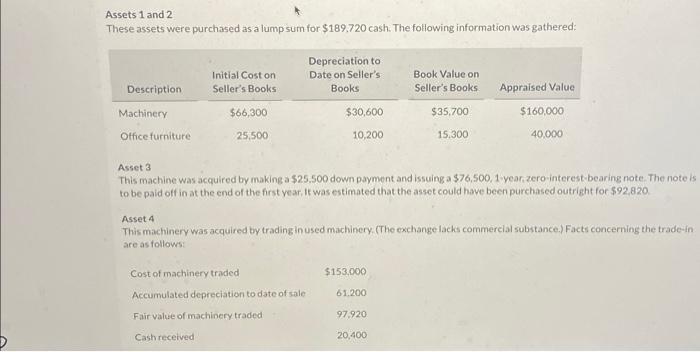

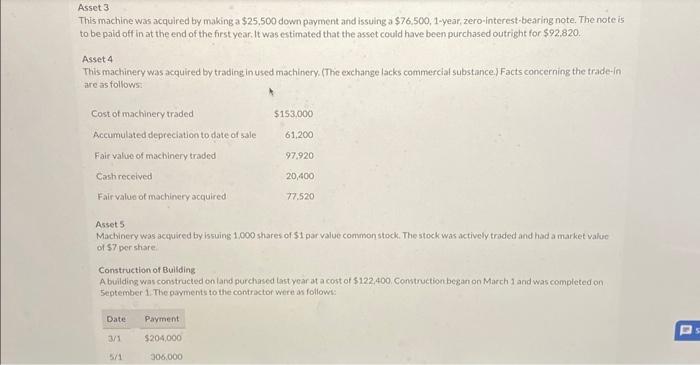

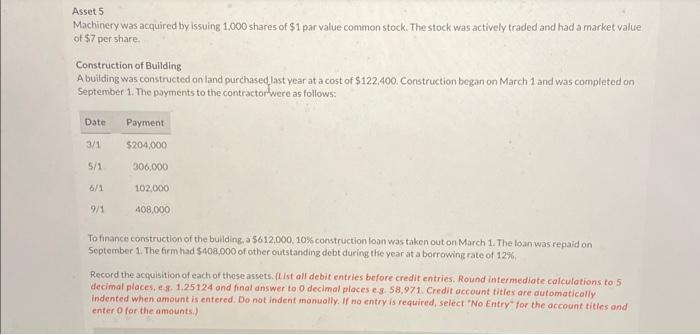

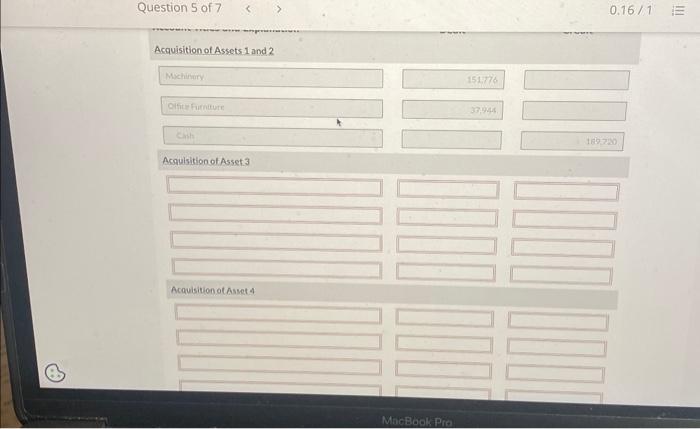

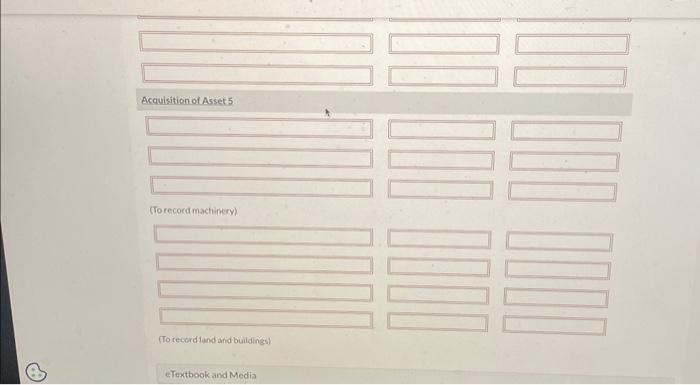

Assets 1 and 2 These assets were purchased as a lump sum for $189.720 cash. The following information was gathered: Asset 3 This machine was acquired by making a $25.500 down payment and issuing a $76,500,1-year, zero-interest-bearing note. The note is to be paid off in at the end of the first vear, If was estimated that the asset could have been purchased outright for $92.820 Asset 4 This machinery was acquired by trading in used machinery. (The exchange lacks commercial substance.) Facts concerning the trade-in are as follows: Asset 3 This machine was acquired by making a $25,500 down payment and issuing a $76,500,1-year, zero-interest-bearing note. The note is to be paid off in at the end of the first year. It was estimated that the asset could have been purchased outright for $92,820. Asset 4 This machinery was acquired by trading in used machinery. (Thie exchange lacks commercial substance). Facts concerning the trade-in are as follows: Asset 5 Mactsinery was acquiced by issuing 1,000 shares of $1 par value conmon stock. The stock was actively traded and had a market valuc or 57 per share. Construction of Buliding A building was constructed on land purchased last year at a cost of $122,400. Construction began on March 1 and was completed on September 1. The owments to the contractor were as follows: Asset 5 Machinery was acquired by issuing 1,000 shares of $1 par value common stock. The stock was actively traded and had a market value of $7 per share. Construction of Bullding A building was constructed on land purchased last year at a cost of \$122,400. Construction began on March 1 and was completed on September 1. The payments to the contractor were as follows: To finance construction of the building, a $612,000,10% construction loan was taken out on March 1. The loan was repaid on September 1 . The firm had $408,000 of other outstanding debt during the year at a borrowing rate of 12%. Record the achuisition of each of those assets. Itist all debit entries before credit entries. Round intermediate calculations to 5 decimal places, es. 1.25124 and finat answer to 0 decimal places e.s. 58,971 . Credit account titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter 0 for the amounts.) Question 5 of 7 0.16/1 Acquisition of Assets 1 and 2 Muchinity Oifitefirnture 37,445 Cints 162720 Acquisition of Asset 3 Acquisition ot Asset 4 Matebook Prit Acauisition of Asset 5 (To recoed machinery) (To record land and buildings) eTextbook and Media