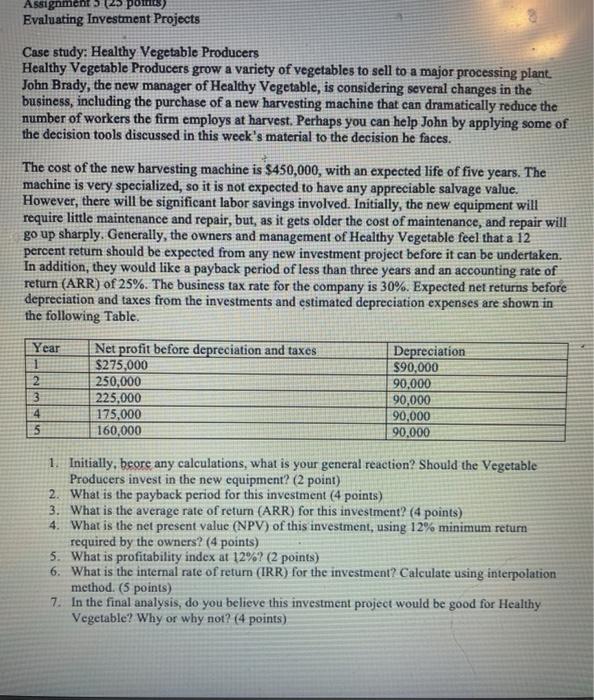

Assignmem Evaluating Investment Projects Case study: Healthy Vegetable Producers Healthy Vegetable Producers grow a variety of vegetables to sell to a major processing plant. John Brady, the new manager of Healthy Vegetable, is considering several changes in the business, including the purchase of a new harvesting machine that can dramatically reduce the number of workers the firm employs at harvest. Perhaps you can help John by applying some of the decision tools discussed in this week's material to the decision he faces. The cost of the new harvesting machine is $450,000, with an expected life of five years. The machine is very specialized, so it is not expected to have any appreciable salvage value. However, there will be significant labor savings involved. Initially, the new equipment will require little maintenance and repair, but, as it gets older the cost of maintenance, and repair will go up sharply. Generally, the owners and management of Healthy Vegetable feel that a 12 percent return should be expected from any new investment project before it can be undertaken. In addition, they would like a payback period of less than three years and an accounting rate of return (ARR) of 25%. The business tax rate for the company is 30%. Expected net returns before depreciation and taxes from the investments and estimated depreciation expenses are shown in the following Table Year Net profit before depreciation and taxes $275,000 250,000 225,000 175,000 160,000 Depreciation $90,000 90,000 90,000 90,000 90,000 1. Initially, beore any calculations, what is your general reaction? Should the Vegetable Producers invest in the new equipment? (2 point) 2. What is the payback period for this investment (4 points) 3. What is the average rate of return (ARR) for this investment? (4 points) 4. What is the net present value (NPV) of this investment, using 12% minimum return required by the owners? (4 points) 5. What is profitability index at 12%? (2 points) 6. What is the internal rate of return (IRR) for the investment? Calculate using interpolation method. (5 points) 7. In the final analysis, do you believe this investment project would be good for Healthy Vegetable? Why or why not? (4 points)