Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment 1 For this assignment, you will use the provided information, as well as what you have learned from class lectures and the reading, to

Assignment

For this assignment, you will use the provided information, as well as what you have learned from class lectures and

the reading, to analyze several loan opportunities, then answer questions to demonstrate your understanding of the

analysis you performed.

The goal of this assignment is for you to use your decisionmaking and analytical skills like you would in the

workplace and to articulate your responses in a professional manner, like you would to a client.

The scenario

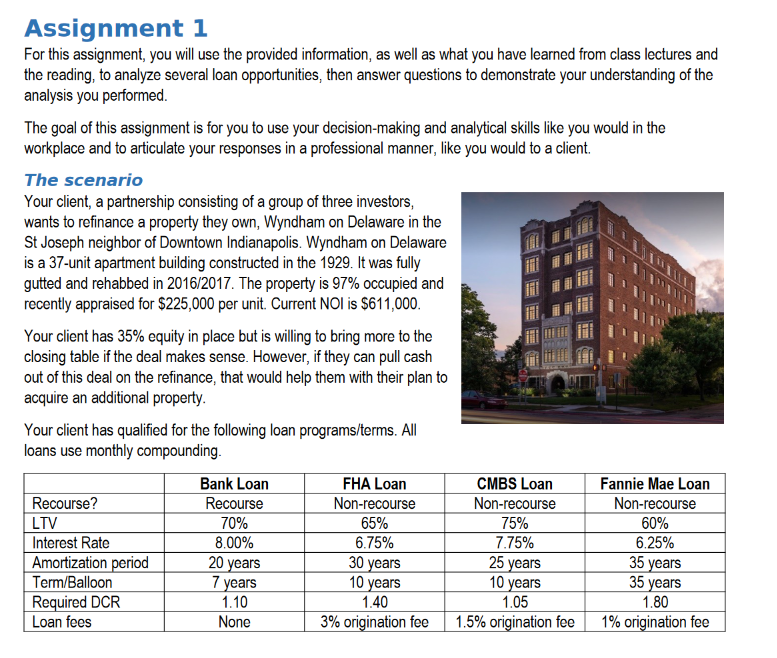

Your client, a partnership consisting of a group of three investors,

wants to refinance a property they own, Wyndham on Delaware in the

St Joseph neighbor of Downtown Indianapolis. Wyndham on Delaware

is a unit apartment building constructed in the It was fully

gutted and rehabbed in The property is occupied and

recently appraised for $ per unit. Current NOI is $

Your client has equity in place but is willing to bring more to the

closing table if the deal makes sense. However, if they can pull cash

out of this deal on the refinance, that would help them with their plan to

acquire an additional property.

Your client has qualified for the following loan programsterms All

loans use monthly compounding.

Review each loan option, and calculate the following for each loan in the assignment spreadsheet:

a Loan amount based on LTV ratio

b Loan amount using max ADS formula based on required DCR

c ADS Annual debt service for lower of loan amounts from steps a and b

d Loan payoff at the end of the loan term

e Principal paid over the loan term

f Interest paid over the loan term

g Actual DCR

h Actual debt yield

i Effective borrowing cost considering early payoff as appropriate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started