Answered step by step

Verified Expert Solution

Question

1 Approved Answer

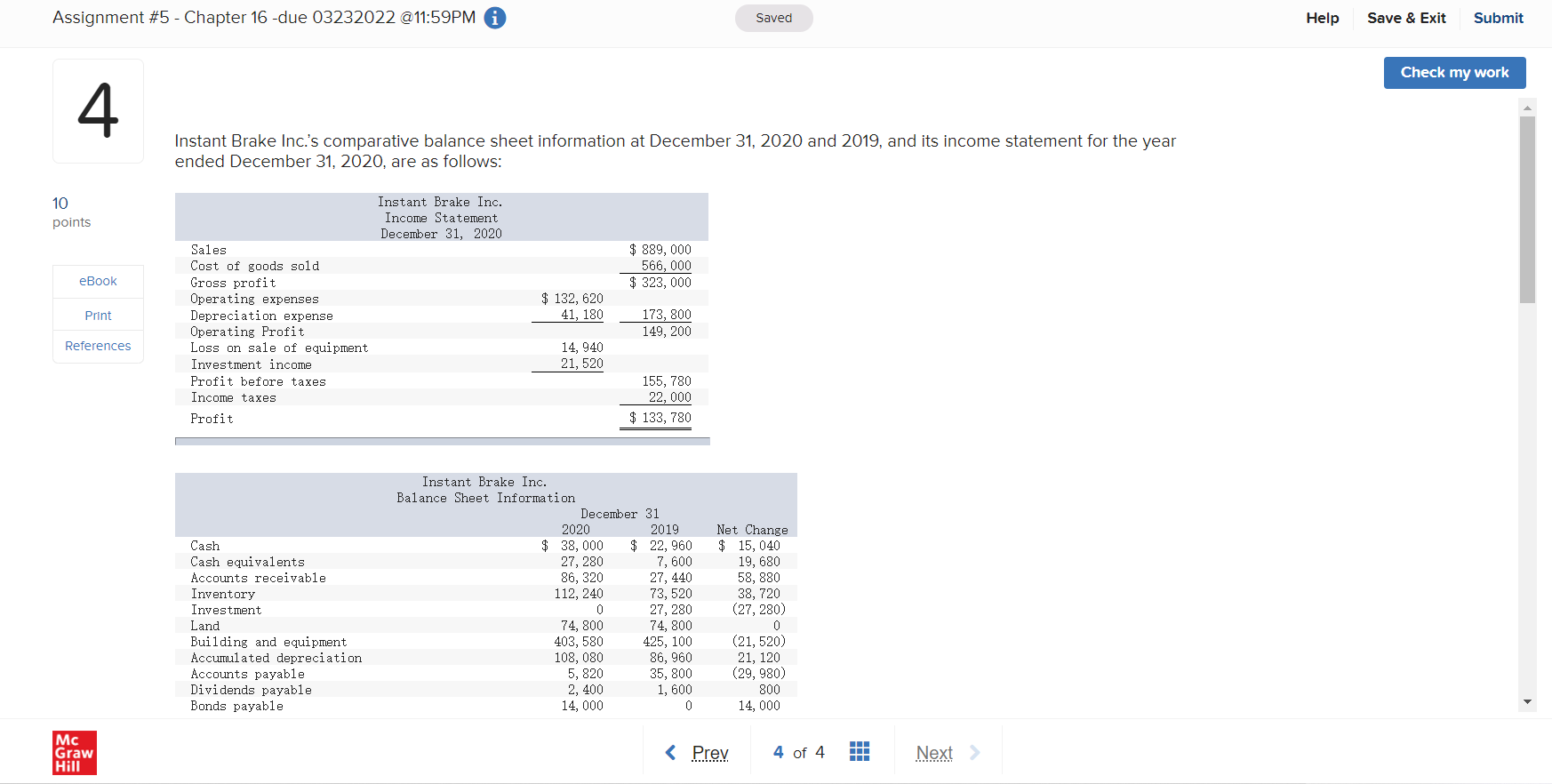

Assignment #5 - Chapter 16 -due 03232022 @11:59PM 10 4 points eBook Print References Mc Graw Hill Saved Instant Brake Inc.'s comparative balance sheet

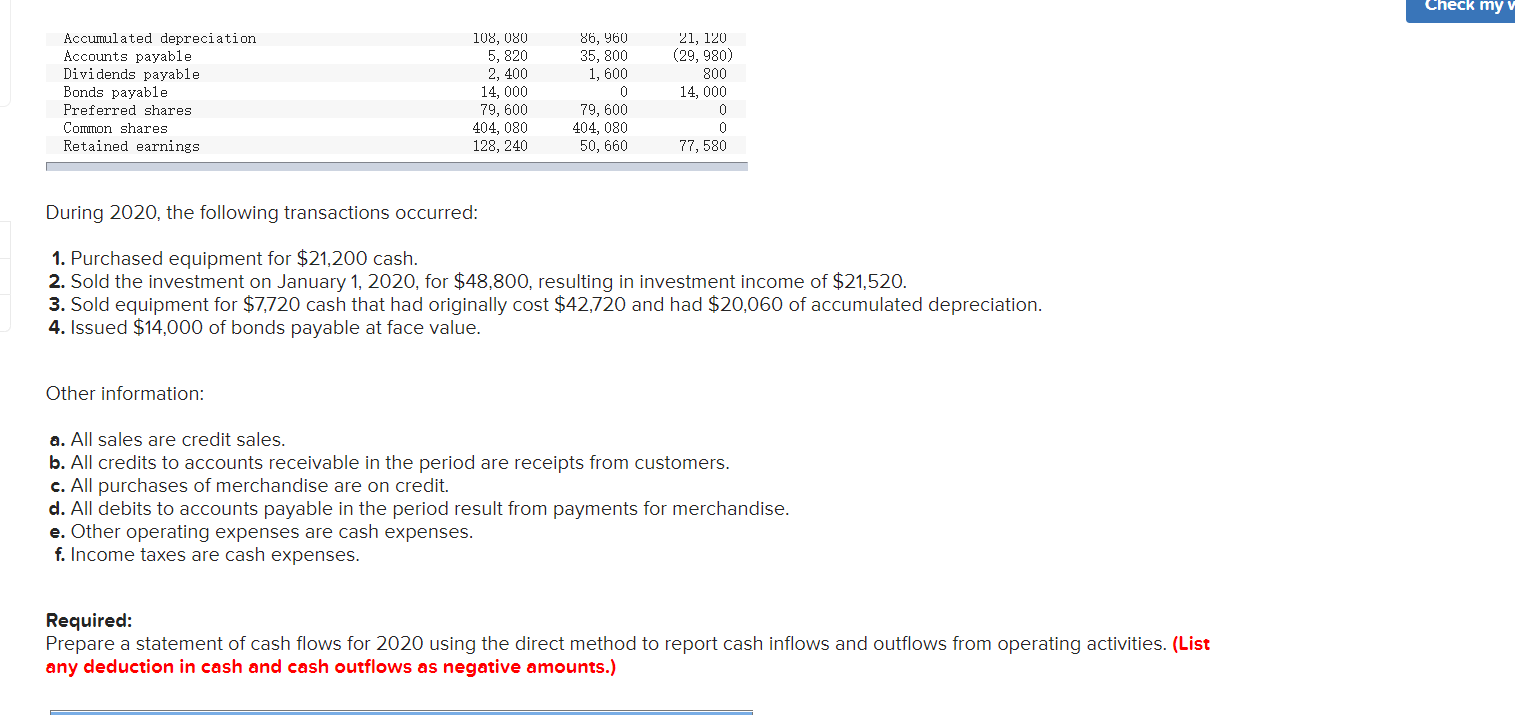

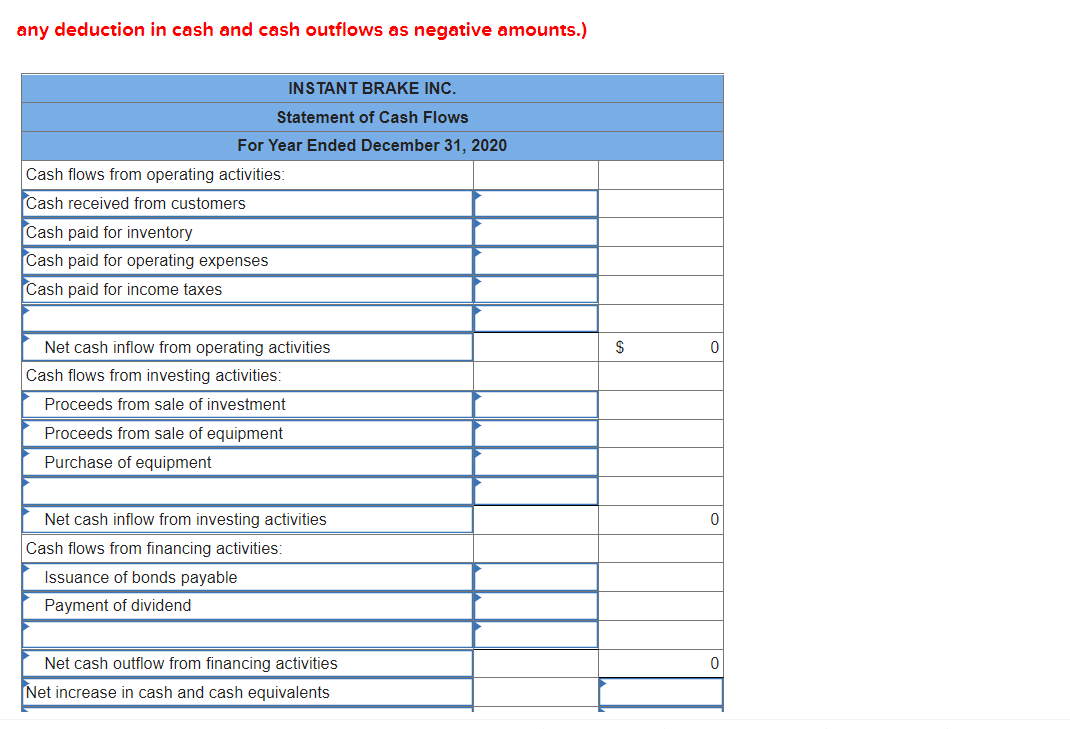

Assignment #5 - Chapter 16 -due 03232022 @11:59PM 10 4 points eBook Print References Mc Graw Hill Saved Instant Brake Inc.'s comparative balance sheet information at December 31, 2020 and 2019, and its income statement for the year ended December 31, 2020, are as follows: Sales Cost of goods sold. Gross profit Operating expenses Depreciation expense Operating Profit Loss on sale of equipment Investment income Profit before taxes. Income taxes Profit Instant Brake Inc. Income Statement December 31, 2020 $ 889,000 566, 000 $ 323,000 $ 132, 620 41, 180 173, 800 149, 200 14, 940 21, 520 155, 780 22,000 Instant Brake Inc. Balance Sheet Information $ 133, 780 December 31 2020 2019 Cash Cash equivalents $ 38,000 $ 22,960 27, 280 7,600 Accounts receivable 86, 320 27, 440 Inventory 112, 240 73, 520 Investment 0 27, 280 Land 74, 800 74, 800 Building and equipment 403, 580 425, 100 Net Change $ 15,040 19,680 58,880 38, 720 (27, 280) 0 (21,520) Accumulated depreciation 108, 080 86, 960 21, 120 Accounts payable 5, 820 35, 800 Dividends payable 2,400 1,600 Bonds payable 14,000 0 (29,980) 800 14,000 < Prev 4 of 4 Next > Help Save & Exit Submit Check my work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started