Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASSIGNMENT 2 PART A AccTut (Pty) Ltd (hereafter AccTut) is a company specializing in Accounting and Maths tutoring. The founder, Mr Kubheka is aware you

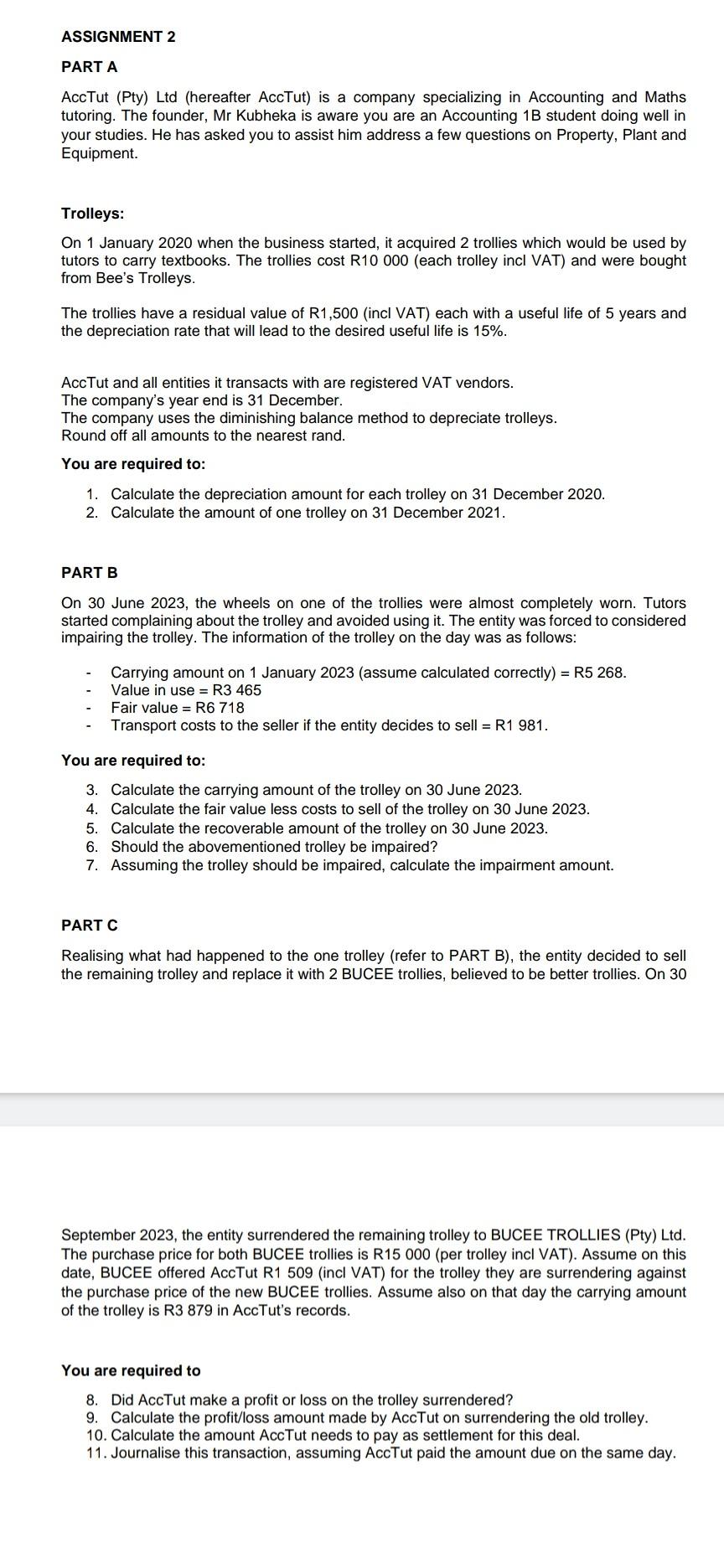

ASSIGNMENT 2 PART A AccTut (Pty) Ltd (hereafter AccTut) is a company specializing in Accounting and Maths tutoring. The founder, Mr Kubheka is aware you are an Accounting 1B student doing well in your studies. He has asked you to assist him address a few questions on Property, Plant and Equipment. Trolleys: On 1 January 2020 when the business started, it acquired 2 trollies which would be used by tutors to carry textbooks. The trollies cost R10 000 (each trolley incl VAT) and were bought from Bee's Trolleys. The trollies have a residual value of R1,500 (incl VAT) each with a useful life of 5 years and the depreciation rate that will lead to the desired useful life is \15. AccTut and all entities it transacts with are registered VAT vendors. The company's year end is 31 December. The company uses the diminishing balance method to depreciate trolleys. Round off all amounts to the nearest rand. You are required to: 1. Calculate the depreciation amount for each trolley on 31 December 2020. 2. Calculate the amount of one trolley on 31 December 2021. PART B On 30 June 2023, the wheels on one of the trollies were almost completely worn. Tutors started complaining about the trolley and avoided using it. The entity was forced to considered impairing the trolley. The information of the trolley on the day was as follows: - Carrying amount on 1 January 2023 (assume calculated correctly) = R5 268. - \\( \\quad \\) Value in use = R3 465 - \\( \\quad \\) Fair value \\( = \\) R6 718 - Transport costs to the seller if the entity decides to sell = R1981. You are required to: 3. Calculate the carrying amount of the trolley on 30 June 2023. 4. Calculate the fair value less costs to sell of the trolley on 30 June 2023. 5. Calculate the recoverable amount of the trolley on 30 June 2023. 6. Should the abovementioned trolley be impaired? 7. Assuming the trolley should be impaired, calculate the impairment amount. PART C Realising what had happened to the one trolley (refer to PART B), the entity decided to sell the remaining trolley and replace it with 2 BUCEE trollies, believed to be better trollies. On 30 September 2023, the entity surrendered the remaining trolley to BUCEE TROLLIES (Pty) Ltd. The purchase price for both BUCEE trollies is R15 000 (per trolley incl VAT). Assume on this date, BUCEE offered AccTut R1 509 (incl VAT) for the trolley they are surrendering against the purchase price of the new BUCEE trollies. Assume also on that day the carrying amount of the trolley is R3 879 in AccTut's records. You are required to 8. Did AccTut make a profit or loss on the trolley surrendered? 9. Calculate the profit/loss amount made by AccTut on surrendering the old trolley. 10. Calculate the amount AccTut needs to pay as settlement for this deal. 11. Journalise this transaction, assuming AccTut paid the amount due on the same day

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started