Answered step by step

Verified Expert Solution

Question

1 Approved Answer

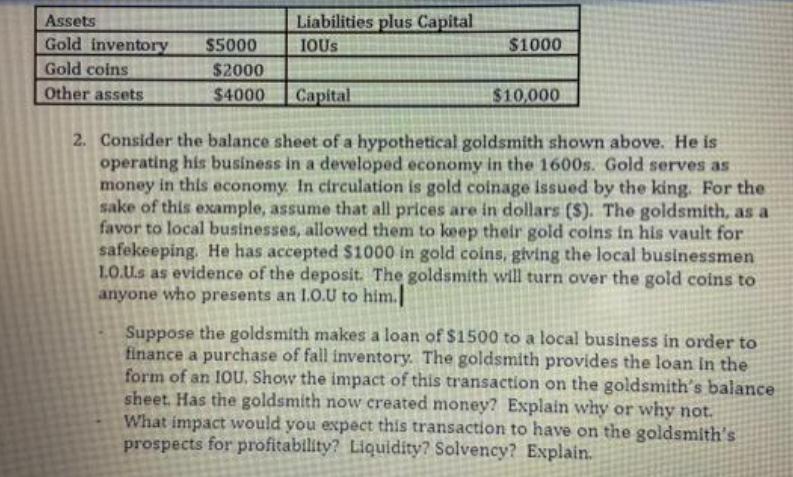

Assets Liabilities plus Capital Gold inventory $5000 IOUS $1000 Gold coins $2000 Other assets $4000 Capital $10,000 2. Consider the balance sheet of a

Assets Liabilities plus Capital Gold inventory $5000 IOUS $1000 Gold coins $2000 Other assets $4000 Capital $10,000 2. Consider the balance sheet of a hypothetical goldsmith shown above. He is operating his business in a developed economy in the 1600s. Gold serves as money in this economy. In circulation is gold coinage issued by the king. For the sake of this example, assume that all prices are in dollars ($). The goldsmith, as a favor to local businesses, allowed them to keep their gold coins in his vault for safekeeping. He has accepted $1000 in gold coins, giving the local businessmen 10.Us as evidence of the deposit. The goldsmith will turn over the gold coins to anyone who presents an 1.0.U to him. Suppose the goldsmith makes a loan of $1500 to a local business in order to finance a purchase of fall inventory. The goldsmith provides the loan in the form of an IOU. Show the impact of this transaction on the goldsmith's balance sheet. Has the goldsmith now created money? Explain why or why not. What impact would you expect this transaction to have on the goldsmith's prospects for profitability? Liquidity? Solvency? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started