Question

Assets ($'mn) Cash 29-day T-bills 270-day Commercial Paper 2-year Corporate Bond 15-year T-Bond 25-year ARM (reset quarterly) $1,000 Total assets 8,570 9,555 4,457 900

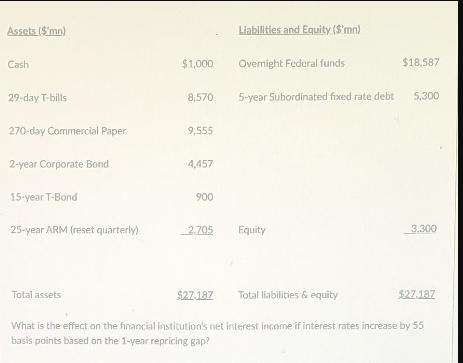

Assets ($'mn) Cash 29-day T-bills 270-day Commercial Paper 2-year Corporate Bond 15-year T-Bond 25-year ARM (reset quarterly) $1,000 Total assets 8,570 9,555 4,457 900 2.705 Liabilities and Equity ($'mn) $27.187 Overnight Federal funds 5-year Subordinated fixed rate debt Equity $18,587 5,300 Total liabilities & equity What is the effect on the financial institution's net interest income if interest rates increase by 55 basis points based on the 1-year repricing gap? 3.300 $27.187

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets calculate the interest rate risk based on the given 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Analysis Valuation Using Financial Statements

Authors: Paul M. Healy

5th edition

1111972303, 978-1111972301

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App