Answered step by step

Verified Expert Solution

Question

1 Approved Answer

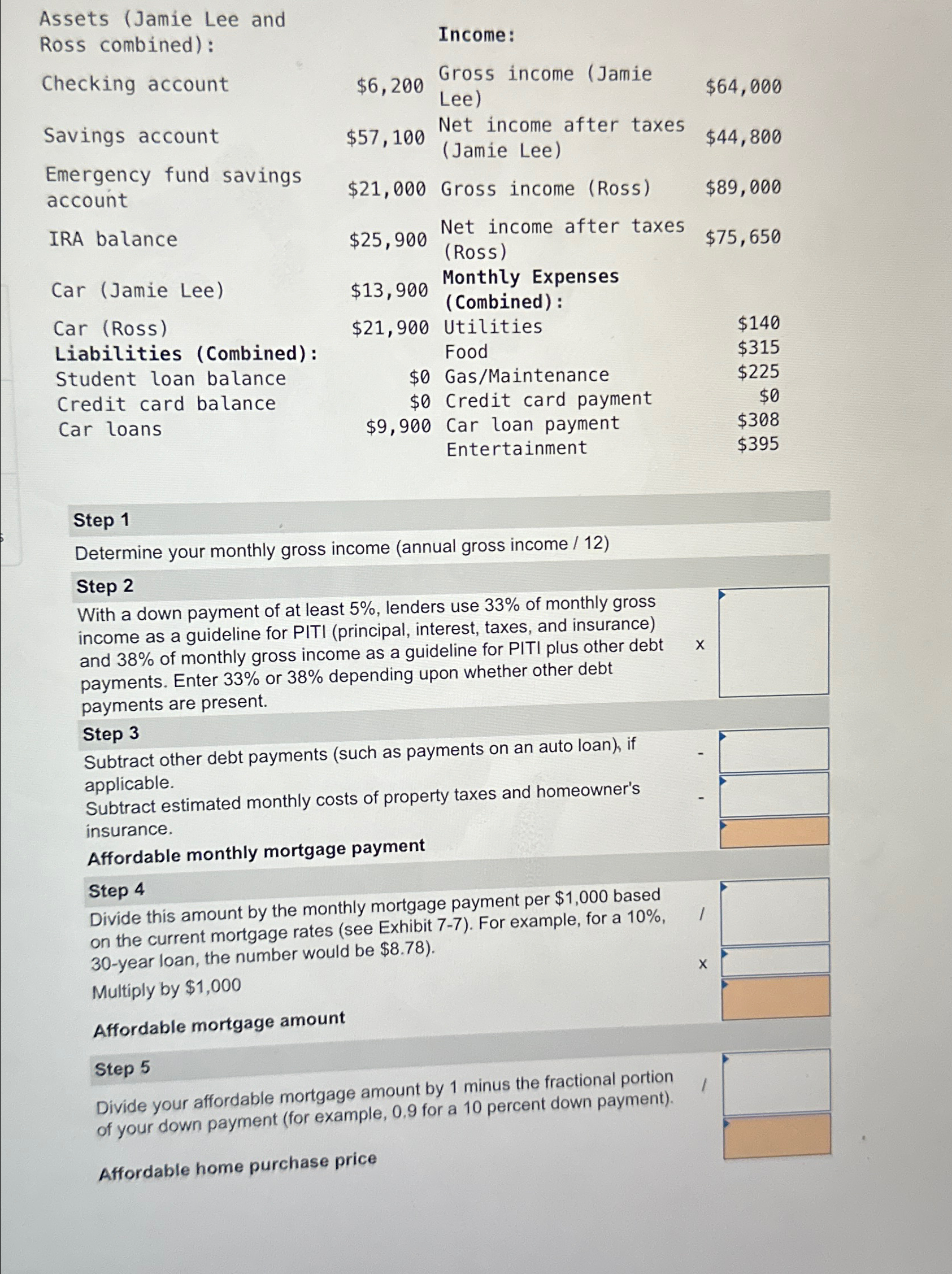

Assets (Jamie Lee and Ross combined): Income: Checking account Gross income (Jamie $6,200 $64,000 Lee) Savings account $57,100 Net income after taxes (Jamie Lee)

Assets (Jamie Lee and Ross combined): Income: Checking account Gross income (Jamie $6,200 $64,000 Lee) Savings account $57,100 Net income after taxes (Jamie Lee) $44,800 Emergency fund savings account $21,000 Gross income (Ross) $89,000 IRA balance Car (Jamie Lee) Car (Ross) Liabilities (Combined): Student loan balance Credit card balance Net income after taxes $25,900 $75,650 (Ross) Monthly Expenses $13,900 (Combined): $21,900 Utilities $140 Food $315 $0 Gas/Maintenance $225 $0 Credit card payment $0 Car loans $9,900 Car loan payment Entertainment $308 $395 Step 1 Determine your monthly gross income (annual gross income / 12) Step 2 With a down payment of at least 5%, lenders use 33% of monthly gross income as a guideline for PITI (principal, interest, taxes, and insurance) and 38% of monthly gross income as a guideline for PITI plus other debt payments. Enter 33% or 38% depending upon whether other debt payments are present. Step 3 Subtract other debt payments (such as payments on an auto loan), if applicable. Subtract estimated monthly costs of property taxes and homeowner's insurance. Affordable monthly mortgage payment Step 4 Divide this amount by the monthly mortgage payment per $1,000 based on the current mortgage rates (see Exhibit 7-7). For example, for a 10%, 30-year loan, the number would be $8.78). Multiply by $1,000 Affordable mortgage amount Step 5 Divide your affordable mortgage amount by 1 minus the fractional portion of your down payment (for example, 0.9 for a 10 percent down payment). Affordable home purchase price X X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started