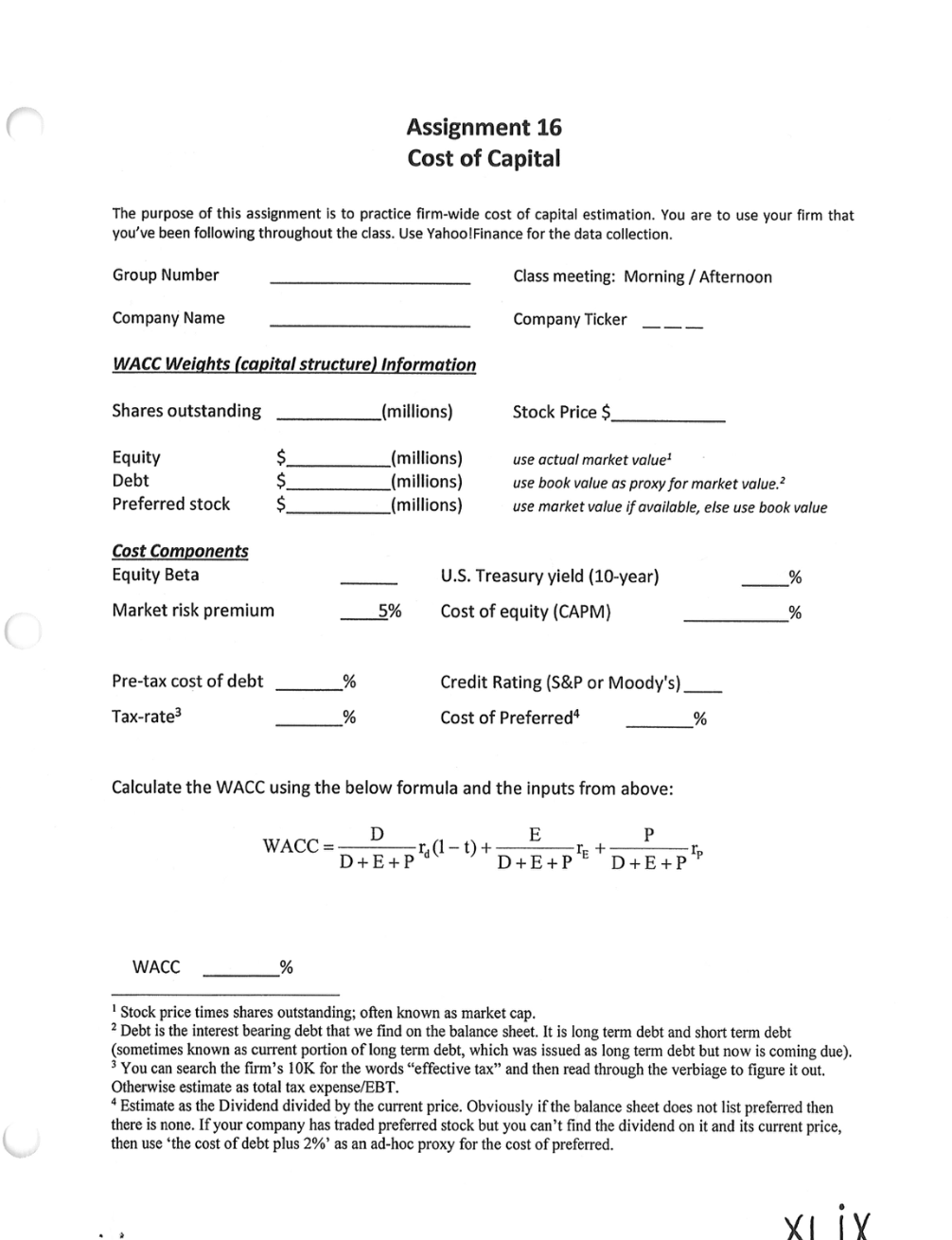

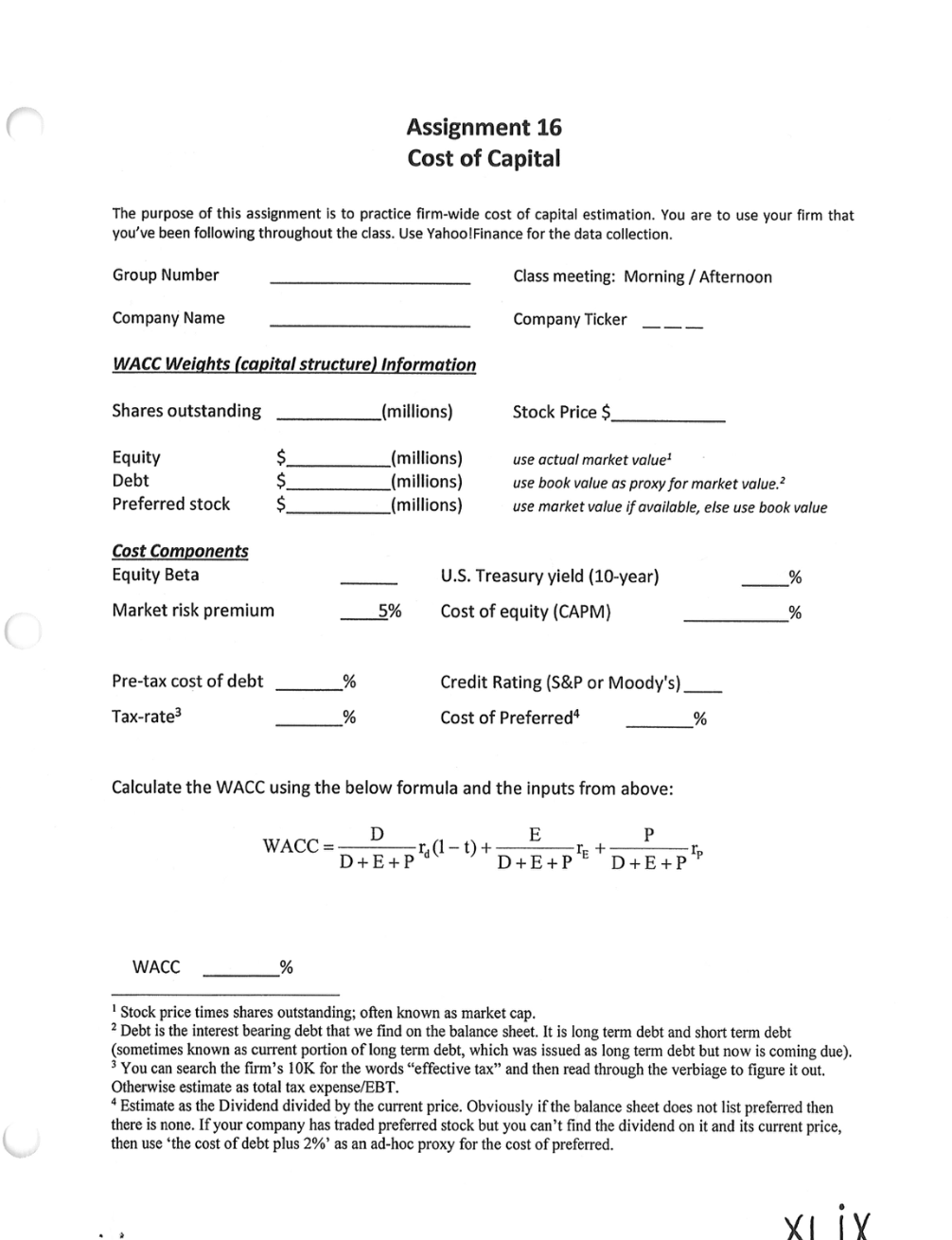

Assignment 16 Cost of Capital The purpose of this assignment is to practice firm-wide cost of capital estimation. You are to use your firm that you've been following throughout the class. Use YahoolFinance for the data collection. Calculate the WACC using the below formula and the inputs from above: WACC=D+E+PDrd(1t)+D+E+PErE+D+E+PPrP WACC % 1 Stock price times shares outstanding; often known as market cap. 2 Debt is the interest bearing debt that we find on the balance sheet. It is long term debt and short term debt (sometimes known as current portion of long term debt, which was issued as long term debt but now is coming due). 3 You can search the firm's 10K for the words "effective tax" and then read through the verbiage to figure it out. Otherwise estimate as total tax expense/EBT. 4 Estimate as the Dividend divided by the current price. Obviously if the balance sheet does not list preferred then there is none. If your company has traded preferred stock but you can't find the dividend on it and its current price, then use 'the cost of debt plus 2% ' as an ad-hoc proxy for the cost of preferred. Assignment 16 Cost of Capital The purpose of this assignment is to practice firm-wide cost of capital estimation. You are to use your firm that you've been following throughout the class. Use YahoolFinance for the data collection. Calculate the WACC using the below formula and the inputs from above: WACC=D+E+PDrd(1t)+D+E+PErE+D+E+PPrP WACC % 1 Stock price times shares outstanding; often known as market cap. 2 Debt is the interest bearing debt that we find on the balance sheet. It is long term debt and short term debt (sometimes known as current portion of long term debt, which was issued as long term debt but now is coming due). 3 You can search the firm's 10K for the words "effective tax" and then read through the verbiage to figure it out. Otherwise estimate as total tax expense/EBT. 4 Estimate as the Dividend divided by the current price. Obviously if the balance sheet does not list preferred then there is none. If your company has traded preferred stock but you can't find the dividend on it and its current price, then use 'the cost of debt plus 2% ' as an ad-hoc proxy for the cost of preferred