Answered step by step

Verified Expert Solution

Question

1 Approved Answer

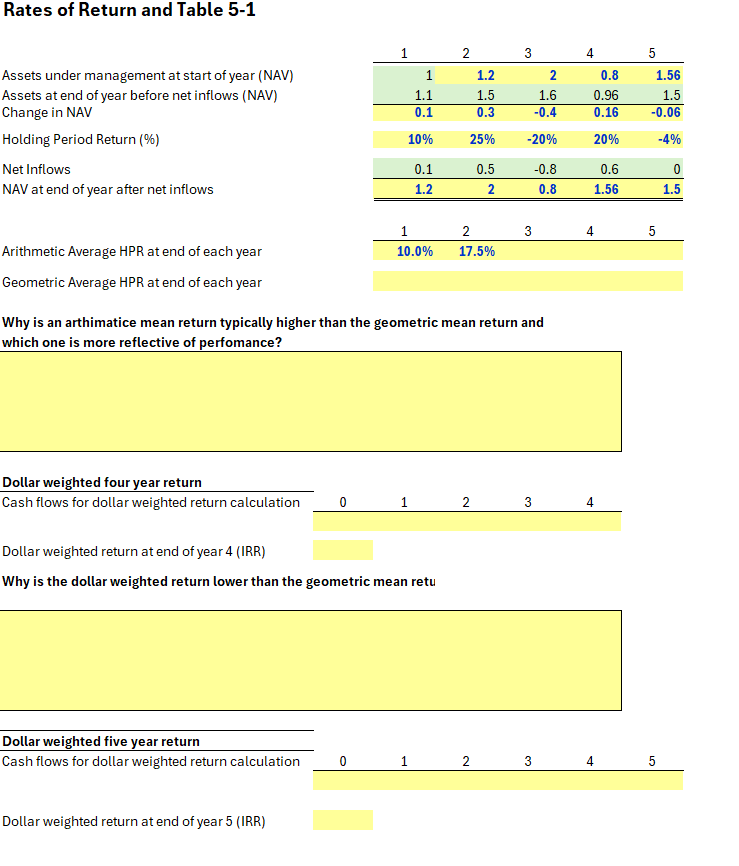

Assets under management at start of year ( NAV ) Assets at end of year before net inflows ( NAV ) Change in NAV Holding

Assets under management at start of year NAV

Assets at end of year before net inflows NAV

Change in NAV

Holding Period Return

Net Inflows

NAV at end of year after net inflows

Arithmetic Average HPR at end of each year

Geometric Average HPR at end of each year

Why is an arthimatice mean return typically higher than the geometric mean return and

which one is more reflective of perfomance?

Dollar weighted four year return

Cash flows for dollar weighted return calculation

Dollar weighted return at end of year IRR

Why is the dollar weighted return lower than the geometric mean retu

Dollar weighted five year return

Cash flows for dollar weighted return calculation

Dollar weighted return at end of year IRR

Can you also assist in labeling the excel functions to solve the problems

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started