Answered step by step

Verified Expert Solution

Question

1 Approved Answer

asset and liabilities not to be the new revalued value. Note for Memorandum Revaluation Account: 1. The first part of revaluation Account has all the

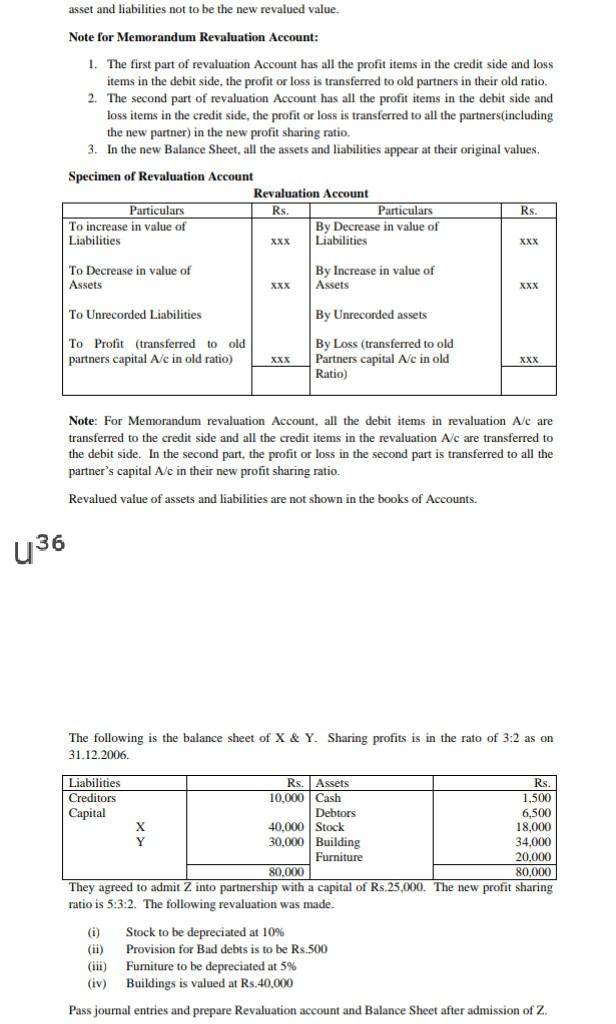

asset and liabilities not to be the new revalued value. Note for Memorandum Revaluation Account: 1. The first part of revaluation Account has all the profit items in the credit side and loss items in the debit side, the profit or loss is transferred to old partners in their old ratio. 2. The second part of revaluation Account has all the profit items in the debit side and loss items in the credit side, the profit or loss is transferred to all the partners(including the new partner) in the new profit sharing ratio. 3. In the new Balance Sheet, all the assets and liabilities appear at their original values, Specimen of Revaluation Account Revaluation Account Particulars Rs. Particulars Rs. To increase in value of By Decrease in value of Liabilities Liabilities XXX XXX To Decrease in value of Assets By Increase in value of Assets XXX XXX To Unrecorded Liabilities By Unrecorded assets To Profit (transferred to old partners capital A/c in old ratio) XXX By Loss (transferred to old Partners capital A/c in old Ratio) XXX Note: For Memorandum revaluation Account, all the debit items in revaluation A/c are transferred to the credit side and all the credit items in the revaluation A/c are transferred to the debit side. In the second part, the profit or loss in the second part is transferred to all the partner's capital A/c in their new profit sharing ratio. Revalued value of assets and liabilities are not shown in the books of Accounts. 36 The following is the balance sheet of X & Y. Sharing profits is in the rato of 3:2 as on 31.12.2006. Liabilities Rs. Assets Rs. Creditors 10,000 Cash 1,500 Capital Debtors 6,500 40,000 Stock 18,000 Y 30,000 Building 34,000 Furniture 20,000 80,000 80,000 They agreed to admit Z into partnership with a capital of Rs. 25,000. The new profit sharing ratio is 5:3:2. The following revaluation was made. (i) Stock to be depreciated at 10% (ii) Provision for Bad debts is to be Rs.500 (iii) Furniture to be depreciated at 5% (iv) Buildings is valued at Rs.40,000 Pass journal entries and prepare Revaluation account and Balance Sheet after admission of Z

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started