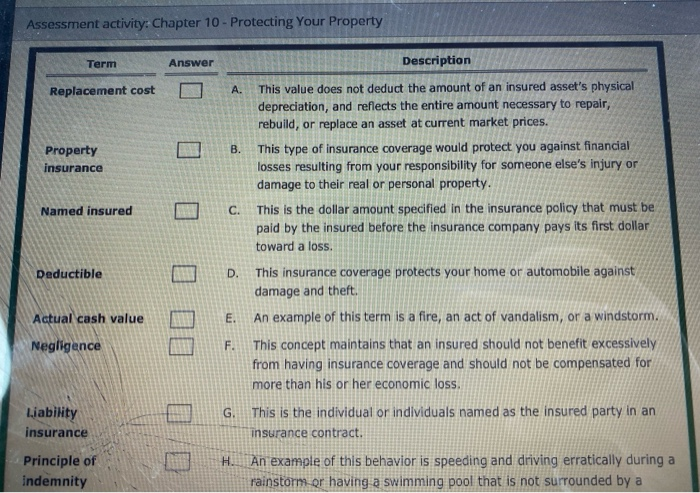

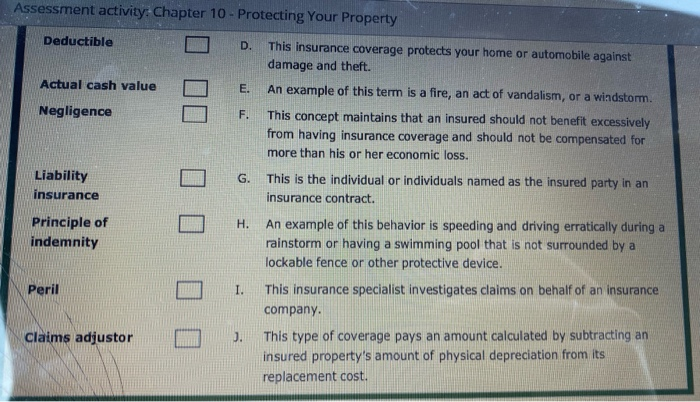

Assessment activity: Chapter 10 - Protecting Your Property Term Answer Description Replacement cost N A. This value does not deduct the amount of an insured asset's physical depreciation, and reflects the entire amount necessary to repair, rebuild, or replace an asset at current market prices. B. Property insurance Named insured Deductible O O O OOO OO Actual cash value This type of insurance coverage would protect you against financial losses resulting from your responsibility for someone else's injury or damage to their real or personal property. This is the dollar amount specified in the insurance policy that must be paid by the insured before the insurance company pays its first dollar toward a loss. D. This insurance coverage protects your home or automobile against damage and theft. E. An example of this term is a fire, an act of vandalism, or a windstorm. This concept maintains that an insured should not benefit excessively from having insurance coverage and should not be compensated for more than his or her economic loss. G. This is the individual or individuals named as the insured party in an insurance contract. An example of this behavior is speeding and driving erratically during a rainstorm or having a swimming pool that is not surrounded by a Negligence Liability insurance Principle of indemnity H Assessment activity: Chapter 10 - Protecting Your Property Deductible D. This insurance coverage protects your home or automobile against damage and theft. Actual cash value An example of this term is a fire, an act of vandalism, or a windstorm. Negligence This concept maintains that an insured should not benefit excessively from having insurance coverage and should not be compensated for more than his or her economic loss. Liability This is the individual or individuals named as the insured party in an insurance insurance contract. Principle of H. An example of this behavior is speeding and driving erratically during a indemnity rainstorm or having a swimming pool that is not surrounded by a lockable fence or other protective device. This insurance specialist investigates claims on behalf of an insurance company. Claims adjustor This type of coverage pays an amount calculated by subtracting an insured property's amount of physical depreciation from its replacement cost. Peril