Question

Sensitivity of Value-Earnings and Value-to-Book to Changes in Assumptions. This problem explores the sensitivity of the value-earnings and value-to-book models to changes in underlying assumptions.

Sensitivity of Value-Earnings and Value-to-Book to Changes in Assumptions.

This problem explores the sensitivity of the value-earnings and value-to-book models to changes in underlying assumptions. We recommend that you design a computer spreadsheet to perform the calculations, particularly for the value-to-book ratio.

REQUIRED

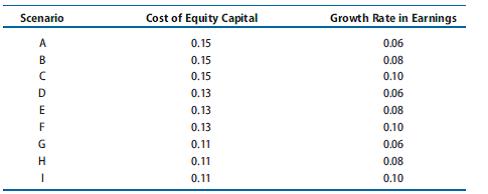

a. Assume that current period earnings per share were $1.00 for each of the following nine scenarios (A through I). Compute the value-earnings ratio based on projected one-year-ahead earnings under each of the following sets of assumptions :

b. Assess the sensitivity of the price-earnings ratio to changes in the cost of equity capital and changes in the growth rate.

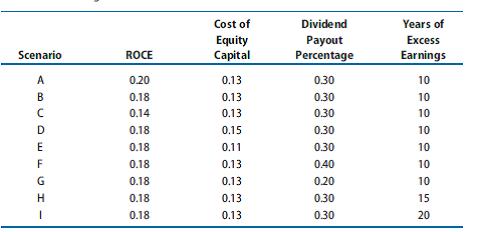

c. Compute the value-to-book ratio under each of the following nine sets of assumptions (A through I). Assume zero abnormal ROCE in the periods following the number of years of excess earnings.

d. Assess the sensitivity of the value-to-book ratio to changes in the assumptions made about the various underlying variables.

Scenario ABCD E F CH- G Cost of Equity Capital 0.15 0.15 0.15 0.13 0.13 0.13 0.11 0.11 0.11 Growth Rate in Earnings 0.06 0.08 0.10 0.06 0.08 0.10 0.06 0.08 0.10

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the valueearnings ratio we use the formula ValueEarnings Ratio Cost of Equity Capital Growth Rate in Earnings Cost of Equity Capital Using the given earnings per share of 100 we can compu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started