ASSIGNMENT 1 Using 2019 and 2020 common size balance sheets and income statements for Bank of Nova Scotia and Newtek Business Services, describe how each

ASSIGNMENT 1

- Using 2019 and 2020 common size balance sheets and income statements for Bank of Nova Scotia and Newtek Business Services, describe how each company is similar to or different from the benchmark.

- Do the time trend analysis and describe how each company changes over time.

- Using the balance sheet and income statement for each company, compute the following financial ratios for each company: 1) current ratio, 2) quick ratio, 3) debt-to-equity ratio, 4) times interest earned ratio (Interest coverage ratio) 5) inventory turnover, 6) receivable turnover, 7) total asset turnover, 8) profit margin, 9) return on asset (ROA), 10) Return on equity (ROE), 11) price-earnings ratio, 12) market-to-book ratio.

4. (Financial Ratio Analysis) Select the benchmark for peer group analysis. Youll use two kinds of benchmarks in this assignment. Your companys ratios and the other is industry averages from finance.yahoo.com or www.reuters.com or investing.money.msn.com). cite the source.

5. Describe how good or bad ratios of your companies are considered. Describe the similarities.

6. (DuPont Identity) Using the Dupont Identity equation, compare the two companies. Find out what makes differences in ROEs between the two companies.

7. Using the DuPont Identity, compare the companies' 2019 ROE and 2020 ROE. Find out what makes differences in ROE between the two periods if there is any difference.

Please show in Excel and with formulas.

Show transcribed image text

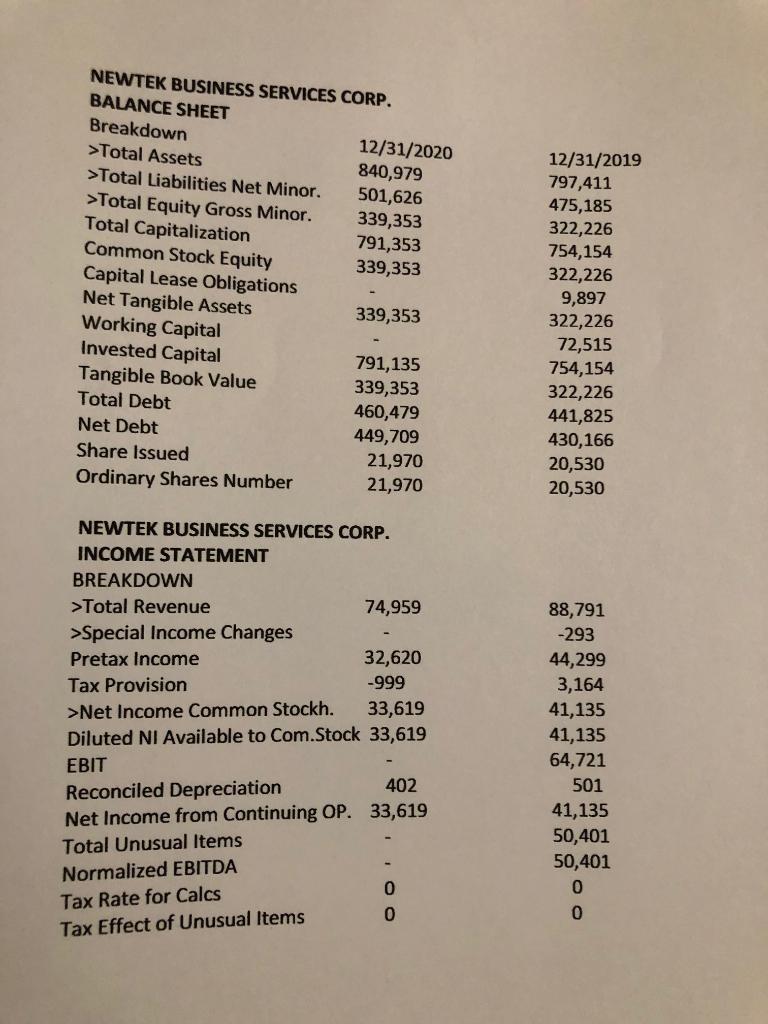

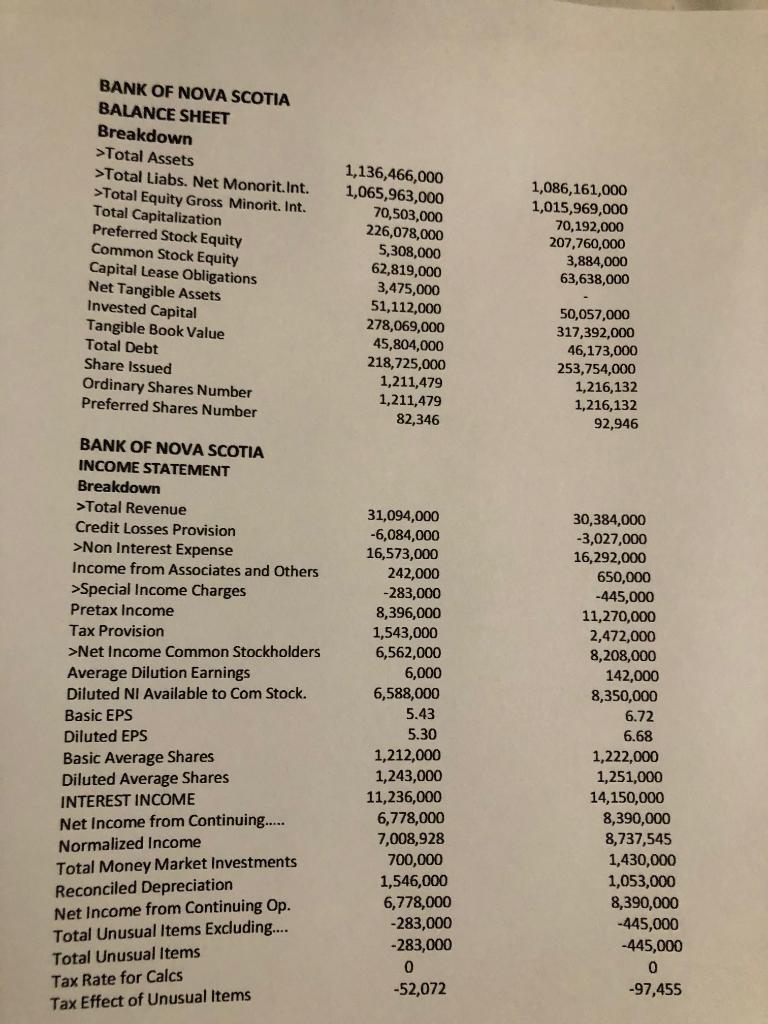

NEWTEK BUSINESS SERVICES CORP. BALANCE SHEET Breakdown 12/31/2020 >Total Assets 840,979 >Total Liabilities Net Minor. 501,626 >Total Equity Gross Minor. 339,353 Total Capitalization 791,353 Common Stock Equity 339,353 Capital Lease Obligations Net Tangible Assets 339,353 Working Capital Invested Capital 791,135 Tangible Book Value 339,353 Total Debt 460,479 Net Debt 449,709 Share Issued Ordinary Shares Number 12/31/2019 797,411 475,185 322,226 754,154 322,226 9,897 322,226 72,515 754,154 322,226 441,825 430,166 20,530 20,530 21,970 21,970 NEWTEK BUSINESS SERVICES CORP. INCOME STATEMENT BREAKDOWN >Total Revenue 74,959 >Special Income Changes Pretax Income 32,620 Tax Provision -999 >Net Income Common Stockh. 33,619 Diluted NI Available to Com.Stock 33,619 EBIT Reconciled Depreciation 402 Net Income from Continuing OP. 33,619 Total Unusual Items Normalized EBITDA Tax Rate for Calcs 0 Tax Effect of Unusual Items 88,791 -293 44,299 3,164 41,135 41,135 64,721 501 41,135 50,401 50,401 0 0 BANK OF NOVA SCOTIA BALANCE SHEET Breakdown >Total Assets >Total Liabs. Net Monorit. Int. >Total Equity Gross Minorit. Int. Total Capitalization Preferred Stock Equity Common Stock Equity Capital Lease Obligations Net Tangible Assets Invested Capital Tangible Book Value Total Debt Share issued Ordinary Shares Number Preferred Shares Number 1,136,466,000 1,065,963,000 70,503,000 226,078,000 5,308,000 62,819,000 3,475,000 51,112,000 278,069,000 45,804,000 218,725,000 1,211,479 1,211,479 1,086,161,000 1,015,969,000 70,192,000 207,760,000 3,884,000 63,638,000 50,057,000 317,392,000 46,173,000 253,754,000 1,216,132 1,216,132 92,946 82,346 BANK OF NOVA SCOTIA INCOME STATEMENT Breakdown >Total Revenue Credit Losses Provision >Non Interest Expense Income from Associates and Others >Special Income Charges Pretax Income Tax Provision >Net Income Common Stockholders Average Dilution Earnings Diluted NI Available to Com Stock. Basic EPS Diluted EPS Basic Average Shares Diluted Average Shares INTEREST INCOME Net Income from Continuing..... Normalized Income Total Money Market Investments Reconciled Depreciation Net Income from Continuing Op. Total Unusual Items Excluding.... 31,094,000 -6,084,000 16,573,000 242,000 -283,000 8,396,000 1,543,000 6,562,000 6,000 6,588,000 5.43 5.30 1,212,000 1,243,000 11,236,000 6,778,000 7,008,928 700,000 1,546,000 6,778,000 -283,000 -283,000 0 -52,072 30,384,000 -3,027,000 16,292,000 650,000 -445,000 11,270,000 2,472,000 8,208,000 142,000 8,350,000 6.72 6.68 1,222,000 1,251,000 14,150,000 8,390,000 8,737,545 1,430,000 1,053,000 8,390,000 -445,000 -445,000 0 -97,455 Total Unusual Items Tax Rate for Calcs Tax Effect of Unusual Items NEWTEK BUSINESS SERVICES CORP. BALANCE SHEET Breakdown 12/31/2020 >Total Assets 840,979 >Total Liabilities Net Minor. 501,626 >Total Equity Gross Minor. 339,353 Total Capitalization 791,353 Common Stock Equity 339,353 Capital Lease Obligations Net Tangible Assets 339,353 Working Capital Invested Capital 791,135 Tangible Book Value 339,353 Total Debt 460,479 Net Debt 449,709 Share Issued Ordinary Shares Number 12/31/2019 797,411 475,185 322,226 754,154 322,226 9,897 322,226 72,515 754,154 322,226 441,825 430,166 20,530 20,530 21,970 21,970 NEWTEK BUSINESS SERVICES CORP. INCOME STATEMENT BREAKDOWN >Total Revenue 74,959 >Special Income Changes Pretax Income 32,620 Tax Provision -999 >Net Income Common Stockh. 33,619 Diluted NI Available to Com.Stock 33,619 EBIT Reconciled Depreciation 402 Net Income from Continuing OP. 33,619 Total Unusual Items Normalized EBITDA Tax Rate for Calcs 0 Tax Effect of Unusual Items 88,791 -293 44,299 3,164 41,135 41,135 64,721 501 41,135 50,401 50,401 0 0 BANK OF NOVA SCOTIA BALANCE SHEET Breakdown >Total Assets >Total Liabs. Net Monorit. Int. >Total Equity Gross Minorit. Int. Total Capitalization Preferred Stock Equity Common Stock Equity Capital Lease Obligations Net Tangible Assets Invested Capital Tangible Book Value Total Debt Share issued Ordinary Shares Number Preferred Shares Number 1,136,466,000 1,065,963,000 70,503,000 226,078,000 5,308,000 62,819,000 3,475,000 51,112,000 278,069,000 45,804,000 218,725,000 1,211,479 1,211,479 1,086,161,000 1,015,969,000 70,192,000 207,760,000 3,884,000 63,638,000 50,057,000 317,392,000 46,173,000 253,754,000 1,216,132 1,216,132 92,946 82,346 BANK OF NOVA SCOTIA INCOME STATEMENT Breakdown >Total Revenue Credit Losses Provision >Non Interest Expense Income from Associates and Others >Special Income Charges Pretax Income Tax Provision >Net Income Common Stockholders Average Dilution Earnings Diluted NI Available to Com Stock. Basic EPS Diluted EPS Basic Average Shares Diluted Average Shares INTEREST INCOME Net Income from Continuing..... Normalized Income Total Money Market Investments Reconciled Depreciation Net Income from Continuing Op. Total Unusual Items Excluding.... 31,094,000 -6,084,000 16,573,000 242,000 -283,000 8,396,000 1,543,000 6,562,000 6,000 6,588,000 5.43 5.30 1,212,000 1,243,000 11,236,000 6,778,000 7,008,928 700,000 1,546,000 6,778,000 -283,000 -283,000 0 -52,072 30,384,000 -3,027,000 16,292,000 650,000 -445,000 11,270,000 2,472,000 8,208,000 142,000 8,350,000 6.72 6.68 1,222,000 1,251,000 14,150,000 8,390,000 8,737,545 1,430,000 1,053,000 8,390,000 -445,000 -445,000 0 -97,455 Total Unusual Items Tax Rate for Calcs Tax Effect of Unusual ItemsStep by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started