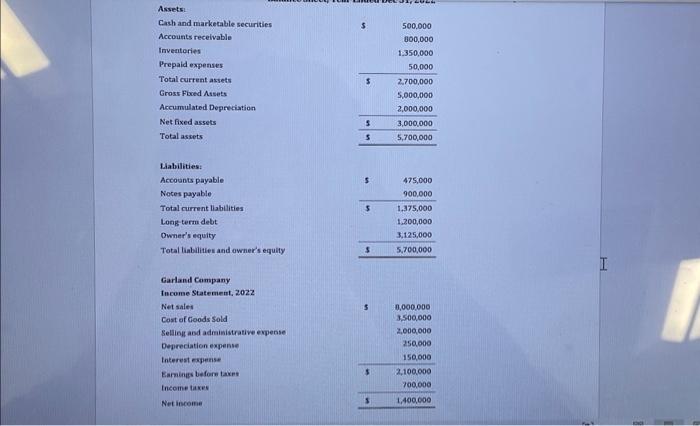

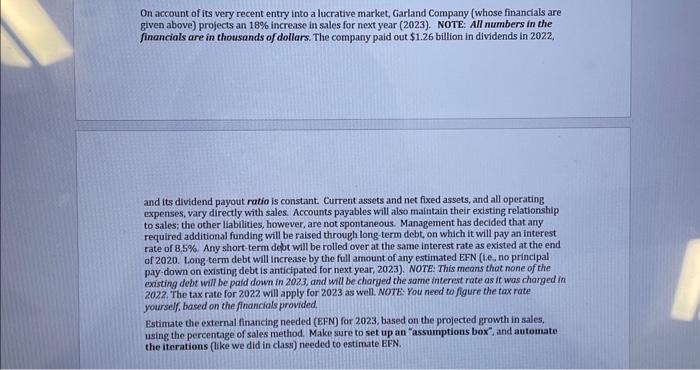

Assets: Cash and marketable securities Accounts receivable Inveateries Prepaid expenses Total current assets Gross Fboed Assets Accumulated Depreciation Net fixed assets Total assets Liabilities: Accounts payable Noces payable Total current liabilities Long-term debt Owner's equity Total liabilities and owner's equity Garland Company fncome Statement. 2022 Net sales Cost of Cioods Sold Seltingl asd adminisurative expense Depreciation expense Intervat expense Earninges beforn taxns Inceme taxes Net iscome \begin{tabular}{rr} 5 & 500,000 \\ 000,000 \\ 1,350,000 \\ 50,000 \\ \hline 5 & 2,700,000 \\ & 5,000,000 \\ & 2,000,000 \\ \hline 5 & 3,000,000 \\ \hline 5 & 5,700,000 \\ \hline \end{tabular} \begin{tabular}{cr} 5 & 475,000 \\ & 900,000 \\ \hline 5 & 1,375,000 \\ 1,200,000 \\ & 3,125,000 \\ \hline 5 & 5,700,000 \\ \hline \end{tabular} \begin{tabular}{|r|r} \hline 5 & 0,000,000 \\ 3,5,00,000 \\ 2,000,000 \\ 250,000 \\ \\ \\ & 150,000 \\ \hline 5 & 2,100,000 \\ & 700,000 \\ \hline 5 & 1,400,000 \\ \hline \end{tabular} On account of its very recent entry into a lucrative market, Garland Company (whose financials are given above) projects an 18% increase in sales for next year (2023). NOTE: All numbers in the financials are in thousands of dollars. The company paid out $1.26 billion in dividends in 2022. and its dividend payout ratio is constant. Current assets and net fixed assets, and all operating expenses, vary directly with sales. Accounts payables will also maintain their existing relationship to sales; the other liabilities, however, are not spontaneous. Management has decided that any required additional funding will be raised through long term debt, on which it will pay an interest rate of 8.5%. Any short-term debt will be rolled over at the same interest rate as existed at the end of 2020 . Long term debt will increase by the full amount of any estimated EFN (t.e, no principal pay-down on existing debt is anticipated for next year, 2023). NOTE: This means that none of the existing debt will he pald down in 2023, and will be charged the same interest rate as it was charged in 2022. The tax rate for 2022 will apply for 2023 as well. NOTE. You need to figure the tax rate yourself, based on the financials provided. Estimate the external financing needed (BFN) for 2023, based on the projected growth in sales, using the percentage of sales method. Make sure to set up an "assumptions box", and automate the iterations (like we did in class) needed to estimate BFN