a positive cash flow. Mack planned to continue raising funds through his client base and per- sonal network while Pale and his staff feverishly marketed their new business model to ISPs. Capital markets had become tighter and Mack seemingly had exhausted his personal resources. By the end of April 2001, Mack and Pale resorted to bootstrapping for short-term financing, pushing several of their own credit cards to their limits, delaying payments to most of the company s creditors, and falling more than $200,000 behind in remitting pay- roll taxes and employee withholdings to the Internal Revenue Service (IRS). The company had also accrued other debts in excess of $1 million (Table 4). Pale and Mack s personal debt had grown to more than $300,000. Employees also started to feel the pinch of the firm s cash flow problems as the issuance of paychecks was often delayed by as much as three to four weeks. Amid the financial pressures, personal conflicts arose between Mack and the employees. Mack was often criti- cized for being too controlling. Key management person- nel had questioned his desire to make all of the company s strategic decisions. Because of Mack s con- stant changing of the business model, employees rarely knew the latest direction of the company. Conflict between Mack and Pale also began to surface. Mack and Pale often did not see eye to eye on strategic or financial issues. Pale felt as though Mack, the CEO, was Table 4 Balance Sheet-Fiscal Year Ending February 2002 Current Assets Checking Account Expense Account Client Fees Receivable Investments Total Current Assets Property and Equipment Furniture and Fixtures Computer Equipment Leasehold Improvements Accum. Depreciation Furniture Accum. Depreciation Computer Equipment Accum. Depreciation-Leasehold Total Property and Equipment Total Assets Current Liabilities Accounts Payable Deductions Payable Federal Payroll Taxes Payable FUTA Tax Payable State Payroll Taxes Payable SUTA Payable Local Payroll Taxes Payable Employee Benefits Payable Total Current Liabilities Long-Term Liabilities Loan from Shareholder-Dan Pale Loan from Shareholder- Jim Mack Long-Term Liabilities Total Liabilities Assets Liabilities and Capital $41.09 237.11 904.94 50,000.00 $21,804.26 257,960.30 19,275.25 (7,014.80) (112,411.33) (6,203.74) $355,748.64 785.71 266,406.50 4,450.64 32,715.16 8,907.29 7,630.73 18,705.47 $304,929.20 68,500.00 $51,183.14 $173,409.94 $224,593.08 $695,350.14 $373,429.20 $1,068,779.34 Capital Treasury Stock Paid-In Capital Retained Earnings Net Income Total Capital Total Liabilities and Capital Liabilities and Capital taking control over the daily activities, which Pale con- sidered his job as president and COO. In May 2001, due to the mounting conflicts and Mack s apparent misman- agement of the company, the board of directors removed Jim Mack as CEO and chairman of the board and appointed Pale as his replacement. Mack would remain on the board of directors but would relinquish all day- to-day operations of the company to Dan Pale. Mack maintained his role in raising capital for the company. The Wall Street Venture Capital Deal During the past several months of funding efforts, Mack and Pale had been working on developing a relationship with a relatively unknown firm named Wall Street Ven- ture Capital from New York City. In June 2001, Pale and Mack capitalized on an invitation to present their business model to this venture capital firm. After seeing their presentation, Wall Street Venture Capital agreed to raise funding for Communitee Web through a partner- ship. If Communitee Web accepted the agreement, Wall Street Venture Capital would acquire 30 percent equity of the company, and Communitee Web would be charged a $20,000 commitment fee. Communitee Web would then be limited to raising an additional $500,000 outside of Wall Street Venture Capital during the next six months to fund current operations. Wall Street Venture Capital would agree to raise $5 million for Communitee- Web within six months, as well as position the firm for a buyout. Communitee Web would also be able to use its relationship with Wall Street Venture Capital as leverage in meeting financial obligations to current investors and for forming new partnerships. For almost two months, Jim Mack and Dan Pale attempted to investigate the viability of this New York- $(7,545.00) 1,892,008.68 (1,017,263.51) (1,711,386.43) $(844,186.26) $224,593.08 based venture capital firm. However, as of June 2001, Mack and Pale had been unable to establish whether or not Wall Street Venture Capital had a proven track record with multimillion-dollar start-up investing. Any informa- tion on the firm was hard to obtain. As an example, its website was not functional and the New York Chamber of Commerce did not have any information on the firm. When Mack and Pale asked the president of Wall Street Venture Capital, Joseph McElroys, to give documentation of the firm s successfully funded projects, the response was that most of Wall Street Venture Capital s deals were inter- national and documentation was not readily available. The Dilemma Dan Pale now faces his toughest decision as CEO of Communitee Web. He has the mounting pressures of sinking deeper and deeper into debt, risking more and more invested capital, and facing the legal issues associ- ated with the debt to the IRS and the improper sale of securities. Pale is seriously considering entering the agreement with Wall Street Venture Capital. The follow- ing issues plague Pale as he considers his next move. Federal Tax Liability-The company owes the IRS an amount in excess of $200,000. The company has filed the IRS form 656 Offer in Compromise to settle this debt. There is no assurance that the IRS will accept this offer in compromise. The IRS may counteroffer or reject the offer completely. In this case, CommuniteeWeb may not have sufficient funds to pay the delinquent taxes, interest, and any penalties. Furthermore, the IRS can even foreclose on the company s assets if it chooses. Indiana State Tax Liability-The company owes the State of Indiana an amount in excess of $20,000. The 456 PART 3 Entrepreneurial Case Analysis entrepreneurial CASE ANALYSIS company has entered into a payment agreement with the State of Indiana on this debt. If the company fails to make the required payments to the State of Indiana, the Indiana Department of Revenue could foreclose on the company s assets. Securities Violations-The company has previously sold investments in the company in excess of $1.6 mil- lion. The sale of these securities may not have been in compliance with all federal and state securities laws. They face the probability that a rescission offer would be made to all purchasers and that an action could be filed by the securities regulatory agencies. In addition, the company s officers could possibly face criminal charges for these SEC violations. Failure to Make a Profit-Since its inception in 2000, the company has been primarily involved in the research and development of its Internet technology and has had no chance to develop revenues. Currently, the company has not made a profit-and there is no future assurance it ever will. The company is operating with a burn rate (a popular term used to denote expenditures without sufficient revenue to at least approach a break-even point) and has yet to establish a working business model that can successfully show a profit. Much of the initial $1.6 million of raised capital was spent on developing the URL database, marketing franchises to potential buyers, and attracting potential investors. Dan Pale needs to make a move to save his com- pany. Taking into account all of these issues, the agree- ment with Wall Street Venture Capital may be the best choice-or is it? Notes 1. See Appendix for more detailed management biographics. 2. http://www.clickz.com/stats/. 3. http://www.nasdaq.com. 4. http://www.emarketer.com. APPENDIX: BUSINESS PLAN Executive Summary Communitee Web, Inc. is the Internet with local flavor and a personal touch. With Communitee Web s unique search technology and full range of connectivity and other Web- related solutions, it enables businesses, nonprofit organiza- tions, and individuals to interact in a specific geographic locale via the Internet. People who use the Communitee- Web portal to search Communitee Web s website database find content that is most relevant to them, from news and sports scores to classified ads and even a community calen- dar. The free, simple search process is based on the individ- ual needs of each end user, which allows him or her to search for information, goods, and services in his or her hometown or almost any specific area without wading through the useless links that traditional search engines yield as results. While optimizing localized Web searches for private citizens, Communitee Web provides area businesses the same luxury for specific geographic areas. A business knows with reasonable certainty that someone who searches a specific location either lives in that community or plans to visit it. Communitee Web enables businesses of all sizes to participate in Internet advertising, Communi- tee Web s dynamic one-to-one marketing enables busi- nesses to market toward specific geographic areas as well as to specific age groups, income ranges, and inter- ests. To motivate end users to register, Communitee Web offers them the free Local Rewards program. Registered members earn points for visiting local advertisers sites. They can then redeem accumulated points for services and merchandise, or donate them to a local charity. Becoming a member is simple and free; in less than one minute, a user can join by providing basic geographic, demographic, and psychographic information. For exam- ple, a user may like music but have no interest in apparel. Businesses spend more than $2 billion per quarter on mar- keting on the World Wide Web, but they collect little to no information about end users. Local Rewards addresses that issue. Communitee Web s Local Rewards program demonstrates yet another way that CommuniteeWeb pro- vides a win-win scenario for businesses and residents of the communities it services. Communitee Web provides a human approach to the Internet. Through its franchise model, Communitee Web will place community coordinators around the country in communities of all sizes. This provides a name and a face for people to call upon when things get confusing and technology changes, as it always does. Communi- tee Web brings the Internet together for the individual and the community. Communitee Web provides a customized browser that carries its name, Internet ser- vices from dial-up to high-speed connectivity solutions (through an alliance with AT&T), and Web design, hosting, and other related services (from alliances with various Web design firms). Many companies have attempted to enter local communities from an Internet perspective. More than 20 companies have succeeded in tier-one cities that are defined as metropolitan statistical areas (MSAs); MSAs contain more than 1 million residents each and repre- sent more than one-third of the American population in 42 distinct areas. Companies that venture into tier-two and tier-three markets have failed from a global per- spective. Individual community sites exist in these mar- kets, but without continuity, they do nothing for commerce or community development in their respective areas. Communitee Web is the platform that combines these communities, serving as the cord that provides individuality while binding communities together to provide true business relevance. Communitee Web plans to corporately maintain these MSA market operations but will focus on initially proving its product through fully operational corporately owned test markets. Communitee Web has partially funded the Indianapolis MSA as a test market and is seeking funding to start one corporately owned mid-market franchise each month, which started in April 2001. Communitee Web s success depends on a loyal number of users and massive name-brand recognition. Communitee Web will employ three immediate strategies to gather these members and create product awareness. All three of these models provide built-in loyalty of membership as well as the opportunity for quick-start franchises. Communitee Web will also allow select entre- preneurs to acquire franchise rights. Communitee Web will continue to franchise the busi- ness model in small-to-midsize markets nationwide. Franchisees can come from four different business backgrounds: (1) companies currently providing Internet service on a more local and/or regional basis; (2) tradi- tional media outlets with built-in membership loyalty that provides a profitable alliance for both the company and Communitee Web; (3) companies currently involved in website design; and (4) existing specific community websites with an identifiable user base. Communitee Web s main attack toward the franchise marketplace is through regional ISPs. Communitee Web has found in its preliminary research that there are more than 600 regional ISPs in the Midwest that have less than 50,000 subscribers. Communitee Web has also found that this will add very little to its current cost structure. These ISPs generally have somewhere around 5,000 subscribers, but they typically only generate approximately $2 per month toward their bottom line per customer. Communitee Web s offer to these ISPs is simple: Communitee Web will provide them with a Com- munitee Web franchise in exchange for their conversion to the Communitee Web system. This includes automatically registering their subscribers with CommuniteeWeb.com memberships, converting their subscribers accounts to the Communitee Web/AT&T virtual ISP, and selling CommuniteeWeb.com advertising in their markets. Com- munitee Web has contacted more than 50 of these ISPs in Indiana alone and has gotten appointments with nearly all of them. Communitee Web is designed to be profitable by August 2001 and remain that way. The company uses Internet technology but is truly an interactive communications com- pany focusing on dynamic one-to-one marketing. Based on current Internet standards for usage and advertising, CommuniteeWeb can generate $15.60 per month per member. The business model and current plan calls for $2 million of initial investment with a pos- itive cash flow of over $17 million in the second year of operations. Communitee Web has also recently seen the value of its unique URL database come to fruition. The database is proving to be highly marketable to thousands of websites at a monthly licensing fee of anywhere from $500 to $5,000. Communitee Web has more than 35 potential franchi- sees and has raised over $1,400,000. Communitee Web is currently seeking an additional $600,000 in first-round funding and another $2 million in bridge financing. Communitee Web is currently offering shares at $4 per share with the minimum investment of $25,000. That investment represents 6,250 voting-class shares controlling 1/8th percent (.00125) of the company. The CommuniteeWeb Business Model The Communitee Web business model revolves around four main areas: members, community coordinators, content, and advertising. These four areas are simple in nature, but they drive the success of Communitee Web. MEMBERS The most important aspect of Communitee Web.com is membership. Communitee Web has put a great deal of emphasis on the development of a dedicated user base. Member interaction through viewing advertise- ments, submitting content, and using the exclusive Communitee Web Directory drives the success of Com- munitee Web. Members are encouraged to submit local content of interest to them. COMMUNITY COORDINATORS Community coordinators, which exist both as franchisees and as MSA coordinators, provide a local heartbeat to the Internet for each community. These community coordinators and their sales force will have established relationships with community businesses, not-for-profits, and the general population, which allows for fast membership growth and accelerated advertising sales. CONTENT Content such as calendar events, local sports stories, local news stories, local press releases, and the Communi- tee Web Directory-is what makes Communitee Web.com an attractive, useful, informative, and successful website. Communitee Web will provide the Communitee Web Directory as well as localized content through news and sports stories, calendar events, and press releases, but members are encouraged to submit the bulk of this local content and represent their community on the Internet. ADVERTISING Localized advertising is the main revenue engine of Communitee Web.com. Very specifically targeted and localized advertising is what makes CommuniteeWeb s advertising system unique to the Internet. Local advertis- ing will be utilized in the community section through pro- motional windows, Communitee Web s Communitee Web Directory, targeted e-mail marketing, and follow-up e-mail. STRATEGIC ALLIANCES Communitee Web has developed several key technologi- cal and business relationships to better position itself in the marketplace. AT&T: CommuniteeWeb has formed a strategic alli- ance with global communications giant AT&T in several areas. AT&T expects to better reach local markets through CommuniteeWeb, and Communitee Web will uti- lize AT&T s resources to host the CommuniteeWeb.com website and provide private-labeled Internet connectivity services through a virtual ISP (VISP) system. This alliance will enable CommuniteeWeb to act as an ISP without having the initial capital expenses usually associated with launching local Internet services. Income from this alliance will come from every home or business that signs up for Internet access service. Communitee Web s wholesale cost for dial-up accounts will be $13.95 per month. Communitee Web plans to resell this service at a very competitive rate of $18.95 per month. This alliance should prove to be very powerful, given AT&T s position in the ISP market. AT&T is the world s largest and high- est rated ISP. Hargiss Communication/Quad Entertainment: The proprietary Set Top Box that Hargiss Communication has developed is a hardware and software solution that provides Movies On Demand, Internet access, games, digital cable TV, and a local guide to the surrounding area (through Communitee Web) to hotel or resort amenities, hospitals, and homes. Communitee Web has entered into a strategic partnership with Hargiss Communication to provide a local guide portal for their interface using the Communitee Web index of local URLS and its local content. Communitee Web currently has a 15 percent ownership in a new subsidiary company formed with Hargiss Communication, called Quad Entertainment, and will be an integral part of developing the Set Top Box business model. In addition, Jed Delke of Communitee Web will serve as CEO of Quad Enter- tainment and Communitee Web will occupy three of the six board of directors spots on the company. InfoSpace.com: CommuniteeWeb has partnered with InfoSpace.com to increase the options and content that Communitee Web can provide to members. InfoSpace is one of the largest information sources on the Web, thus providing a very powerful resource to Communitee Web members. The information resources that InfoSpace provides enhance Communitee Web s content, allowing Communitee Web to concentrate on its core business. InfoSpace will provide these resources on contract through a co-branded system. CommuniteeWeb mem- bers will see the Communitee Web website, color scheme, and structure when navigating the InfoSpace content through CommuniteeWeb.com. This partnership also provides Communitee Web with a revenue source through the advertising revenue sharing model. LEGAL, PROFESSIONAL, ACCOUNTING, AND TECHNICAL PARTNERS AND ASSOCIATES Thomas Reardon, partner of James, Austin, Cooper, and Burr Law Offices, located in Seymour, Indiana, heads the legal counsel. Reardon s role is to help determine any specialized counsel that Communitee Web will need along the business development process. In addition, Communitee Web has partnered with franchise attorney Mark Jacoby of Indianapolis. Communitee Web will work with the Commercial Ser- vices Group of Crowe Chizek LLP for assistance with SEC and accounting issues. As a leading accounting and consulting organization, Crowe Chizek offers spe- cialized services with a client-focused relationship cul- ture. Crowe is the leading member firm of Howarth International, an international network of independent accounting and consulting firms, with more than 100 members and 400 offices in 372 cities throughout the world. Crowe Chizek s clients include IBM, Micro- soft, Oracle, and Onyx Software. Specifically, Crowe Chizek will provide Communitee Web assistance in find- ing an appropriate enterprise accounting package. They will also provide independent audits of Communitee- Web s financial statements. Crowe Chizek will be able to provide consulting expertise should the need arise in the future. Four different individuals handle the account- ing department. Donald Hager is chief advisor. He has contributed to acquisition planning and stock distribu- tion. Jim Mack is serving in the capacity of controller. Gregory Borst, CPA, will handle current payroll and day-to-day taxation issues. TECHNOLOGY EXPERTISE - INTERNAL AND EXTERNAL Communitee Web has a team of highly educated and experienced database developers, programmers, and sys- tem architects. In addition, CommuniteeWeb has part- nered with several higher-education institutions in the area. Communitee Web has developed a dynamic site, which requires expertise from several different technol- ogy sectors. A commercially viable product was released on January 28, 2001, and is continuing to be built and improved. Communitee Web has accomplished this mission by using its own talented employees and by contracting for services from Joseph A. Graves and Associates (JGA). Michael Hunt has led this team through the development phases and will continue to lead this team through continuous improvement phases. JGA has provided project management and program- ming expertise on different components of the site. Jeff Lehm has provided the database expertise. COMMUNITIEWE ASSOCIATES Communitee Web has assembled a very talented, ener- getic, and enthusiastic group of entrepreneurial, busi- ness, and creative minds to drive this venture. Associate education backgrounds include marketing, entrepreneurship, political science, communication, journalism, and information sciences at both the under- graduate and graduate levels. Experiences include financial planning, retail management, franchise devel- opment, business development, education, and mass media management. Officers, Board of Directors, Principals, and Significant Associates JAMES A. MACK, CFP, RFC Chairman, Board of Directors and CEO Jim Mack is a certified financial planner and registered financial consultant. Mack serves as president and cofounder of the Financial Investors Group, based in Seymour, Indiana, with clients in 17 states. He has spent 13 years in the financial services industry creating and evaluating business and succession plans. He hosted a weekly radio show for five years and helped contribute to The Roaring 2000s Investor: Strategies for the Life You Want. Mack sits on the advisory board to the H. S. Dent Foundation and speaks nationally to thou- sands on business development concepts that focus on fundamental trends that drive the U.S. economy. DANIEL E. PALE President Dan Pale has more than ten years of experience in retail business operations. At the age of 23, he started a retail clothing business that quickly grew to generate more than $1.2 million in sales per year. Pale also co-owns a True Value hardware store and a Just Ask Rental Center. In 1998, he entered the broadcast industry, taking over the management of WKBY Talk Radio in Seymour, Indiana. In less than two years, he increased station rev- enue by 600 percent and increased listenership, making the station the number one talk radio format in southern Indiana. He is also a member of the adjunct faculty at a local university s telecommunications program and- through April 2000-maintained a management role with Indiana Regional Radio Partners, Inc. GREG DENT Board of Directors Greg Dent is currently president and CEO of Healthx.com. Dent has more than 20 years of experience in the health care and technology industries. In 1987, Greg founded First Benefit Corp., a Midwest-based third-party adminis- trator (TPA) that appeared in Inc. magazine s top 500 growth companies in 1991, 1992, and 1993. He also founded Qubic, a nationwide organization that comprises 12 independently owned TPAs. In 1993, First Benefit Corp. was acquired by CoreSource. In 1995, Dent founded a new company, Intermark, and began develop- ment of what is now the Healthx.com product. In 1998, the company officially became Healthx.com. DOMINIC MANCINO Board of Directors A native of Southern California and a resident of Indiana for the past eight years, Dominic Mancino has been with AT&T for several years and works as a sales director for business services in Indiana. He comes with a wealth of industry knowledge, having worked within telecommu- nications for 20 years for companies like Western Electric and Pacific Bell. His responsibilities have taken him from sales and engineering to his current position as sales director. Mancino has consulted with companies all around the United States to define Internet strategies and the practical application of IP-based solutions for business development. Mancino is a graduate of Ricks College, which is now known as Brigham Young Univer- sity of Idaho. DR. NATHAN WALKER Board of Directors Nathan Walker was recently with the National Associa- tion of Broadcasters in Washington, DC, where he was vice president of television operations. He currently teaches courses in technology, business aspects, and regu- latory issues at the Center for Information and Communi- cation Sciences at Ball State University, along with serving as codirector of the Applied Research Institute. His work includes the development of the network, interactive kiosk system. Dr. Walker regularly consults with AT&T Bell Labs, U.S. West Advanced Technologies, Ameritech, McDonald s Corporation, and GTE Labs. SHERI WATERS Board of Directors Sheri Waters is a motivational speaker, trainer, and coach. She is the president/owner of the Waters Connection, Inc., a Midwest-based national consulting firm that specializes in improving organizational performance through leader- ship development, sales and customer services coaching/ training, team building, and organizational development. Waters developed her expertise through years of service at Ameritech Corporation. Her responsibilities included training, developing, coaching, and supporting more than 3,000 senior managers and 4,000 associates in the Con- sumer Market Unit, which includes 17 Customer Care Centers across the states of Indiana, Illinois, Michigan, Wisconsin, and Ohio. Her most recent clients include Ameritech Consumer Services, Ameritech New Media, Cheap Tickets, Inc., and 21st Century Telecom, among others. Waters is a Gold member of the Indianapolis Chamber of Commerce. MICHAEL A. MARELL Board of Directors Mike Marell is the owner of Michael A. Marell & Associates, a consulting firm established to assist busi- nesses in continuous improvement strategies using sta- tistical methods. The firm uses many improvement methods, including the methods of Dr. W. Edwards Deming, Dr. Donald Wheeler, Dr. Genichi Taguchi, and William Conway. The firm s objective for its clients is to train and support them to make their business processes and customer services more effec- tive. Marell was employed at Delco Remy Division of General Motors and Delphi Automotive Systems for more than 31 years in engineering, quality, and sta- tistical assignments. For 18 years, Marell trained employees from all areas of the company to make improvements and to assist in the application of statis- tical process control, machine qualification, supplier development, design of experiments, and robust engi- neering. Marell is a licensed professional engineer and certified quality engineer. WILLIAM VACARRO, MD Board of Directors William Vacarro has served the public through the practice of family medicine since 1973. Dr. Vacarro currently serves as the president and CEO of Commu- nity Hospital in Seymour, Indiana. Dr. Vacarro is on the board of directors for the Anderson Chamber of Commerce and the Corporation for Economic Devel- opment. Dr. Vacarro serves on the Executive Commit- tee, Health Status Committee, and the Facilities and Technology Committee for the Madison Health Partners. DR. MICHAEL FOSTER Board of Directors Michael Foster received his bachelor s degree in account- ing from the University of Wisconsin-Whitewater and his master s degree in guidance and counseling, also from Wisconsin-Whitewater. Dr. Foster went on to earn his doctoral degree in higher education from Indi- ana University in 1984. Since that time, Dr. Foster has consulted for several organizations, both for-profit and nonprofit in nature. Dr. Foster has also served since 1982 as a professor of management in Seymour Univer- sity s School of Business. Dr. Foster served as the presi- dent and CEO of Marcon, Inc., in Seymour, Indiana, from 1995 to 1997. DR. STEPHAN REECE Principal Stephan Reece is the codirector of the Applied Research Institute at Ball State University and an associate professor at the Center for Information and Communication Sciences, also at Ball State University. He was the owner of Communications and Digital Services, Inc., for ten years and engineered all system installations, data net- works, and peripheral equipment (T-1, E&M, DID, voice processing, call sequencers, call accounting systems, CLID, ACDs, Centrex, ISDN services and products). JEFFREY LEHM Director of Database Development and Technology Jeff Lehm, as owner of Valcour Computer Group, Inc., constructed data management systems for government agencies and entities such as the Indiana Department of Workforce Development, and associations such as the National Free Flight Association. He is the Computer Information Systems regional program chair for Ivy Tech State College in Seymour, Indiana, and has exten- sive knowledge in database research and technology as it applies to the Internet. Lehm played an instrumental role in the development of the E-commerce Certification Pro- gram at Ivy Tech State College. MICHAEL HUNT Chief Information Officer Michael Hunt is a 1995 graduate of Ball State University s Entrepreneurship and Small Business Management program. In addition, Hunt recently completed his master s degree in information and communication sciences at the Center for Information and Communication Sciences at Ball State Uni- versity. Hunt contributed to the Network Integration Center (NIC), the Ball-Foster Unified Messaging Team, and the VPN Forum project. From 1995 to 1997, Hunt wrote the business plan and helped start Escapades, Inc., a family enter- tainment center in Marion, Indiana. After leaving Escapades in 1997, he worked at Knapp Supply Co., Inc., as the net- work administrator and purchasing agent. JONATHAN LESTER Director of Communications Jon Lester earned degrees in both advertising and market- ing from Ball State University and is currently finishing a master s degree in public relations. As owner and operator of a successful advertising agency, JL Unlimited, Lester built a reputation within the small-to-midsize business market, winning several Addy Awards and Citations of Excellence. Clients include Alltrista; Community Hospi- tals, Indianapolis; and Community Hospital, Seymour, among others. Realizing the impact that the Internet is having on the advertising industry, Lester established webaxis, LLC-a high-end e-solutions provider-to coex- ist with his agency. Under his direction, webaxis has achieved several large strides in just under a year-a user window for controlling their e-environment (Execu- tive Dashboard Systems), Web leasing financing, Perpetual Marketing Systems, and more. TONY BAKER Director of Franchise Sales and Business Development Tony Baker was the director of marketing for the largest franchise of BD s Mongolian Barbeque restaurants, one of the fastest growing casual dining concepts in America. Baker strengthened and advanced the growth of BD s Mongolian Barbeque while spending less than 2 percent of its marketing budget on conventional advertising med- iums. His local, or neighborhood, marketing techniques have brought franchises as much as 20 percent growth in sales in an industry that marvels at anything above 5 percent. Baker has designed and executed five record openings for franchisees. He has overseen marketing and operations for this $10 million franchise for three years. JIM MCDUFFY Director of Special Markets McDuffy has more than ten years of management experi- ence in various business environments, ranging from the entertainment industry to Web development. He has served as lead developer and consultant for many Web- based projects, including the Web strategy of Connecticut Electric, one of the world s largest suppliers of replace- ment circuit breakers. McDuffy s leadership enabled the Degerberg Academy in Chicago to grow to a 600 percent student increase during a four-year period, resulting in a national award from the United States Martial Arts Asso- ciation in 1993. He studied theatre and filmmaking at Indiana University and worked in several production venues in Chicago between 1987 and 1997. McDuffy has also served as a radio personality, hosting a weekly computer talk show called Computer Digest. JOHN TAYLOR Director of Wireless Strategies/Research and Development John Taylor received his bachelor of arts degree in marketing from Ball State University with a double minor in Japanese and Asian studies. He has demonstrated success in international relationship building, developing promo- tional material, marketing media, and project management. Taylor also recently completed his graduate degree at the Ball State University Center for Information and Commu- nication Sciences. His project experience includes work with a leading wireless manufacturer and network hard- ware manufacturers and Web development for industry, nonprofit, and research organizations. His Web develop- ment portfolio includes the Applied Research Institute, the Virtual Private Network Forum, the Ohana Foundation, and the Institute for Wireless Innovation, among others. TROY SIMON Director of Indianapolis Operations Troy Simon is a 1997 graduate of Ball State University, where he earned a degree in corporate management and financial institutions as a scholar athlete. In December 1998, he completed his master s of science degree in infor- mation and communication sciences at the Center for Infor- mation and Communication Sciences, also at Ball State University. Simon then served as a business development representative at Intelliseek, a leading provider in personal- ized Internet services. He implemented more than 40 part- nerships and created an estimated user count of 6 million. He brings knowledge of search technologies and experience in working with start-up companies to CommuniteeWeb. Stock Distribution The following chart details the stockholders in Communitee- Web and their ownership percentage. Five million shares have been authorized, and another 2.3 million shares are being held for future authorizations, issued as follows: Owner Number of Shares Investors 2,300,000 850,000 Dan Pale Jim Mack Associates 850,000 600,000 Board of Directors 200,000 100,000 Stephan Reece Nathan Walker 100,000 Of the 2.3 million investor shares, 1.8 million are being held for future placements and 500,000 are dedi- cated to the current placement. It will be the practice of Communitee Web to allow all employees to participate in stock ownership. Each of the directors has the opportunity to earn 50,000 options each year. The board of directors will determine the execution price on a year-by-year basis. For the year August 1, 2000 through July 31, 2001, the price will be $10 per share. Each new full-time employee will receive 1,000 options at the same price provided to the directors. Each board of directors member will receive 5,000 shares per year of participation. Partners BALL STATE UNIVERSITY-CENTER FOR INFORMATION AND COMMUNICATION SCIENCES Ball State University has contributed extensively to this project. More than 150 students at Ball State University have tested and developed concepts to further the scopes of the Communitee Web website. Ball State also has elected to use Communitee Web in a senior-level public relations curriculum. Six students initially were assigned to Communitee Web to help in micro and macro devel- opment of the company. Their emphasis was in creating partnerships with local nonprofit and government orga- nizations, as well as national firms. Communitee Web has access to more than 150 undergraduate and graduate students from the Applied Research Institute Laboratory at Ball State University s Center for Information and Communication Sciences for research, testing, and employee recruitment. Present clients of the center include Ameritech, Cisco, Ericsson, First Consulting Group, Lucent, McDonald s, and Nortel. IVY TECH STATE COLLEGE-COMPUTER SCIENCE LABORATORY Ivy Tech State College has created an entire curriculum for a two-year degree to help provide assistance in develop- ment as well as provide Communitee Web with a long- term employee pool. Ivy Tech students, under the direction of professors and Communitee Web staff, provide develop- mental solutions to assure that Communitee Web is the most technologically advanced local Web portal. CommuniteeWeb.com Exclusive Features GEOGRAPHICALLY AND CATEGORICALLY SEARCHABLE COMMUNITEEWEB DIRECTORY Communitee Web s valuable directory of locally based. websites is searchable by state, city, category, and sub- category. Searches by zip code and county are also planned for future search tool revisions. According to research conducted at the Center for Information and Communication Sciences at Ball State University, no search index of this kind currently exists on the Internet. Research has shown that the major local search engines today catalog only half of the URLS in existence. This would help to explain why just 6.86 percent of global website referrals are through traditional search engines. A poll recently taken by Roper Starch found that 71 percent of all users view their search engine experiences as being very frustrating. Communitee Web gathers URLS in a unique manner that enables Communitee Web to gather and catalog more URLs than any other search engine site. This data-mining method of gathering URLS also enables Communitee Web to screen the con- tents of the websites to avoid any adult-oriented or other objectionable material. The directory offers unique Web marketing opportunities for the future development of business-to-business and business-to-consumer sales. LOCAL REWARDS PROGRAM CommuniteeWeb has created a unique free membership program to businesses, nonprofit organizations, and indi- viduals that accepts press releases, sports scores, edito- rials, birth announcements, calendar events, and more. The membership program will allow members to be rewarded with Local Rewards points for visiting adver- tisers websites, interacting with promotions geared at driving traffic to a retailer s website and physical store- front location, and submitting content to Communitee- Web. Local Rewards points can then be redeemed in the Communitee Web Online Prize Catalog to win products, services, merchandise, and more. The technology that powers this membership program will allow for advertis- ing by specific geographic locations and demographic/ psychographic groupings with the delivery of targeted banner advertising to a viewer s interest. This membership program has demonstrated click-through rates of more than 5,000 times the national average. COMMUNITEEWEB.COM UNIQUE FEATURES An events community calendar for the display of event times, locations, and other information specific by location and category classification. End users can customize the calendar to display only those events that they have identified as important to them. 0 A News and Sports section featuring national, state, and local content. Weather forecasts dynamically generated by Commu- niteeWeb from data supplied by the National Weather Service. Forecasts can be viewed by geographic location and can be delivered daily via e-mail to the end user. The ABC affiliate weatherman for Indianapolis, Paul Poteet, will provide a human face to the site as the national forecaster on CommuniteeWeb.com. Direct links to local media sites with local radio and TV broadcast listings. A Web directory of community-based websites searchable by geographic location and keywords. The Web directory consists of the website name, categori- zation and subcategory listing, site description, and a direct link to the site. Industry Background Without a doubt, the world has been turned upside down since the Internet became commercialized in the early 1990s. An estimated 57 million people used the Internet in 1997, according to CyberAtlas. Internet usage grew to 200 million in 1999 and is expected to reach more than 300 million by the year 2005, which is approximately 5 percent of the world s population. Internet usage patterns are reported by CyberAtlas every month on their website. A typical Internet user: Uses the Internet 19 times per month Views 671 pages per month Visits 11 unique sites per session Views an average of 36 pages per session According to the Census Bureau, 80 percent of the people who use the Internet use it for e-mail or to find government, business, health, or education information. The next most sought-after information is news, weather, and sports. People access the Internet primarily through analog phone lines. The U.S. market for Internet service providers generated $32.5 billion in revenue in 2000, a 37 percent increase over 1999. Twelve million homes accessed the Internet through high-speed services in 2000. High-speed Internet access is expected to sur- pass dial-up services by the year 2005. Online Advertising Market This newer medium has created another avenue for businesses to reach customers. Advertising on the Inter- net started with simple websites and links to a com- pany s site from other websites. Online advertisements have become the way to reach customers on the Internet. Contrary to popular myth, online advertising is still growing at a significant rate. Internet advertising increased over 63 percent in the third quarter of 2000 compared to the third quarter of 1999.7 In addition, online advertising revenues grew more than 53 percent in 2000. Those revenues from online advertisements exceeded $8 billion in 2000 and are expected to reach $32 billion by 2005.8 Market Analysis TARGET MARKET Communitee Web is targeting its product to the baby boomer market, aged 35 to 54. This target group provides the best base to grow Communitee Web into a profitable business. Demographics of this age group include: D O D 0 O 0 a Internet usage: 66% have Internet access at home and/or work 15% use the Internet on a daily basis 9% use the Internet three to six times per week. 52% prefer products that offer the latest technology Older Internet users now constitute the fastest growing demographic group in the Internet market. Approximately 20 percent of U.S. Internet users are aged 45 to 64. This same group is on the Internet more often, stays on longer, and visits more sites than their younger counterparts. Baby boomers typically use the Internet to communicate with friends and family as well as to search for health and lifestyle-related information. 0 83% Caucasian, 12% African American 50% male/female G 70% married 30% attended or graduated from college 34% have an income above $75,000 76% work full-time more than 30% are in professional and/or managerial positions Communitee Web will reach this target market through key community influences. These influencing individuals include nonprofit organization leaders and constituents, public opinion leaders, and community coordinators (franchisees). Communitee Web has developed an aggres- sive grassroots marketing plan that will drive membership through localized community influences. Communitee- Web s presence in each community will show these com- munity leaders how their organizations and communities can benefit from CommuniteeWeb.com. MARKET POSITION According to Media Metrix, baby boomers and seniors are the fastest growing section of the online population. Last year, this demographic grew by 18.4 percent and outpaced the 18-to 24-year-old demographic, which had a 17.5 per- cent growth rate. The report by Media Metrix also shows that this group stays online longer and views more pages. On average, they access the Internet 6.3 more days per month and stay logged on 235.7 minutes longer. Lifestyle- and health-related sites are the most popular among the baby boomers. Communitee Web will capture this market by catering to this demographic group s desire for localized lifestyle information. Communitee Web is pursuing a fran- chise model for market penetration. This grassroots effort will help establish the heartbeat in a local community that has been lacking from most Internet websites. COMPETITION Communitee Web is positioning itself to be the premier local content provider and largest local search index in the world. Current attempts to localize content and services on the Web are being made by Internet service providers, search engines, media sites, local government, and others. Current attempts at providing this content and service have primarily been limited to only major market cities with populations above one million. America Online s Digital City, Yahoo!, Citysearch.com, and many others have maintained a narrow focus with limited community information and no content for small- to medium-size cities and towns. The competition for providing Internet services and e- commerce solutions is intense. Communitee Web s niche is the human factor, putting real people in their own communities as a franchise owner. Whereas most companies depend heavily on costly national advertis- ing and direct mail campaigns, CommuniteeWeb will launch a grassroots effort that will provide the highest level of customer service available today. Local Calendar Local News Local Sports Movie Times Dining Maps Local Advertisement Reward System Personalization CommuniteeWeb OneMain The chart below details the competitive strengths and weaknesses of Communitee Web s competition. MARKETING PLAN Goal 1-To establish CommuniteeWeb as the leading supplier of local content and Internet-related services on the Web. Goal 2-To maintain and continually grow the world s deepest and most comprehensible index of local, regional, national, and global URLS in existence. Goal 3-To create the most extensive database of individuals classified geographically, demographically, and psychographically available on the Web. BRAND EVALUATION Communitee Web is the first company on the Internet to compile all of the necessary tools that enable users to stay in touch with their local environment in such an in-depth manner. Communitee Web makes all of these tools available in an easy-to-understand Web portal spe- cifically designed to provide local content and services to individual communities. BRAND AWARENESS Communitee Web strives to be the decisive winner in pro- viding a public forum and information source for specific communities and/or geographic regions. The website strives to relate reliable data and provide a place for com- munity interaction on issues that are most important to individual families. Community for You will instantly be associated with family-friendly content and user- friendly navigation. The community portal on the Web is the branding stance Communitee Web will take. MyCity > Digital City V Yahoo! The company is a step ahead of its competition because of the focus on depth of information in conjunction with breadth of local information, interaction, and community services. Whereas others try to do a little of everything, Communitee Web focuses on providing the most compre- hensive source of content that is user perpetuated. CUSTOMER PROMISE We strive to be your one stop comprehensive resource for providing insight into your local environment and in doing so, never creating a disappointing experience. CONSUMER MARKET In terms of target markets, Communitee Web will focus its efforts on those markets it believes not only will ben- efit greatly from its technology but also will be the most receptive to its products and services, notably: Educational sector Corporate sector Small business sector Nonprofit sector Government Communitee Web market share will be achieved through: 0 0 O 0 Grassroots efforts with the local franchisees Volunteers within each community helping the grass- roots effort to take hold Direct competition in the marketplace Affiliations with other companies with dominant positions in their fields High-profile, local, regional, and national marketing and advertising campaigns Technology Plan Communitee Web has developed and continues to fur- ther develop a dynamic site, which requires expertise from several different technology sectors. Communitee- Web has accomplished this mission by using its own talented employees and by contracting for services from JGA. Michael Hunt has led this team through the development phases and will continue to lead this team through continuous improvement phases. JGA has provided project management and programming expertise on different components of the website. Jeff Lehm has provided the databases expertise. A com- mercially viable product was released on January 28, 2001. This product is continuing to be built and improved. CommuniteeWeb will populate the directory data- base with more than one million URLs representing a broad range of community-based websites across the nation by April 1, 2001. This index will be the most comprehensive of its kind when compared to the Open Directory Project (approximately 300,000 URLS as of January 31, 2001) at www.dmoz.org. To accomplish this, CommuniteeWeb hired more than 100 full-time employees to harvest this data. A cus- tom application was written to aid these data miners to ensure the quality and quantity of the information collected. The 100 full-time employees will be responsible for maintaining and adding new URLs after the initial pop- ulation of the database has occurred. They will also be responsible for screening content that is submitted to our community pages. The design, testing, and implementation of this website took place in approximately 12 weeks, starting October 17, 2000. Financial Segment ONLINE ADVERTISING-PER USER REVENUE A typical Internet user accesses the Internet an average of 19 times per month, visits 17 unique sites per month, and views an average of 36 pages per session. 10 Com- munitee Web has projected that a user of the site will visit it 15 times per month and view 6 pages on each of the 11 community sections (2 on the Communitee- Web Directory) per month. Communitee Web has designed a website that has the capability to show a user five online advertisements per page. Each ad impression will result in an average of 3 cents of rev- enue. The result, coupled with 1 page of national adver- tising, is $15.60 in revenue from each member from online advertising. Communitee Web has the ability to dynamically display advertising by geographic regions and in targeted categories of information. This will allow advertising customers to target not only a specific demographic but also a specific geographic region as small as a zip code. Communitee Web has used these numbers to generate all of its monthly revenue projections. AT&T INTERNET SERVICES Dial-up access will continue to be the main method of accessing the Internet during the next few years. High-speed access subscription is increasing and is expected to take over the dial-up access market by the year 2005. Communitee Web is currently developing a high-speed Internet access program with AT&T. The alliance with AT&T will provide Communitee Web with the ability to offer both dial-up access (short-term) and high-speed connectivity solutions (long-term) to the Internet. Franchisees will be able to sell dial-up access to users at $18.95 per month, which costs Communitee- Web $13.95 per month. CommuniteeWeb will have the luxury of a constant one-month cash float from revenues of this service through AT&T. Communitee Web has projected that 5 percent of its members, in addition to an undetermined amount of nonmembers, will use Communitee Web for Internet access. INFOSPACE.COM ADVERTISING REVENUES Although Communitee Web will outsource the InfoSpace content for a $5,000 monthly fee, Communitee Web expects to recover and exceed this cost with advertising revenue gains once a member navigates the InfoSpace content through CommuniteeWeb.com. Communitee- Web will receive 35 percent of the banner advertising revenues on the co-branded pages once a unique visitor per day threshold of 10,000 is met. FRANCHISE SALES AND FEES Revenue from franchising is generated in two ways: (1) through a one-time fee for the sale of franchises, and (2) through a continuous revenue stream from fees charged to the franchise owner on a monthly basis. The average starting sale price for a franchise will be $35,000 per 100,000 capita. This price will increase as member- ship numbers are established in given areas. In other words, a market with an established membership will result in a larger investment for a potential franchisee. This is because Communitee Web has already increased the value and potential of the market by providing an established membership, thus providing revenue existing streams to the franchisee. The sale of franchises will provide a great deal of revenue during the infancy and growth stage of the company. Each franchisee will also pay 12.5 percent of revenues as a royalty fee to Communitee Web. QUAD ENTERTAINMENT Everyone who stays in a hotel or resort that is Hi-5 Set Top Box equipped will receive a free membership to CommuniteeWeb.com. Of the free memberships provided, Communitee Web expects that 5 percent will continue to use Communitee Web s website when they return home. The hotel and resort industry experiences a 67.5 percent utilization of the rooms available, and the average stay is 2.75 days. Given that there will be 40,000 rooms available, 27,000 will be occupied during a one-month period. Each of those rooms will accommo- date 11 distinct visitors (30 days/2.75), resulting in 297,000 visitors and free memberships.12 Five percent of those visitors, or 14,850, will continue to use Communitee Web.com upon their return home. Revenue models for Internet access, the membership program, and normal website usage will apply to these end users as well. Revenue projections for the first month (starting in August 2001) are as follows: Internet Access = $3,712 ($5.00 x 14,850 5%) Online Advertising = $220,522 ($14.85 14,850) Memberships will increase exponentially after the first month. Quad will continue to add boxes each month, and each box in place will provide Communitee Web with two additional members per month. LICENSING OF THE COMMUNITEEWEB DIRECTORY Another revenue opportunity has recently surfaced for Communitee Web: CommuniteeWeb has taken offers to lease its database of categorized URLs. Through research and its contact with the CEO of MyCoupons.com, Randy Conrad, Communitee Web has learned that there are more than 7,500 websites that would be willing to pay an average of more than $500 per month to lease the Communitee Web Directory (as it exists today) in a co-branded environment. The directory is currently populated with more than 400,000 URLs-this num- ber and the marketable value of the directory stand to increase drastically due to relationships that Communitee Web has developed with NUOS and List Guy. Communitee Web is in the process of partner- ing with the two to further develop and market its database of URLs. ListGuy specializes in business mailing lists, has a database with more than 4 million URLS, and wishes to be the marketing and brokering arm of the Communitee Web Directory. NUOS was started by two Harvard professors and has been very involved in the creation and maintenance of Dunn and Bradstreet s online database. They have more than 6 million URLs, which can be loaded into Communitee- Web s database. NUOS and ListGuy see value in merging the databases while utilizing CommuniteeWeb s expertise and search tool. Commission levels are still in negotiation, but Communitee Web expects to retain 60 percent of the profits from this venture. (See the financial projection highlights that follows.) $ Millions Revenues Net Income Cash Flow 0 Financial Projection Highlights (Corporate) Year 1 . 0 Note: Net Income and Cash totals merely represent earning potential, as the majority of the positive cash flow and net profit earned will be utilized to further market the Communitee Web name and product. Year I cash flow of $2.87 million includes $3.38 million in investment capital. O 2.22 (41) 2.87 MILESTONE SCHEDULE Goal: 10 MSAS, 100 Franchises Communitee Web believes that the Midwest is the best market to penetrate using our warm marketing approach. We will use marketing dollars and the loyalty of the Midwest to attack the west and east coasts. Franchises Rollout-Year 1: 9 Year 2 30.83 19.08 19.08 20 franchises in California 20 franchises on East Coast MSA Phase 1: Phase 1: 12 franchises by March 31, 2001 Phase 2: 28 franchises by June 31, 2001 Phase 3: 30 franchises by September 31, 2001 Phase 4: 30 franchises by December 31, 2001 First-Year Franchise Rollout by Region: 40 franchises in Indiana, Illinois, and Michigan (Midwest) Louisville-April 1, 2001 Year 3 Indianapolis currently in operation Detroit-currently in operation Cleveland-currently in operation 182.15 148.64 148.64 Communitee Web knows that a large part of the online community in the United States is located in the state of California. Communitee Web s plan is to develop the three largest MSAs in California to capture this market early in our development. Silicon Valley is the cradle of many technology companies. This region s ability to duplicate CommuniteeWeb s concept and develop its own version is the primary reason Califor- nia is in the second phase of the rollout. California also has 10 percent of the total population of the United States within its borders. Communitee Web s marketing plans will reach more users more cost-effectively in this highly populated state. Communitee Web will focus its marketing efforts on the MSAs. The marketing medi- ums in these MSAs are expected to bleed into the rest of the state. MSA Phase 2: O 9 0 O Los Angeles-April 1, 2001 San Diego March 1, 2001 San Francisco May 1, 2001 MSA Phase 3: @ Dallas-November 1, 2001 Houston December 1, 2001 San Antonio-January 1, 2002 New York-June 1, 2001 Washington-July 1, 2001 Philadelphia-August 1, 2001 Boston September 1, 2001 MSA Phase 4: QUESTIONS 1. Should Communitee Web utilize Wall Street Venture Capital as its primary funding source? If not, why, and what should the firm s next step be? 2. Assess the company s burn rate (cash expenditure without any notable cash inflow) and financial outlook. 3. 4. 5. What are some critical mistakes made by Communitee Web? Are there any ethical and/or legal concerns in this case? What were some of the major reasons that Communi- tee Web was having problems taking its business model to market? 6. What were some of the reasons that Communitee Web was having trouble obtaining financing? 7. Evaluate the Communitee Web business plan as an effective tool for raising capital. Notes 1. See the CommuniteeWeb.com Exclusive Features section. 2. AT&T promotional literature. 3. Banners Effective Even When People Don t Click, Media (January 2001): 7. 4. http://www.nua.com/surveys/.

Step by Step Solution

★★★★★

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 2 A Case synopsis DP who is the CEO of Comuity webcom confronted t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started