Answered step by step

Verified Expert Solution

Question

1 Approved Answer

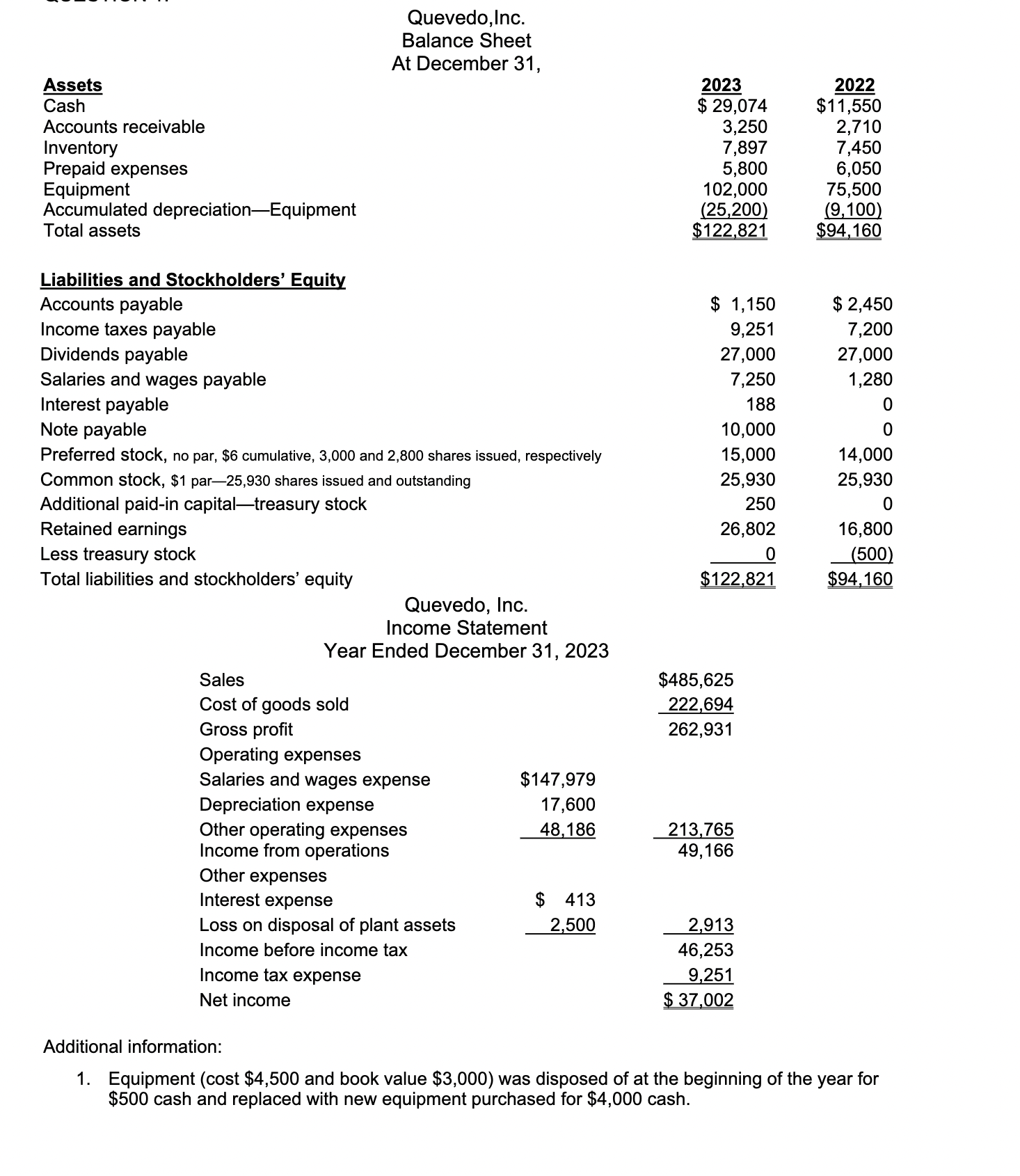

Assets Cash Accounts receivable Inventory Prepaid expenses Equipment Accumulated depreciation-Equipment Total assets Liabilities and Stockholders' Equity Quevedo, Inc. Balance Sheet At December 31, 2023

Assets Cash Accounts receivable Inventory Prepaid expenses Equipment Accumulated depreciation-Equipment Total assets Liabilities and Stockholders' Equity Quevedo, Inc. Balance Sheet At December 31, 2023 2022 $ 29,074 $11,550 3,250 2,710 7,897 7,450 5,800 6,050 102,000 75,500 (25,200) (9,100) $122,821 $94,160 Accounts payable $ 1,150 $ 2,450 Income taxes payable 9,251 7,200 Dividends payable 27,000 27,000 Salaries and wages payable 7,250 1,280 Interest payable 188 0 Note payable 10,000 0 Preferred stock, no par, $6 cumulative, 3,000 and 2,800 shares issued, respectively 15,000 14,000 Common stock, $1 par-25,930 shares issued and outstanding 25,930 25,930 Additional paid-in capital-treasury stock Retained earnings Less treasury stock 250 26,802 0 0 16,800 Total liabilities and stockholders' equity $122,821 (500) $94,160 Quevedo, Inc. Income Statement Year Ended December 31, 2023 Sales $485,625 Cost of goods sold 222,694 Gross profit 262,931 Operating expenses Salaries and wages expense $147,979 Depreciation expense 17,600 Other operating expenses 48,186 213,765 Income from operations 49,166 Other expenses Interest expense $ 413 Loss on disposal of plant assets 2,500 Income before income tax 2,913 46,253 Income tax expense Net income 9,251 $ 37,002 Additional information: 1. Equipment (cost $4,500 and book value $3,000) was disposed of at the beginning of the year for $500 cash and replaced with new equipment purchased for $4,000 cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Quevedo Inc Financial Analysis Based on the provided information heres an analysis of Quevedo Incs financial performance Liquidity Analysis Current Ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started