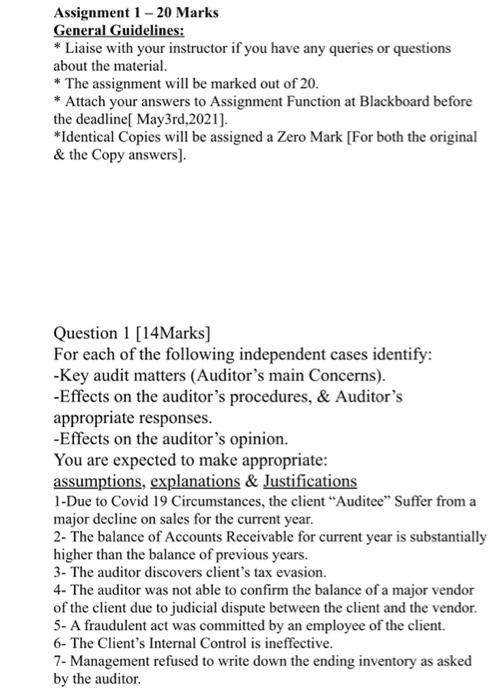

Assignment 1 - 20 Marks General Guidelines: * Liaise with your instructor if you have any queries or questions about the material. * The assignment will be marked out of 20. * Attach your answers to Assignment Function at Blackboard before the deadline[ May 3rd,2021). *Identical Copies will be assigned a Zero Mark [For both the original & the Copy answers). Question 1 [14Marks] For each of the following independent cases identify: -Key audit matters (Auditor's main Concerns). -Effects on the auditor's procedures, & Auditor's appropriate responses. -Effects on the auditor's opinion. You are expected to make appropriate: assumptions, explanations & Justifications 1-Due to Covid 19 Circumstances, the client Auditee Suffer from a major decline on sales for the current year. 2- The balance of Accounts Receivable for current year is substantially higher than the balance of previous years. 3- The auditor discovers client's tax evasion. 4- The auditor was not able to confirm the balance of a major vendor of the client due to judicial dispute between the client and the vendor. 5- A fraudulent act was committed by an employee of the client. 6- The Client's Internal Control is ineffective. 7- Management refused to write down the ending inventory as asked by the auditor. Assignment 1 - 20 Marks General Guidelines: * Liaise with your instructor if you have any queries or questions about the material. * The assignment will be marked out of 20. * Attach your answers to Assignment Function at Blackboard before the deadline[ May 3rd,2021). *Identical Copies will be assigned a Zero Mark [For both the original & the Copy answers). Question 1 [14Marks] For each of the following independent cases identify: -Key audit matters (Auditor's main Concerns). -Effects on the auditor's procedures, & Auditor's appropriate responses. -Effects on the auditor's opinion. You are expected to make appropriate: assumptions, explanations & Justifications 1-Due to Covid 19 Circumstances, the client Auditee Suffer from a major decline on sales for the current year. 2- The balance of Accounts Receivable for current year is substantially higher than the balance of previous years. 3- The auditor discovers client's tax evasion. 4- The auditor was not able to confirm the balance of a major vendor of the client due to judicial dispute between the client and the vendor. 5- A fraudulent act was committed by an employee of the client. 6- The Client's Internal Control is ineffective. 7- Management refused to write down the ending inventory as asked by the auditor