Answered step by step

Verified Expert Solution

Question

1 Approved Answer

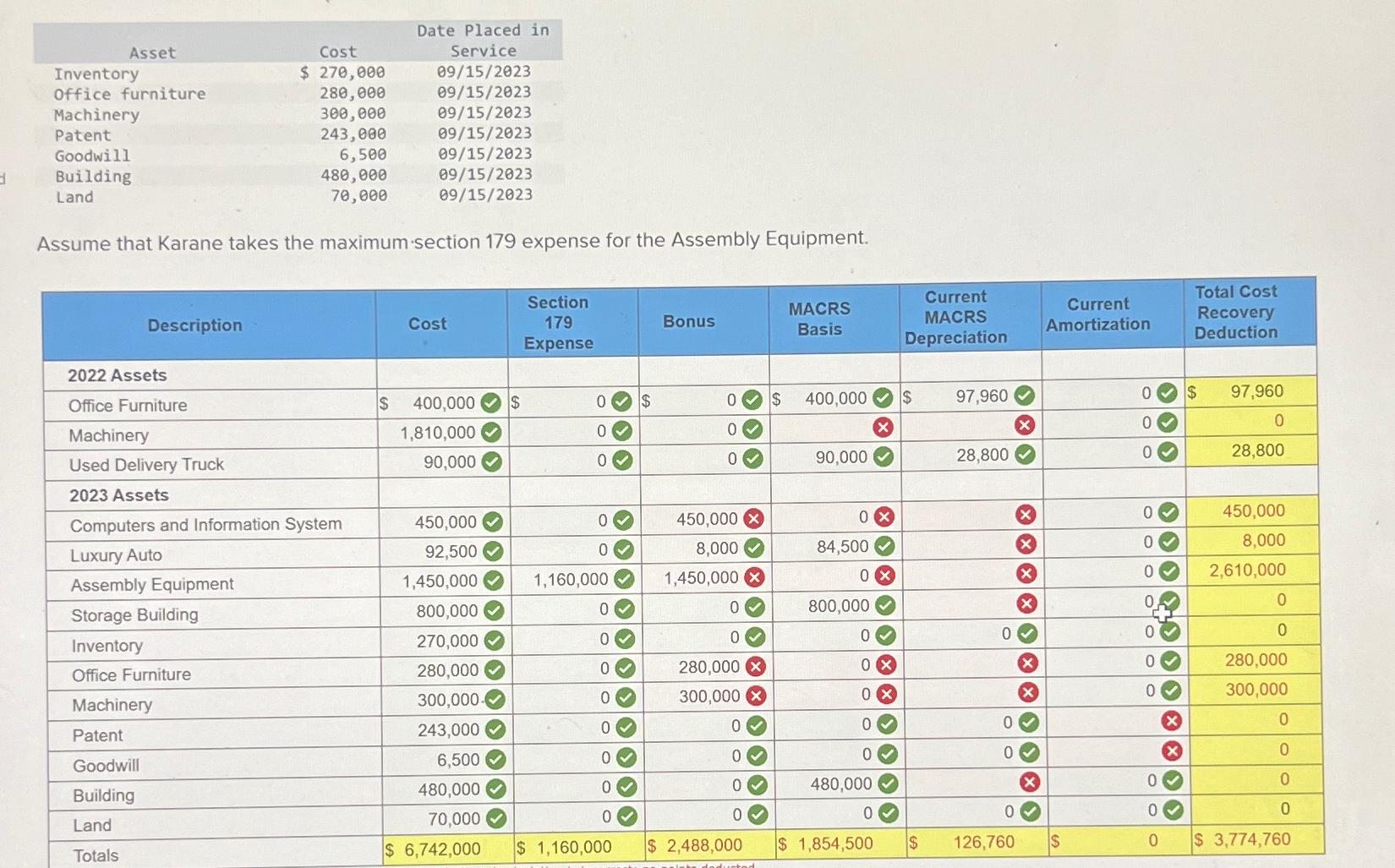

Asset Inventory Office furniture Machinery Patent Goodwill d Building Land Cost Date Placed in Service 09/15/2023 $ 270,000 280,000 09/15/2023 300,000 09/15/2023 243,000 09/15/2023

Asset Inventory Office furniture Machinery Patent Goodwill d Building Land Cost Date Placed in Service 09/15/2023 $ 270,000 280,000 09/15/2023 300,000 09/15/2023 243,000 09/15/2023 6,500 09/15/2023 480,000 70,000 09/15/2023 09/15/2023 Assume that Karane takes the maximum section 179 expense for the Assembly Equipment. Description 2022 Assets Office Furniture Machinery Used Delivery Truck Cost Section 179 Expense Bonus MACRS Basis Current MACRS Depreciation Current Amortization Total Cost Recovery Deduction $ 400,000 $ 0 $ 1,810,000 0 90,000 0 000 $ 400,000 $ 97,960 0 90,000 0 $ 97,960 0 0 28,800 0 28,800 2023 Assets Computers and Information System 450,000 0 450,000 x 0 0 450,000 Luxury Auto 92,500 Assembly Equipment 1,450,000 1,160,000 Storage Building 800,000 0 Inventory 270,000 8,000 1,450,000 x 0 0 84,500 0 8,000 0 0 2,610,000 800,000 0 0 0 0 0 0 Office Furniture 280,000 0 280,000 x 0 0 280,000 Machinery 300,000. 0 300,000 0x 300,000 Patent Goodwill Building Land 243,000 0 0 0 0 0 6,500 0 0 0 0 0 480,000 0 480,000 0 0 70,000 0 0 0 0 0 0 Totals $ 6,742,000 $ 1,160,000 $ 2,488,000 $ 1,854,500 $ 126,760 0 $ 3,774,760

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started