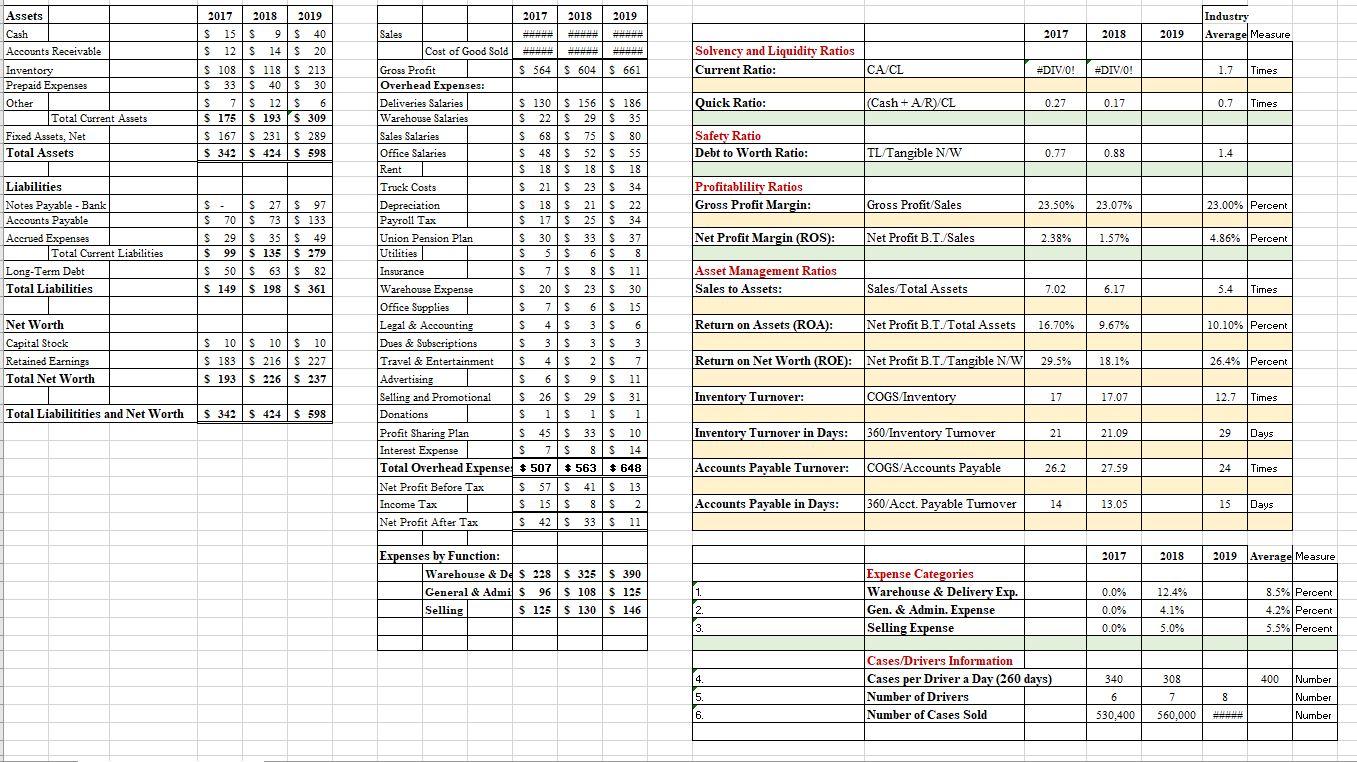

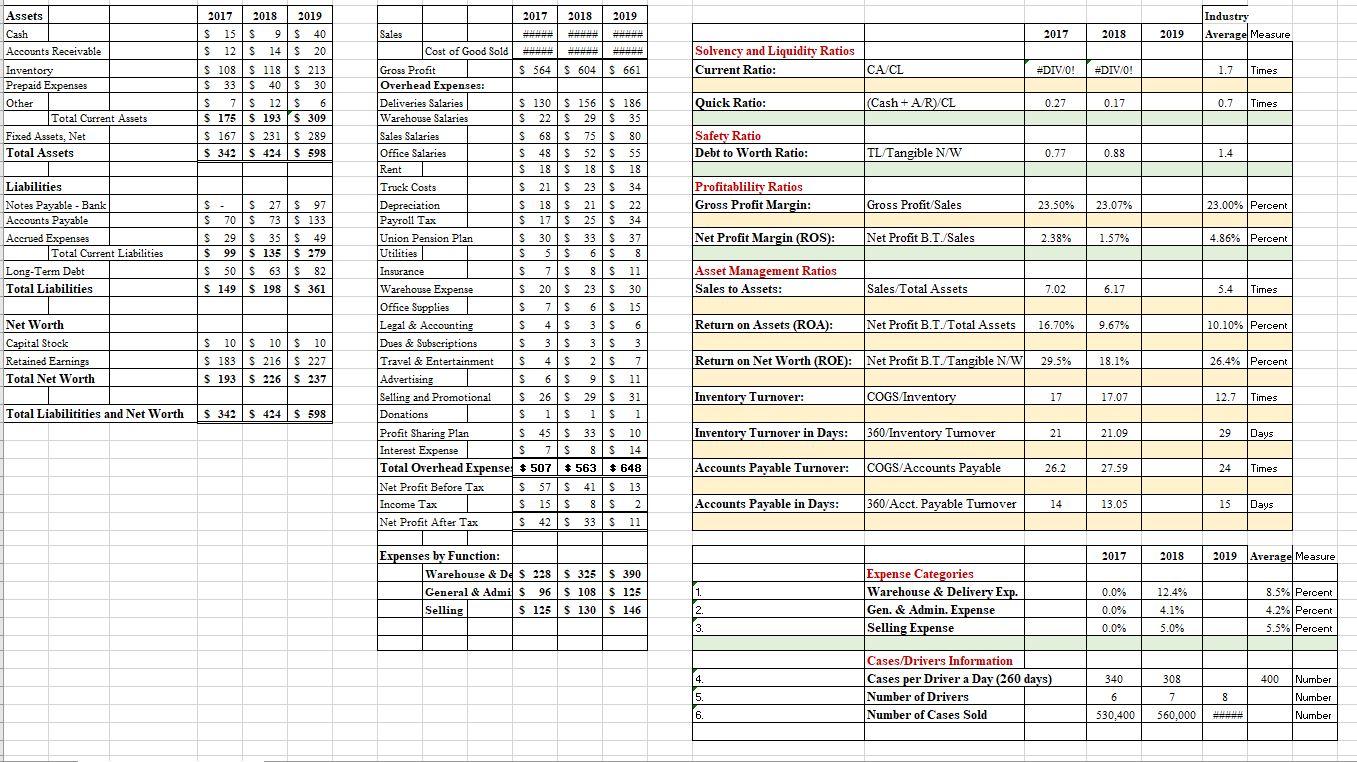

Assets Industry Average Measure 2017 2018 2019 Solvency and Liquidity Ratios Current Ratio: CA CL #DIV/0! #DIV/0! 1.7 Times Cash Accounts Receivable Inventory Prepaid Expenses Other Total Current Assets Fixed Assets, Net Total Assets 2017 2018 2019 S 15$ 9 $ 40 $ $ 125 14 $20 S $ 108 S 118 S 213 S 33 S 40 40 $ 30 S S 7S 12S 6 $ 175 $ 193S 309 $ 167 S 231 S 289 $ 342 $ 424S 598 Quick Ratio: (Cash + A/R) CL 0.27 0.17 0.7 Times Safety Ratio Debt to Worth Ratio: TL Tangible N/W 0.77 0.88 1.4 Profitablility Ratios Gross Profit Margin: Gross Profit Sales 23.50% 23.07% 23.00% Percent Liabilities Notes Payable - Bank Accounts Payable Accrued Expenses Total Current Liabilities Long-Term Debt Total Liabilities Net Profit Margin (ROS): Net Profit B.T./Sales 2.38% 1.57% 4.86% Percent S $- S 27S 97 S70 S 73 S 133 S $ 29 S 35S 35 $ 49 $ 99 $ 135 $ 279 S 50S 63 $82 $ $ 149$ 198 S 361 2017 2018 2019 Sales ### Cost of Good Sold # ** Gross Profit S S 564 S 604 $ 661 S Overhead Expenses: Deliveries Salaries S 130 S 156 S 136 S S Warehouse Salaries S 22 S 29S S S 35 Sales Salaries $ $ 68 S 75 S 80 Office Salaries S 48 48 $ $ 52S 55 Rent S 18$ 18$ S 18 Truck Costs S 21 S 23 S 23 S 34 Depreciation S 18 S 21S S 22 Payroll Tax S 17 S 25 S 34 Union Pension Plan $ 30 S 33 S 37 Utilities S 5 S 6S 8 Insurance S 7$ SS 11 Warehouse Expense S S 20 S 23S 30 Office Supplies S $ 7 s S 6 S 15 Legal & Accounting & s 4 4 s S 3 S 6 Dues & Subscriptions S 31S 3 | S 3 Travel & Entertainment S 4 $ 2S 7 Advertising S 6 s 91S $ 11 Selling and Promotional S S 26 S 29 S 31 Donations $ 1s 1 is 1 Profit Sharing Plan S 45$ 33$ 10 Interest Expense $ 7S S 8 8 $ S 14 Total Overhead Expense #507 $ 563 | 648 Net Profit Before Tax S 57S 41 S 13 Income Tax $ 15 S S 8 S 2 Net Profit After Tax S 42S 33 S S 11 Asset Management Ratios Sales to Assets: Sales/Total Assets 7.02 6.17 5.4 Times Return on Assets (ROA): Net Profit B.T./Total Assets 16.70% 9.67% 10.10% Percent Net Worth Capital Stock Retained Earnings Total Net Worth S 10 $ 10 $ 10 $ 183 S 216 S 227 S 193 $ 226 $ 237 Return on Net Worth (ROE): Net Profit B.T. Tangible N/W 29.5% 18.1% 26.4% Percent Inventory Turnover: COGS/Inventory 17 17.07 12.7 Times Total Liabilitities and Net Worth $ 342 $ 424 $ 598 Inventory Turnover in Days: 360/Inventory Tumover 21 21.09 29 Days Accounts Payable Turnover: COGS/Accounts Payable 26.2 27.59 24 Times Accounts Payable in Days: 360/Acct. Payable Tumover 14 13.05 15 Days 2017 2018 2019 Average Measure Expenses by Function: Warehouse & De$ 228 S 325 $ 390 General & Admis 96 $ 108 $ 125 Selling $ 125 $ 130 S 146 S 1. 12.4% Expense Categories Warehouse & Delivery Exp. Gen. & Admin. Expense Selling Expense 2. 0.0% 0.0% 0.0% 4.1% 5.0% 8.5% Percent 4.2% Percent 5.5% Percent 3. 4. 4 400 Number Cases/Drivers Information Cases per Driver a Day (260 days) Number of Drivers Number of Cases Sold 5. 340 6 530,400 308 7 560.000 8 Number 6. Number Assets Industry Average Measure 2017 2018 2019 Solvency and Liquidity Ratios Current Ratio: CA CL #DIV/0! #DIV/0! 1.7 Times Cash Accounts Receivable Inventory Prepaid Expenses Other Total Current Assets Fixed Assets, Net Total Assets 2017 2018 2019 S 15$ 9 $ 40 $ $ 125 14 $20 S $ 108 S 118 S 213 S 33 S 40 40 $ 30 S S 7S 12S 6 $ 175 $ 193S 309 $ 167 S 231 S 289 $ 342 $ 424S 598 Quick Ratio: (Cash + A/R) CL 0.27 0.17 0.7 Times Safety Ratio Debt to Worth Ratio: TL Tangible N/W 0.77 0.88 1.4 Profitablility Ratios Gross Profit Margin: Gross Profit Sales 23.50% 23.07% 23.00% Percent Liabilities Notes Payable - Bank Accounts Payable Accrued Expenses Total Current Liabilities Long-Term Debt Total Liabilities Net Profit Margin (ROS): Net Profit B.T./Sales 2.38% 1.57% 4.86% Percent S $- S 27S 97 S70 S 73 S 133 S $ 29 S 35S 35 $ 49 $ 99 $ 135 $ 279 S 50S 63 $82 $ $ 149$ 198 S 361 2017 2018 2019 Sales ### Cost of Good Sold # ** Gross Profit S S 564 S 604 $ 661 S Overhead Expenses: Deliveries Salaries S 130 S 156 S 136 S S Warehouse Salaries S 22 S 29S S S 35 Sales Salaries $ $ 68 S 75 S 80 Office Salaries S 48 48 $ $ 52S 55 Rent S 18$ 18$ S 18 Truck Costs S 21 S 23 S 23 S 34 Depreciation S 18 S 21S S 22 Payroll Tax S 17 S 25 S 34 Union Pension Plan $ 30 S 33 S 37 Utilities S 5 S 6S 8 Insurance S 7$ SS 11 Warehouse Expense S S 20 S 23S 30 Office Supplies S $ 7 s S 6 S 15 Legal & Accounting & s 4 4 s S 3 S 6 Dues & Subscriptions S 31S 3 | S 3 Travel & Entertainment S 4 $ 2S 7 Advertising S 6 s 91S $ 11 Selling and Promotional S S 26 S 29 S 31 Donations $ 1s 1 is 1 Profit Sharing Plan S 45$ 33$ 10 Interest Expense $ 7S S 8 8 $ S 14 Total Overhead Expense #507 $ 563 | 648 Net Profit Before Tax S 57S 41 S 13 Income Tax $ 15 S S 8 S 2 Net Profit After Tax S 42S 33 S S 11 Asset Management Ratios Sales to Assets: Sales/Total Assets 7.02 6.17 5.4 Times Return on Assets (ROA): Net Profit B.T./Total Assets 16.70% 9.67% 10.10% Percent Net Worth Capital Stock Retained Earnings Total Net Worth S 10 $ 10 $ 10 $ 183 S 216 S 227 S 193 $ 226 $ 237 Return on Net Worth (ROE): Net Profit B.T. Tangible N/W 29.5% 18.1% 26.4% Percent Inventory Turnover: COGS/Inventory 17 17.07 12.7 Times Total Liabilitities and Net Worth $ 342 $ 424 $ 598 Inventory Turnover in Days: 360/Inventory Tumover 21 21.09 29 Days Accounts Payable Turnover: COGS/Accounts Payable 26.2 27.59 24 Times Accounts Payable in Days: 360/Acct. Payable Tumover 14 13.05 15 Days 2017 2018 2019 Average Measure Expenses by Function: Warehouse & De$ 228 S 325 $ 390 General & Admis 96 $ 108 $ 125 Selling $ 125 $ 130 S 146 S 1. 12.4% Expense Categories Warehouse & Delivery Exp. Gen. & Admin. Expense Selling Expense 2. 0.0% 0.0% 0.0% 4.1% 5.0% 8.5% Percent 4.2% Percent 5.5% Percent 3. 4. 4 400 Number Cases/Drivers Information Cases per Driver a Day (260 days) Number of Drivers Number of Cases Sold 5. 340 6 530,400 308 7 560.000 8 Number 6. Number