Answered step by step

Verified Expert Solution

Question

1 Approved Answer

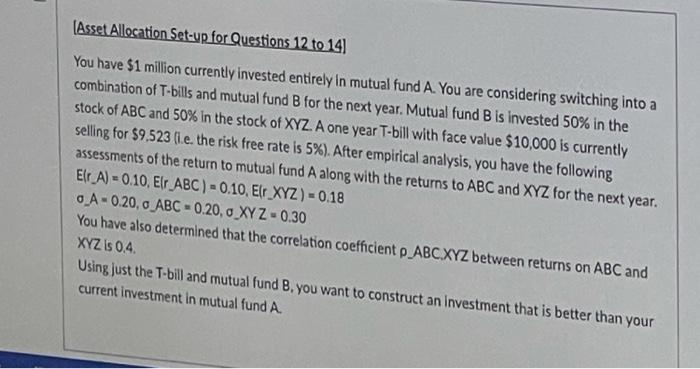

(Asset Allocation Set-up for Questions 12 to 14) You have $1 million currently invested entirely in mutual fund A. You are considering switching into a

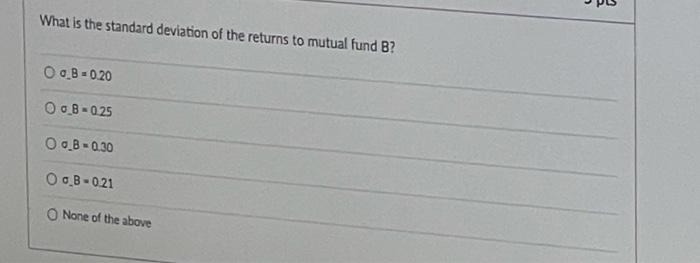

(Asset Allocation Set-up for Questions 12 to 14) You have $1 million currently invested entirely in mutual fund A. You are considering switching into a combination of T-bills and mutual fund B for the next year. Mutual fund B is invested 50% in the stock of ABC and 50% in the stock of XYZ. A one year T-bill with face value $10,000 is currently selling for $9.523 (.e. the risk free rate is 5%). After empirical analysis, you have the following assessments of the return to mutual fund A along with the returns to ABC and XYZ for the next year. Elr_A) = 0.10, Elr ABC) - 0.10, Elr_XYZ) -0.18 0-A-0.20, 0 ABC -0.20,0 XYZ -0.30 You have also determined that the correlation coefficient o ABC.XYZ between returns on ABC and XYZ is 04. Using just the T-bill and mutual fund B. you want to construct an investment that is better than your current investment in mutual fund A. What is the standard deviation of the returns to mutual fund B? O B=0.20 Oo_B-025 O_B0.30 O 08-021 O None of the above

(Asset Allocation Set-up for Questions 12 to 14) You have $1 million currently invested entirely in mutual fund A. You are considering switching into a combination of T-bills and mutual fund B for the next year. Mutual fund B is invested 50% in the stock of ABC and 50% in the stock of XYZ. A one year T-bill with face value $10,000 is currently selling for $9.523 (.e. the risk free rate is 5%). After empirical analysis, you have the following assessments of the return to mutual fund A along with the returns to ABC and XYZ for the next year. Elr_A) = 0.10, Elr ABC) - 0.10, Elr_XYZ) -0.18 0-A-0.20, 0 ABC -0.20,0 XYZ -0.30 You have also determined that the correlation coefficient o ABC.XYZ between returns on ABC and XYZ is 04. Using just the T-bill and mutual fund B. you want to construct an investment that is better than your current investment in mutual fund A. What is the standard deviation of the returns to mutual fund B? O B=0.20 Oo_B-025 O_B0.30 O 08-021 O None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started