Answered step by step

Verified Expert Solution

Question

1 Approved Answer

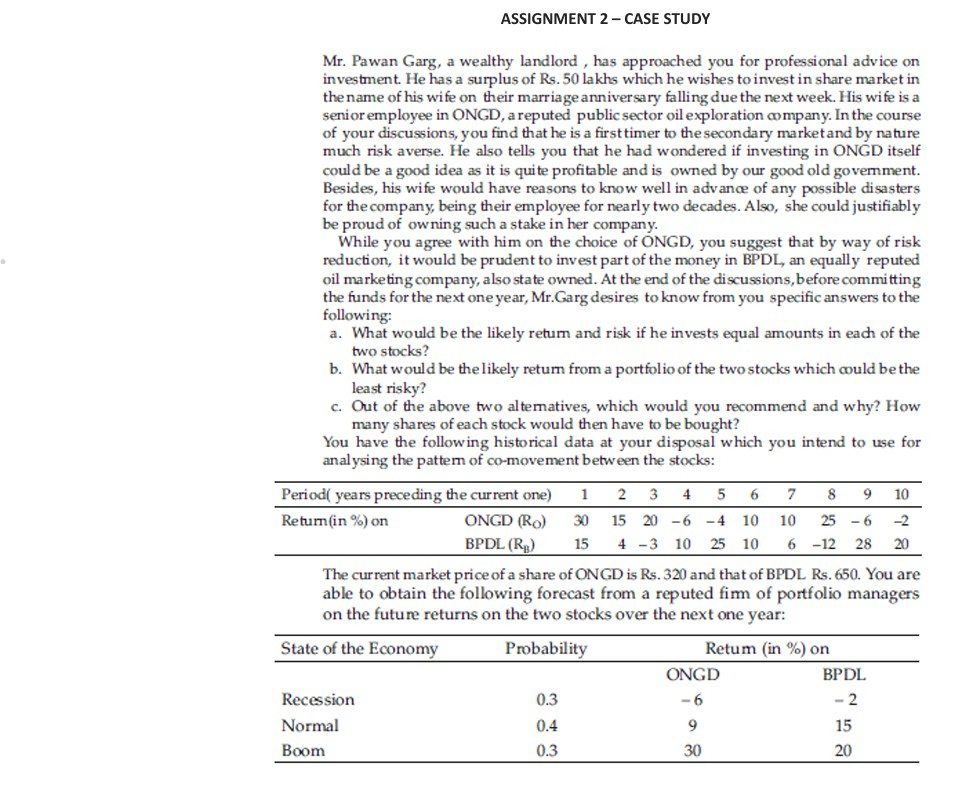

ASSIGNMENT 2 - CASE STUDY Mr . Pawan Garg, a wealthy landlord, has approached you for professional advice on investment. He has a surplus of

ASSIGNMENT CASE STUDY

Mr Pawan Garg, a wealthy landlord, has approached you for professional advice on

investment. He has a surplus of Rs lakhs which he wishes to invest in share market in

the name of his wife on their marriage anniversary falling due the next week. His wife is a

senior employee in ONGD, a reputed public sector oil exploration company. In the course

of your discussions, you find that he is a first timer to the secondary market and by nature

much risk averse. He also tells you that he had wondered if investing in ONGD itself

could be a good idea as it is quite profitable and is owned by our good old govemment.

Besides, his wife would have reasons to know well in advance of any possible disasters

for the company, being their employee for nearly two decades. Also, she could justifiably

be proud of owning such a stake in her company.

While you agree with him on the choice of ONGD, you suggest that by way of risk

reduction, it would be prudent to invest part of the money in BPDL an equally reputed

oil marketing company, also state owned. At the end of the discussions, before committing

the funds for the next one year, MrGarg desires to know from you specific answers to the

following:

a What would be the likely retum and risk if he invests equal amounts in each of the

two stocks?

b What would be the likely return from a portfolio of the two stocks which could be the

least risky?

c Out of the above two alternatives, which would you recommend and why? How

many shares of each stock would then have to be bought?

You have the following historical data at your disposal which you intend to use for

analysing the pattern of comovement between the stocks:

The current market price of a share of ONGD is Rs and that of BPDL Rs You are

able to obtain the following forecast from a reputed firm of portfolio managers

on the future returns on the two stocks over the next one year:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started