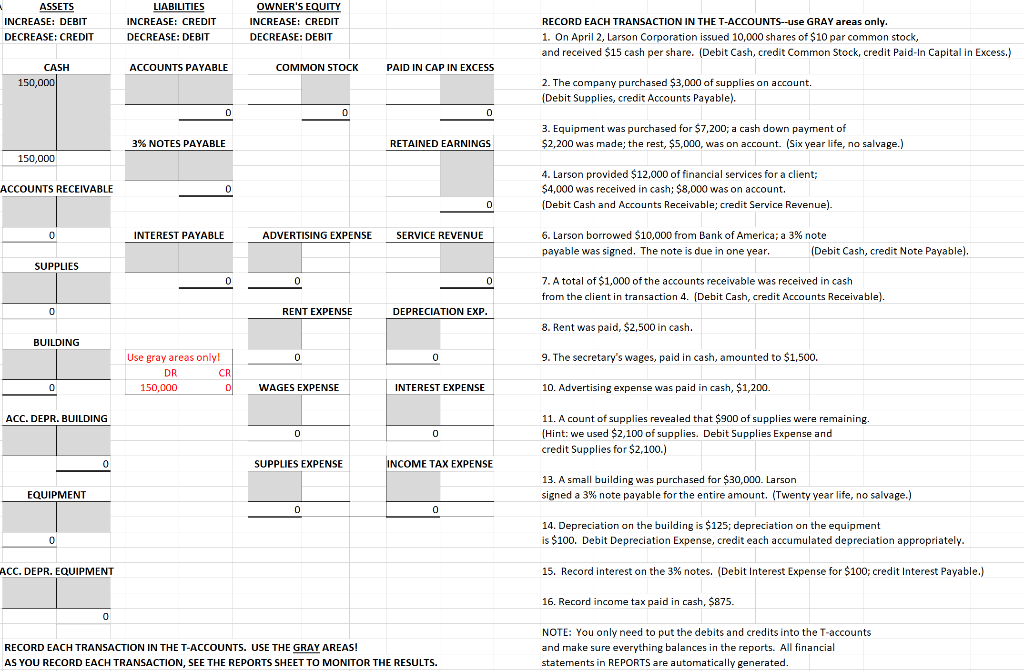

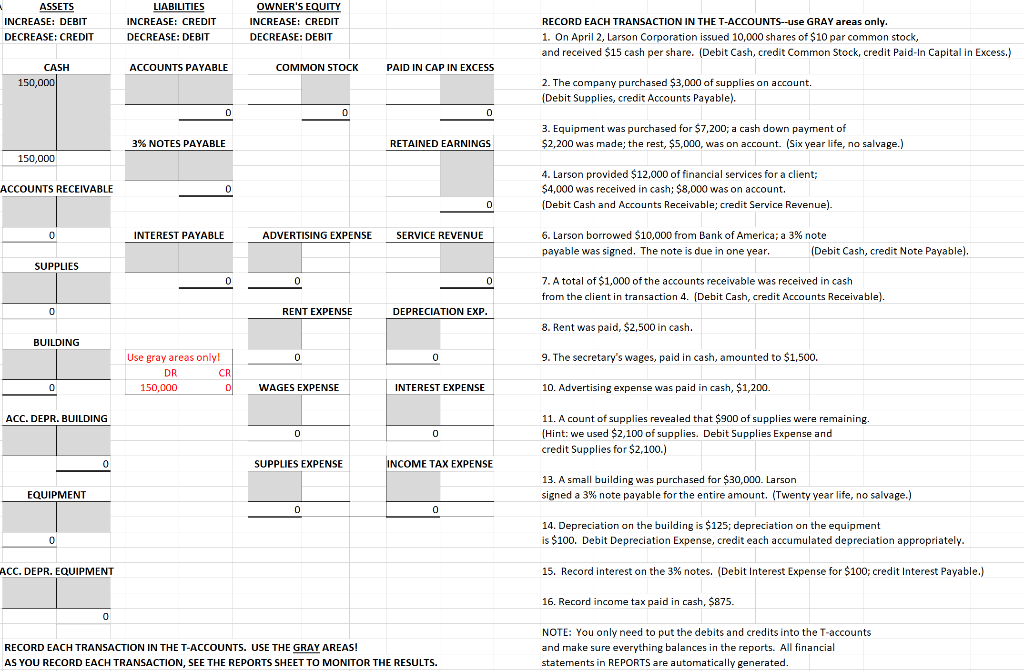

ASSETS INCREASE: DEBIT DECREASE: CREDIT LIABILITIES INCREASE: CREDIT DECREASE: DEBIT OWNER'S EQUITY INCREASE: CREDIT DECREASE: DEBIT RECORD EACH TRANSACTION IN THE T-ACCOUNTS--use GRAY areas only. 1. On April 2, Larson Corporation issued 10,000 shares of $10 par common stock, and received $15 cash per share. (Debit Cash, credit Common Stock, credit Paid-In Capital in Excess.) ACCOUNTS PAYABLE COMMON STOCK PAID IN CAP IN EXCESS CASH 150,000 2. The company purchased $3,000 of supplies on account. (Debit Supplies, credit Accounts Payable). 3% NOTES PAYABLE RETAINED EARNINGS 3. Equipment was purchased for $7,200, a cash down payment of $2,200 was made, the rest, $5,000, was on account. (Six year life, na salvage.) 150,000 ACCOUNTS RECEIVABLE 4. Larson provided $12,000 of financial services for a client; $4,000 was received in cash; $8,000 was on account. (Debit Cash and Accounts Receivable; credit Service Revenue). INTEREST PAYABLE ADVERTISING EXPENSE SERVICE REVENUE 6. Larson borrowed $10,000 from Bank of America; a 3% note payable was signed. The note is due in one year. (Debit Cash, credit Note Payable). SUPPLIES 0 0 7. A total of $1,000 of the accounts receivable was received in cash from the client in transaction 4. (Debit Cash, credit Accounts Receivable). RENT EXPENSE DEPRECIATION EXP. 8. Rent was paid, $2,500 in cash. BUILDING 0 0 9. The secretary's wages, paid in cash, amounted to $1,500. Use gray areas only! CR 150,000 WAGES EXPENSE INTEREST EXPENSE 10. Advertising expense was paid in cash, $1,200. ACC. DEPR. BUILDING 11. A count of supplies revealed that $900 of supplies were remaining. (Hint: we used $2,100 of supplies. Debit Supplies Expense and credit Supplies for $2,100.) SUPPLIES EXPENSE INCOME TAX EXPENSE 13. A small building was purchased for $30,000. Larson signed a 3% note payable for the entire amount. (Twenty year life, no salvage.) EQUIPMENT 14. Depreciation on the building is $125; depreciation on the equipment is $100. Debit Depreciation Expense, credit each accumulated depreciation appropriately. ACC. DEPR. EQUIPMENT 15. Record interest on the 3% notes. (Debit Interest Expense for $100, credit Interest Payable.) 16. Record income tax paid in cash, $875. RECORD EACH TRANSACTION IN THE T-ACCOUNTS. USE THE GRAY AREAS! AS YOU RECORD EACH TRANSACTION, SEE THE REPORTS SHEET TO MONITOR THE RESULTS. NOTE: You only need to put the debits and credits into the T-accounts and make sure everything balances in the reports. All financial statements in REPORTS are automatically generated