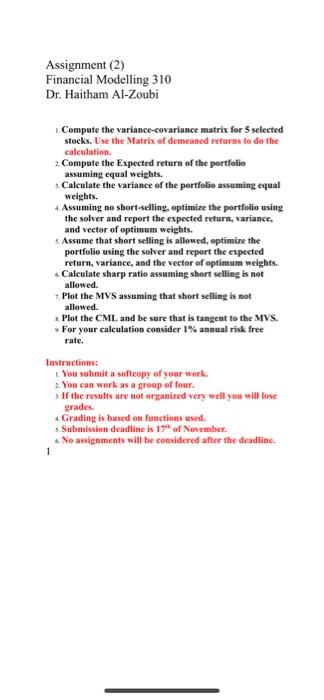

Assignment (2) Financial Modelling 310 Dr. Haitham Al-Zoubi Compute the variance-covariance matrix for selected stocks. Use the Matrix of demeaned returns to do the calculation 2. Compute the Expected return of the portfolio assuming equal weights. Calculate the variance of the portfolio assuming equal weights. Assuming no short-selling, optimize the portfolio using the solver and report the expected return, variance. and vector of optimum weights. 5. Assume that short selling is allowed, optimize the portfolio using the solver and report the expected return, variance, and the vector of optimum weights. Calculate sharp ratio assuming short selling is not allowed. Plot the MVS assuming that short selling is not allowed. Plot the CML and be sure that is tangent to the MVS. For your calculation consider 1% annual risk free rate. Instructions: 1. You submit a softcopy of your work 2. You can work as a group of four. 1. If the results are not organized very well you will lose grades. 4 Grading is based on functions used. 5. Submission deadline is 17" of November No assignments will be considered after the deadline 1 Assignment (2) Financial Modelling 310 Dr. Haitham Al-Zoubi Compute the variance-covariance matrix for selected stocks. Use the Matrix of demeaned returns to do the calculation 2. Compute the Expected return of the portfolio assuming equal weights. Calculate the variance of the portfolio assuming equal weights. Assuming no short-selling, optimize the portfolio using the solver and report the expected return, variance. and vector of optimum weights. 5. Assume that short selling is allowed, optimize the portfolio using the solver and report the expected return, variance, and the vector of optimum weights. Calculate sharp ratio assuming short selling is not allowed. Plot the MVS assuming that short selling is not allowed. Plot the CML and be sure that is tangent to the MVS. For your calculation consider 1% annual risk free rate. Instructions: 1. You submit a softcopy of your work 2. You can work as a group of four. 1. If the results are not organized very well you will lose grades. 4 Grading is based on functions used. 5. Submission deadline is 17" of November No assignments will be considered after the deadline 1