Assess the future external financing needs of the company based on the following information including $ amount, timing and duration, and deferability.

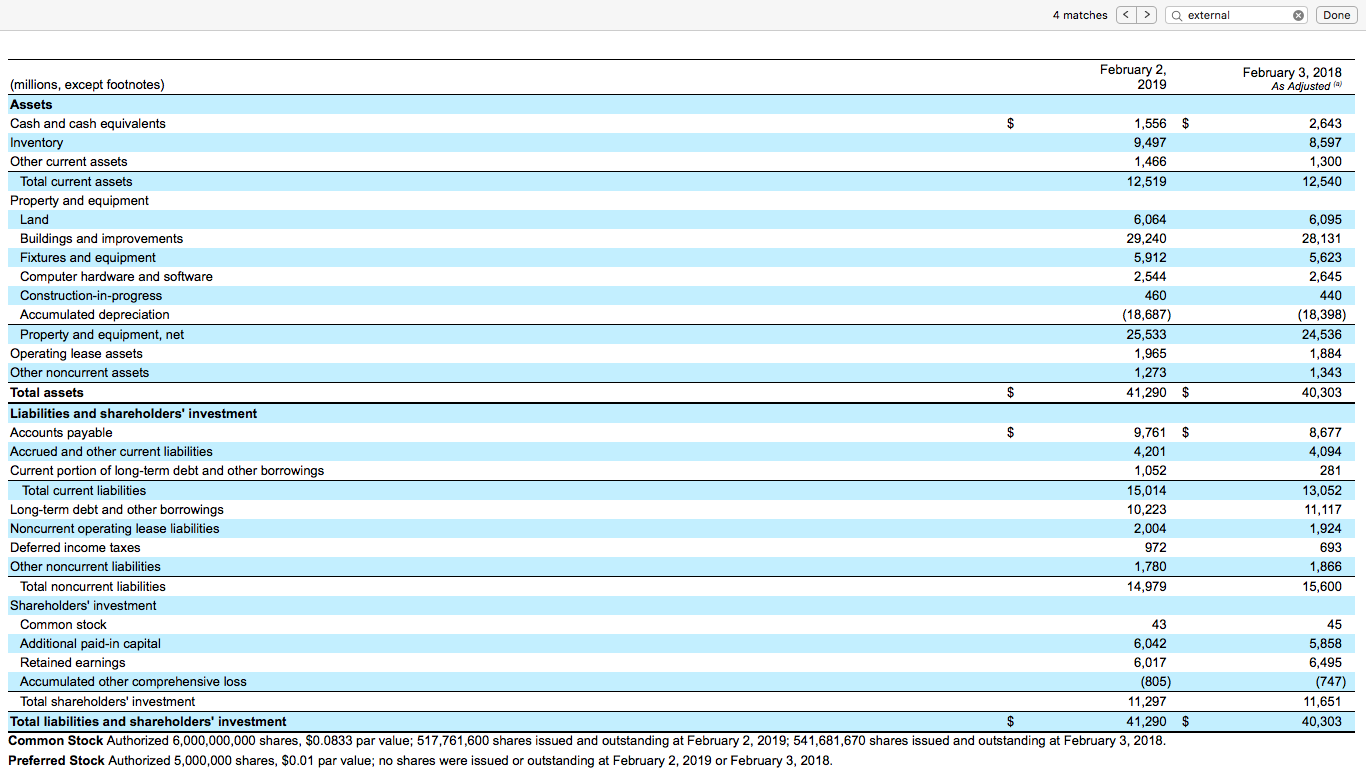

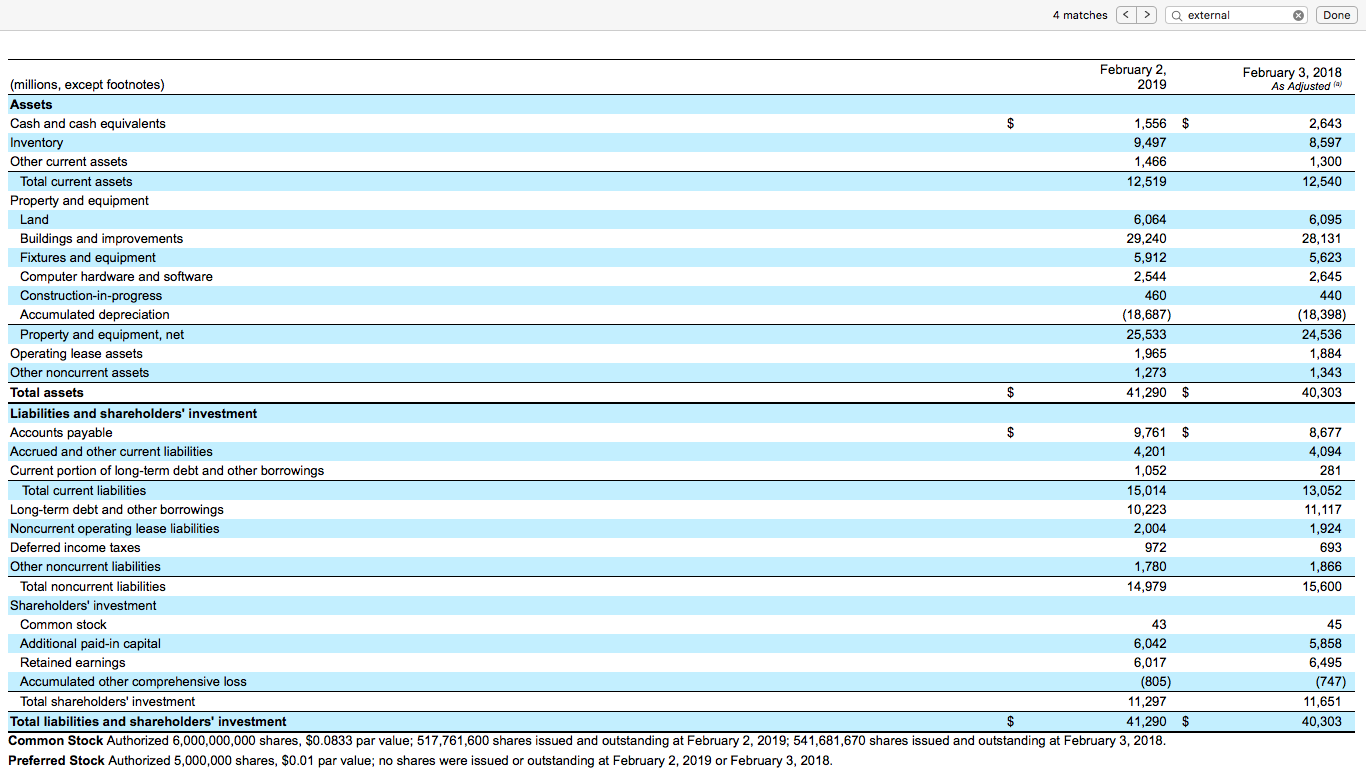

4 matches external X Done February 3, 2018 As Adjusted a 2,643 8,597 1,300 12,540 6,095 28,131 5,623 2,645 440 (18,398) 24,536 1,884 1,343 40,303 1,965 February 2, (millions, except footnotes) 2019 Assets Cash and cash equivalents $ 1,556 $ Inventory 9,497 Other current assets 1,466 Total current assets 12,519 Property and equipment Land 6,064 Buildings and improvements 29,240 Fixtures and equipment 5,912 Computer hardware and software 2,544 Construction-in-progress 460 Accumulated depreciation (18,687) Property and equipment, net 25,533 Operating lease assets Other noncurrent assets 1,273 Total assets $ 41,290 $ Liabilities and shareholders' investment Accounts payable $ 9,761 $ Accrued and other current liabilities 4,201 Current portion of long-term debt and other borrowings 1,052 Total current liabilities 15,014 Long-term debt and other borrowings 10,223 Noncurrent operating lease liabilities 2,004 Deferred income taxes 972 Other noncurrent liabilities 1,780 Total noncurrent liabilities 14,979 Shareholders' investment Common stock 43 Additional paid-in capital 6,042 Retained earnings 6,017 Accumulated other comprehensive loss (805) Total shareholders' investment 11,297 Total liabilities and shareholders' investment $ 41,290 $ Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 517,761,600 shares issued and outstanding at February 2, 2019; 541,681,670 shares issued and outstanding at February 3, 2018. Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding at February 2, 2019 or February 3, 2018. 8,677 4,094 281 13,052 11,117 1,924 693 1,866 15,600 45 5,858 6,495 (747) 11,651 40,303 4 matches external X Done February 3, 2018 As Adjusted a 2,643 8,597 1,300 12,540 6,095 28,131 5,623 2,645 440 (18,398) 24,536 1,884 1,343 40,303 1,965 February 2, (millions, except footnotes) 2019 Assets Cash and cash equivalents $ 1,556 $ Inventory 9,497 Other current assets 1,466 Total current assets 12,519 Property and equipment Land 6,064 Buildings and improvements 29,240 Fixtures and equipment 5,912 Computer hardware and software 2,544 Construction-in-progress 460 Accumulated depreciation (18,687) Property and equipment, net 25,533 Operating lease assets Other noncurrent assets 1,273 Total assets $ 41,290 $ Liabilities and shareholders' investment Accounts payable $ 9,761 $ Accrued and other current liabilities 4,201 Current portion of long-term debt and other borrowings 1,052 Total current liabilities 15,014 Long-term debt and other borrowings 10,223 Noncurrent operating lease liabilities 2,004 Deferred income taxes 972 Other noncurrent liabilities 1,780 Total noncurrent liabilities 14,979 Shareholders' investment Common stock 43 Additional paid-in capital 6,042 Retained earnings 6,017 Accumulated other comprehensive loss (805) Total shareholders' investment 11,297 Total liabilities and shareholders' investment $ 41,290 $ Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 517,761,600 shares issued and outstanding at February 2, 2019; 541,681,670 shares issued and outstanding at February 3, 2018. Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding at February 2, 2019 or February 3, 2018. 8,677 4,094 281 13,052 11,117 1,924 693 1,866 15,600 45 5,858 6,495 (747) 11,651 40,303