Answered step by step

Verified Expert Solution

Question

1 Approved Answer

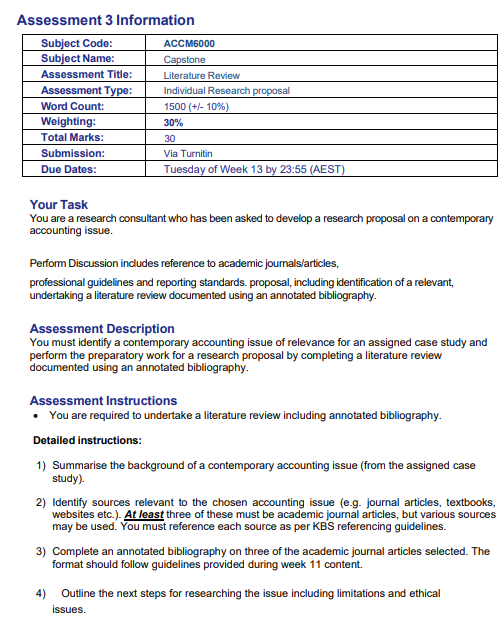

Assessment 3 Information Subject Code: ACCM6000 Subject Name: Capstone Assessment Title: Assessment Type: Word Count: Weighting: Total Marks: Submission: Due Dates: Your Task Literature

Assessment 3 Information Subject Code: ACCM6000 Subject Name: Capstone Assessment Title: Assessment Type: Word Count: Weighting: Total Marks: Submission: Due Dates: Your Task Literature Review Individual Research proposal 1500 (+/- 10%) 30% 30 Via Turnitin Tuesday of Week 13 by 23:55 (AEST) You are a research consultant who has been asked to develop a research proposal on a contemporary accounting issue. Perform Discussion includes reference to academic journals/articles, professional guidelines and reporting standards. proposal, including identification of a relevant, undertaking a literature review documented using an annotated bibliography. Assessment Description You must identify a contemporary accounting issue of relevance for an assigned case study and perform the preparatory work for a research proposal by completing a literature review documented using an annotated bibliography. Assessment Instructions You are required to undertake a literature review including annotated bibliography. Detailed instructions: 1) Summarise the background of a contemporary accounting issue (from the assigned case study). 2) Identify sources relevant to the chosen accounting issue (e.g. journal articles, textbooks, websites etc.). At least three of these must be academic journal articles, but various sources may be used. You must reference each source as per KBS referencing guidelines. 3) Complete an annotated bibliography on three of the academic journal articles selected. The format should follow guidelines provided during week 11 content. 4) Outline the next steps for researching the issue including limitations and ethical issues.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started