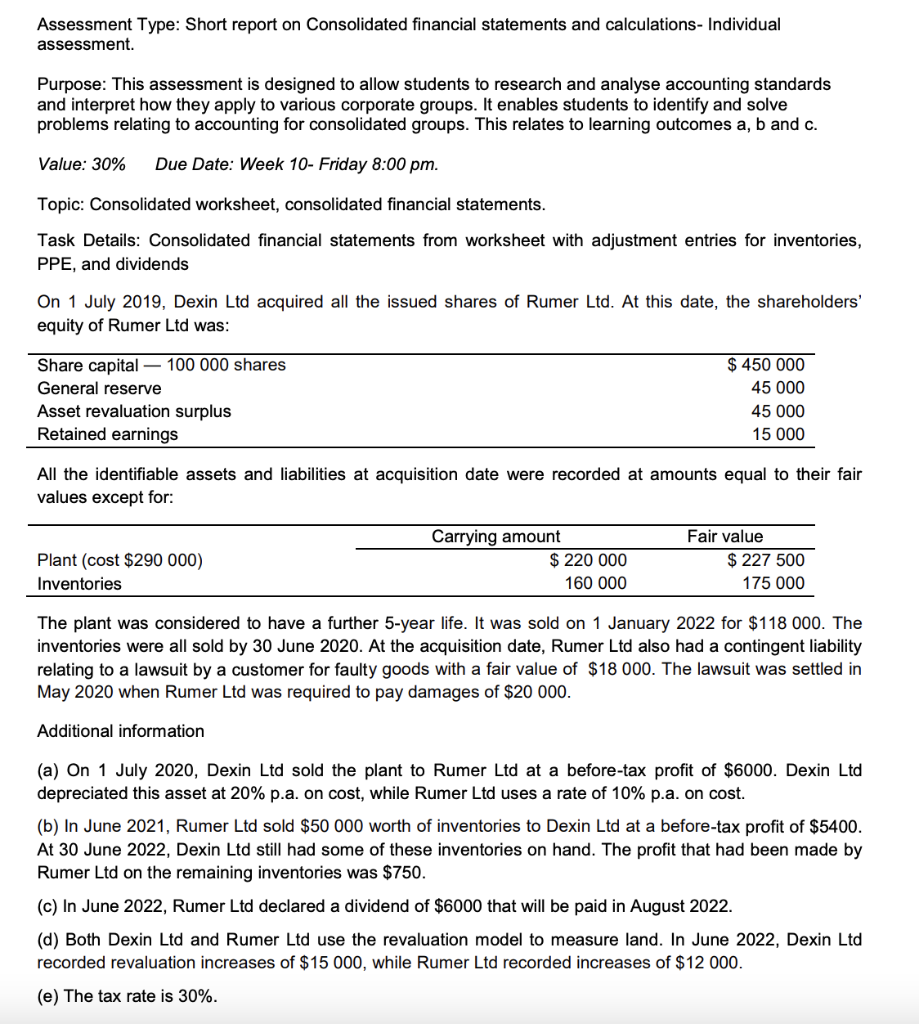

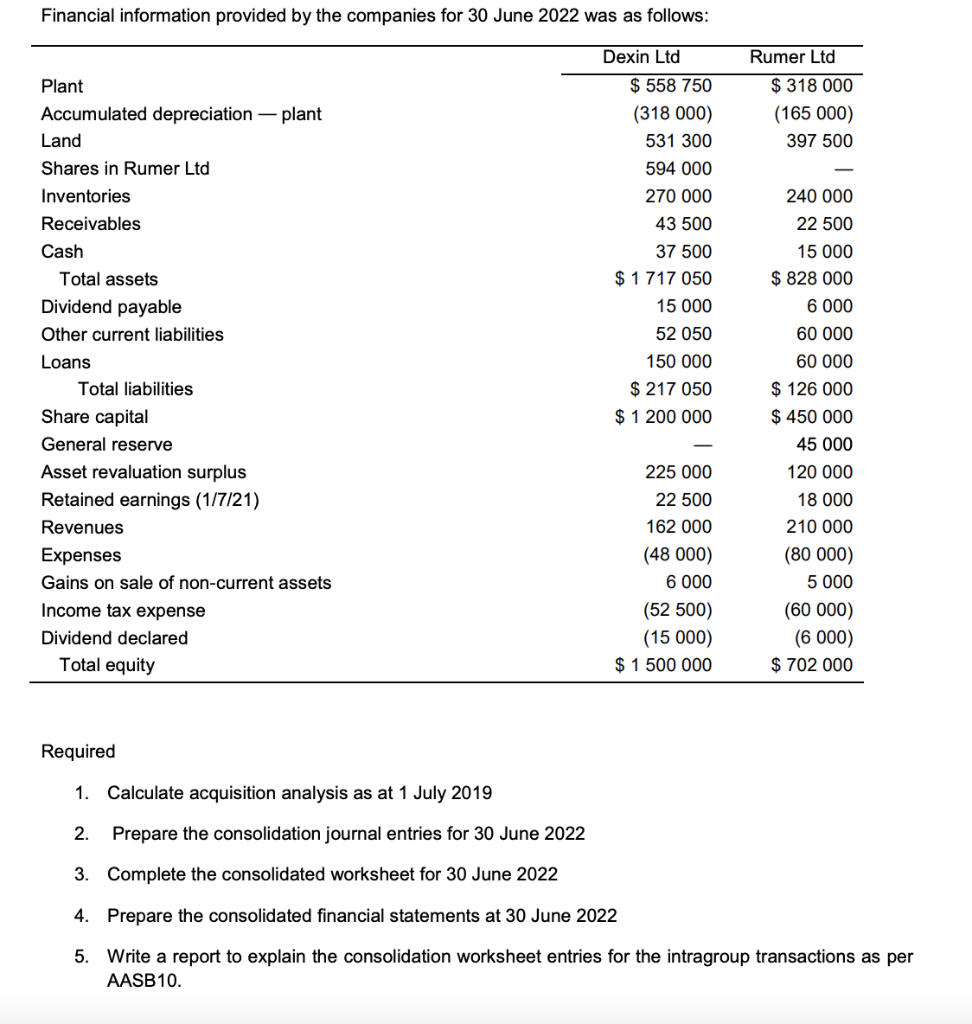

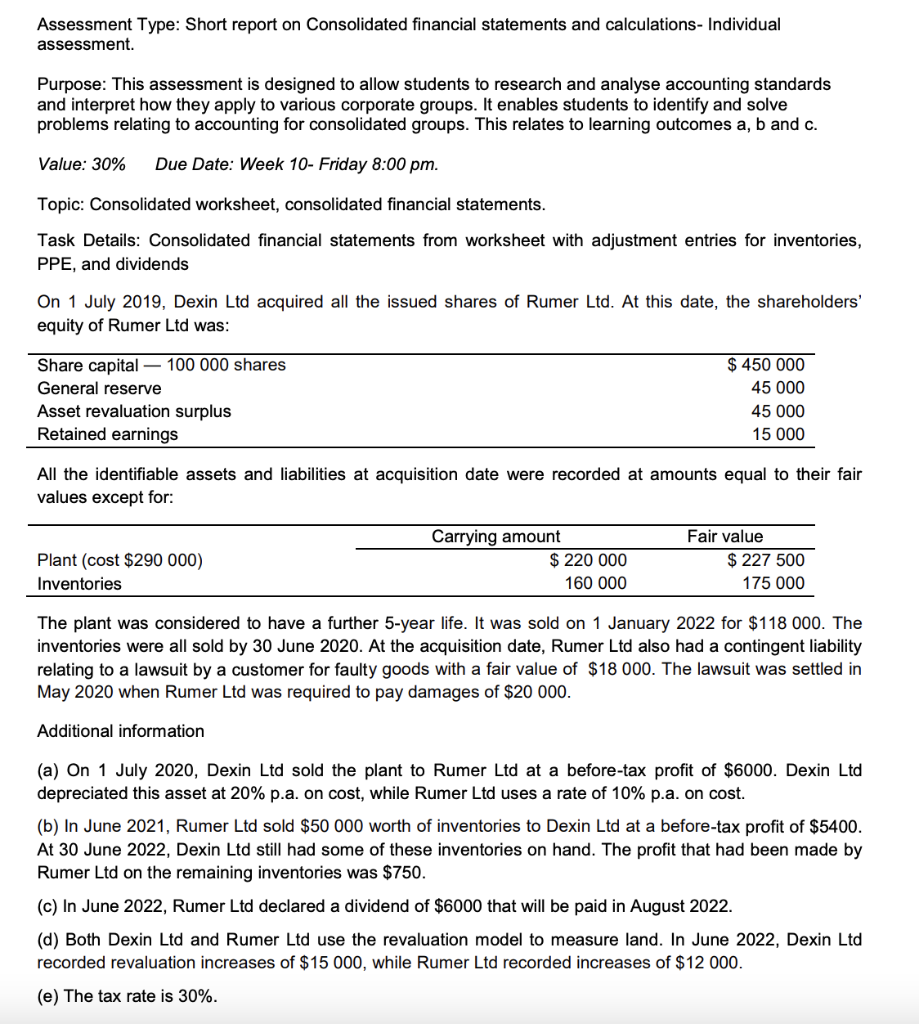

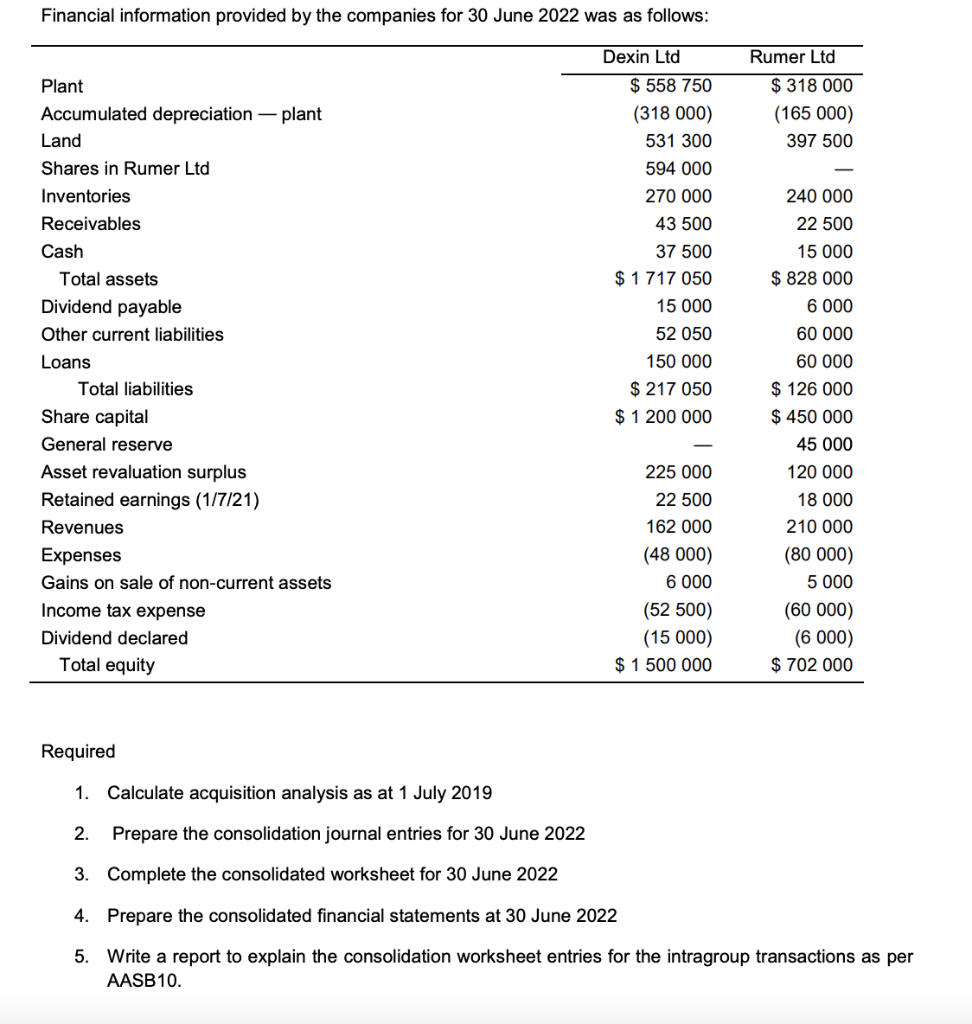

Assessment Type: Short report on Consolidated financial statements and calculations- Individual assessment. Purpose: This assessment is designed to allow students to research and analyse accounting standards and interpret how they apply to various corporate groups. It enables students to identify and solve problems relating to accounting for consolidated groups. This relates to learning outcomes a,b and c. Value: 30% Due Date: Week 10- Friday 8:00 pm. Topic: Consolidated worksheet, consolidated financial statements. Task Details: Consolidated financial statements from worksheet with adjustment entries for inventories, PPE, and dividends On 1 July 2019 , Dexin Ltd acquired all the issued shares of Rumer Ltd. At this date, the shareholders' equity of Rumer Ltd was: All the identifiable assets and liabilities at acquisition date were recorded at amounts equal to their fair values except for: FI The plant was considered to have a further 5 -year life. It was sold on 1 January 2022 for $118000. The inventories were all sold by 30 June 2020 . At the acquisition date, Rumer Ltd also had a contingent liability relating to a lawsuit by a customer for faulty goods with a fair value of $18000. The lawsuit was settled in May 2020 when Rumer Ltd was required to pay damages of $20000. Additional information (a) On 1 July 2020, Dexin Ltd sold the plant to Rumer Ltd at a before-tax profit of $6000. Dexin Ltd depreciated this asset at 20% p.a. on cost, while Rumer Ltd uses a rate of 10% p.a. on cost. (b) In June 2021, Rumer Ltd sold $50000 worth of inventories to Dexin Ltd at a before-tax profit of $5400. At 30 June 2022, Dexin Ltd still had some of these inventories on hand. The profit that had been made by Rumer Ltd on the remaining inventories was $750. (c) In June 2022, Rumer Ltd declared a dividend of $6000 that will be paid in August 2022. (d) Both Dexin Ltd and Rumer Ltd use the revaluation model to measure land. In June 2022, Dexin Ltd recorded revaluation increases of $15000, while Rumer Ltd recorded increases of $12000. (e) The tax rate is 30%. Financial information provided by the companies for 30 June 2022 was as follows: Required 1. Calculate acquisition analysis as at 1 July 2019 2. Prepare the consolidation journal entries for 30 June 2022 3. Complete the consolidated worksheet for 30 June 2022 4. Prepare the consolidated financial statements at 30 June 2022 5. Write a report to explain the consolidation worksheet entries for the intragroup transactions as per AASB10