Answered step by step

Verified Expert Solution

Question

1 Approved Answer

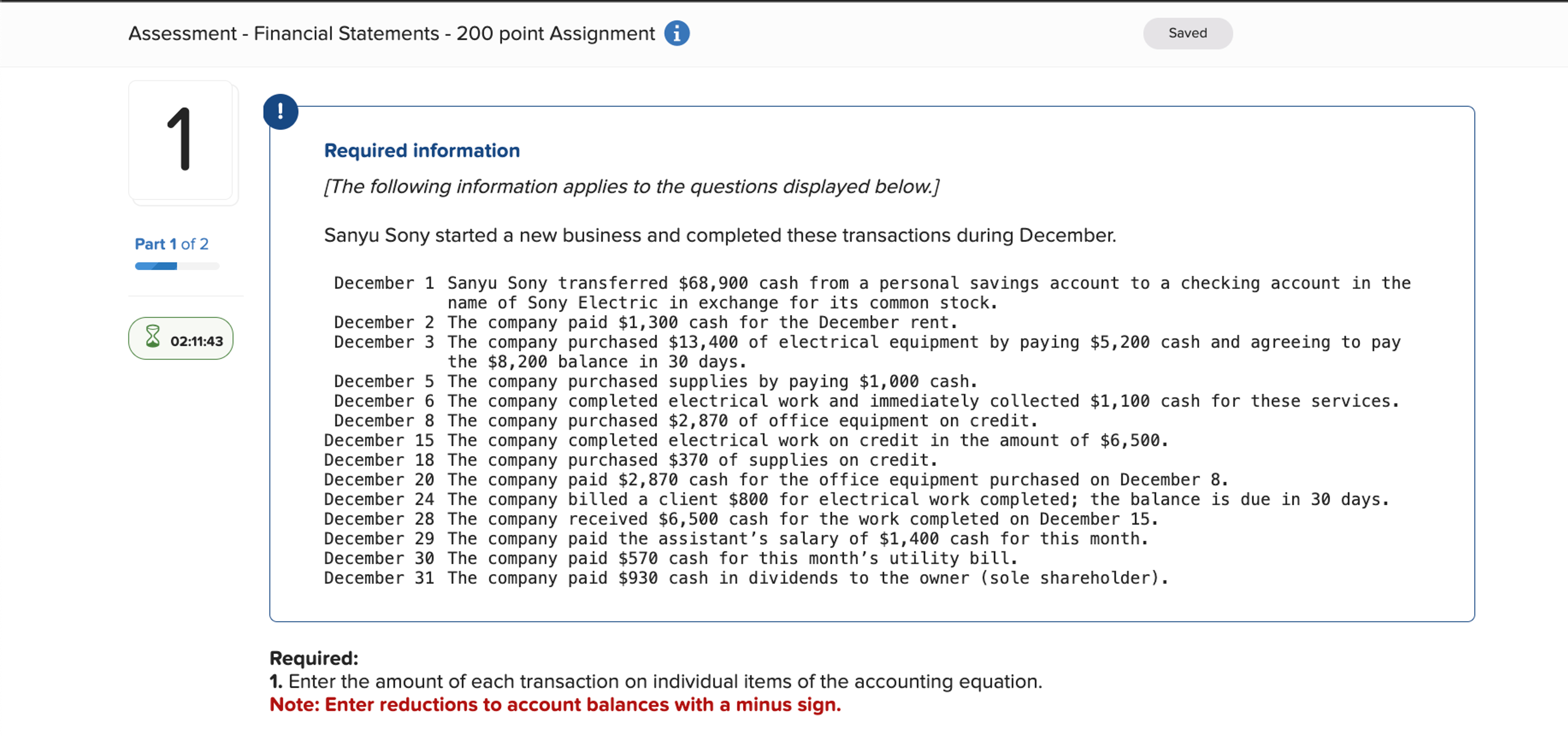

Assessment - Financial Statements - 2 0 0 point Assignment i . Saved Required: Enter the amount of each transaction on individual items of the

Assessment Financial Statements point Assignment

i

Saved

Required:

Enter the amount of each transaction on individual items of the accounting equation.

Note: Enter reductions to account balances with a minus sign.

Required:

Enter the amount of each transaction on individual items of the accounting equation.

Note: Enter reductions to account balances with a minus sign.

Part of

::

tableDateAssets,tableLiabilitiesAccountsPayableEquityCashtableAccountsReceivableSupplies,tableOfficeEquipmenttableElectricalEquipmenttableCommonStockDividends,Revenues,ExpensesDecember iDecember Balance after December and December December Balance after December December December iBalance after December December Balance after December December iBalance after December December iDecember Balance after December December Balance after December December iBalance after December December iBalance after December December Balance after December December Required information

Skip to question

The following information applies to the questions displayed below.

Sanyu Sony started a new business and completed these transactions during December.

December Sanyu Sony transferred $ cash from a personal savings account to a checking account in the name of Sony Electric in exchange for its common stock.

December The company paid $ cash for the December rent.

December The company purchased $ of electrical equipment by paying $ cash and agreeing to pay the $ balance in days.

December The company purchased supplies by paying $ cash.

December The company completed electrical work and immediately collected $ cash for these services.

December The company purchased $ of office equipment on credit.

December The company completed electrical work on credit in the amount of $

December The company purchased $ of supplies on credit.

December The company paid $ cash for the office equipment purchased on December

December The company billed a client $ for electrical work completed; the balance is due in days.

December The company received $ cash for the work completed on December

December The company paid the assistants salary of $ cash for this month.

December The company paid $ cash for this months utility bill.

December The company paid $ cash in dividends to the owner sole shareholder

Required:

Enter the amount of each transaction on individual items of the accounting equation.

Note: Enter reductions to account balances with a minus sign.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started