Answered step by step

Verified Expert Solution

Question

1 Approved Answer

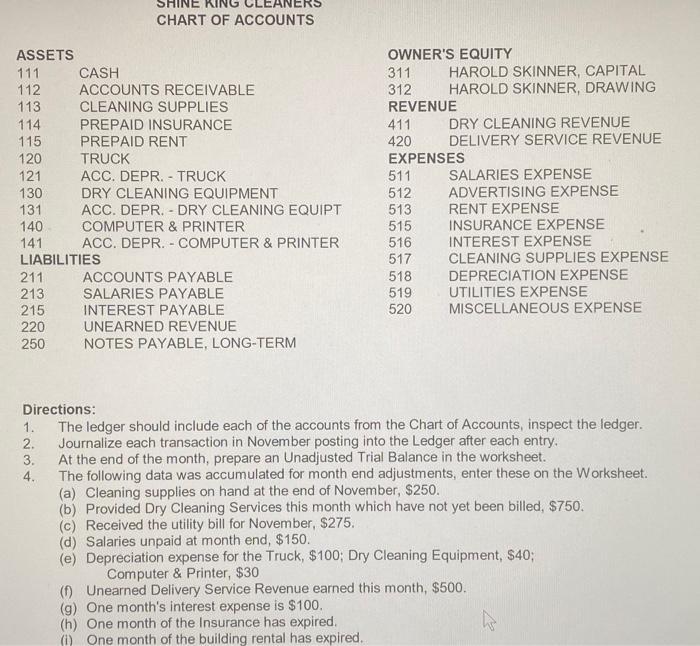

ASSETS 111 112 113 114 115 120 121 130 131 140 141 211 213 215 220 250 CL CHART OF ACCOUNTS CASH ACCOUNTS RECEIVABLE

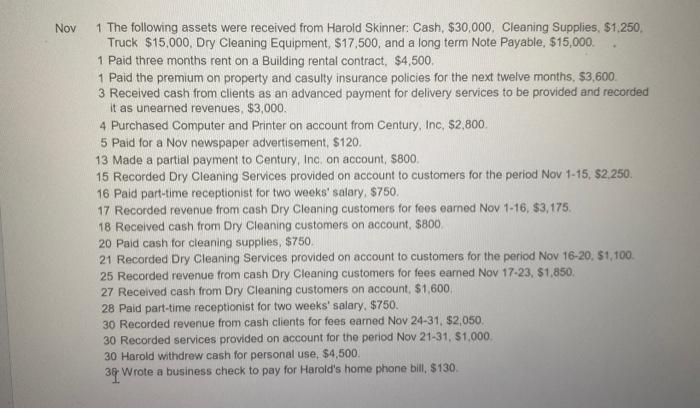

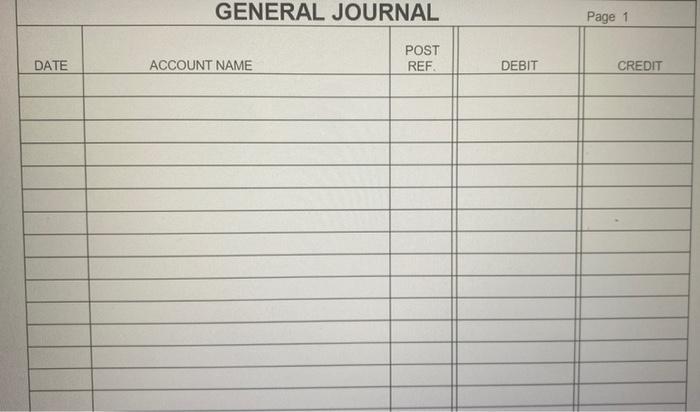

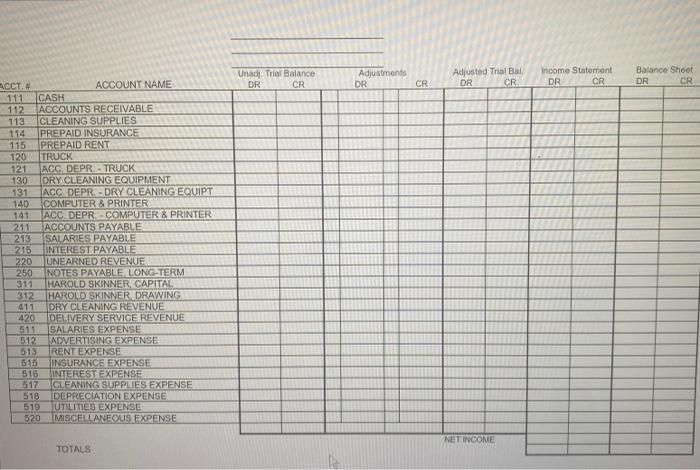

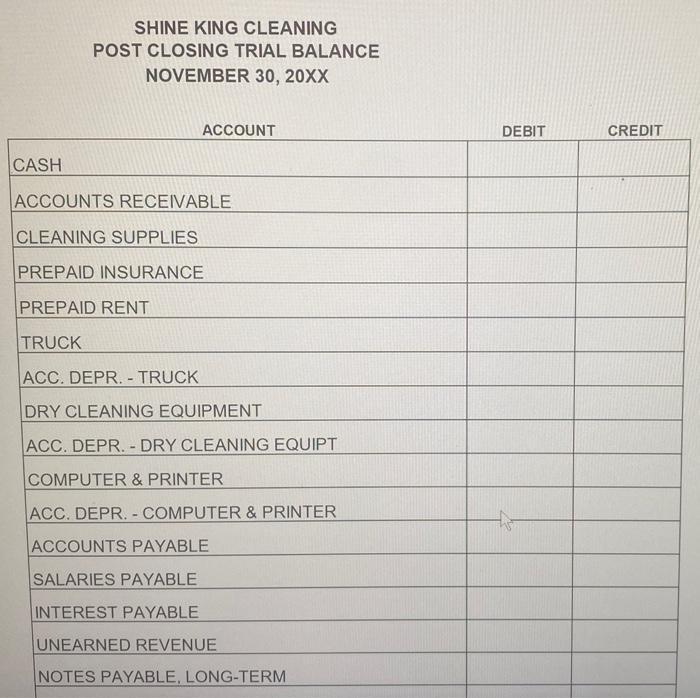

ASSETS 111 112 113 114 115 120 121 130 131 140 141 211 213 215 220 250 CL CHART OF ACCOUNTS CASH ACCOUNTS RECEIVABLE CLEANING SUPPLIES LIABILITIES 1. 2. 3. 4. PREPAID INSURANCE PREPAID RENT TRUCK ACC. DEPR. - TRUCK DRY CLEANING EQUIPMENT ACC. DEPR. DRY CLEANING EQUIPT - COMPUTER & PRINTER ACC. DEPR. - COMPUTER & PRINTER ACCOUNTS PAYABLE SALARIES PAYABLE INTEREST PAYABLE UNEARNED REVENUE NOTES PAYABLE, LONG-TERM OWNER'S EQUITY 311 312 REVENUE HAROLD SKINNER, CAPITAL HAROLD SKINNER, DRAWING 411 420 DRY CLEANING REVENUE DELIVERY SERVICE REVENUE EXPENSES 511 512 513 515 516 517 518 519 520 SALARIES EXPENSE ADVERTISING EXPENSE RENT EXPENSE INSURANCE EXPENSE INTEREST EXPENSE CLEANING SUPPLIES EXPENSE DEPRECIATION EXPENSE UTILITIES EXPENSE MISCELLANEOUS EXPENSE Directions: The ledger should include each of the accounts from the Chart of Accounts, inspect the ledger. Journalize each transaction in November posting into the Ledger after each entry. At the end of the month, prepare an Unadjusted Trial Balance in the worksheet. The following data was accumulated for month end adjustments, enter these on the Worksheet. (a) Cleaning supplies on hand at the end of November, $250. (b) Provided Dry Cleaning Services this month which have not yet been billed, $750. (c) Received the utility bill for November, $275. (d) Salaries unpaid at month end, $150. (e) Depreciation expense for the Truck, $100; Dry Cleaning Equipment, $40; Computer & Printer, $30 (f) Unearned Delivery Service Revenue earned this month, $500. (g) One month's interest expense is $100. (h) One month of the Insurance has expired. (i) One month of the building rental has expired. Nov 1 The following assets were received from Harold Skinner: Cash, $30,000, Cleaning Supplies, $1,250, Truck $15,000, Dry Cleaning Equipment, $17,500, and a long term Note Payable, $15,000. 1 Paid three months rent on a Building rental contract, $4,500. 1 Paid the premium on property and casulty insurance policies for the next twelve months, $3,600. 3 Received cash from clients as an advanced payment for delivery services to be provided and recorded it as unearned revenues, $3,000. 4 Purchased Computer and Printer on account from Century, Inc. $2,800. 5 Paid for a Nov newspaper advertisement, $120. 13 Made a partial payment to Century, Inc. on account, $800. 15 Recorded Dry Cleaning Services provided on account to customers for the period Nov 1-15, $2,250. 16 Paid part-time receptionist for two weeks' salary, $750. 17 Recorded revenue from cash Dry Cleaning customers for fees earned Nov 1-16, $3,175. 18 Received cash from Dry Cleaning customers on account, $800. 20 Paid cash for cleaning supplies, $750. 21 Recorded Dry Cleaning Services provided on account to customers for the period Nov 16-20, $1,100. 25 Recorded revenue from cash Dry Cleaning customers for fees earned Nov 17-23, $1,850. 27 Received cash from Dry Cleaning customers on account, $1,600. 28 Paid part-time receptionist for two weeks' salary, $750. 30 Recorded revenue from cash clients for fees earned Nov 24-31, $2,050. 30 Recorded services provided on account for the period Nov 21-31, $1,000. 30 Harold withdrew cash for personal use, $4,500. 39 Wrote a business check to pay for Harold's home phone bill, $130. DATE GENERAL JOURNAL ACCOUNT NAME POST REF. DEBIT Page 1 CREDIT CCT. # 111 CASH 112 ACCOUNTS RECEIVABLE 113 CLEANING SUPPLIES ACCOUNT NAME 114 PREPAID INSURANCE PREPAID RENT 115 120 TRUCK 121 ACC DEPR TRUCK 130 131 140 COMPUTER & PRINTER 141 ACC. DEPR COMPUTER & PRINTER ACCOUNTS PAYABLE 211 213 SALARIES PAYABLE 215 INTEREST PAYABLE 220 UNEARNED REVENUE 250 DRY CLEANING EQUIPMENT ACC DEPR. DRY CLEANING EQUIPT 513 515 516 517 NOTES PAYABLE, LONG-TERM 311 HAROLD SKINNER, CAPITAL 312 HAROLD SKINNER, DRAWING 411 DRY CLEANING REVENUE 420 511 512 ADVERTISING EXPENSE DELIVERY SERVICE REVENUE SALARIES EXPENSE RENT EXPENSE INSURANCE EXPENSE INTEREST EXPENSE CLEANING SUPPLIES EXPENSE 518 DEPRECIATION EXPENSE 519 UTILITIES EXPENSE 520 MISCELLANEOUS EXPENSE TOTALS Unadj. Trial Balance CR DR will Adjustments DR CR Adjusted Trial Bal DR CR NET INCOME Income Statement DR CR Balance Sheet DR CR CASH SHINE KING CLEANING POST CLOSING TRIAL BALANCE NOVEMBER 30, 20XX ACCOUNT ACCOUNTS RECEIVABLE CLEANING SUPPLIES PREPAID INSURANCE PREPAID RENT TRUCK ACC. DEPR. - TRUCK DRY CLEANING EQUIPMENT ACC. DEPR. DRY CLEANING EQUIPT COMPUTER & PRINTER ACC. DEPR. - COMPUTER & PRINTER ACCOUNTS PAYABLE SALARIES PAYABLE INTEREST PAYABLE UNEARNED REVENUE NOTES PAYABLE, LONG-TERM DEBIT CREDIT

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Depreciation expenses for the first year Depreciable cost 760207800 68220 Depreciation expense...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started