Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment 1 AIKON Inc. assembles three different telephone models, X1, Y2 and Z3. Assume the market is will- ing to buy whatever can be

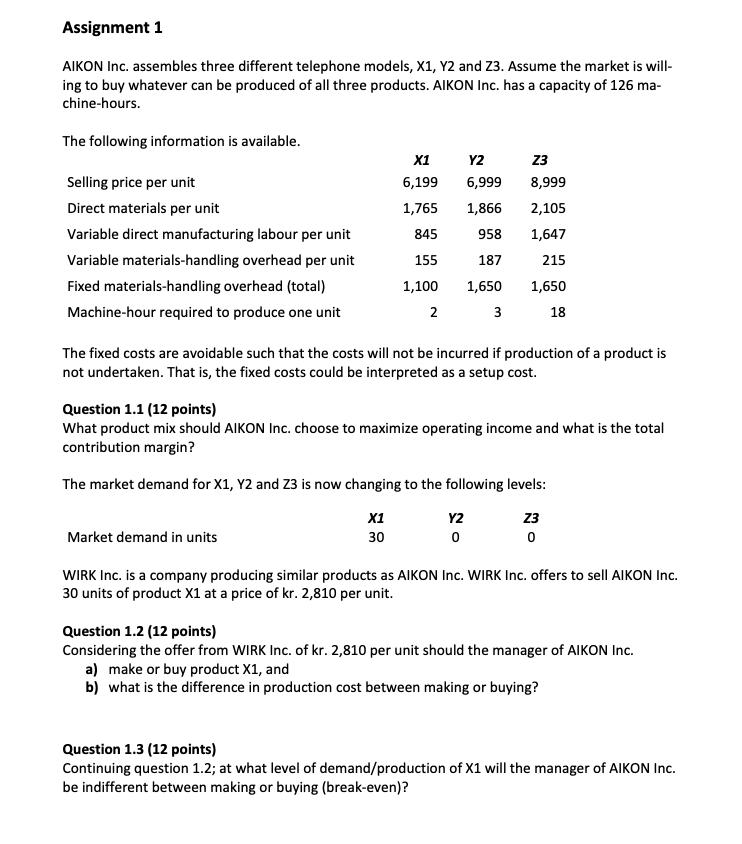

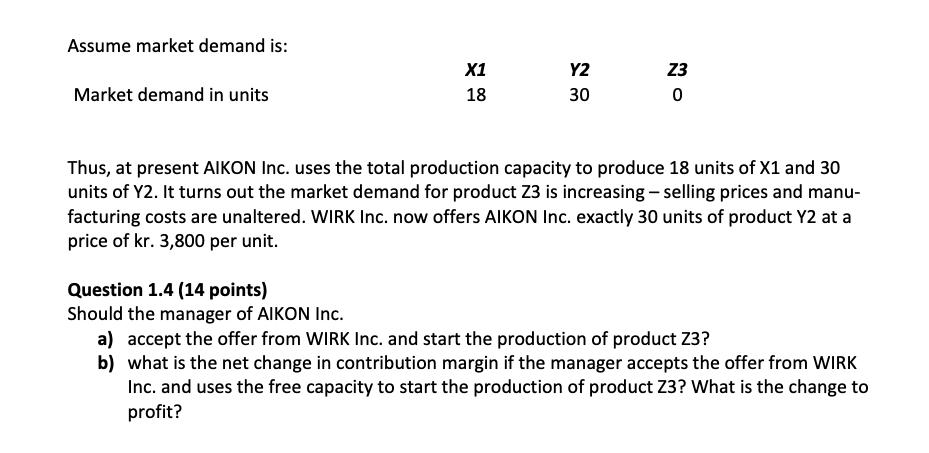

Assignment 1 AIKON Inc. assembles three different telephone models, X1, Y2 and Z3. Assume the market is will- ing to buy whatever can be produced of all three products. AIKON Inc. has a capacity of 126 ma- chine-hours. The following information is available. Selling price per unit Direct materials per unit Variable direct manufacturing labour per unit Variable materials-handling overhead per unit Fixed materials-handling overhead (total) Machine-hour required to produce one unit X1 6,199 1,765 845 155 1,100 2 The fixed costs are avoidable such that the costs will not be incurred if production of a product is not undertaken. That is, the fixed costs could be interpreted as a setup cost. Y2 Z3 6,999 8,999 1,866 2,105 958 1,647 187 215 1,650 1,650 3 18 Question 1.1 (12 points) What product mix should AIKON Inc. choose to maximize operating income and what is the total contribution margin? Market demand in units The market demand for X1, Y2 and Z3 is now changing to the following levels: X1 Z3 30 0 Y2 0 WIRK Inc. is a company producing similar products as AIKON Inc. WIRK Inc. offers to sell AIKON Inc. 30 units of product X1 at a price of kr. 2,810 per unit. Question 1.2 (12 points) Considering the offer from WIRK Inc. of kr. 2,810 per unit should the manager of AIKON Inc. a) make or buy product X1, and b) what is the difference in production cost between making or buying? Question 1.3 (12 points) Continuing question 1.2; at what level of demand/production of X1 will the manager of AIKON Inc. be indifferent between making or buying (break-even)? Assume market demand is: Market demand in units X1 18 Y2 30 Z3 0 Thus, at present AIKON Inc. uses the total production capacity to produce 18 units of X1 and 30 units of Y2. It turns out the market demand for product Z3 is increasing - selling prices and manu- facturing costs are unaltered. WIRK Inc. now offers AIKON Inc. exactly 30 units of product Y2 at a price of kr. 3,800 per unit. Question 1.4 (14 points) Should the manager of AIKON Inc. a) accept the offer from WIRK Inc. and start the production of product Z3? b) what is the net change in contribution margin if the manager accepts the offer from WIRK Inc. and uses the free capacity to start the production of product Z3? What is the change to profit?

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution Particulars Selling Price per Unit Less Direct materialsunit Variable direct manufact...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started