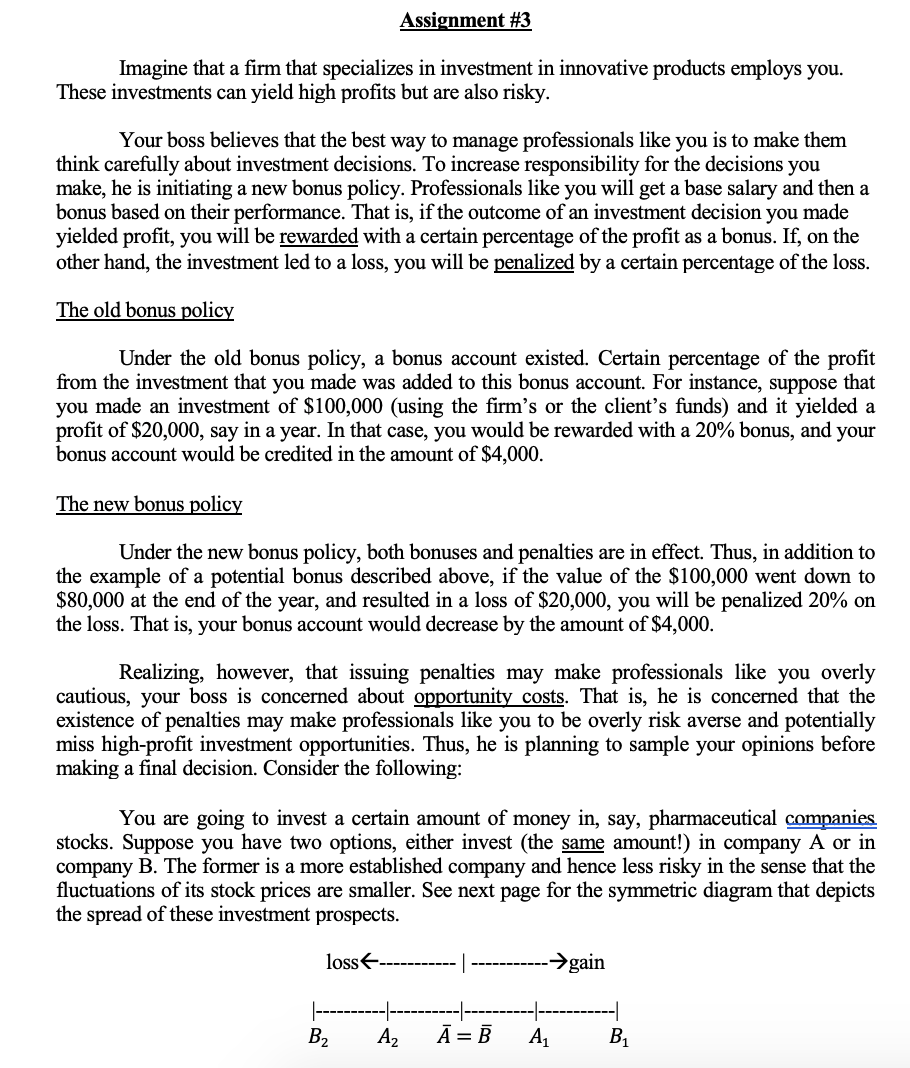

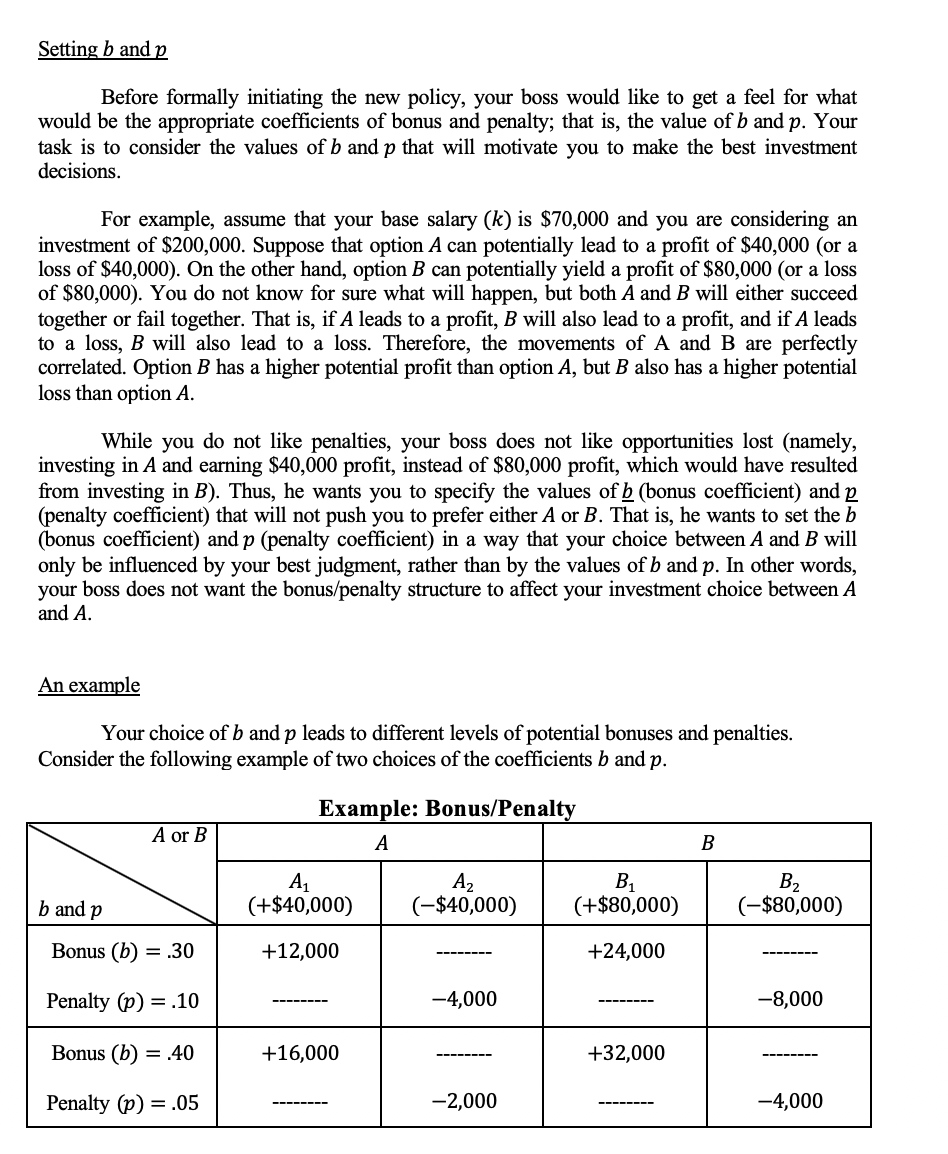

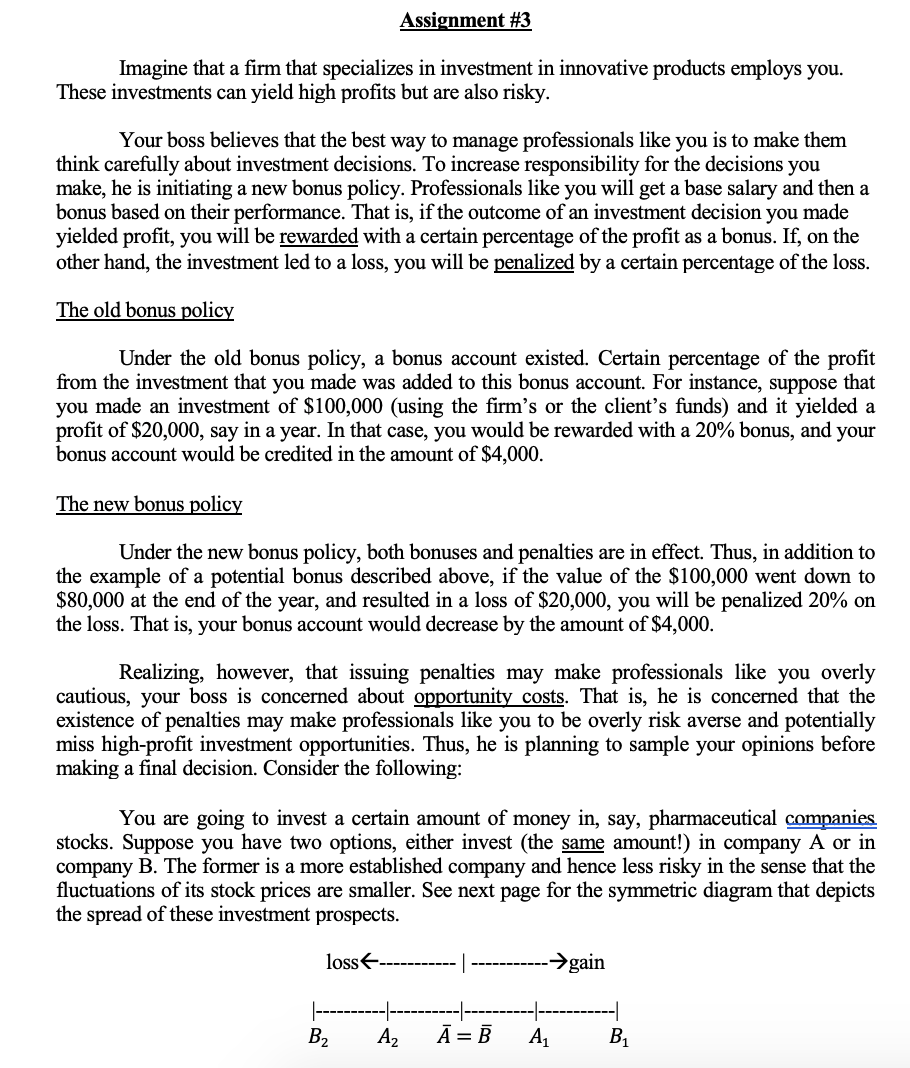

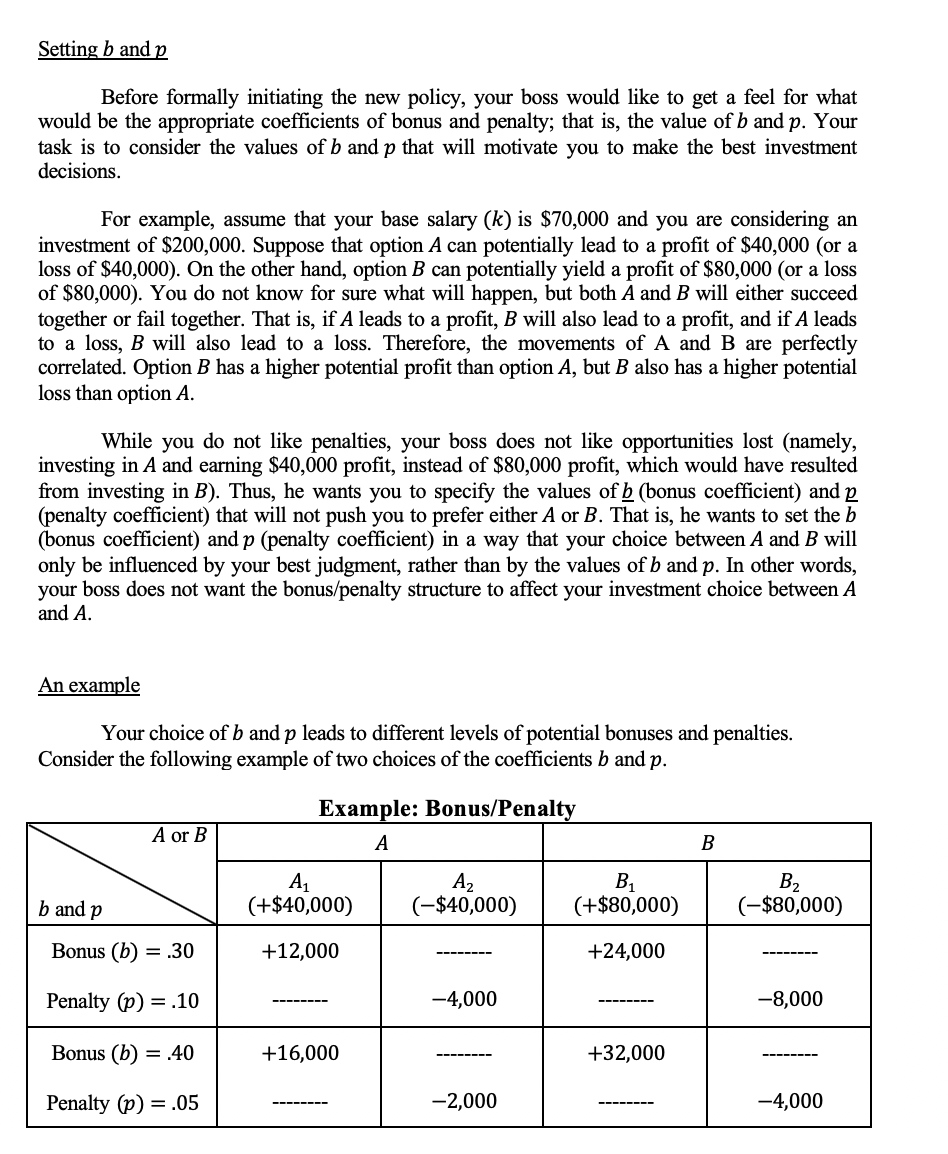

Assignment #3 Imagine that a firm that specializes in investment in innovative products employs you. These investments can yield high profits but are also risky. Your boss believes that the best way to manage professionals like you is to make them think carefully about investment decisions. To increase responsibility for the decisions you make, he is initiating a new bonus policy. Professionals like you will get a base salary and then a bonus based on their performance. That is, if the outcome of an investment decision you made yielded profit, you will be rewarded with a certain percentage of the profit as a bonus. If, on the other hand, the investment led to a loss, you will be penalized by a certain percentage of the loss. The old bonus policy Under the old bonus policy, a bonus account existed. Certain percentage of the profit from the investment that you made was added to this bonus account. For instance, suppose that you made an investment of $100,000 (using the firm's or the client's funds) and it yielded a profit of $20,000, say in a year. In that case, you would be rewarded with a 20% bonus, and your bonus account would be credited in the amount of $4,000. The new bonus policy Under the new bonus policy, both bonuses and penalties are in effect. Thus, in addition to the example of a potential bonus described above, if the value of the $100,000 went down to $80,000 at the end of the year, and resulted in a loss of $20,000, you will be penalized 20% on the loss. That is, your bonus account would decrease by the amount of $4,000. Realizing, however, that issuing penalties may make professionals like you overly cautious, your boss is concerned about opportunity costs. That is, he is concerned that the existence of penalties may make professionals like you to be overly risk averse and potentially miss high-profit investment opportunities. Thus, he is planning to sample your opinions before making a final decision. Consider the following: You are going to invest a certain amount of money in, say, pharmaceutical companies stocks. Suppose you have two options, either invest (the same amount!) in company A or in company B. The former is a more established company and hence less risky in the sense that the fluctuations of its stock prices are smaller. See next page for the symmetric diagram that depicts the spread of these investment prospects. loss gain B2 A2 = B A1 B. Where A, and B, are considered gains and A2 and By are considered losses. , and are the average profits of the investments. Assume also that all these values are known to you before deciding. =B A4 - = - A2 By B = B B2 (Average profits of the two investments are equal) (Absolute value of gains and losses are identical for A) (Absolute value of gains and losses are identical for B) As it is clear from the above diagram, the stocks of the companies A and B both go up, both remain unchanged, or both go down. In other words, the stock price of the two companies moves in the same direction. The difference between A and B is that the stock of company B fluctuates more than the stock of company A. Obviously, you want to obtain the highest value, but you do not know ahead of time whether the investment will be successful or not. You, however, can get an estimate in the form of the probability of success. Again, both A and B have the same probability of success, denoted q. Thus, you have two potential states of the world: Success(A1,B) Faiilure(A2,B2) with with probability = 9 probability = 1-9 Bonus/Penalty and total income determination Based on the new policy, your income (W) will be determined as follows: If you choose to invest in A, there are two potential outcomes for your income: Wsuccess = k + b(A4 - ) WFailure = k + P(A2 - A) Where (A2>) Where (A2) Where (B>

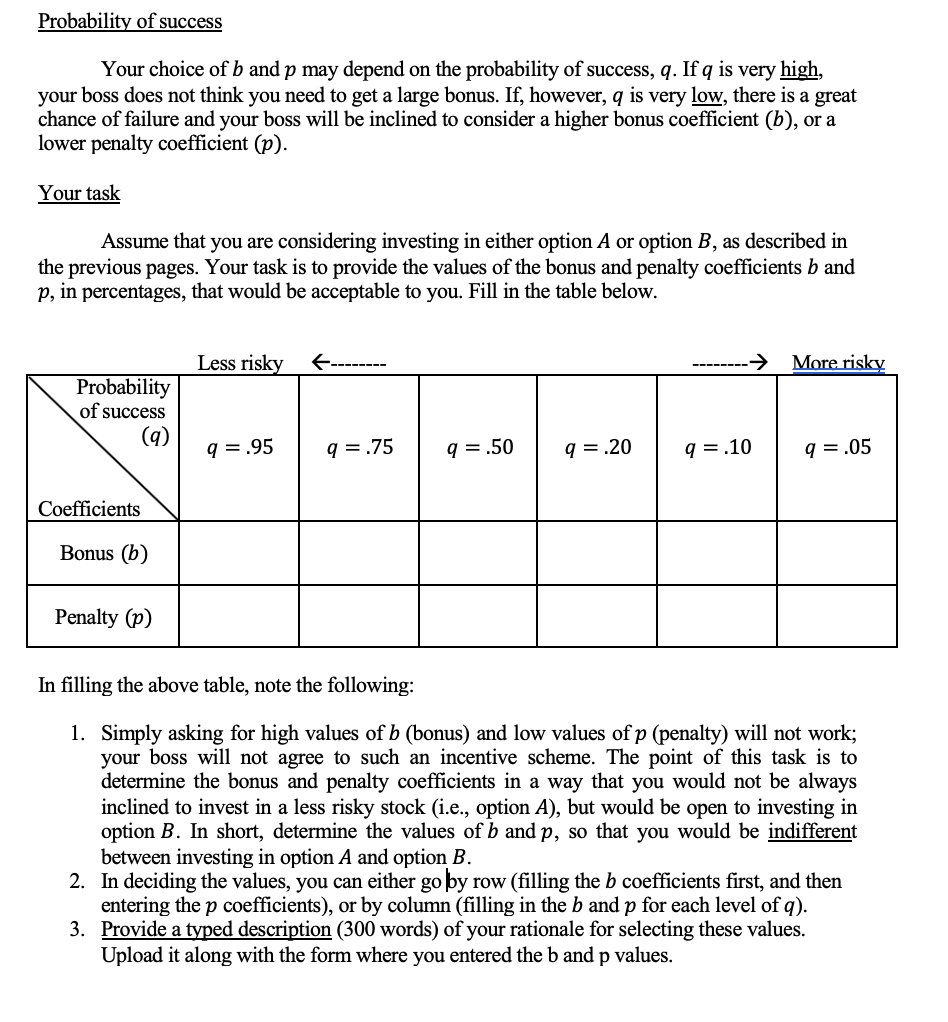

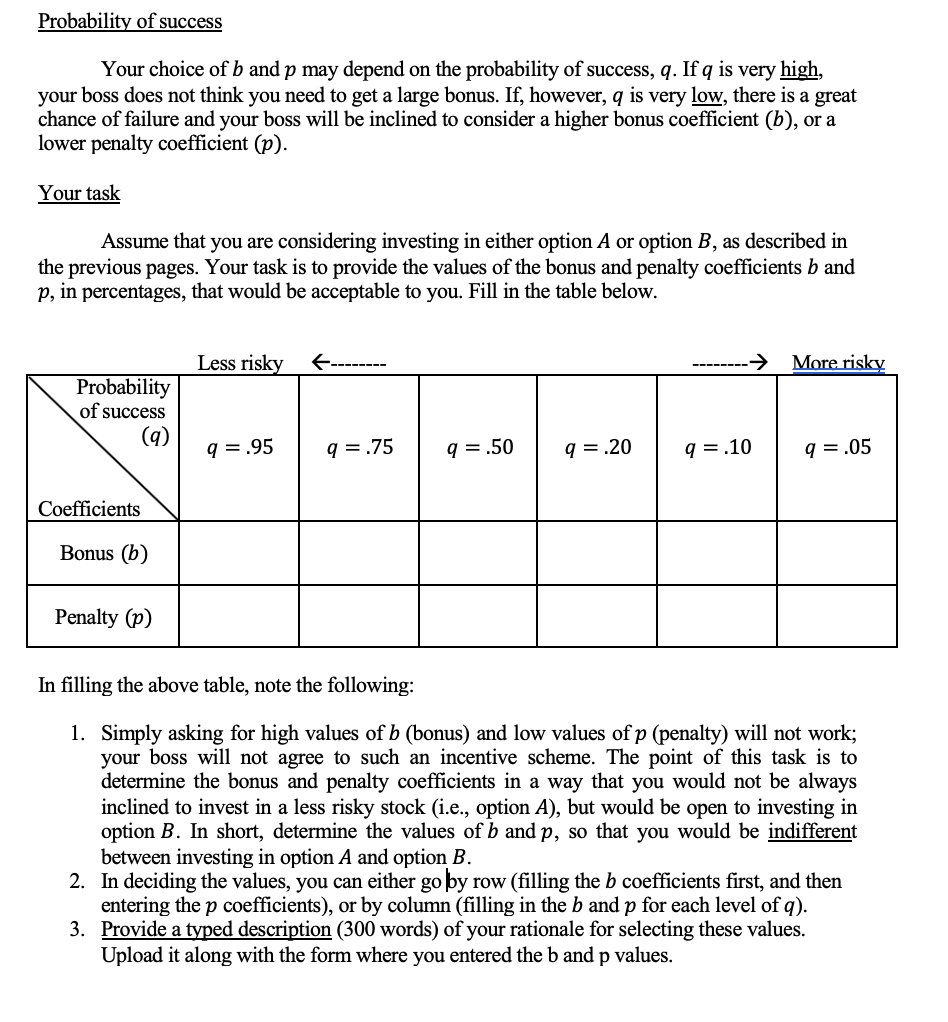

More risky Probability of success (9) q=.95 q=.75 q=.50 9 = 20 9 = .10 9 = .05 Coefficients Bonus (b) Penalty (p) In filling the above table, note the following: 1. Simply asking for high values of b (bonus) and low values of p (penalty) will not work; your boss will not agree to such an incentive scheme. The point of this task is to determine the bonus and penalty coefficients in a way that you would not be always inclined to invest in a less risky stock (i.e., option A), but would be open to investing in option B. In short, determine the values of b and p, so that you would be indifferent between investing in option A and option B. 2. In deciding the values, you can either go by row (filling the b coefficients first, and then entering the p coefficients), or by column (filling in the b and p for each level of q). 3. Provide a typed description (300 words) of your rationale for selecting these values. Upload it along with the form where you entered the b and p values. Assignment #3 Imagine that a firm that specializes in investment in innovative products employs you. These investments can yield high profits but are also risky. Your boss believes that the best way to manage professionals like you is to make them think carefully about investment decisions. To increase responsibility for the decisions you make, he is initiating a new bonus policy. Professionals like you will get a base salary and then a bonus based on their performance. That is, if the outcome of an investment decision you made yielded profit, you will be rewarded with a certain percentage of the profit as a bonus. If, on the other hand, the investment led to a loss, you will be penalized by a certain percentage of the loss. The old bonus policy Under the old bonus policy, a bonus account existed. Certain percentage of the profit from the investment that you made was added to this bonus account. For instance, suppose that you made an investment of $100,000 (using the firm's or the client's funds) and it yielded a profit of $20,000, say in a year. In that case, you would be rewarded with a 20% bonus, and your bonus account would be credited in the amount of $4,000. The new bonus policy Under the new bonus policy, both bonuses and penalties are in effect. Thus, in addition to the example of a potential bonus described above, if the value of the $100,000 went down to $80,000 at the end of the year, and resulted in a loss of $20,000, you will be penalized 20% on the loss. That is, your bonus account would decrease by the amount of $4,000. Realizing, however, that issuing penalties may make professionals like you overly cautious, your boss is concerned about opportunity costs. That is, he is concerned that the existence of penalties may make professionals like you to be overly risk averse and potentially miss high-profit investment opportunities. Thus, he is planning to sample your opinions before making a final decision. Consider the following: You are going to invest a certain amount of money in, say, pharmaceutical companies stocks. Suppose you have two options, either invest (the same amount!) in company A or in company B. The former is a more established company and hence less risky in the sense that the fluctuations of its stock prices are smaller. See next page for the symmetric diagram that depicts the spread of these investment prospects. loss gain B2 A2 = B A1 B. Where A, and B, are considered gains and A2 and By are considered losses. , and are the average profits of the investments. Assume also that all these values are known to you before deciding. =B A4 - = - A2 By B = B B2 (Average profits of the two investments are equal) (Absolute value of gains and losses are identical for A) (Absolute value of gains and losses are identical for B) As it is clear from the above diagram, the stocks of the companies A and B both go up, both remain unchanged, or both go down. In other words, the stock price of the two companies moves in the same direction. The difference between A and B is that the stock of company B fluctuates more than the stock of company A. Obviously, you want to obtain the highest value, but you do not know ahead of time whether the investment will be successful or not. You, however, can get an estimate in the form of the probability of success. Again, both A and B have the same probability of success, denoted q. Thus, you have two potential states of the world: Success(A1,B) Faiilure(A2,B2) with with probability = 9 probability = 1-9 Bonus/Penalty and total income determination Based on the new policy, your income (W) will be determined as follows: If you choose to invest in A, there are two potential outcomes for your income: Wsuccess = k + b(A4 - ) WFailure = k + P(A2 - A) Where (A2>) Where (A2) Where (B> More risky Probability of success (9) q=.95 q=.75 q=.50 9 = 20 9 = .10 9 = .05 Coefficients Bonus (b) Penalty (p) In filling the above table, note the following: 1. Simply asking for high values of b (bonus) and low values of p (penalty) will not work; your boss will not agree to such an incentive scheme. The point of this task is to determine the bonus and penalty coefficients in a way that you would not be always inclined to invest in a less risky stock (i.e., option A), but would be open to investing in option B. In short, determine the values of b and p, so that you would be indifferent between investing in option A and option B. 2. In deciding the values, you can either go by row (filling the b coefficients first, and then entering the p coefficients), or by column (filling in the b and p for each level of q). 3. Provide a typed description (300 words) of your rationale for selecting these values. Upload it along with the form where you entered the b and p values.