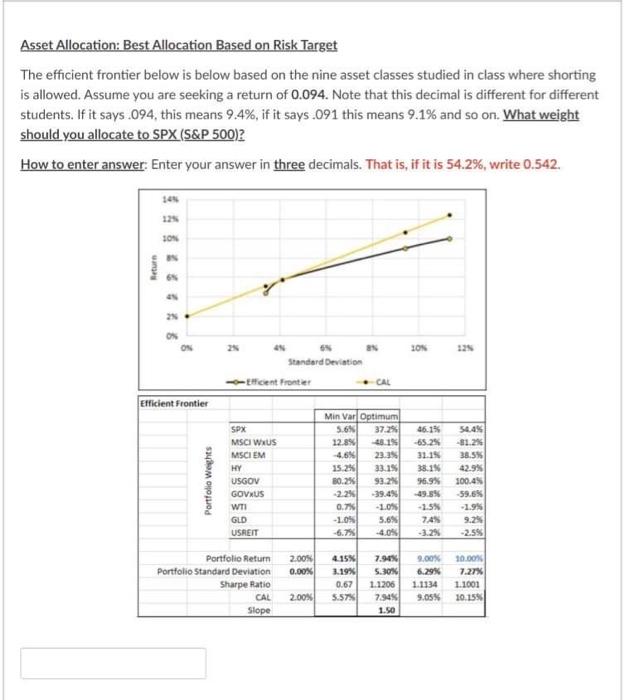

Asset Allocation: Best Allocation Based on Risk Target The efficient frontier below is below based on the nine asset classes studied in class where shorting is allowed. Assume you are seeking a return of 0.094. Note that this decimal is different for different students. If it says.094, this means 9.4%, if it says.091 this means 9.1% and so on. What weight should you allocate to SPX (S&P 500? How to enter answer. Enter your answer in three decimals. That is, if it is 54.2%, write 0.542. IN SON IN Return 6 2 ON 2 2 2 LON 12 AN ON Standard deviation Efficient Frontier -CAL Efficient Frontier Portfolio Wechts SPX MSCI WNUS MSCI EM HY USGOV GOVXUS WTI GLD USREIT Min Var Optimum 5.6% 37.25 12.8% 18.15 -4.6% 23.35 15.2% 33.15 30.2% 93.2 -2.2% -39.4 0.7% -2.09 -1.05 5.6% 4.0% 46.1% -65.2% 31.15 38.15 96.9% -49.5% -2.5% 745 54.4% -8121 38.5 42.9% 100.45 59.6% -1.9 9.2% 2.556 2.00% 0.00% Portfolio Return Portfolio Standard Deviation Sharpe Ratio CAL Slope 4.15% 3.19% 0.67 S.57% 7.90% 5.30% 1.1206 7.30 1.50 9.00 6.29% 1.1134 9.05% 10.00 7.27% 1.1001 10.155 2.00% Asset Allocation: Best Allocation Based on Risk Target The efficient frontier below is below based on the nine asset classes studied in class where shorting is allowed. Assume you are seeking a return of 0.094. Note that this decimal is different for different students. If it says.094, this means 9.4%, if it says.091 this means 9.1% and so on. What weight should you allocate to SPX (S&P 500? How to enter answer. Enter your answer in three decimals. That is, if it is 54.2%, write 0.542. IN SON IN Return 6 2 ON 2 2 2 LON 12 AN ON Standard deviation Efficient Frontier -CAL Efficient Frontier Portfolio Wechts SPX MSCI WNUS MSCI EM HY USGOV GOVXUS WTI GLD USREIT Min Var Optimum 5.6% 37.25 12.8% 18.15 -4.6% 23.35 15.2% 33.15 30.2% 93.2 -2.2% -39.4 0.7% -2.09 -1.05 5.6% 4.0% 46.1% -65.2% 31.15 38.15 96.9% -49.5% -2.5% 745 54.4% -8121 38.5 42.9% 100.45 59.6% -1.9 9.2% 2.556 2.00% 0.00% Portfolio Return Portfolio Standard Deviation Sharpe Ratio CAL Slope 4.15% 3.19% 0.67 S.57% 7.90% 5.30% 1.1206 7.30 1.50 9.00 6.29% 1.1134 9.05% 10.00 7.27% 1.1001 10.155 2.00%