Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assessment #2: Variable Payout Payment Calculations A person purchases a 5-year annual-pay period certain immediate variable payout contract with a premium of $100,000. The

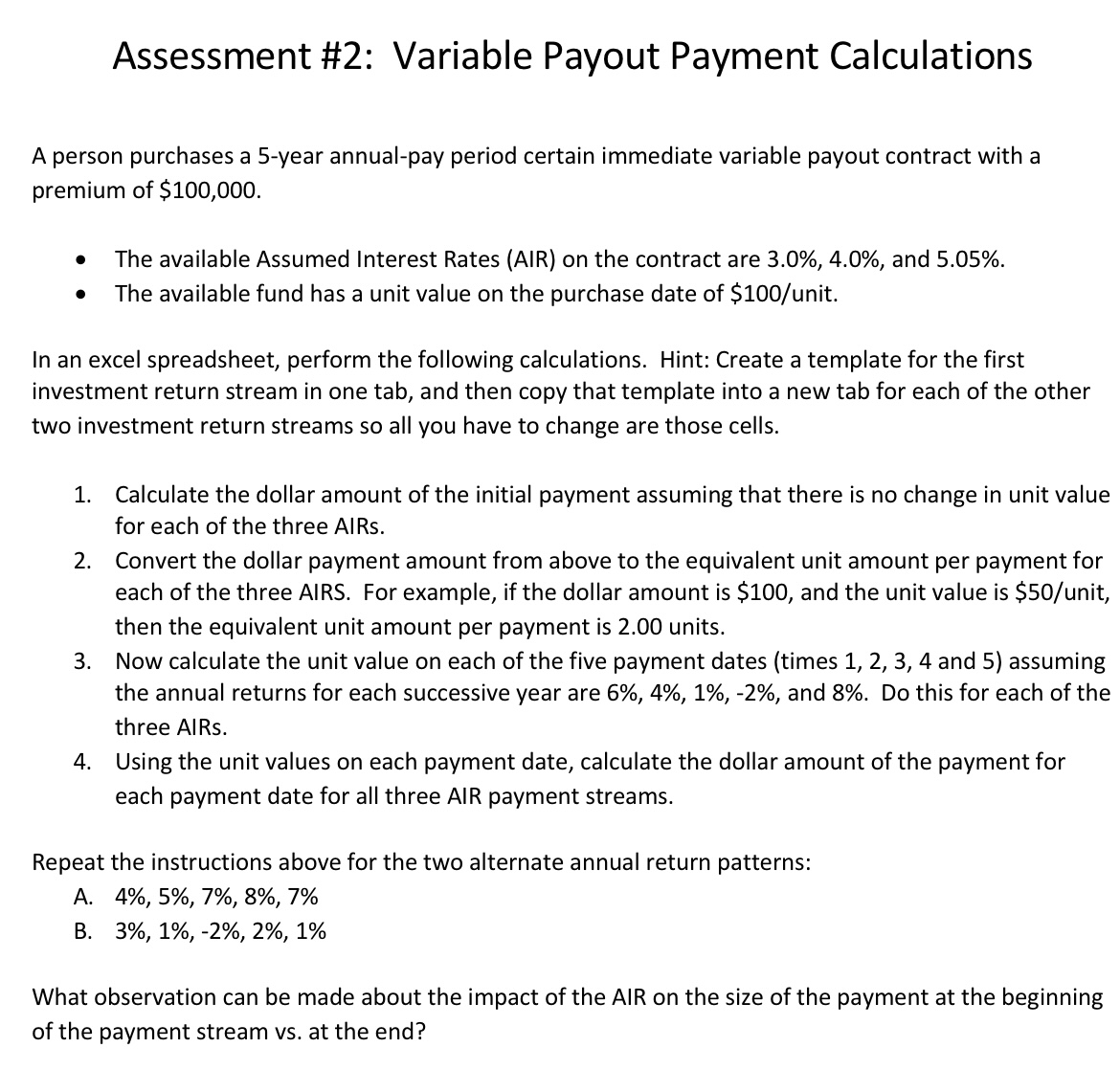

Assessment #2: Variable Payout Payment Calculations A person purchases a 5-year annual-pay period certain immediate variable payout contract with a premium of $100,000. The available Assumed Interest Rates (AIR) on the contract are 3.0%, 4.0%, and 5.05%. The available fund has a unit value on the purchase date of $100/unit. In an excel spreadsheet, perform the following calculations. Hint: Create a template for the first investment return stream in one tab, and then copy that template into a new tab for each of the other two investment return streams so all you have to change are those cells. 1. Calculate the dollar amount of the initial payment assuming that there is no change in unit value for each of the three AIRS. 2. Convert the dollar payment amount from above to the equivalent unit amount per payment for each of the three AIRS. For example, if the dollar amount is $100, and the unit value is $50/unit, then the equivalent unit amount per payment is 2.00 units. 3. Now calculate the unit value on each of the five payment dates (times 1, 2, 3, 4 and 5) assuming the annual returns for each successive year are 6%, 4%, 1%, -2%, and 8%. Do this for each of the three AIRs. 4. Using the unit values on each payment date, calculate the dollar amount of the payment for each payment date for all three AIR payment streams. Repeat the instructions above for the two alternate annual return patterns: A. 4%, 5%, 7%, 8%, 7% B. 3%, 1%, -2%, 2%, 1% What observation can be made about the impact of the AIR on the size of the payment at the beginning of the payment stream vs. at the end?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started