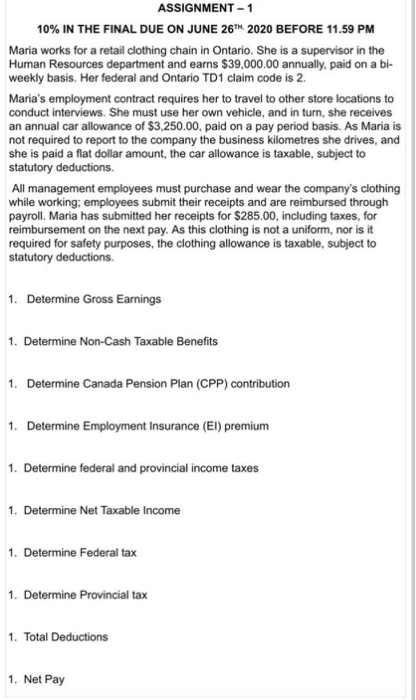

ASSIGNMENT - 1 10% IN THE FINAL DUE ON JUNE 26TH 2020 BEFORE 11.59 PM Maria works for a retail clothing chain in Ontario. She is a supervisor in the Human Resources department and earns $39,000.00 annually, paid on a bi- weekly basis. Her federal and Ontario TD1 claim code is 2. Maria's employment contract requires her to travel to other store locations to conduct interviews. She must use her own vehicle, and in turn, she receives an annual car allowance of $3,250.00, paid on a pay period basis. As Maria is not required to report to the company the business kilometres she drives, and she is paid a flat dollar amount, the car allowance is taxable, subject to statutory deductions All management employees must purchase and wear the company's clothing while working; employees submit their receipts and are reimbursed through payroll. Maria has submitted her receipts for $285.00, including taxes, for reimbursement on the next pay. As this clothing is not a uniform, nor is it required for safety purposes, the clothing allowance is taxable, subject to statutory deductions. 1. Determine Gross Earnings 1. Determine Non-Cash Taxable Benefits 1. Determine Canada Pension Plan (CPP) contribution 1. Determine Employment Insurance (EI) premium 1. Determine federal and provincial income taxes 1. Determine Net Taxable income 1. Determine Federal tax 1. Determine Provincial tax 1. Total Deductions 1. Net Pay ASSIGNMENT - 1 10% IN THE FINAL DUE ON JUNE 26TH 2020 BEFORE 11.59 PM Maria works for a retail clothing chain in Ontario. She is a supervisor in the Human Resources department and earns $39,000.00 annually, paid on a bi- weekly basis. Her federal and Ontario TD1 claim code is 2. Maria's employment contract requires her to travel to other store locations to conduct interviews. She must use her own vehicle, and in turn, she receives an annual car allowance of $3,250.00, paid on a pay period basis. As Maria is not required to report to the company the business kilometres she drives, and she is paid a flat dollar amount, the car allowance is taxable, subject to statutory deductions All management employees must purchase and wear the company's clothing while working; employees submit their receipts and are reimbursed through payroll. Maria has submitted her receipts for $285.00, including taxes, for reimbursement on the next pay. As this clothing is not a uniform, nor is it required for safety purposes, the clothing allowance is taxable, subject to statutory deductions. 1. Determine Gross Earnings 1. Determine Non-Cash Taxable Benefits 1. Determine Canada Pension Plan (CPP) contribution 1. Determine Employment Insurance (EI) premium 1. Determine federal and provincial income taxes 1. Determine Net Taxable income 1. Determine Federal tax 1. Determine Provincial tax 1. Total Deductions 1. Net Pay