Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Asset 4 has E[R4] = 7.4% and SD = 21% meaning it is at least as risky as the other risky assets and has a

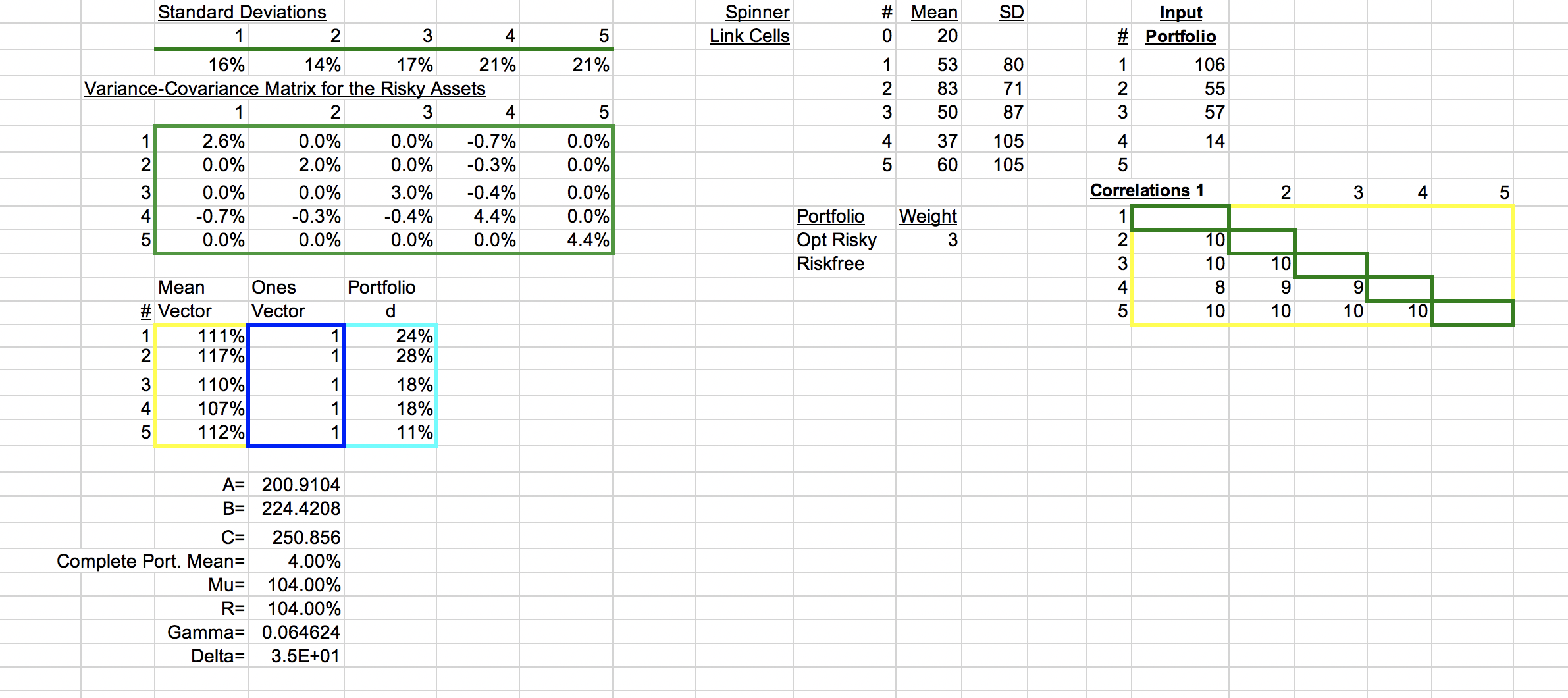

Asset 4 has E[R4] = 7.4% and SD = 21% meaning it is at least as risky as the other risky assets and has a lower expected return than any of the other risky assets. In other words, it appears to be a dominated asset. Why does it have a positive weight in the optimal portfolio?

All needed date is here:

2 3 14% 17% Variance-Covariance Matrix for the Risky Assets 2 3 0.0% 0.0% 1 2 3 4 5 1 2 Standard Deviations 34 5 1 16% Mean # Vector 1 2.6% 0.0% 0.0% -0.7% 0.0% 111% 117% 110% 107% 112% 0.0% 2.0% Complete Port. Mean= Mu= R= 0.0% -0.3% 0.0% A= 200.9104 B= 224.4208 Ones Vector C= 250.856 4.00% Gamma= 104.00% 104.00% 0.064624 Delta= 3.5E+01 Portfolio d 3.0% -0.4% -0.4% 4.4% 0.0% 0.0% 24% 28% 4 21% 18% 18% 11% 4 -0.7% -0.3% 5 21% 5 0.0% 0.0% 0.0% 0.0% 4.4% Spinner Link Cells # Mean 0 20 23 4 st LO 53 83 50 SD Portfolio Weight Opt Risky 3 Riskfree 80 71 87 37 105 60 105 Input # Portfolio 1 23 2 45 4 5 106 55 57 14 Correlations 1 12345 10 10 8 10 2 10 9 10 3 9 10 4 10 5

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

There are a few reasons why Asset 4 may have a positive weight in the optimal portfolio even though ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started