Answered step by step

Verified Expert Solution

Question

1 Approved Answer

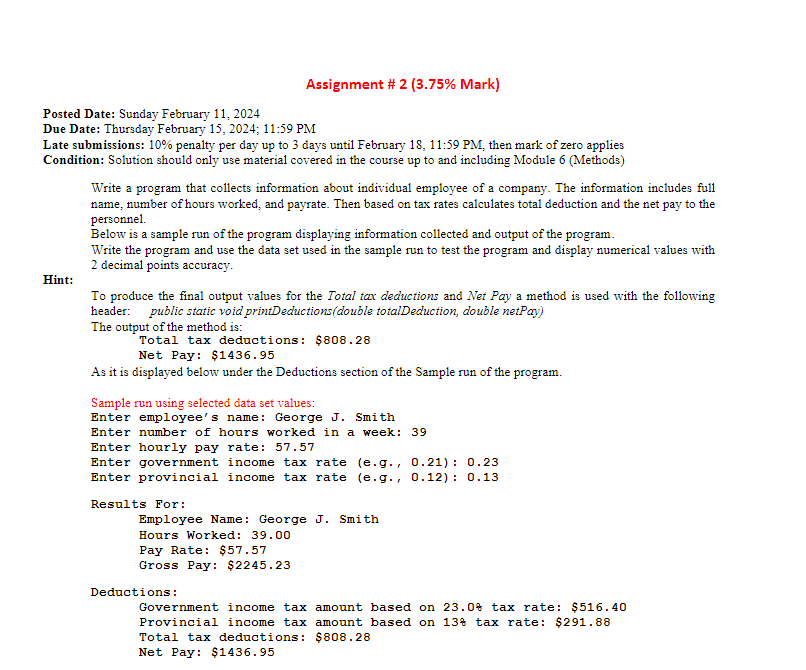

Assignment # 2 ( 3 . 7 5 % Mark ) Posted Date: Sunday February 1 1 , 2 0 2 4 Due Date: Thursday

Assignment # Mark

Posted Date: Sunday February

Due Date: Thursday February ;: PM

Late submissions: penalty per day up to days until February : then mark of zero applies

Condition: Solution should only use material covered in the course up to and including Module Methods

Write a program that collects information about individual employee of a company. The information includes full

name, number of hours worked, and payrate. Then based on tax rates calculates total deduction and the net pay to the

personnel.

Below is a sample run of the program displaying information collected and output of the program.

Write the program and use the data set used in the sample run to test the program and display numerical values with

decimal points accuracy.

Hint:

To produce the final output values for the Total tax deductions and Net Pay a method is used with the following

header: public static void printDeductionsdouble totalDeduction, double netPay

The output of the method is:

Total tax deductions: $

Net Pay: $

As it is displayed below under the Deductions section of the Sample run of the program.

Sample run using selected data set values:

Enter employee's name: George J Smith

Enter number of hours worked in a week:

Enter hourly pay rate:

Enter government income tax rate eg:

Enter provincial income tax rate eg:

Results For:

Employee Name: George J Smith

Hours Worked:

Pay Rate: $

Gross Pay: $

Deductions :

Government income tax amount based on tax rate: $

Provincial income tax amount based on tax rate: $

Total tax deductions: $

Net Pay: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started