Answered step by step

Verified Expert Solution

Question

1 Approved Answer

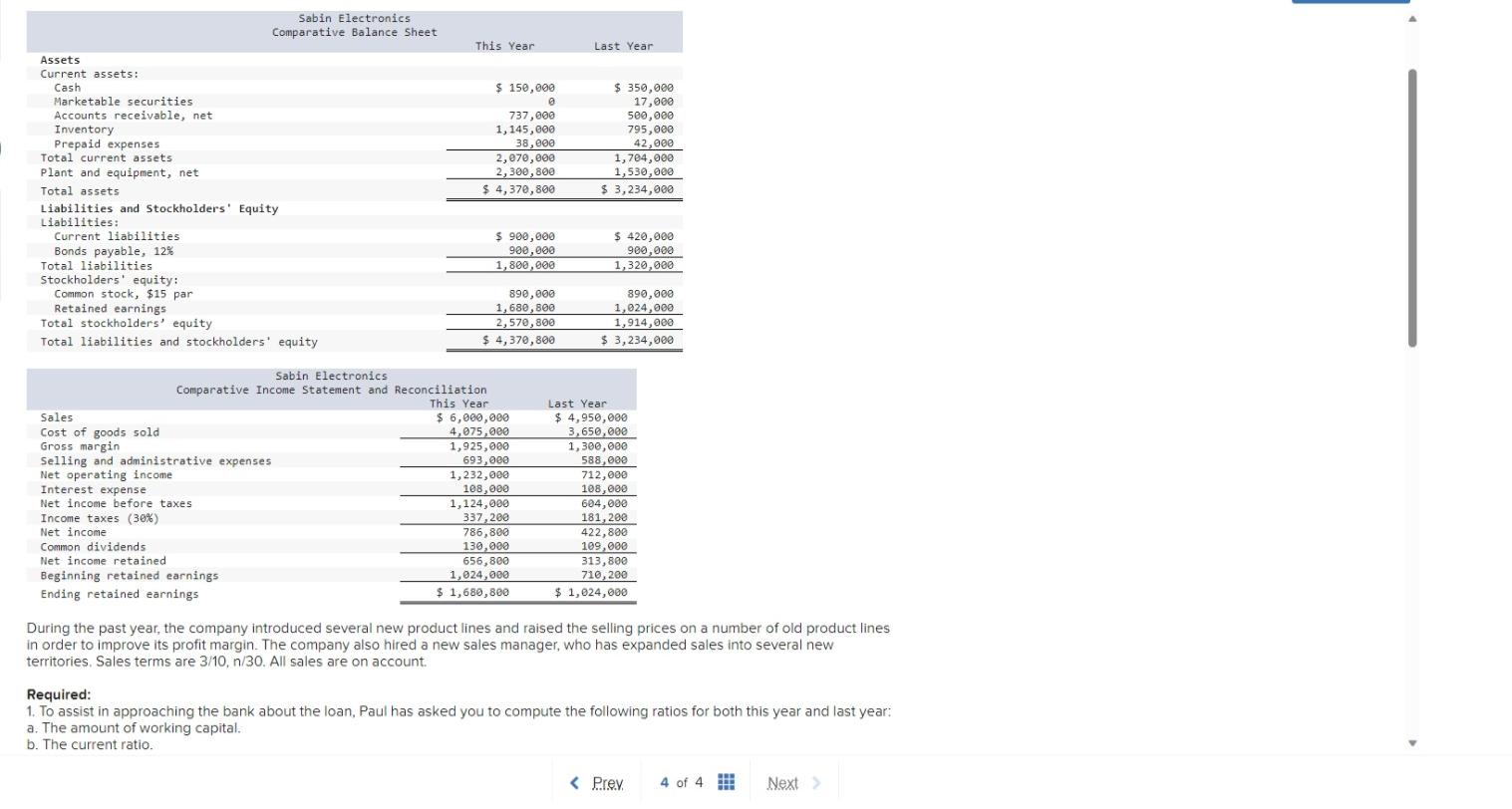

Sabin Electronics Comparative Balance Sheet This Year Last Year Assets Current assets: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets

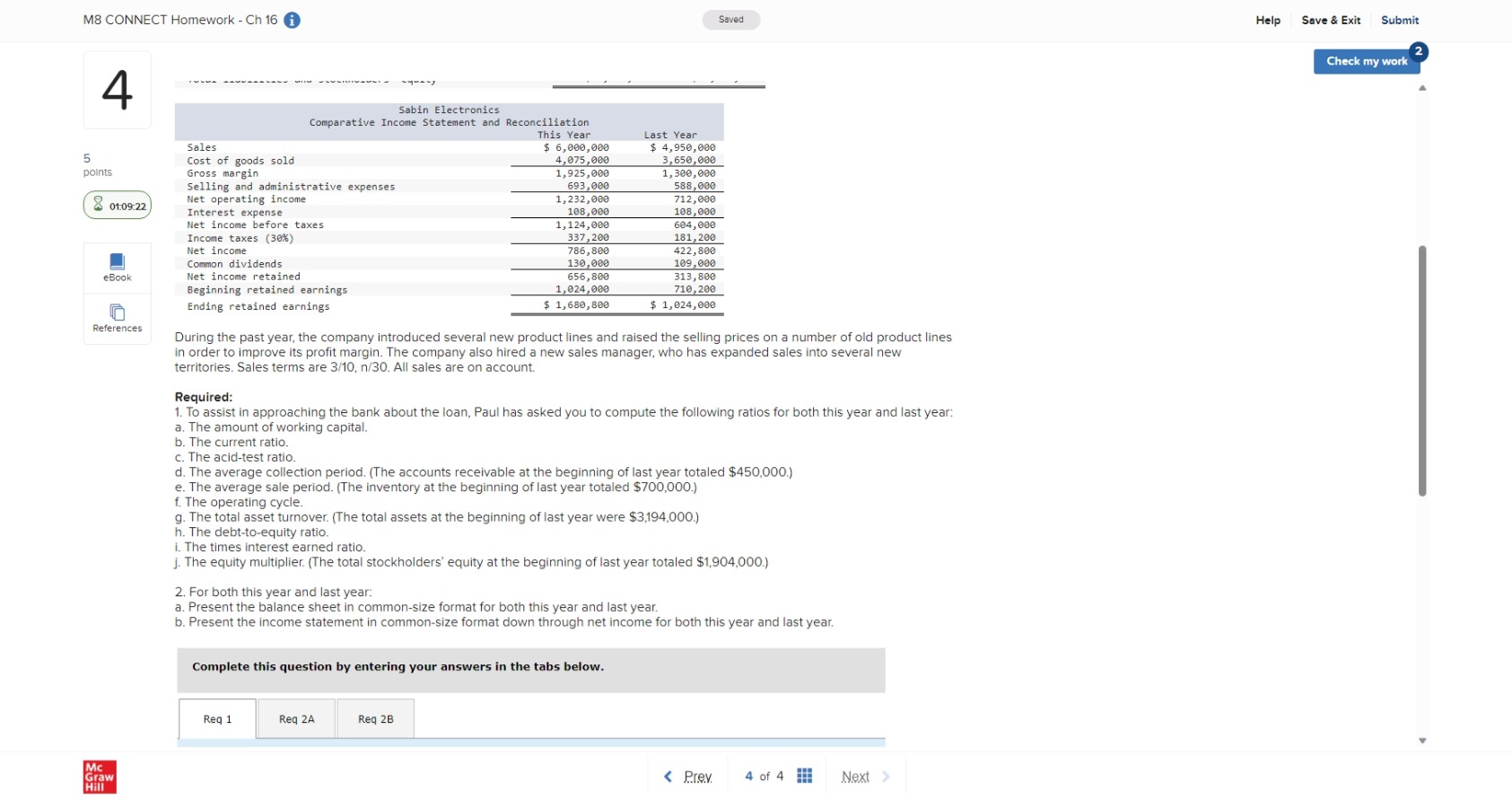

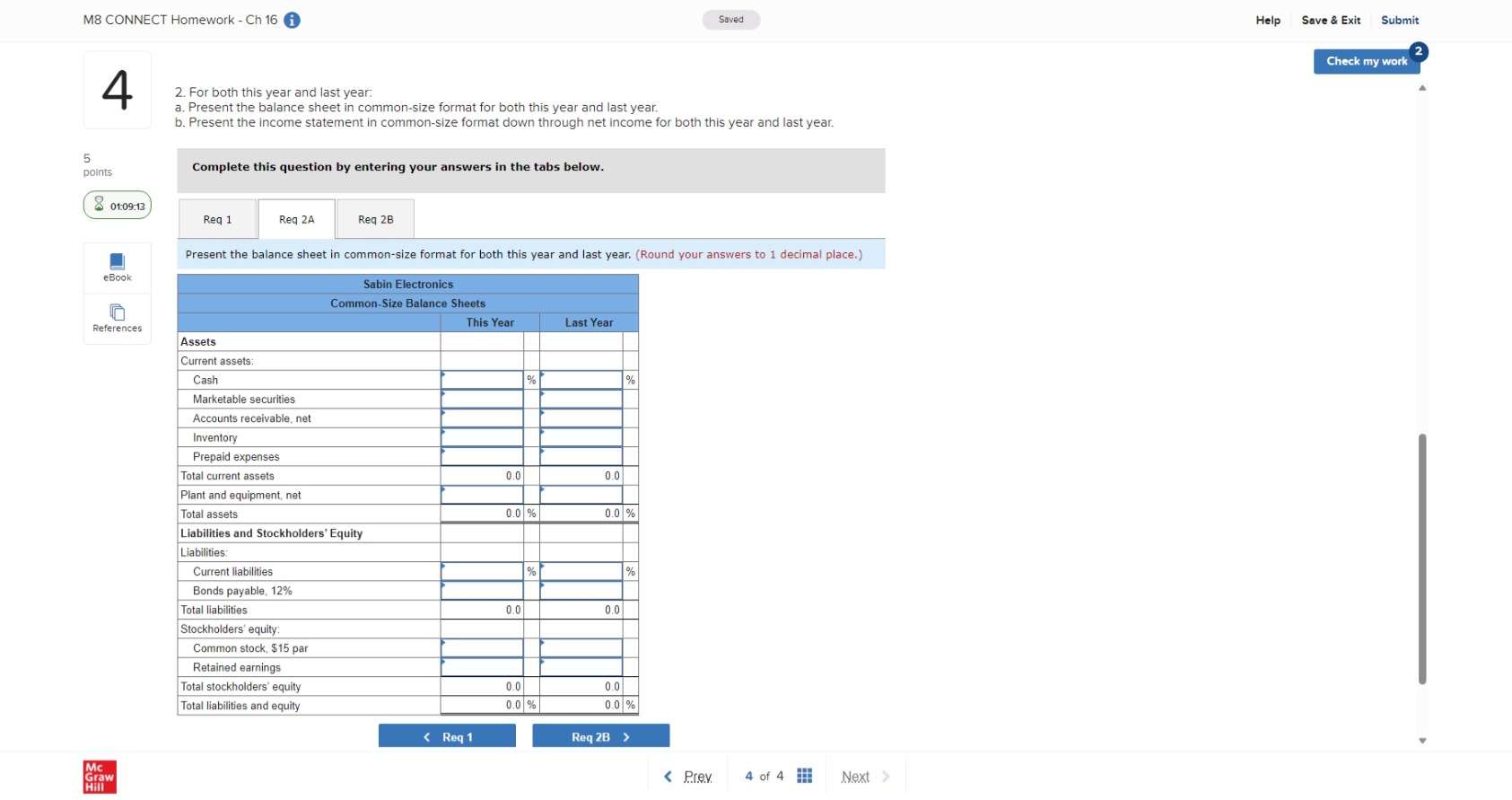

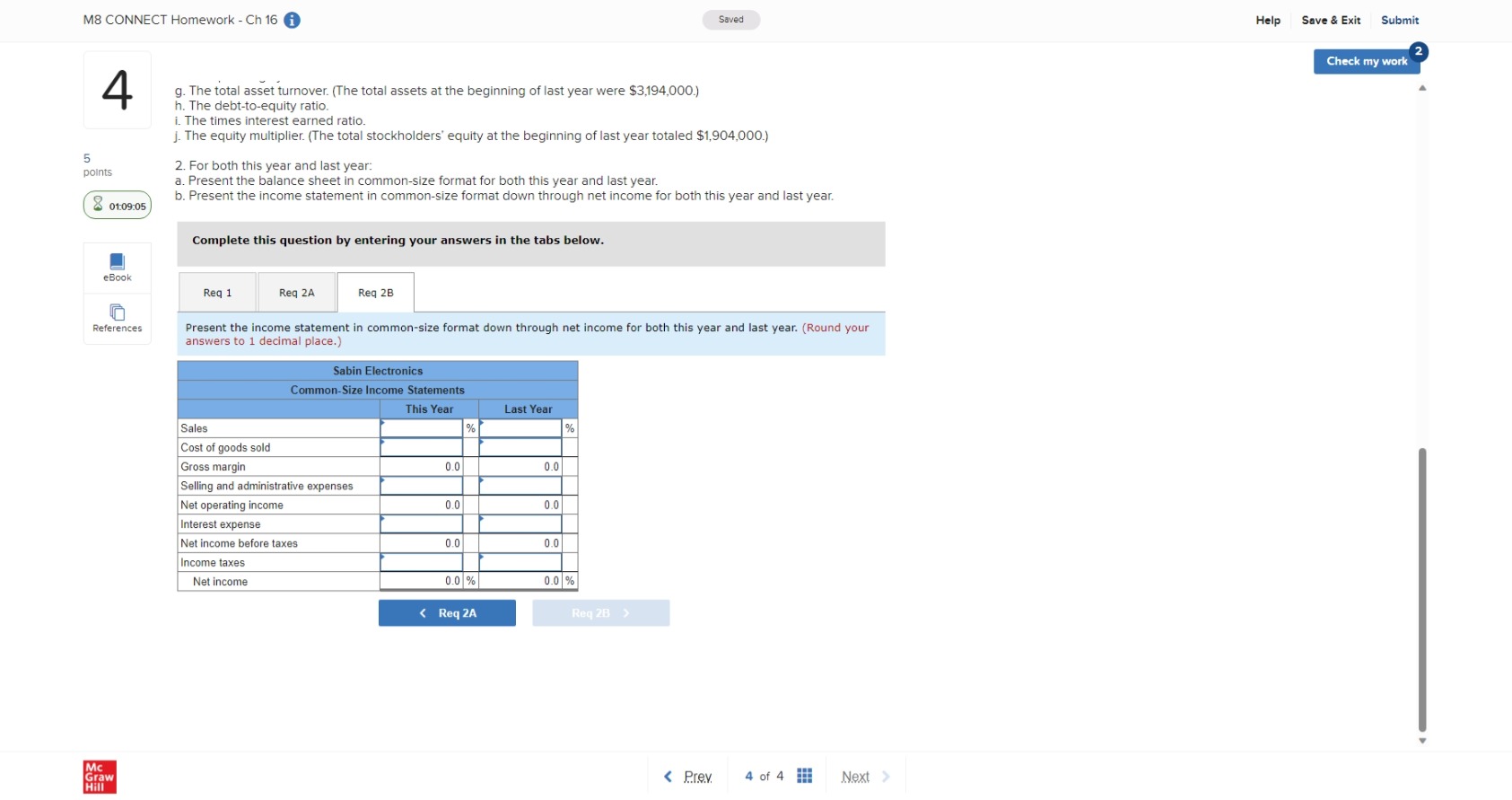

Sabin Electronics Comparative Balance Sheet This Year Last Year Assets Current assets: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 12% Total liabilities Stockholders' equity: Common stock, $15 par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 150,000 $ 350,000 0 17,000 737,000 500,000 1,145,000 38,000 2,070,000 2,300,800 $ 4,370,800 795,000 42,000 1,704,000 1,530,000 $ 3,234,000 $ 900,000 900,000 1,800,000 890,000 1,680,800 2,570,800 $ 420,000 900,000 1,320,000 890,000 1,024,000 1,914,000 $ 3,234,000 $ 4,370,800 Sales Cost of goods sold Gross margin Sabin Electronics Comparative Income Statement and Reconciliation This Year Selling and administrative expenses Net operating income Interest expense Net income before taxes Income taxes (30%) Net income Common dividends Net income retained Beginning retained earnings Ending retained earnings $ 6,000,000 4,075,000 1,925,000 693,000 1,232,000 Last Year $ 4,950,000 3,650,000 1,300,000 588,000 712,000 108,000 108,000 1,124,000 604,000 337,200 181,200 786,800 422,800 130,000 109,000 656,800 313,800 1,024,000 710,200 $ 1,680,800 $ 1,024,000 During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lines in order to improve its profit margin. The company also hired a new sales manager, who has expanded sales into several new territories. Sales terms are 3/10, n/30. All sales are on account. Required: 1. To assist in approaching the bank about the loan, Paul has asked you to compute the following ratios for both this year and last year: a. The amount of working capital. b. The current ratio. < Prev 4 of 4 Next > M8 CONNECT Homework - Ch 16 4 points Sales Cost of goods sold Gross margin Sabin Electronics Comparative Income Statement and Reconciliation Selling and administrative expenses Net operating income Interest expense 01:09:22 Net income before taxes eBook Income taxes (30%) Net income Common dividends Net income retained Beginning retained earnings This Year $ 6,000,000 4,075,000 1,925,000 693,000 Last Year $ 4,950,000 3,650,000 1,300,000 588,000 1,232,000 712,000 108,000 108,000 1,124,000 604,000 337,200 181,200 786,800 422,800 130,000 109,000 656,800 313,800 1,024,000 710,200 Saved References Ending retained earnings $ 1,680,800 $ 1,024,000 During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lines in order to improve its profit margin. The company also hired a new sales manager, who has expanded sales into several new territories. Sales terms are 3/10, n/30. All sales are on account. Required: 1. To assist in approaching the bank about the loan, Paul has asked you to compute the following ratios for both this year and last year: a. The amount of working capital. b. The current ratio. c. The acid-test ratio. d. The average collection period. (The accounts receivable at the beginning of last year totaled $450,000.) e. The average sale period. (The inventory at the beginning of last year totaled $700,000.) f. The operating cycle. g. The total asset turnover. (The total assets at the beginning of last year were $3,194,000.) h. The debt-to-equity ratio. i. The times interest earned ratio. j. The equity multiplier. (The total stockholders' equity at the beginning of last year totaled $1,904,000.) 2. For both this year and last year: a. Present the balance sheet in common-size format for both this year and last year. b. Present the income statement in common-size format down through net income for both this year and last year. Mc Graw Hill Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B < Prev 4 of 4 Next > Help Save & Exit Submit Check my work M8 CONNECT Homework - Ch 16 4 2. For both this year and last year: points Saved a. Present the balance sheet in common-size format for both this year and last year. b. Present the income statement in common-size format down through net income for both this year and last year. Complete this question by entering your answers in the tabs below. 01:09:13 Req 1 Req 2A Req 2B eBook o References Mc Graw Hill Present the balance sheet in common-size format for both this year and last year. (Round your answers to 1 decimal place.) Sabin Electronics Assets Current assets: Cash Marketable securities Common-Size Balance Sheets This Year Last Year % % Accounts receivable, net Inventory Prepaid expenses Total current assets 0.0 0.0 Plant and equipment, net Total assets 0.0 % 0.0 % Liabilities and Stockholders' Equity Liabilities: Current liabilities % % Bonds payable, 12% Total liabilities Stockholders' equity: Common stock, $15 par Retained earnings Total stockholders' equity Total liabilities and equity 0.0 0.0 0.0 0.0 0.0 % 0.0 % < Req 1 Req 2B > < Prev 4 of 4 Next > Help Save & Exit Submit Check my work M8 CONNECT Homework - Ch 16 Saved 4 points 01:09:05 g. The total asset turnover. (The total assets at the beginning of last year were $3,194,000.) h. The debt-to-equity ratio. i. The times interest earned ratio. j. The equity multiplier. (The total stockholders' equity at the beginning of last year totaled $1,904,000.) 2. For both this year and last year: a. Present the balance sheet in common-size format for both this year and last year. b. Present the income statement in common-size format down through net income for both this year and last year. Complete this question by entering your answers in the tabs below. eBook Req 1 Req 2A Req 2B References Mc Graw Hill Present the income statement in common-size format down through net income for both this year and last year. (Round your answers to 1 decimal place.) Sabin Electronics Common-Size Income Statements Sales This Year Last Year % Cost of goods sold Gross margin 0.0 0.0 Selling and administrative expenses Net operating income 0.0 0.0 Interest expense Net income before taxes 0.0 0.0 Income taxes Net income 0.0 % 0.0 % < Req 2A Req 2B > < Prev 4 of 4 Next > Help Save & Exit Submit Check my work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Vertical analysis Assets This Year Line itemTotal assets100 Last Year Line itemTotal assets100 Current Assets Cash 960000 56 1260000 85 Marketa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started