Answered step by step

Verified Expert Solution

Question

1 Approved Answer

assignment: 1 . Sales occur evenly throughout the year. 2 . The firm is currently operating under - capacity. 3 . Opportunity cost of Inventory

assignment:

Sales occur evenly throughout the year.

The firm is currently operating undercapacity.

Opportunity cost of Inventory Investment

Change in Annual Sales x COGS Annual Inventory Turnover

X r

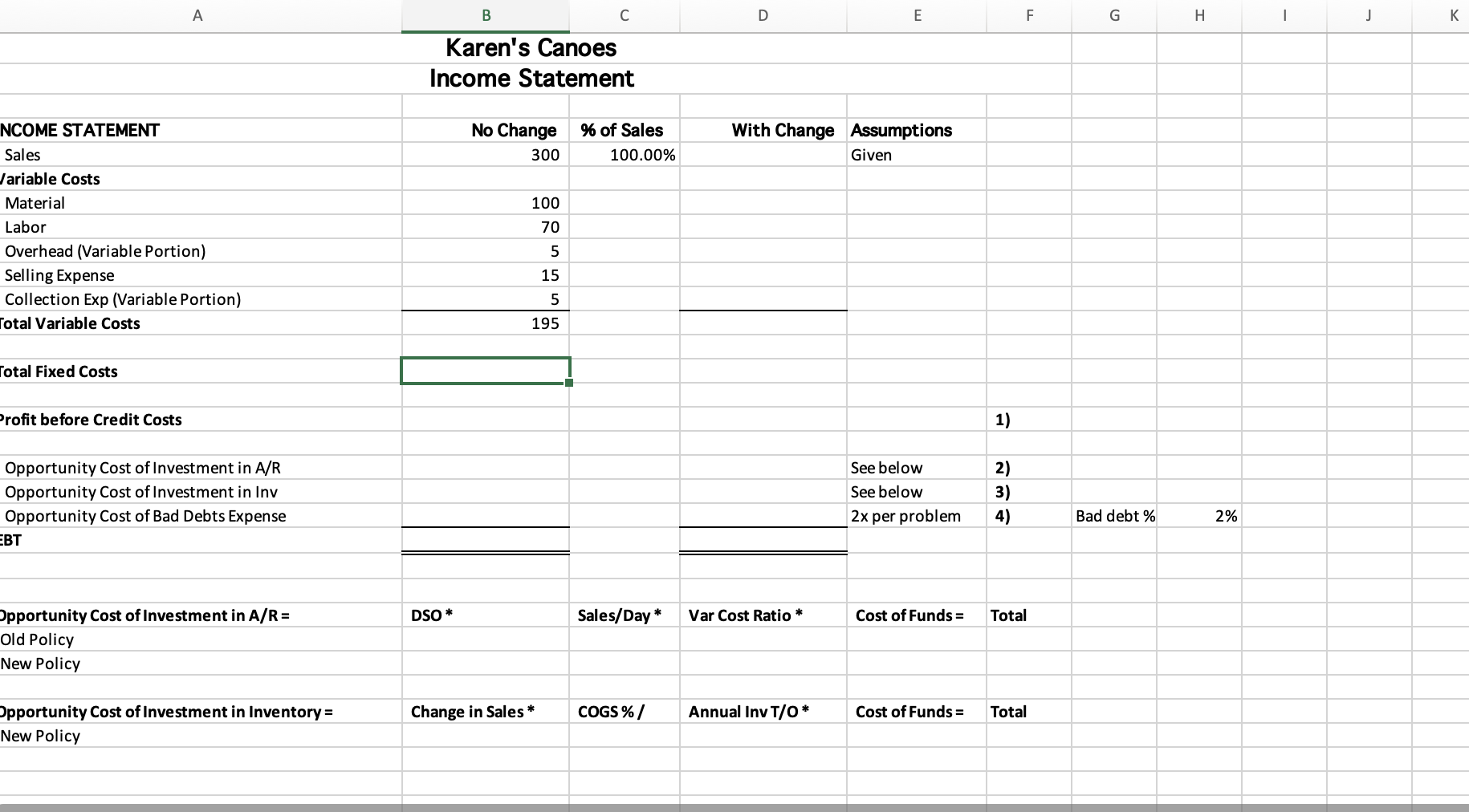

Karens Canoes

Determine the expected change in beforetax profit for the proposed change in credit standards. Prepare the income statements in total, not per unit. The following information should be used in your analysis.

Karens Canoes is considering relaxing its credit standards to encourage more sales. As a result, sales are expected to increase from canoes per year to canoes per year. The average collection period is expected to increase to days from days and bad debts are expected to double the current level as a of sales To support the higher sales level, an increase in the level of inventory will be necessary. The firms required return on investment is and their annual inventory turnover is times. Their COGS is

The current standard cost data is shown below.

Sales Price per canoe

Variable Costs per canoe:

Material

Labor

Overhead

Selling Expense

Collection Expense

Total VC Costs per canoe

Bad Debts of sales

I attached the template for the assignment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started