Answered step by step

Verified Expert Solution

Question

1 Approved Answer

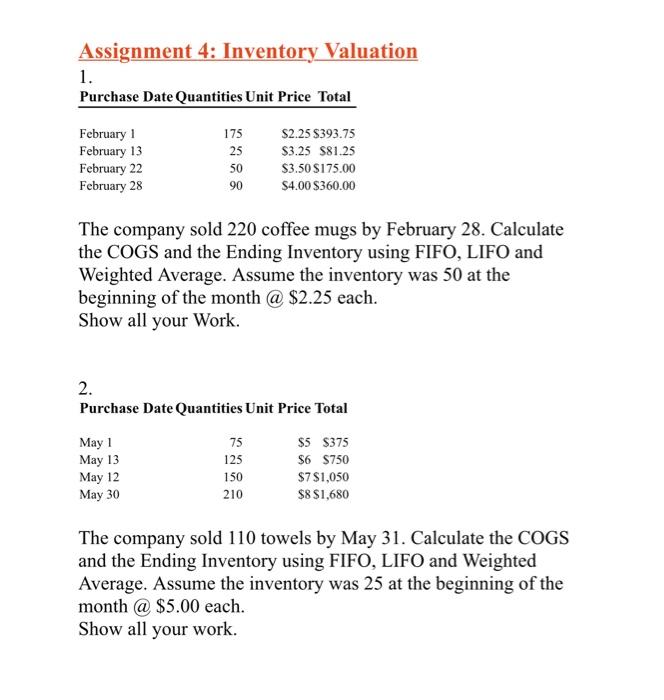

Assignment 4: Inventory Valuation 1. Purchase Date Quantities Unit Price Total February 1 February 13 February 22 February 28 175 25 50 90 The company

Assignment 4: Inventory Valuation 1. Purchase Date Quantities Unit Price Total February 1 February 13 February 22 February 28 175 25 50 90 The company sold 220 coffee mugs by February 28. Calculate the COGS and the Ending Inventory using FIFO, LIFO and Weighted Average. Assume the inventory was 50 at the beginning of the month @ $2.25 each. Show all your Work. May 1 May 13 2. Purchase Date Quantities Unit Price Total May 12 May 30 $2.25 $393.75 $3.25 $81.25 $3.50 $175.00 $4.00 $360.00 75 125 150 210 $5 $375 $6 $750 $7 $1,050 $8 $1,680 The company sold 110 towels by May 31. Calculate the COGS and the Ending Inventory using FIFO, LIFO and Weighted Average. Assume the inventory was 25 at the beginning of the month @ $5.00 each. Show all your work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started