Answered step by step

Verified Expert Solution

Question

1 Approved Answer

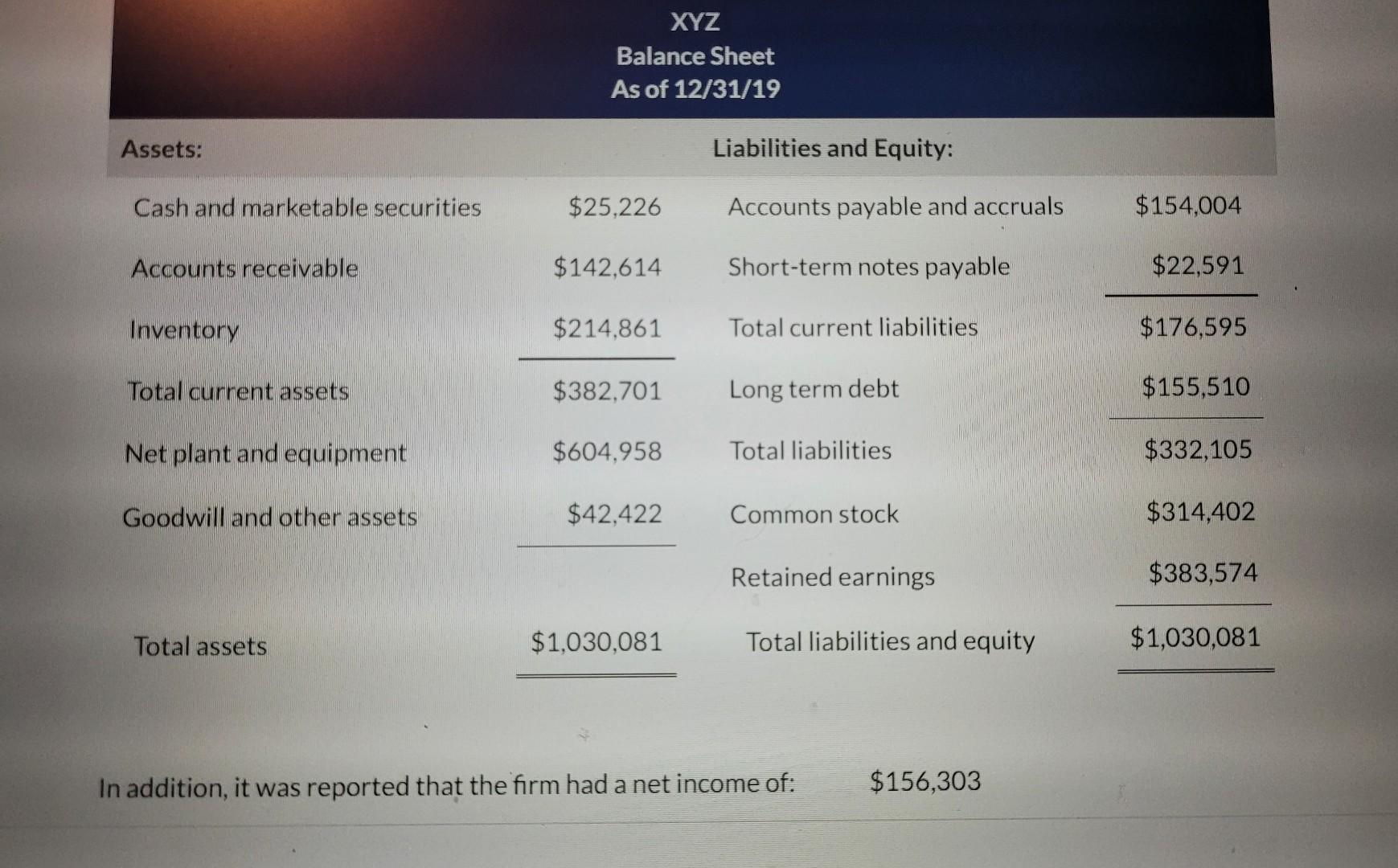

Assets: Cash and marketable securities Accounts receivable Inventory Total current assets Net plant and equipment Goodwill and other assets Total assets XYZ Balance Sheet

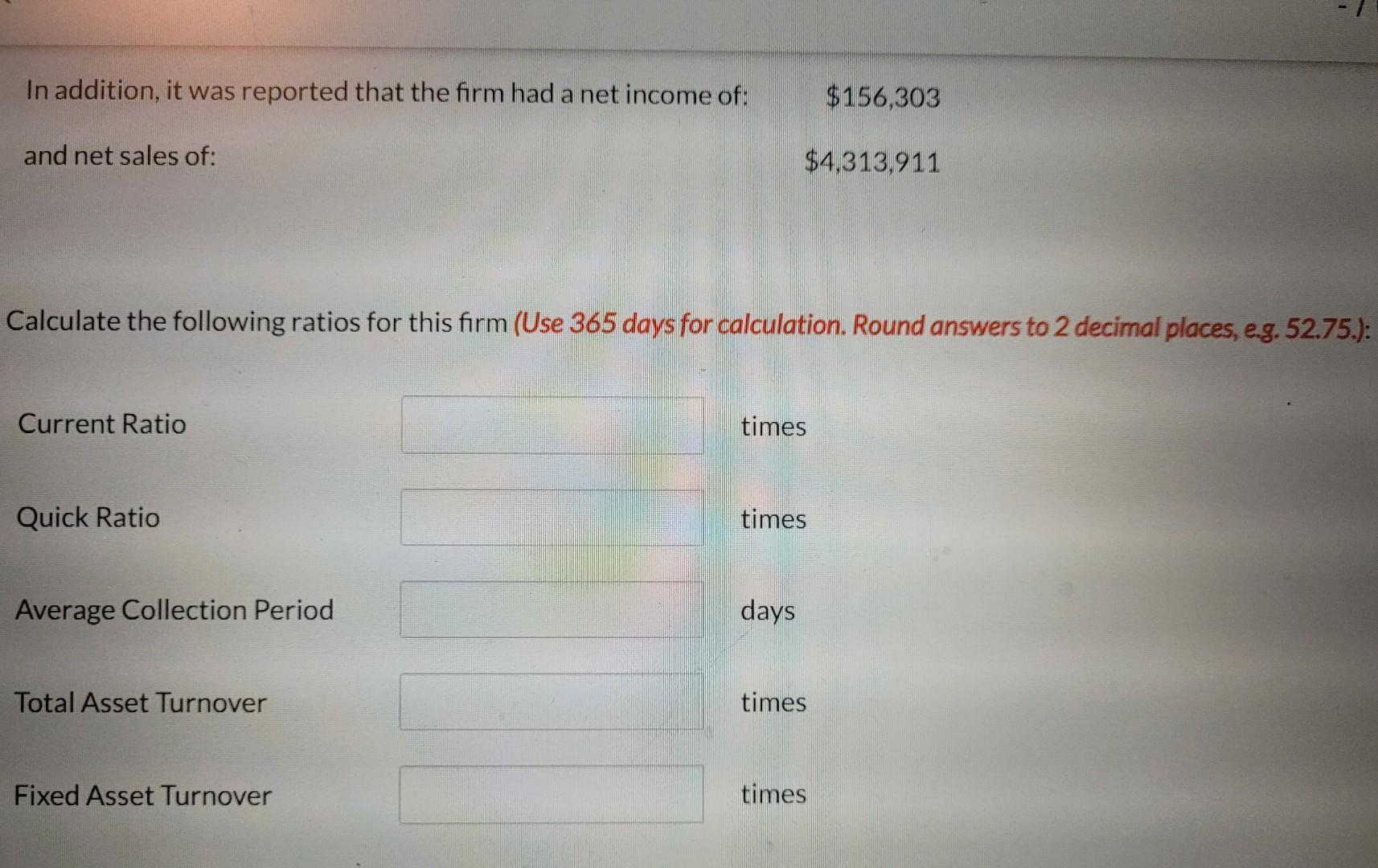

Assets: Cash and marketable securities Accounts receivable Inventory Total current assets Net plant and equipment Goodwill and other assets Total assets XYZ Balance Sheet As of 12/31/19 $25,226 $142,614 $214,861 $382,701 $604,958 $42,422 $1,030,081 Liabilities and Equity: Accounts payable and accruals Short-term notes payable Total current liabilities Long term debt Total liabilities Common stock Retained earnings Total liabilities and equity In addition, it was reported that the firm had a net income of: $156,303 $154,004 $22,591 $176,595 $155,510 $332,105 $314,402 $383,574 $1,030,081 In addition, it was reported that the firm had a net income of: and net sales of: Current Ratio Calculate the following ratios for this firm (Use 365 days for calculation. Round answers to 2 decimal places, e.g. 52.75.): Quick Ratio Average Collection Period Total Asset Turnover Fixed Asset Turnover $4,313,911 times times days $156,303 times times

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Current Ratio Current Asset Current Liabilities 382701 176595 217 times Quick Ratio Cash Short ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started