Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASSESSE Heading 1 1 Normal 1 No Spac... Heading 2 He Paragraph Styles Question Two: 1) For the following stable growth firm, calculate: a. Cost

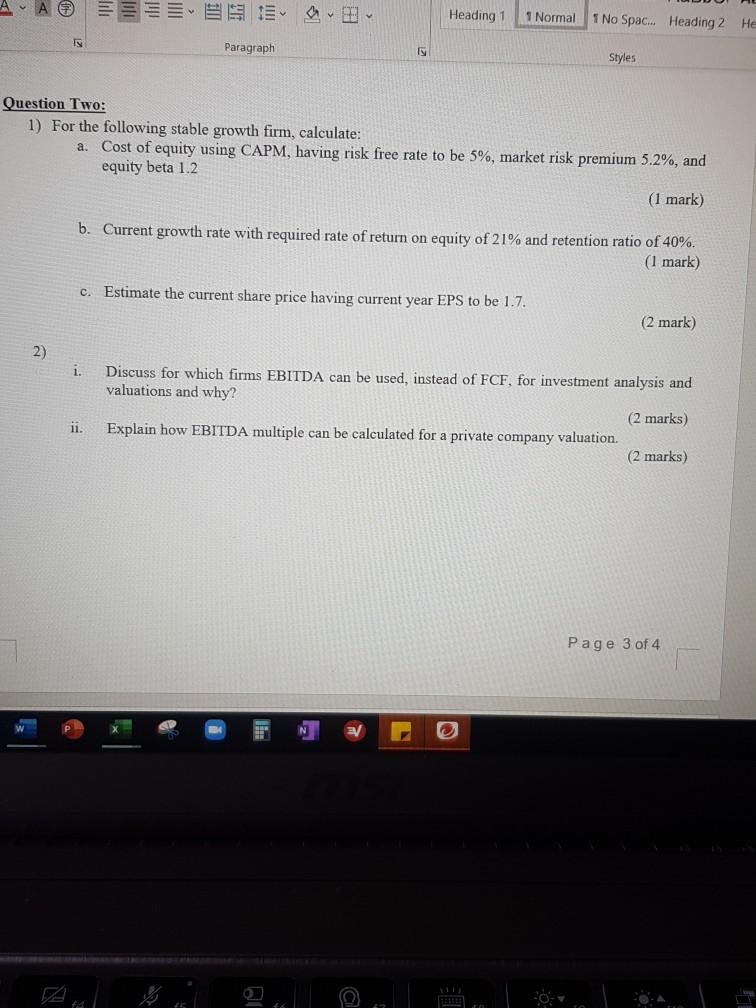

ASSESSE Heading 1 1 Normal 1 No Spac... Heading 2 He Paragraph Styles Question Two: 1) For the following stable growth firm, calculate: a. Cost of equity using CAPM, having risk free rate to be 5%, market risk premium 5.2%, and equity beta 1.2 (1 mark) b. Current growth rate with required rate of return on equity of 21% and retention ratio of 40%. (1 mark) c. Estimate the current share price having current year EPS to be 1.7. (2 mark) 2) 1. Discuss for which firms EBITDA can be used, instead of FCF, for investment analysis and valuations and why? (2 marks) Explain how EBITDA multiple can be calculated for a private company valuation. (2 marks) 11. Page 3 of 4 a/

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started